Mega Bank Earnings (I) — MUFG

All three Japanese mega banks reported strong earnings last week. All of them performed strongly after the Bank of Japan raised its policy…

All three Japanese mega banks reported strong earnings last week. All of them performed strongly after the Bank of Japan raised its policy rate to 0.25%, as they should, since their net interest margin had just widened. MUFG passed through the 0.15% raise to its short-term interest rates, which will ultimately be reflected in mortgage rates, and increased the deposit rate from 0.01% to 0.10%. For each of the banks, we have selected some key slides from the earnings presentations.

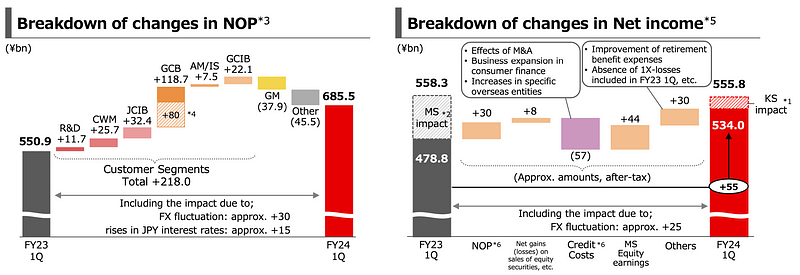

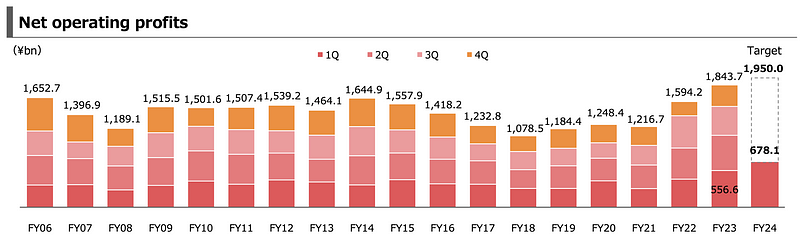

MUFG reported net operating profits (NOP) of JPY678.1bn, up by JPY 121.5bn YoY, and 34% progress towards the FY2024 target, driven by continuing good performance in customer segments domestically and globally.

MUFG reported net income of JPY 555.8bn, up by JPY 55.1bn adj. YoY, and 37% progress towards the FY2024 target, excluding the Morgan Stanley impact and the Krasikorn impact (both accounting period changes), mainly driven by the increases of NOP and gains on the sales of equity securities, as well as FX impact.

