LINE NEXT Taps JPYC for Integration into Messaging Giant’s Upcoming Stablecoin Wallet

In a move aimed at bringing blockchain-based settlements to the mass market, JPYC Inc., the issuer of the yen-pegged stablecoin JPYC, has signed a Memorandum of Understanding (MOU) with LINE NEXT, the U.S.-based Web3 subsidiary of tech conglomerate LINE Yahoo.

The partnership explores the integration of the JPYC stablecoin into a new digital wallet planned for the LINE app. The initiative represents a significant push to transition stablecoins from speculative crypto-assets into practical tools for daily transactions and reward systems within Japan’s dominant messaging ecosystem.

Strategic Rationale: From Niche to Mainstream

The collaboration targets the primary hurdle facing Web3 adoption in Japan: the lack of intuitive user touchpoints. By embedding JPYC utility directly into LINE—an application described in the release as "already deeply rooted in daily life"—the companies aim to allow users to handle yen-denominated digital value without navigating the complexities typically associated with blockchain technology.

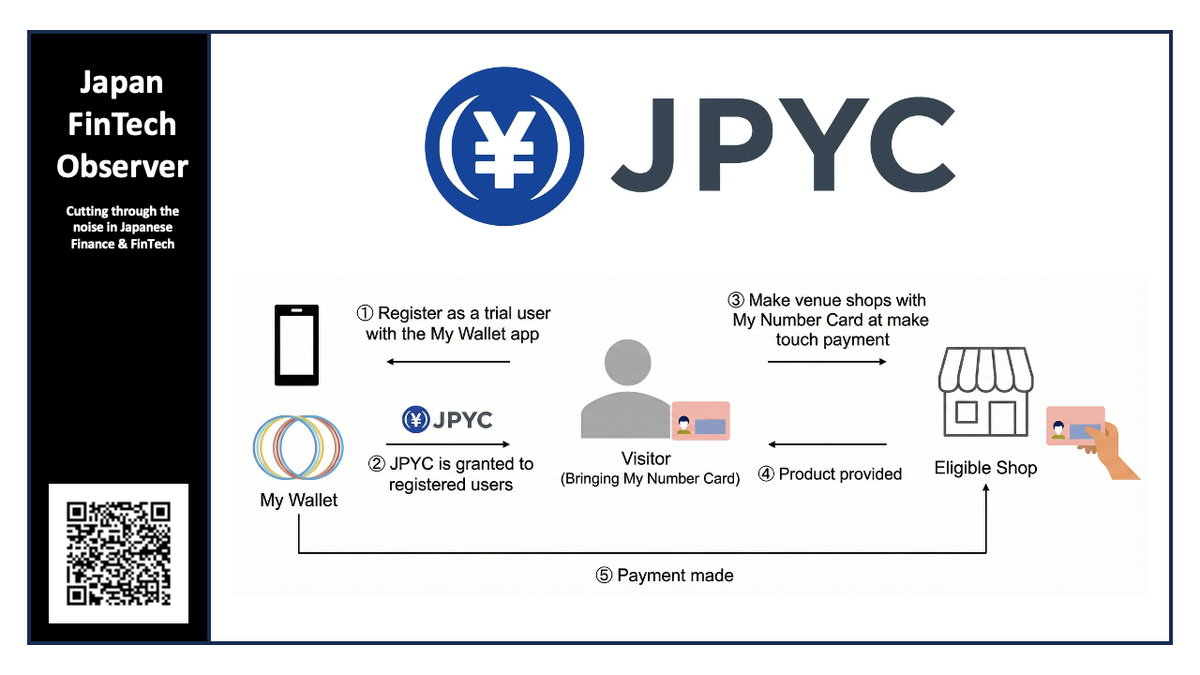

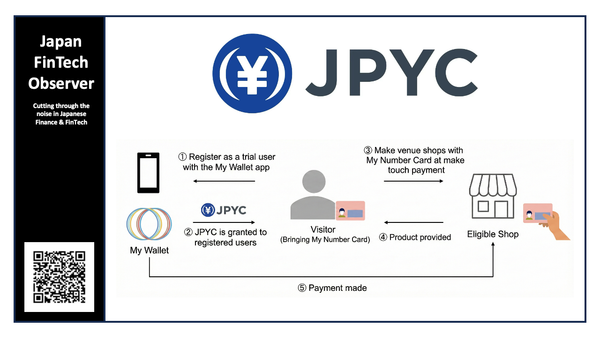

Under the terms of the MOU, the two entities will focus on three core pillars:

- Distribution & Compliance: Developing scenarios for JPYC usage within LINE NEXT’s wallet while ensuring strict adherence to user protection laws and safety regulations.

- Technical Integration: Validating the connectivity between JPYC’s API and LINE NEXT’s wallet infrastructure to create a seamless value transfer experience.

- Joint Marketing: Co-developing reward and incentive programs to drive user engagement.

Executive Commentary

Youngsu Ko, CEO of LINE NEXT Inc., emphasized the necessity of a local currency peg for market penetration. "For Web3 to spread in the Japanese market, an easy-to-understand value experience using a yen-denominated stablecoin is indispensable," Ko said, noting that the partnership is a critical step toward normalizing Web3 usage for rewards and payments.

Noritaka Okabe, Representative Director of JPYC Inc., described the potential integration into a "mega-app" as a watershed moment. "Expanding the convenience of a Japanese yen stablecoin in areas where value is easily felt, such as rewards and daily payments, holds immense significance," Okabe stated.

Regulatory and Asset Structure

JPYC Inc., which obtained registration as a Funds Transfer Service Provider, issues JPYC as a 1:1 yen-pegged stablecoin backed by highly liquid assets, including bank deposits and government bonds. The issuer currently operates on the Avalanche, Ethereum, and Polygon networks.

Looking ahead, JPYC Inc. indicated that the stablecoin is being positioned for broader use cases beyond simple transfers, including payroll processing and cash withdrawals via ATMs, signaling an intent to establish JPYC as a core component of Japan's future financial infrastructure.