Mission to Tallinn: Inbank

We were delighted to participate in the "ICT & FinTech Mission to Tallinn" this past week, courtesy of Enterprise Estonia. Our second stop was Inbank, where we were hosted by Founder & Chief Executive Officer Priit Poldoja, as well as Chief Product & Technology Officer Erik Kaju.

Introduction

The meeting provided a comprehensive deep dive into Inbank’s operational philosophy, financial performance, and strategic direction as a leading European embedded finance provider, outlining how the company has evolved from a FinTech startup into a regulated, profitable banking institution with a unique distribution model.

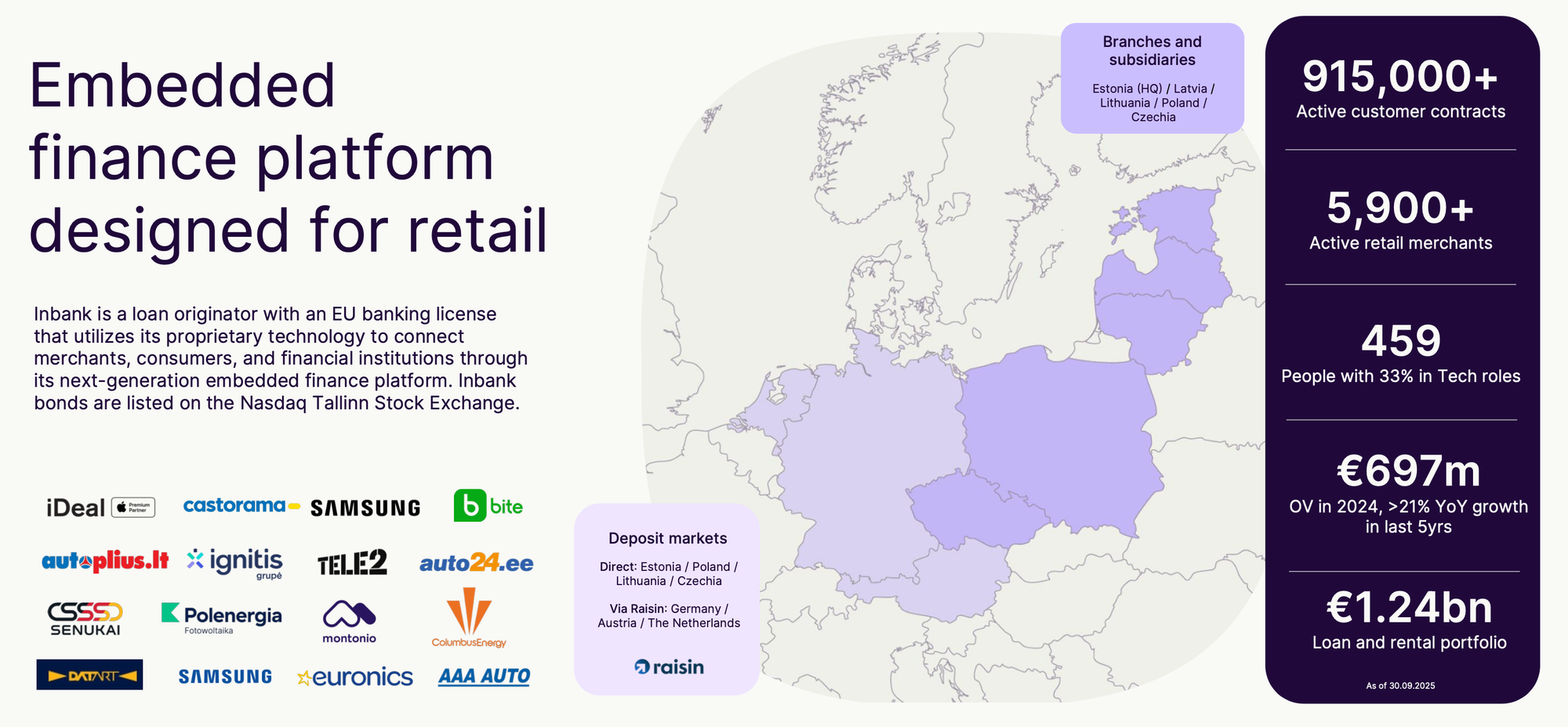

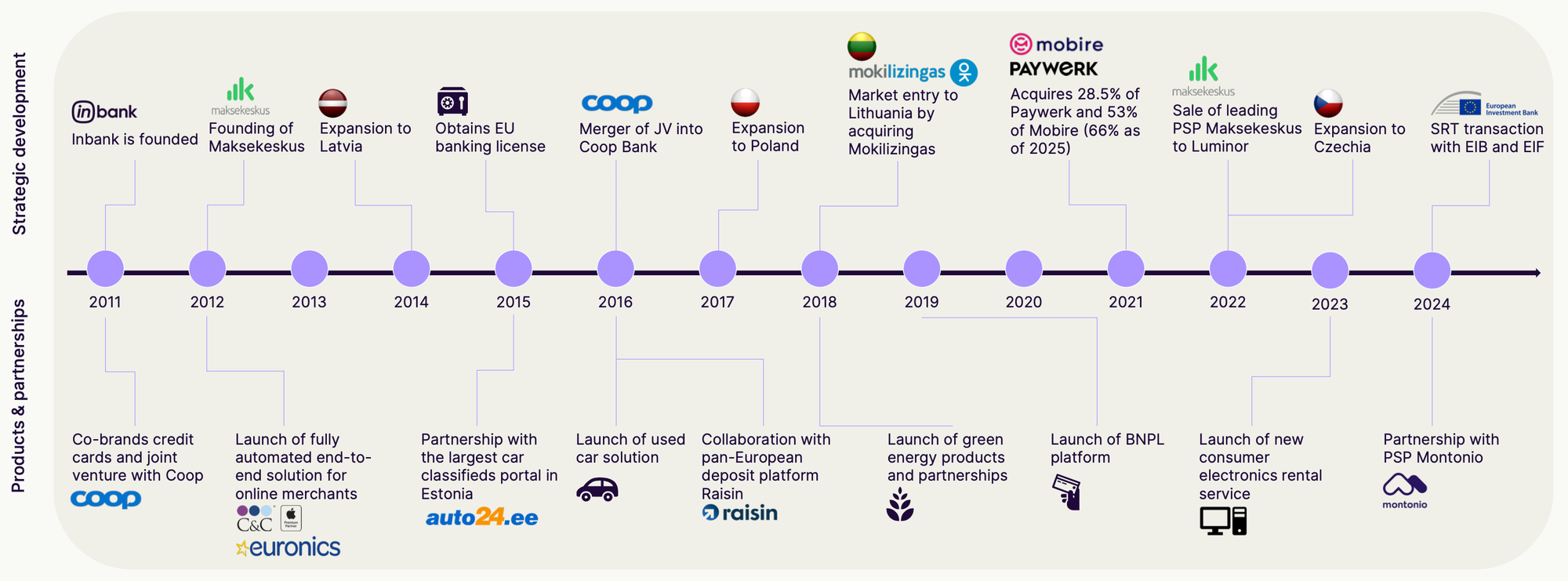

The overarching theme of the presentation was Inbank’s successful divergence from traditional banking models. Poldoja opened the session by establishing a personal connection with the delegation, recalling the start of his career at a Japanese bank in San Francisco in 1995, highlighting a long-standing appreciation for Japanese financial diligence. He proceeded to define Inbank not merely as a bank, but as a specialized financial technology company with a banking license. This distinction is crucial to their strategy; unlike traditional universal banks that rely on branch networks and broad service offerings, Inbank focuses entirely on embedded finance. They integrate their financing solutions directly into the sales flows of over 5,900 merchant partners, effectively becoming an invisible enabler of commerce rather than a destination for banking services.

This partner-focused distribution strategy underpins a strong organic and inorganic growth strategy, while delivering 13 consecutive years of profit producing an average ROE of 21%. In 2024, Inbank successfully raised 10 million euro of equity capital and signed the first significant risk transfer („SRT“) transaction backed by solar panel loans to private individuals in Poland with the European Investment Bank Group.