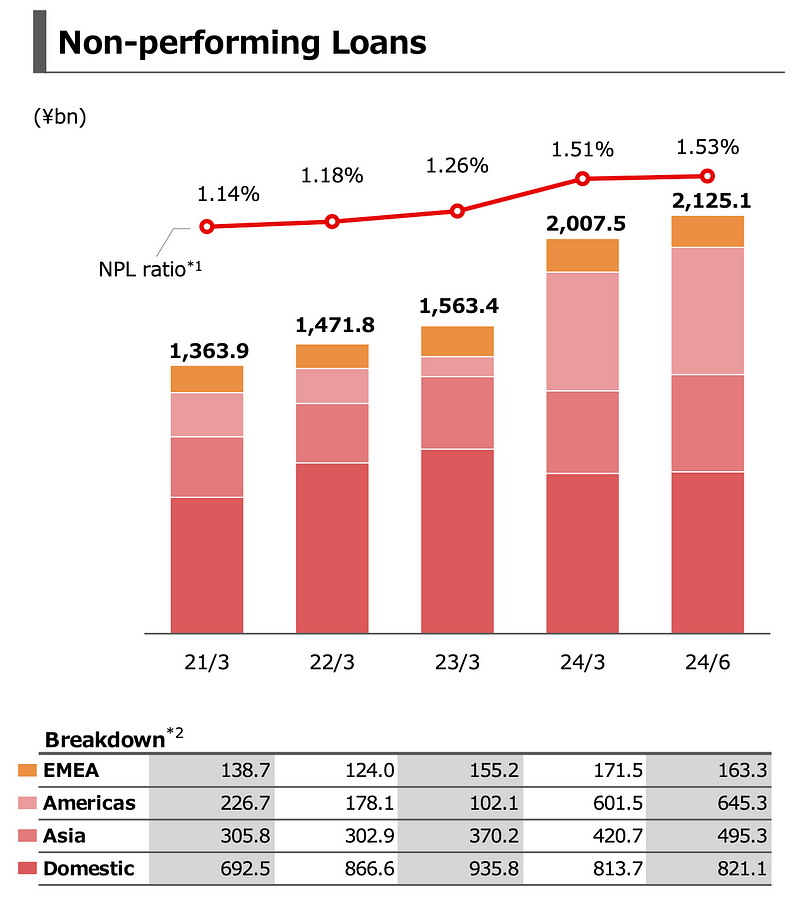

Non-performing loans have slightly increased, to 1.53%, with EMEA seeing a slight reduction in absolute terms, and Domestic and equal increase, while both Americas and Asia saw significant accumulation of NPLs in absolute numbers.

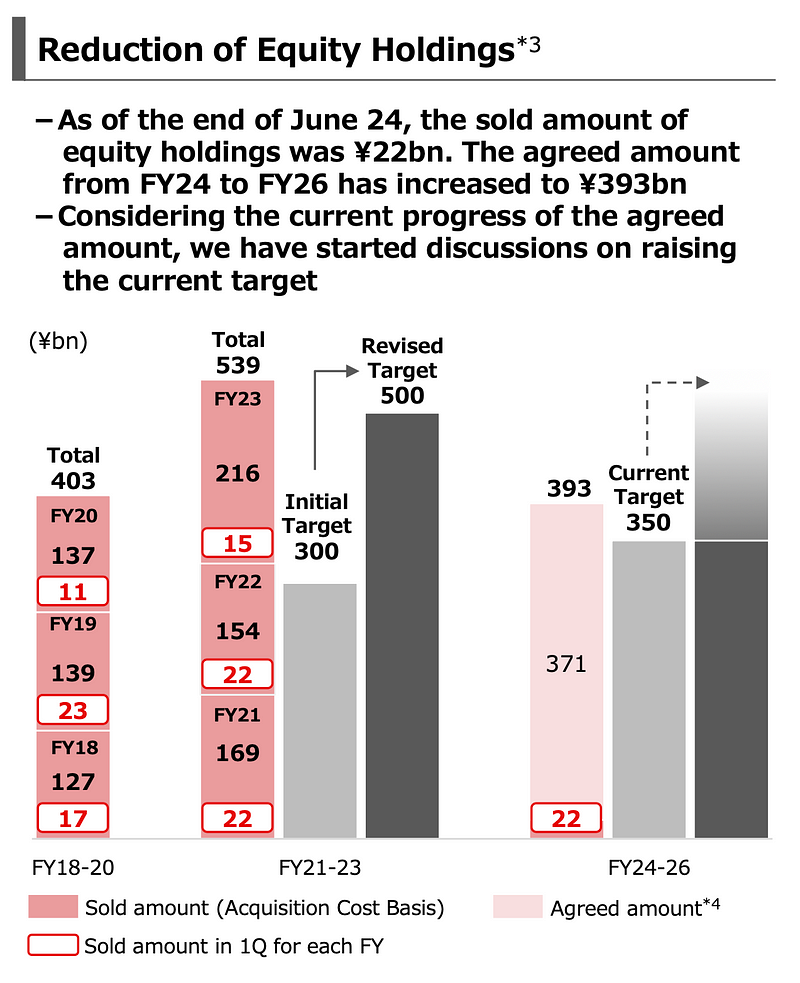

On the reduction of equity cross-holdings (like the Toyota tender offer currently under way), MUFG had set a target of JPY 350bn of disposals during the current Mid-Term Business Plan, but expects that this target will raised. Typically, we would expect such sales to realize gains, and the funds generated to be used for new investments (organic/inorganic), dividends, and share buybacks, possibly in equal amounts.

Just a great chart showing the net operating profits that MUFG generated since it came into existence. FY2024 is forecast to be another record year.

Please follow us to read more about Finance & FinTech in Japan, like hundreds of readers do every day. We invite you to also register for our short weekly digest, the “Japan FinTech Observer”, on Medium or on LinkedIn. Our global Finance & FinTech Podcast, “eXponential Finance” is also available through its own LinkedIn newsletter, or via our Podcast Page.

Should you live in Tokyo, or just pass through, please also join our meetup. In any case, our YouTube channel and LinkedIn page are there for you as well.