Mitsubishi UFJ Trust and Banking Invests in Euglena's Overseas SPC

Mitsubishi UFJ Trust and Banking (MUTB) has entered into a Preferred Shares Investment Agreement with Euglena in which MUTB invests up to USD 30 million in preferred shares issued by Euglena Sustainable Investment Limited (ESIL), Euglena's overseas special purpose company (SPC).

Sustainable Aviation Fuel (SAF) shows great promise as a measure to tackle climate change and is expected to be utilized to significantly reduce carbon dioxide emissions compared to fossil fuels. To promote SAF, the Japanese government has set a 2030 target for SAF to comprise 10% of domestic aviation fuel consumption. By engaging in a project to construct and operate a biofuel manufacturing plant in Malaysia (the Project) through the investment in ESIL, MUTB will support establishing SAF supply chain and contribute to Japan's decarbonization together with Euglena.

MUTB, based on its corporate message “Connecting People, Connecting the Future,” is working to realize a sustainable future by addressing various social issues to ensure that the cherished aspirations of society and customers are carried forward into the future.

In response to the challenges facing Japan's energy and social infrastructure, MUTB will play a role in accelerating the diffusion of new technologies through the supply of risk capital to new assets focusing on new technologies and businesses both in Japan and overseas. This investment agreement aims to promote SAF by supporting the securing of interests in domestic SAF, where supply shortages are anticipated in the future.

Going forward, MUTB aims to provide investment opportunities to diverse investors in domestic infrastructure, where investment opportunities are currently limited due to the sector's immaturity, by forming funds that invest in infrastructure facilities.

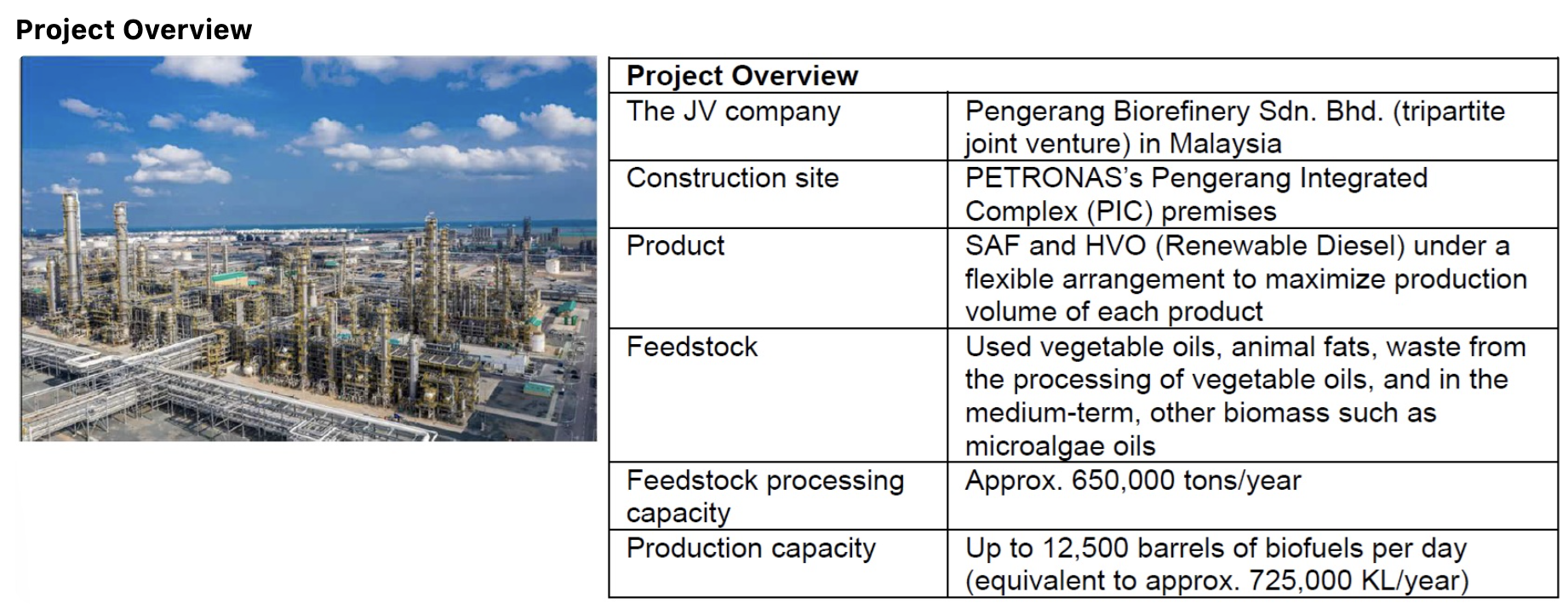

Euglena has been promoting this project jointly with Malaysia's PETRONAS and Italy's Enilive with the aim of commercializing its biofuel business. In December 2024, Euglena acquired a 5% equity interest in a Malaysian joint venture responsible for constructing and operating the biofuel manufacturing plant. Euglena has the right to increase its shareholding up to 15% under a shareholder agreement with the Joint Venture partners, and aims to do so soon by providing additional financial commitments on the basis of the Investment Agreement.

The Investment Agreement establishes a financing facility in which ESIL will issue non-voting debt-like preferred shares, and MUTB will invest up to USD 30 million in stages upon request from ESIL. Euglena already injected approximately USD 50 million into ESIL's common shares in 2024 and, by using ESIL's cash on hand and the Facility, plans to make phased cash contributions upon cash calls from the JV.

Mizuho Securities has acted as a financial advisor to Euglena on the structuring of the Facility and the documentation of the Investment Agreement.