LIFENET FY3/25 Financial Results

LIFENET Insurance Company has released its results for fiscal year 2024 (ending in March 2025), providing a comprehensive overview of its financial performance, strategic initiatives, and future outlook. LIFENET's key achievements in FY2024 include significant growth in annualized premium of policies-in-force, strong insurance service results, and steady growth in comprehensive equity despite market volatility and tax changes. Looking ahead, LIFENET is focused on reaccelerating investment for growth in FY2025, enhancing market valuation through transparent disclosure of its internal economic solvency ratio (ESR), and transitioning to a new management team to drive further business expansion.

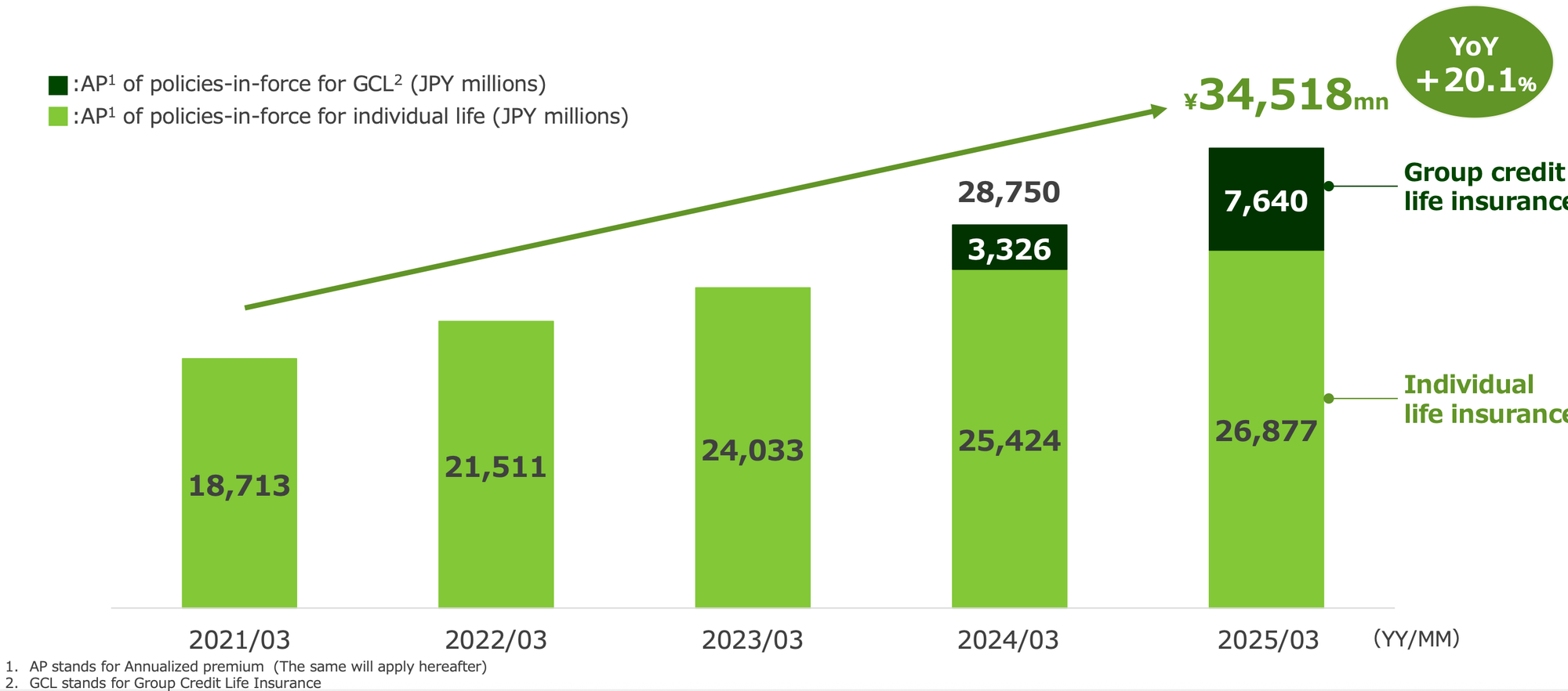

A notable highlight from the past fiscal year is the impressive 20.1% year-over-year increase in annualized premium of policies-in-force, reaching ¥34,518 million. This growth was fueled by a combination of individual life insurance and group credit life (GCL) insurance policies.

