Mega Bank Earnings (II) — SMBC

All three Japanese mega banks reported strong earnings last week. All of them performed strongly after the Bank of Japan raised its policy…

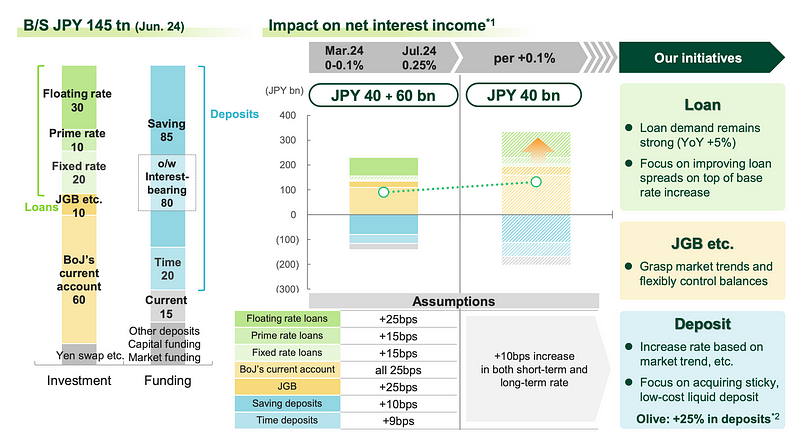

All three Japanese mega banks reported strong earnings last week. All of them performed strongly after the Bank of Japan raised its policy rate to 0.25%, as they should, since their net interest margin had just widened. While SMBC (unlike MUFG) did not immediately pass through the 0.15% raise to its short-term interest rates (although SMBC said it will consider such action), it did increase the deposit rate from 0.01% to 0.10%. For each of the banks, we have selected some key slides from the earnings presentations.

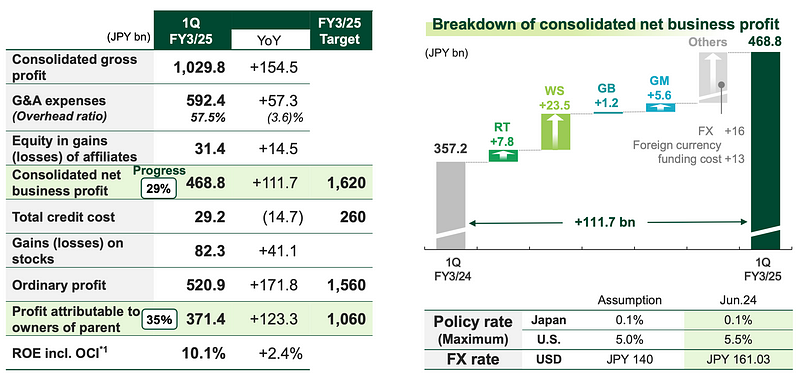

SMBC reported net business profits of JPY 468.8bn, up by JPY 111.7bn YoY, and 29% progress towards the FY2024 target. Profit attributable to owners of parent was of JPY 371.4bn, up by JPY 123.3bn YoY, and 35% progress towards the FY2024 target.

SMBC notes that growth has been driven mainly by the Wholesale and Retail Business Units, while initiatives of the Medium-Term Management Plan are making steady progress under a positive business environment. The overhead ratio improved due to top-line growth and successful control of credit costs without significant deterioration.

SMBC provides an excellent explanation of the impact of rising JPY interest rates on earnings, with net interest income expecting to increase by JPY 100bn due to the BOJ’s policy changes in both March and July 2024, with about 70% of this increase contributing to FY3/25. Beyond that, should the Bank of Japan raise rates further in October or January, there will be another JPY 100bn positive impact for every quarter point raise.

