METI & JETRO Publish Expanded Startup Investment Agreement Guidelines

Japan's Ministry of Economy, Trade and Industry (METI), together with the Japan External Trade Organization (JETRO), has compiled an expanded version of the “Key Points to Consider in Contracts for Sound Venture Investments in Japan” based on discussions held at the “Study Group on Development of Startup Ecosystems.” These guidelines were originally formulated in 2018, and revised in 2022. Investors and those involved in startup investment, particularly startup companies, are encouraged to make use of these guidelines, taking into account not only the latest business practices but also the investment environment and the circumstances of individual companies.

The updated document has unveiled a sweeping and remarkably detailed blueprint aimed at fundamentally rewiring the nation's venture capital landscape, a move designed to shift the focus from simply cultivating a large number of startups to forging globally competitive unicorns. METI/JETRO are calling for a radical modernization of investment contracts and corporate governance, seeking to align domestic practices with global standards to attract foreign capital and empower a new generation of ambitious entrepreneurs.

METI/JETRO argue that while Japan's startup ecosystem has successfully expanded in "breadth", it now faces the critical challenge of achieving "height". For the past decade, the focus has been on increasing the number of startups and raising their public profile. The result is a vibrant but shallow ecosystem, often characterized by small-scale IPOs on Tokyo's Growth Market and a governance culture that lags behind international norms.

This updated guidance, developed in consultation with a panel of leading lawyers, academics, and venture capitalists, represents a direct intervention to address these shortcomings. It serves as both a diagnosis of the current system's limitations and a prescriptive manual for change, targeting the very legal architecture that underpins the relationship between founders and investors. The ultimate goal is to create a "world-class environment" that is more attractive to international investors and top-tier global talent, in line with the government's ambitious "Five-Year Plan for Nurturing Startups."

From Founder Control to Professional Governance: A New Paradigm

At the heart of the METI/JETRO proposal is a philosophical shift in the understanding of corporate governance. The document forcefully refutes the common misconception that governance is merely a box-ticking exercise for compliance or IPO preparation. Instead, it frames governance as a dynamic and strategic tool for maximizing long-term corporate value—a "mechanism for making transparent, fair, swift, and decisive decisions."

The guide begins by highlighting the stark differences in governance maturity between Japanese and American startups. In Japan, founders tend to remain as CEO throughout the company's lifecycle, often retaining majority or significant minority stakes even at the time of an IPO. A 2023 analysis revealed that in 59% of companies listed on the Tokyo Stock Exchange's Growth Market, the founding shareholders still held over a third of the voting rights. This contrasts sharply with the U.S., where founder-CEOs are often replaced as a company scales, and their equity is significantly diluted through successive funding rounds. U.S. boards also tend to be dominated by independent directors, emphasizing a supervisory function, whereas Japanese boards are often majority-composed of company insiders, blurring the lines between execution and oversight.

To bridge this gap, the report advocates for an evolutionary approach to governance that adapts to a startup's growth stage. In the early days, a founder-centric model enabling rapid decision-making is appropriate. However, as the company matures, raises significant capital, and faces increasing complexity, the governance structure must evolve. This means building a professional board of directors where executive and supervisory functions are clearly separated.

The guide uses the real-world case of SmartHR, a leading Japanese cloud services startup, as an exemplar. The company's journey illustrates a deliberate and phased strengthening of its governance. Starting with a founder-led board, it progressively added VC-nominated directors, established a formal board of directors, and eventually appointed highly respected independent directors, including a former CEO of Konica Minolta as chairman. It also established audit, nomination, and compensation committees and saw a change in the founding CEO, all moves designed to prepare the company for global-scale operations and a major public listing. This evolution, the guide argues, should become the model for Japan's most promising startups, moving from a system of founder control to one of professional, institutionalized management.

This transition requires a new understanding of the roles of all key players. Founders must learn to cede control for the benefit of the company, recognizing that the skills required to start a company differ from those needed to scale one. VCs are expected to be more than just capital providers; they must act as true partners, leveraging their networks to recruit talent, provide strategic advice, and nominate qualified directors who act in the best interest of the company as a whole, not just the fund they represent. Crucially, the guide emphasizes the role of independent directors as neutral arbiters who can mediate potential conflicts of interest between founders (common shareholders) and investors (preferred shareholders) and provide objective, panoramic oversight.