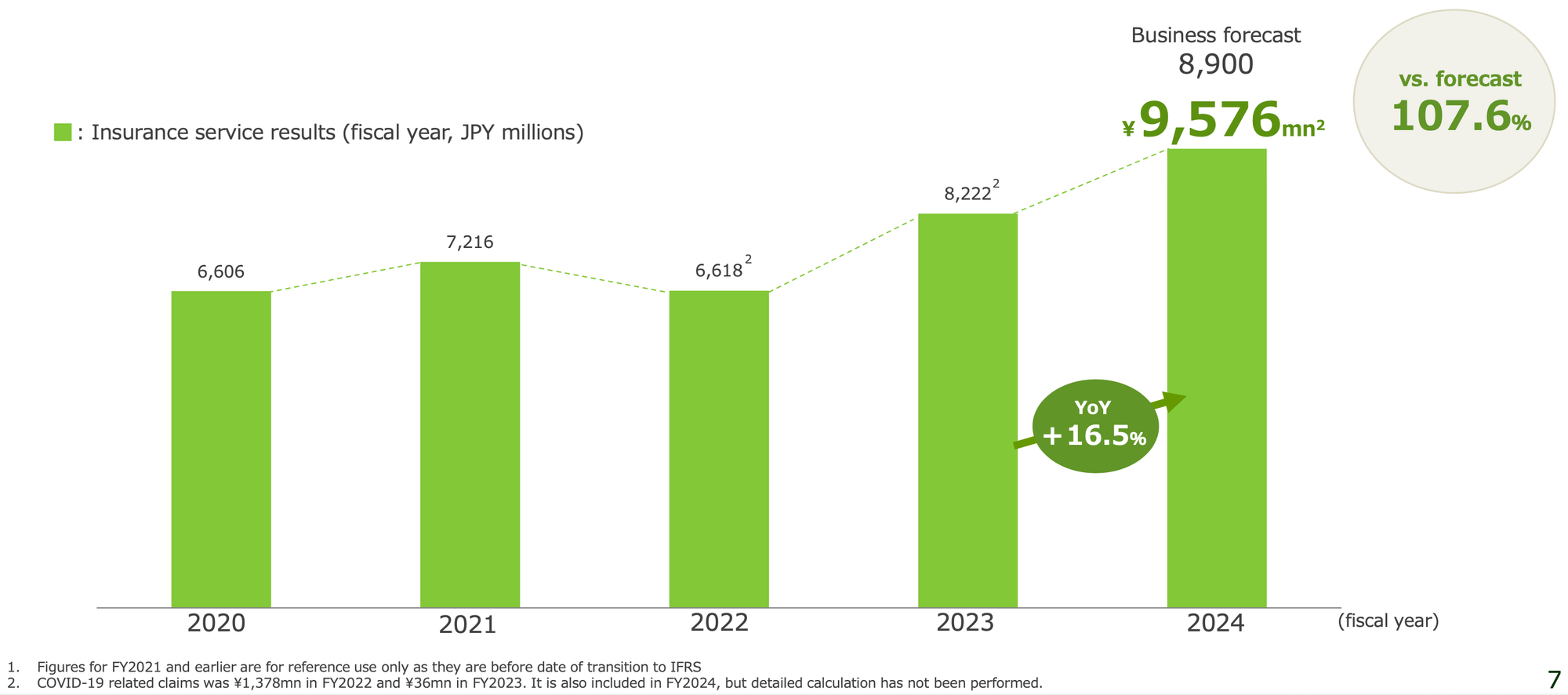

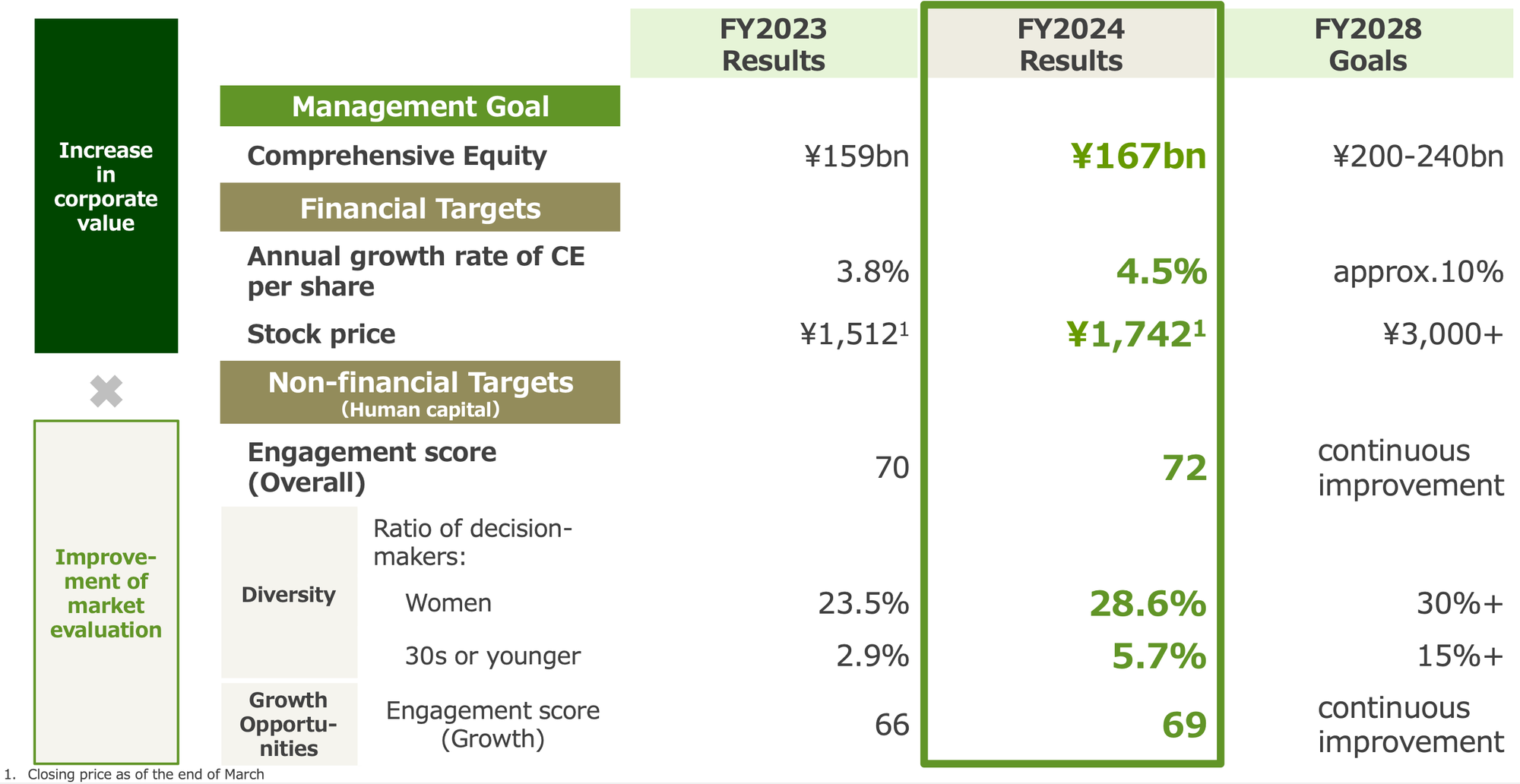

The company's insurance service results also experienced substantial growth, increasing by 16.5% to ¥9,576 million, indicating strong operational efficiency and customer value proposition. Moreover, LIFENET's comprehensive equity, a key indicator of its corporate value, has shown steady growth despite prevailing market factors and tax adjustments, reaching ¥167,090 million, a 4.6% year-over-year increase, demonstrating the company's resilience and effective risk management.

