Mitsui Sumitomo Insurance Acquires Stake in Asset Manager Barings

Mitsui Sumitomo Insurance, a subsidiary of MS&AD Insurance Group, has agreed to acquire an 18% equity interest in Barings, an asset management company and wholly owned subsidiary of Massachusetts Mutual Life Insurance (“MassMutual”), from MassMutual for a total investment of USD 1.44bn.

Background of the Investment

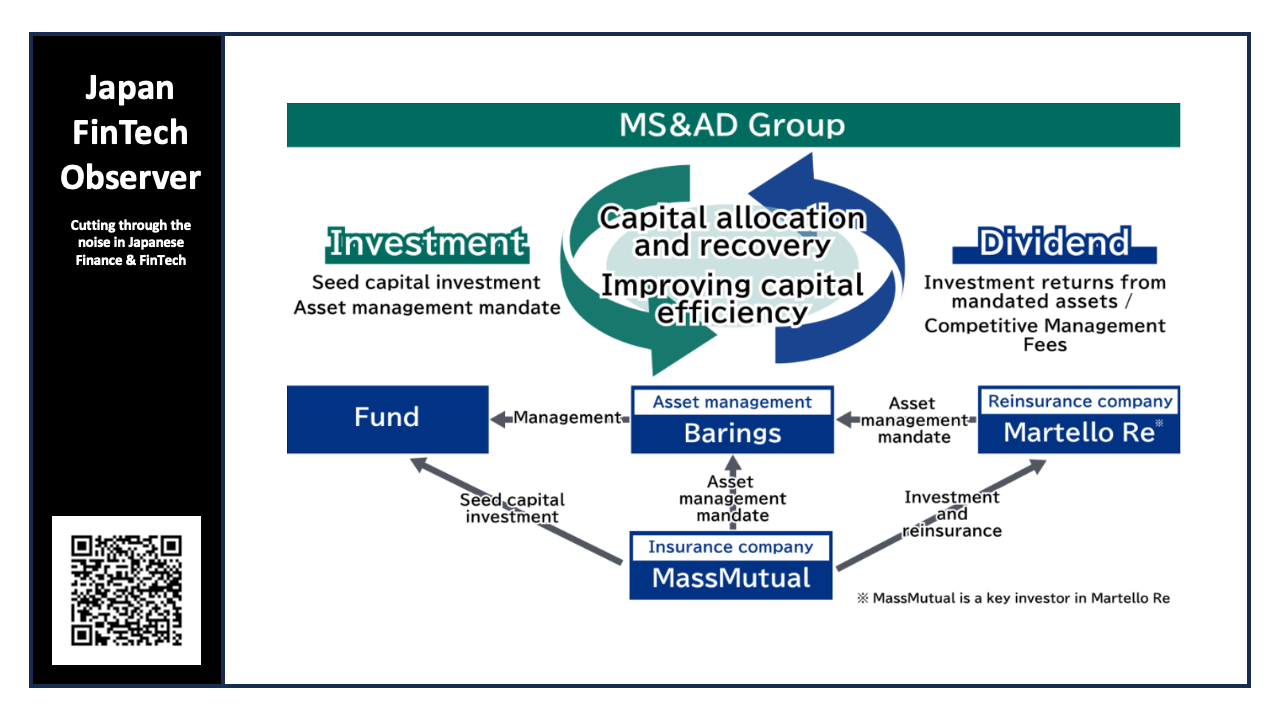

MS&AD Group has been promoting the “transformation of our business and risk portfolio” as one of its core strategies, and has been working to grow through investments in overseas business. In this context, MS&AD Group has been considering strengthening its asset management business, which is expected to improve long-term capital efficiency while controlling required capital, has a low correlation with the insurance underwriting business, and can diversify the business portfolio.

Against this backdrop, MS&AD Group has decided to invest in Barings, which possesses abundant expertise and talent in public and private credit as well as real assets, and with a high degree of cultural compatibility.

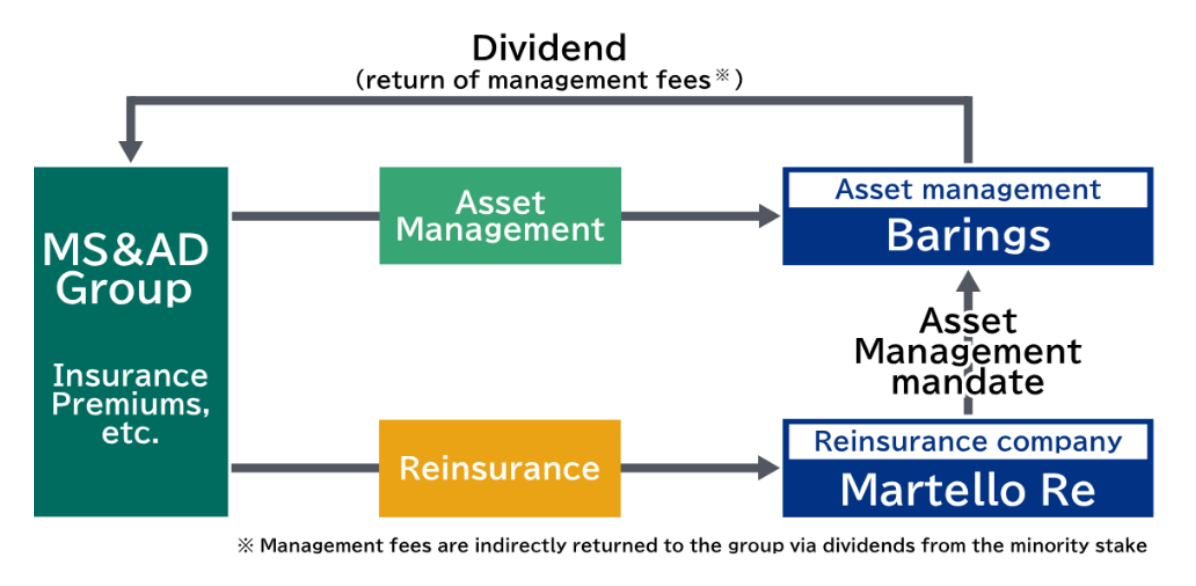

This investment will also enable collaboration between MS&AD Group and Martello Re, a highly creditworthy reinsurance company where MassMutual is a key investor, and which has a partnership with Barings who currently manages a majority of their assets. This will allow MS&AD Group a flexible selection between retaining and transferring insurance underwriting risks, leading to further improved capital efficiency and the development of more competitive products.

Overview of the Investment

By leveraging the investment opportunities, information, and expertise gained through the Investment across the entire group, MS&AD Group will promote initiatives that contribute to the “diversification of the business portfolio”, “improvement of capital efficiency”, and “enhancement of insurance product development capabilities”, thereby aiming to further enhance enterprise value.

Through the strategic alliance resulting from the Investment, MS&AD Group will also maximize cash flow and achieve efficient capital circulation. MS&AD Group aims to swiftly allocate the funds generated to growth investments and shareholder returns.