Rewriting the Rulebook: A Clause-by-Clause Revolution in Investment Contracts

This new vision for governance necessitates a profound overhaul of the investment contracts that form the bedrock of Japan's venture ecosystem. The METI/JETRO guide dives deep into the technical details of these agreements, comparing standard Japanese terms with the models provided by the U.S. National Venture Capital Association (NVCA) and proposing significant updates. The proposed changes collectively aim to reduce founder risk, streamline operations, and better align incentives among all stakeholders, particularly as a company approaches an exit.

1. Dismantling the "Founder as Guarantor" Model

A central theme is the need to separate the legal and financial liability of the founder from that of the corporation. Traditional Japanese venture contracts often impose a heavy personal burden on founders, a practice the guide identifies as a major impediment to ambitious risk-taking.

- Share Repurchase Rights (株式買取請求権): In Japan, it is common for investment contracts to grant investors the right to demand that the company, and often the founders personally, buy back their shares if the company breaches the contract. The guide argues for the abolition of this clause, especially as it applies to founders. It posits that a well-structured governance system with an independent board is a far more effective tool for preventing contract breaches than punitive financial penalties. Forcing a founder to personally repurchase shares conflates corporate and individual responsibility and acts as a powerful disincentive to entrepreneurship.

- Representations & Warranties (表明保証): Similarly, Japanese contracts typically require both the company and the founders to personally attest to a long list of facts about the business. If any of these statements prove untrue, the founders can be held personally liable. The NVCA model, by contrast, places this obligation solely on the company. The guide strongly advocates for adopting the U.S. standard, arguing that the investment contract is an agreement for the company to raise capital, not for the founder to secure a personal loan. While acknowledging that in the very earliest stages the line between founder and company can be blurry, the default position should be that the corporation, not the individual, provides the warranties.

- Indemnification (補償責任): The practice of making founders jointly and severally liable with the company for any damages arising from a contract breach is also targeted for reform. The guide decries this as a violation of the fundamental principle of limited liability that underpins corporate law. It argues that while founders who are also directors already owe a duty of care to the company, making them personal guarantors for all corporate actions is excessive and counterproductive.

Taken together, these recommendations represent a concerted effort to de-risk entrepreneurship on a personal level, shifting the focus from punishment to proactive, supportive governance.

2. Aligning Exit Incentives: The Participating vs. Non-Participating Debate

Perhaps the most economically significant reform proposed concerns the structure of preferred stock, specifically the terms governing how investors are paid out in an M&A or liquidation event. This is a highly technical area, but one that has profound implications for founder and investor incentives.

In Japan, the dominant form of preferred stock is "participating preferred" (参加型). This allows an investor to first receive back their initial investment (typically a 1x liquidation preference) and then also share in the remaining proceeds on a pro-rata basis with common shareholders, as if their preferred shares had converted to common stock. This is often referred to as "double-dipping."

The U.S. market, by contrast, has largely standardized on "non-participating preferred" (非参加型). With this structure, an investor has a choice upon exit: either take their liquidation preference (e.g., their money back) or convert their preferred shares to common stock and share in the proceeds pro-rata. They cannot do both.

The guide argues that Japan's preference for participating preferred creates a critical misalignment of incentives. Because investors with participating shares get a superior return in any M&A scenario, it can create a bias where founders (common shareholders) are incentivized to pursue a risky, high-valuation IPO, while investors might prefer a more certain, moderately valued M&A. This can lead to conflicts on the board and potentially suboptimal decisions for the company.

By advocating for a shift towards non-participating preferred as the default, METI and JETRO are aiming to level the playing field. In a non-participating structure, once an exit valuation surpasses the point where converting to common stock becomes more lucrative, the economic interests of both investors and founders become perfectly aligned: both want the highest possible exit price, regardless of whether it comes from an IPO or an M&A. The guide also acknowledges middle-ground solutions, such as "capped participation," which allows for double-dipping up to a certain return multiple, as a potential compromise.