Core Business Model and Product Strategy

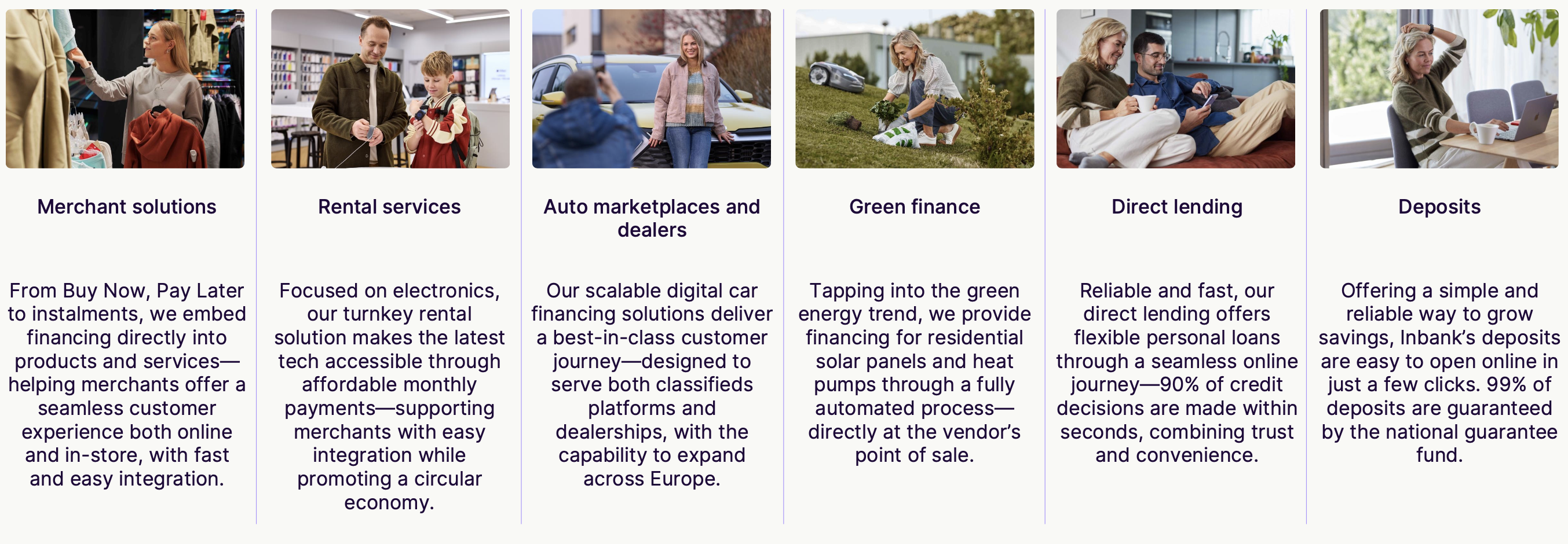

The delegation was given a detailed walkthrough of Inbank’s business model, which revolves around the concept of "embedded finance." Rather than asking consumers to visit a bank branch to apply for a loan, Inbank embeds its financing options directly into the checkout process of retailers, both online and in physical stores. This "B2B2C" (Business-to-Business-to-Consumer) model relies on deep integration with merchant partners.

The product portfolio is diversified across several key verticals to mitigate risk and capture different segments of consumer spending. The largest segment remains "Merchant Solutions," encompassing Buy Now, Pay Later (BNPL) and point-of-sale financing. This vertical generated sales of 68.1 million euros in Q3 2025, growing 13% year-on-year.

A standout performer in the portfolio has been "Green Financing," which caters to the growing demand for energy-efficient home improvements like solar panels and heat pumps. This segment saw explosive growth, particularly in Poland, with sales volumes increasing by 57% year-on-year to reach 39.3 million euros.

Direct lending, where Inbank offers loans directly to consumers via its own channels, also saw impressive growth of 48% year-on-year, reaching 35.1 million euros. This indicates that while the partner channel is primary, the Inbank brand is gaining independent traction among consumers.

Conversely, the car financing segment faced headwinds, particularly in Estonia due to new motor vehicle taxes, resulting in an 18% decline in quarterly sales to 49.3 million euros. However, management framed this as a localized and temporary impact within a broader diversified portfolio that continues to expand.

In addressing the competitive landscape, management clarified their market positioning relative to global giants like Revolut or Klarna. While those entities excel in daily banking and payments, Inbank has carved out a niche in credit underwriting for higher-value purchases. They target a "sweet spot" of transaction values between 1,000 and 25,000 euros. Purchases in this range—such as used cars, extensive home renovations, or high-end electronics—require more sophisticated credit analysis than a simple 50-euro BNPL purchase, yet customers still demand the speed and convenience that traditional banks struggle to provide.