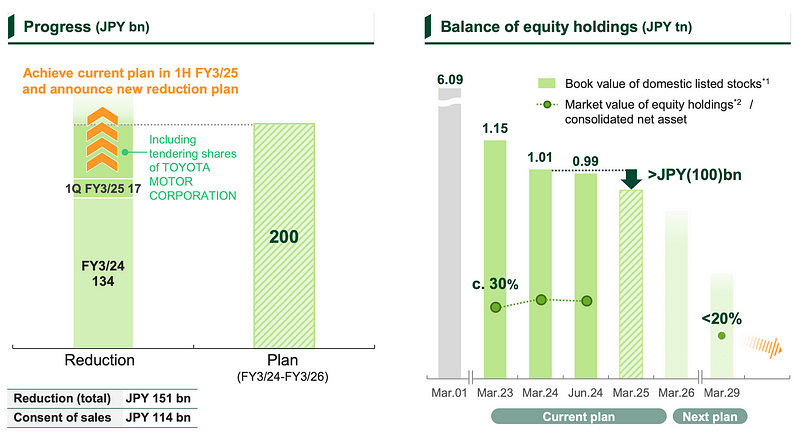

Like MUFG, SMBC is aggressively reducing cross-shareholdings, and will reach its Medium-Term Management Plan target early, therefore planning to announce a new reduction plan with its H1 results.

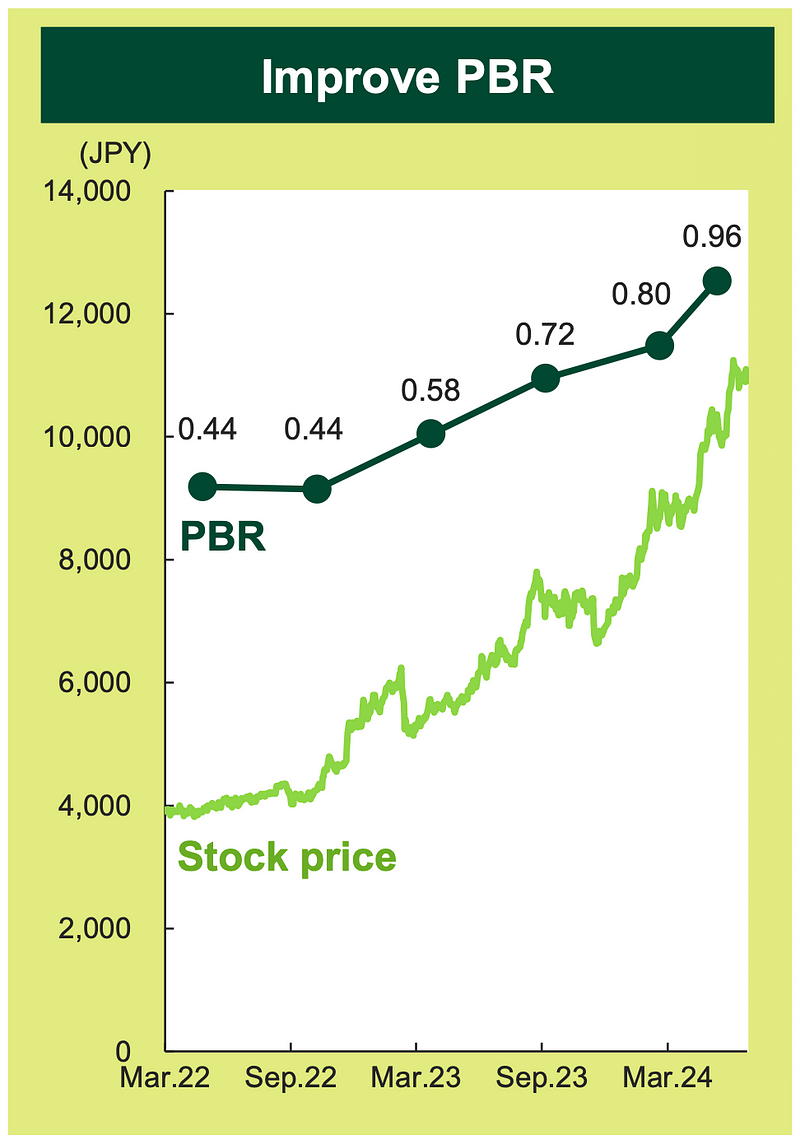

Unfortunately, the price-book-ratio (PBR), which looked pretty good as late as after the BOJ Monetary Policy Meeting, will have taken a beating through the historic sell-off starting the month of August.

Please follow us to read more about Finance & FinTech in Japan, like hundreds of readers do every day. We invite you to also register for our short weekly digest, the “Japan FinTech Observer”, on Medium or on LinkedIn. Our global Finance & FinTech Podcast, “eXponential Finance” is also available through its own LinkedIn newsletter, or via our Podcast Page.

Should you live in Tokyo, or just pass through, please also join our meetup. In any case, our YouTube channel and LinkedIn page are there for you as well.