LIFENET attributes its success in FY2024 to several factors, including successful initiatives to attract younger customers through new product launches and refreshed brand messaging. Furthermore, the company has significantly expanded its customer base by leveraging partnerships and integrating its services into partners' point-based ecosystems. The group credit life insurance business has also contributed significantly to key indicators, demonstrating its growing importance as a revenue stream.

LIFENET is now transitioning to its "Future Initiatives," and is poised to reaccelerate investment in growth in FY2025 after three years of careful management and strategic positioning. This renewed investment is intended to capitalize on market opportunities and drive further expansion across key business segments.

The company is committed to enhancing its market valuation through increased transparency and disclosure. A key initiative in this regard is the disclosure of the company's internal ESR, a measure of its capital adequacy and risk management capabilities. By providing stakeholders with a clear understanding of its ESR, LIFENET aims to highlight its efficient risk-return profile and build confidence in its long-term financial stability.

Looking ahead, LIFENET is committed to creating new customer value by leveraging cutting-edge technology to maximize the potential of online life insurance. The company plans to enhance customer convenience through AI-powered voice technology, revolutionize user experience by integrating individual numbers with AI, and seize opportunities in AI-powered search to drive traffic and customer acquisition.

The company is also focused on advancing its partner business by further embedding its products and services within partner ecosystems, including the au Jibun Bank. This strategy involves leveraging partner customer bases and expanding the competitive edge of partners' core offerings through integrated insurance solutions.

LIFENET is strategically directing its marketing investments for FY2025 towards individual life insurance performance to support and reboost. This involves transitioning to a new management team, instilling a renewed focus and enhanced business development skills to enhance proactive investment, which the company expects to improve performance.

LIFENET anticipates an increase in insurance service revenue, with the company forecasting ¥9.8 billion in insurance service results, and ¥6.9 billion in net income, demonstrating confidence in its ability to sustain growth. The business forecasts estimate an increase of approximately ¥1,400 and ¥1,600 in individual and GCL respectively, with an estimated AP reaching around ¥37,500 million.

The company has set ambitious goals for FY2028, as it will look to create a strong performance by creating a sustainable investment in priority areas to create Comprehensive Equity. The company aims to achieve a comprehensive equity of ¥200-240 billion. The company also estimated a Stock price to be ¥3,000+ to match, as well as an approximate annual growth rate of CE per share by roughly 10%.

To support this goal, LIFENET is implementing a comprehensive human resources strategy to enhance long-term corporate value, promoting organizational transition to focus on priority areas, fostering a virtuous cycle of employee growth and business growth, and maintaining and strengthening its organizational culture based on the LIFENET Manifesto.

LIFENET is actively implementing various initiatives to improve its market evaluation, including a commitment to shareholder value, adoption of corporate value indicators linked to IFRS, strengthening corporate governance, and improving market liquidity. These efforts are aimed at achieving a price-to-CE ratio exceeding 1x, reflecting the company's underlying value and growth potential.

The company is also committed to responsible risk-taking, as reflected in its high internal ESR of 364%. LIFENET's focus on protection products and careful risk management contribute to a stable and sustainable business model.

A key element of LIFENET's future strategy is the transition to a new management team. The transition is designed to bring fresh perspectives and expertise to the company, driving further innovation and growth, with a focus on creating growth from a long term perspective. The new management team is composed of a mix of internal promotions and external hires, including Junpei Yokozawa as President and Representative Director and Takeshi Kawasaki as Director, Executive Vice President, and CFO. The company is also maintaining a board with a majority of independent outside directors, ensuring strong corporate governance and oversight.