Customer Deposits

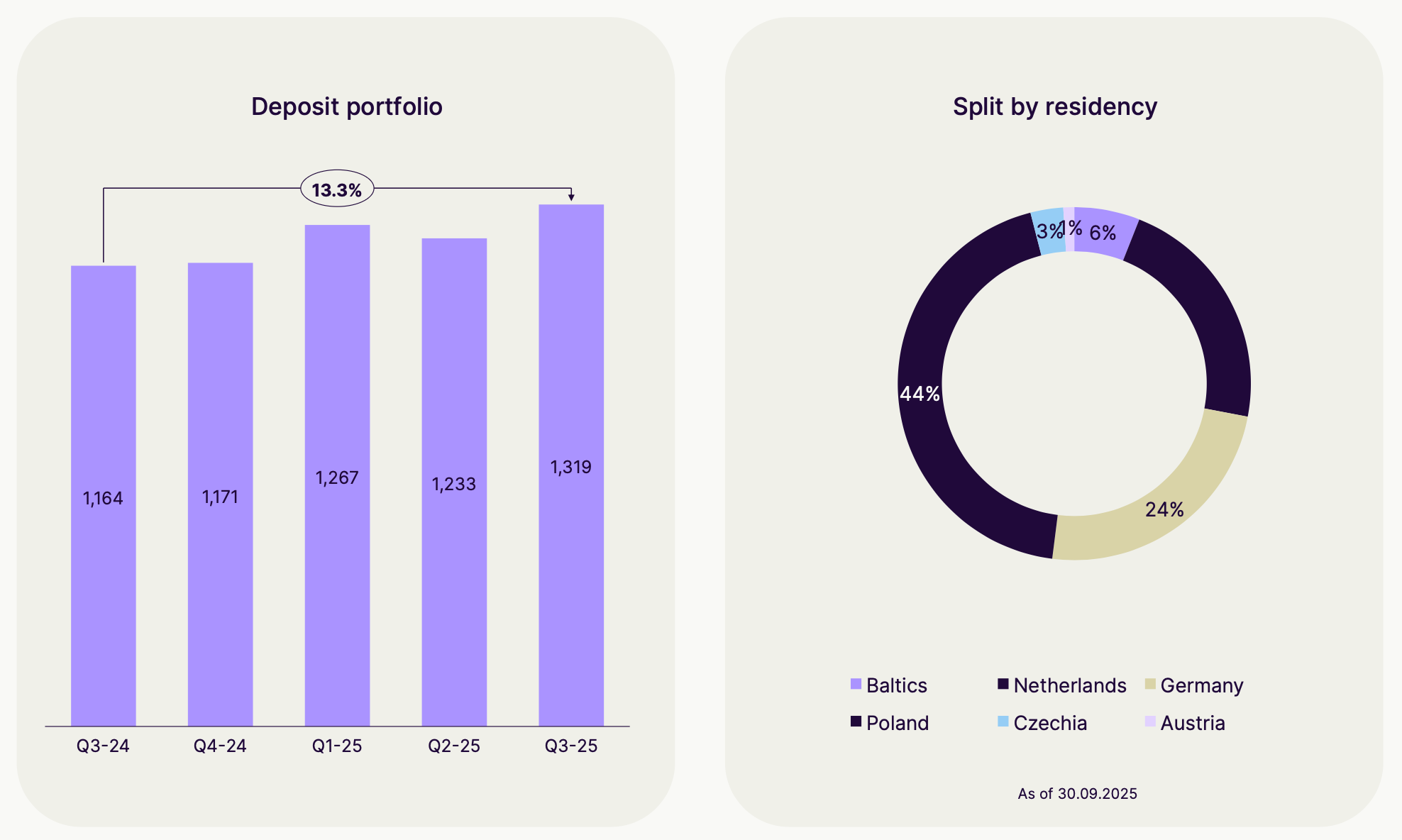

Inbank has a highly diversified funding base of nearly 120,000 depositors. Inbank accepts term deposits from private individuals in Estonia, Lithuania, Poland, Czechia, Germany, Austria, and the Netherlands, and has accumulated a deposit portfolio of 1.3 billion euros. 99% of these deposits are covered by the Estonian Guarantee Fund.

Deep Dive: The Rental and Subscription Model

A focal point of the presentation was Inbank’s aggressive expansion into "Rental Services," a business line that moves beyond traditional lending into the "Product-as-a-Service" economy. This segment grew by 30% in Q3 2025, generating 10.0 million euros in revenue, and represents a strategic pivot toward circular economy principles.

The delegation learned that in this model, Inbank retains ownership of the underlying asset—whether it is a vehicle or a piece of consumer electronics—and rents it to the customer for a fixed period. This fundamentally differs from a loan where the customer takes ownership and pays back the principal with interest. For the consumer, this translates into an affordable monthly subscription fee that grants access to the latest technology or mobility solutions without the high upfront cost or long-term commitment of ownership.

