MDM & Sumitomo Mitsui Trust Bank Launch "ALTERNA Trust" for Digital Securities

Mitsui & Co. Digital Asset Management (MDM) and Sumitomo Mitsui Trust Bank have jointly established "ALTERNA Trust", a trust company specializing in digital securities, with a view to further development of the digital securities market, with MDM holding 85.1% and Sumitomo Mitsui Trust Bank holding 14.9% of the shares.

ALTERNA Trust is currently preparing multiple projects including its inaugural case, which will be announced subsequently. ALTERNA Trust anticipates structuring digital securities worth 100 billion yen in its first year and aims for cumulative trust assets of 1 trillion yen within 5 years. Initially focusing on real estate, the company envisions future expansion to more diverse asset classes including alternative assets other than real estate, corporate bonds, and debt assets held by Sumitomo Mitsui Trust Bank. The company also plans to advance trust acceptance from asset management companies other than MDM.

Background

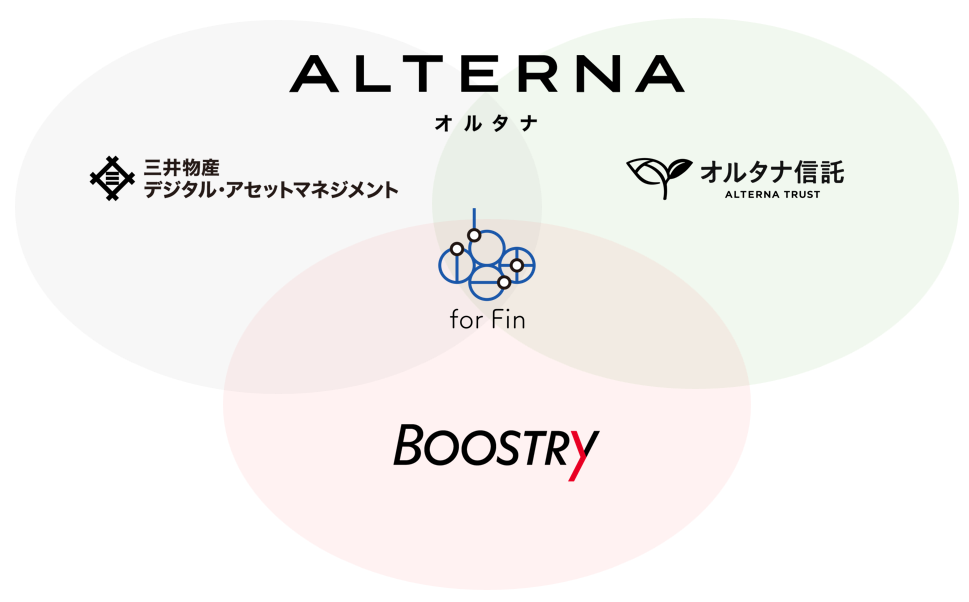

ALTERNA Trust was established as a trust company specializing in the acceptance of beneficial securities issuance trusts, which play an important role in the issuance of digital securities (ST: Security Token). ALTERNA Trust aims to contribute to the development of the digital securities market by combining MDM's digital technologies such as AI specialized in finance with Sumitomo Mitsui Trust Bank's expertise in trust acceptance, enabling efficient and speedy trust acceptance. In digital securitization schemes, ALTERNA Trust will serve as a hub, acting as a trustee while coordinating closely with asset management companies, securities companies, and others to advance the structuring of digital securities.

Since its founding in 2020, MDM has been a leading company in Japan under the motto "a new investment option that is neither deposits nor stocks," developing comprehensive services from the acquisition and management of alternative assets such as real estate to the sale of digital securities backed by these assets. MDM actively utilizes digital technologies including AI, developing and providing the asset management platform "ALTERNA" for individual investors, and promoting the efficiency of management operations and automation of contract creation. Since structuring its first fund in December 2021, MDM has provided a total of 17 funds - 5 through external securities companies and 12 through its own "ALTERNA" service - the largest number in Japan. Total assets under management, including fundraising from individual investors, have expanded to over 200 billion yen.

Meanwhile, the Sumitomo Mitsui Trust Group, under the purpose of "Opening up the entrusted future," is advancing initiatives in the digital securitization field to realize a virtuous cycle of "funds, assets, and capital" by utilizing highly specialized trust functions.

ALTERNA Trust combines MDM's digital securitization know-how, including AI and other digital technologies specialized in finance, with Sumitomo Mitsui Trust Bank's advanced trust expertise to provide a flexible and speedy digital securitization process and an environment that reduces the burden of complex operational tasks. This will enable companies holding alternative assets, primarily real estate, to raise funds from individual investors in an agile manner. Furthermore, according to customer needs, ALTERNA Trust will provide one-stop services by combining its trust functions with MDM's existing securities and management functions.

In conjunction with the establishment of ALTERNA Trust, MDM and Sumitomo Mitsui Trust Bank have concluded a business alliance aimed at activating the digital securities market. Through the collaboration of both companies, they will further expand the digital securities market and contribute to the realization of an "asset management nation."

Infrastructure

MDM has established a comprehensive framework to provide end-to-end services for the acquisition, management, custody, and sales of digital securities. In constructing this framework, BOOSTRY plans to provide E-Prime, which comprehensively offers the functions necessary for ST management, to ALTERNA Trust. E-Prime already has a proven track record of use at multiple major financial institutions and is a service equipped with the functions necessary for ST trustees and issuers, enabling centralized management of STs on the leading domestic platform "ibet for Fin".

BOOSTRY and MDM have been collaborating through the use of E-Wallet SaaS, which provides the functions necessary for handling STs offered by BOOSTRY. By utilizing BOOSTRY's E-Prime service at ALTERNA Trust in addition to E-Wallet SaaS, systems will be linked through blockchain technology, enabling more seamless digital management of the ST lifecycle from issuance to redemption.

BOOSTRY is an IT vendor that provides systems and other services necessary for ST sales and management. Additionally, the blockchain platform "ibet for Fin," which BOOSTRY leads as secretariat, has reached a public offering amount of 92.7 billion yen (as of the end of June 2025) and leads the domestic ST market. BOOSTRY continues to aim for the creation of new capital markets that connect to corporate fundraising and core business support by collaborating with various players to serve ST stakeholders.