3. Modernizing the Path to IPO: Reforming Share Conversion

The report tackles another major point of friction between Japanese practice and global norms: the timing of preferred stock conversion into common stock for an IPO.

The standard procedure in Japan requires preferred shares to be converted before the formal IPO application is filed. This creates a significant risk for investors. If the IPO is unexpectedly cancelled or postponed after the conversion has occurred, investors are left holding less-protected common stock. Reversing the conversion is a legally cumbersome process requiring unanimous shareholder consent, which may be difficult to obtain.

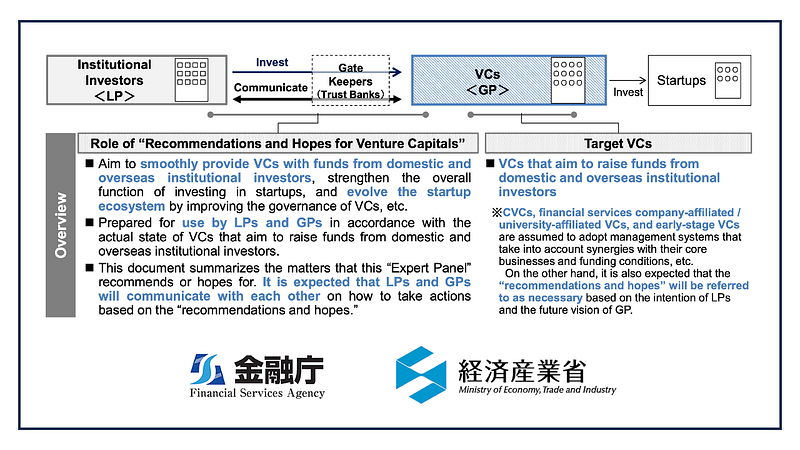

The global standard, practiced in the U.S. and other major markets, is automatic conversion that takes effect at the moment of the IPO. This eliminates the risk for investors, as the conversion only happens if the listing is successful. The METI/JETRO guide makes a forceful case for Japan to adopt this practice. Crucially, the document includes feedback from the Tokyo Stock Exchange (TSE) and Japan's Financial Services Agency (FSA), who confirm that there are no legal or regulatory barriers to implementing conversion-on-IPO. The guide even provides a sample timeline and outlines the necessary disclosure procedures, effectively removing any ambiguity and providing a clear path for companies and their legal advisors to follow.

4. Broadening the Horizon: Beyond the IPO-or-Bust Mentality

Finally, the guide seeks to broaden the strategic options for startups by reforming the "Exit Cooperation Clause" (Exit協力義務). Many Japanese contracts contain a clause obligating the company and founders to make "best efforts" to achieve an IPO by a certain date. This reflects a deep-seated cultural preference for IPOs as the primary, and often only, legitimate exit path.

The new guidance recommends replacing this narrow "IPO effort" clause with a broader commitment to securing an exit for investors, explicitly including M&A and secondary sales as valid and desirable options. This change recognizes that for many startups, being acquired by a strategic corporate partner can be a faster and more effective path to scaling their technology and achieving market impact than a standalone IPO. This reflects a growing maturity in the ecosystem and a desire to foster a more liquid and dynamic market for startup equity.

The Road Ahead: From Guidance to Practice

The METI/JETRO document is a guideline, not a law. Its success will depend entirely on its adoption by the key players in Japan's venture ecosystem: the venture capital firms, the corporate venture arms, the law firms that draft the contracts, and the founders themselves.

However, its weight and detail signal a clear direction from the top. By systematically dismantling long-held but outdated practices and providing a clear, globally-aligned alternative, the government is aiming to reduce friction for international investors who have often been deterred by unfamiliar and founder-punitive terms. For domestic entrepreneurs, it offers the promise of a more supportive legal framework that encourages bold, ambitious risk-taking.

If this new playbook gains traction, it could mark a pivotal moment for Japanese innovation. It could accelerate the flow of global capital into Tokyo's most promising startups, foster more constructive and professional boardroom dynamics, and ultimately help the nation achieve its goal of moving beyond "breadth" to build the towering, globally-recognized pillars of "height" in its startup ecosystem.