For Inbank, the financial mechanics of the rental model differ from standard lending. Revenue is derived from the monthly rental payments and, crucially, the resale of the asset at the end of the contract term. In Q3 2025 alone, Inbank generated 4.2 million euros from the sale of assets previously rented to customers. This model introduces residual value risk—the risk that the asset will be worth less than expected when returned—which Inbank manages through specialized subsidiaries like Mobire (for cars) and Inbank Rent (for electronics). These subsidiaries handle the logistics of asset lifecycle management, including refurbishment and resale, turning a potential logistical burden into a competitive advantage that is difficult for purely digital competitors to replicate.

The rental model aligns well with Inbank’s Green Financing initiatives by extending the lifecycle of devices and vehicles. Returned electronics are refurbished and re-rented or sold on secondary markets, reducing electronic waste and offering a sustainable alternative to the traditional "take-make-dispose" consumption model. This circular approach has resonated with partners and consumers alike, particularly in the Baltics and Poland, where the demand for flexible, subscription-based access to goods is accelerating.

Operational Risk Management and Credit Strategy

Given the speed at which Inbank operates, the Japanese delegation was particularly interested in how the bank manages credit risk. Inbank’s value proposition to merchants is the "one-minute standard"—the ability to finalize a financing contract in under sixty seconds at the point of sale. Achieving this speed without compromising the balance sheet requires a highly sophisticated, automated risk management framework.

Kaju explained that over 90% of Inbank’s credit decisions are fully automated, requiring zero human intervention. The decision engine is built to query external databases—such as population registers, income tax databases, and credit bureaus—in real-time. By combining this external data with internal behavioral models, the system can render a binding credit decision in under 30 seconds, and often in as little as 10 to 15 seconds. This speed is critical to preventing cart abandonment in e-commerce scenarios.

Despite this high velocity, the portfolio quality remains robust. The ratio of impairments to the total loan and rental portfolio stood at 1.5% for the third quarter of 2025, a figure that the management described as well within their target range. This stability is achieved through granular credit scoring models that utilize machine learning to assess not just the applicant, but the specific context of the transaction, including the item being purchased and the risk profile of the merchant.

Furthermore, Inbank employs a proactive strategy for managing non-performing loans (NPLs). Rather than maintaining a massive internal collections department, the bank regularly sells receivables that are more than 90 days overdue to external debt collection agencies. This practice keeps the balance sheet clean and allows the internal team to focus on origination and technology rather than distressed asset recovery.

The delegation also inquired about the "zero interest" loans often seen in retail. Management clarified that these are not losses for the bank; rather, they are subsidized marketing campaigns where the merchant or manufacturer pays the interest cost upfront to drive sales volume. This structure allows Inbank to maintain a healthy portfolio yield—averaging 11.1% in Q3 2025—while offering attractive terms to the end consumer.

Technology and AI Integration

Underpinning the entire operation is a proprietary technology platform designed for modularity and scale. Kaju described the system as a collection of "Lego bricks," allowing different financial modules to be assembled rapidly to meet the specific needs of a merchant partner. Whether a partner needs a complex full-service car leasing checkout or a simple split-payment solution for sneakers, the underlying platform adapts without requiring bespoke development for every client.

The discussion also touched upon the role of Artificial Intelligence (AI) within the bank. Currently, Inbank utilizes machine learning extensively for credit scoring and pricing, which is the core engine of their automated decisioning. AI is also deployed in operational back-office tasks to automate routine processes, enabling the bank to scale its volumes without a corresponding linear increase in headcount. Looking forward, the leadership team sees significant potential in Generative AI for enhancing developer efficiency and eventually for direct customer interaction through advanced chatbots, although widespread deployment in customer-facing roles is part of the future roadmap rather than the current standard.

Conclusion

The meeting concluded with a forward-looking discussion on Inbank’s growth trajectory. The management reaffirmed their commitment to the "B2B2C" embedded finance model, viewing it as the future of consumer lending. By stripping away the friction of traditional banking and placing financial products exactly where they are needed—at the point of purchase—Inbank has secured a 20% market share in consumer lending in its home market of Estonia and is replicating this success across Poland, Latvia, Lithuania, and the Czech Republic.

The Q3 2025 results serve as a validation of this strategy. With record origination volumes, rising net income, and a solid capital base, Inbank is well-positioned to navigate the evolving European financial landscape. The successful capital raise through another Tier 2 bond issue on Nasdaq Tallinn in October and the ongoing diversification into rental and green financing products provide a strong foundation for continued expansion. The Japanese delegation departed with a clear understanding of how Inbank combines the regulatory stability of a licensed bank with the agility and technological sophistication of a fintech to deliver profitable growth.