Mizuho FY3/25 Financial Results

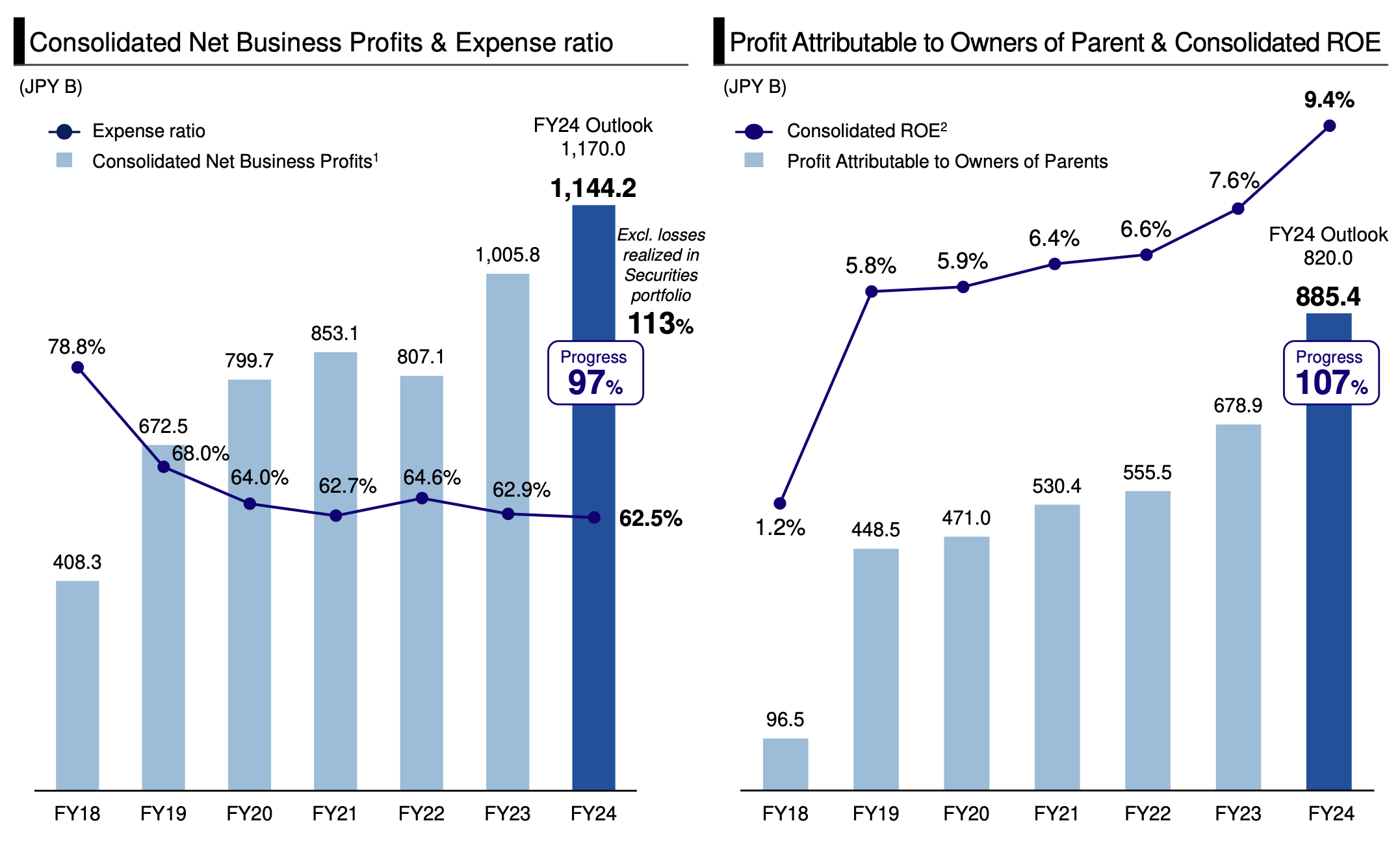

Mizuho Financial Group has released its financial results for FY24 (ending in March 2025), showcasing a year of significant progress and notable achievements. The organization has demonstrated a solid increase overall, primarily driven by larger non-interest income and a positive impact from the Bank of Japan's rate hikes. These factors have contributed to the attainment of record highs in both Consolidated Net Business Profits and Profit Attributable to Owners of Parent, marking a significant milestone for the company. Mizuho has also successfully met its targets for the current medium-term business plan, achieving this accomplishment one year ahead of schedule. Furthermore, the organization has strategically realized losses in its securities portfolio and recorded forward-looking reserves, positioning itself for future financial stability and growth.

Consolidated Net Business Profits and Profit Attributable to Owners of Parent have reached record highs, reflecting the success of Mizuho's strategic initiatives and business operations. The company's ability to capitalize on favorable market conditions and effectively manage its resources has resulted in exceptional financial performance. Mizuho's commitment to innovation, customer satisfaction, and responsible financial management has been instrumental in achieving these remarkable results. As a result, Mizuho has demonstrated its resilience and adaptability in a dynamic and ever-changing business landscape.

In addition to its strong financial performance, Mizuho has also taken proactive measures to prepare for future challenges and opportunities. The organization has realized losses in its securities portfolio and recorded forward-looking reserves, demonstrating its commitment to prudent risk management and financial stability. These actions will enable Mizuho to navigate potential market fluctuations and uncertainties with confidence, ensuring its long-term success and resilience. As a result, Mizuho is well-positioned to continue delivering value to its stakeholders and contributing to the overall health of the financial system.

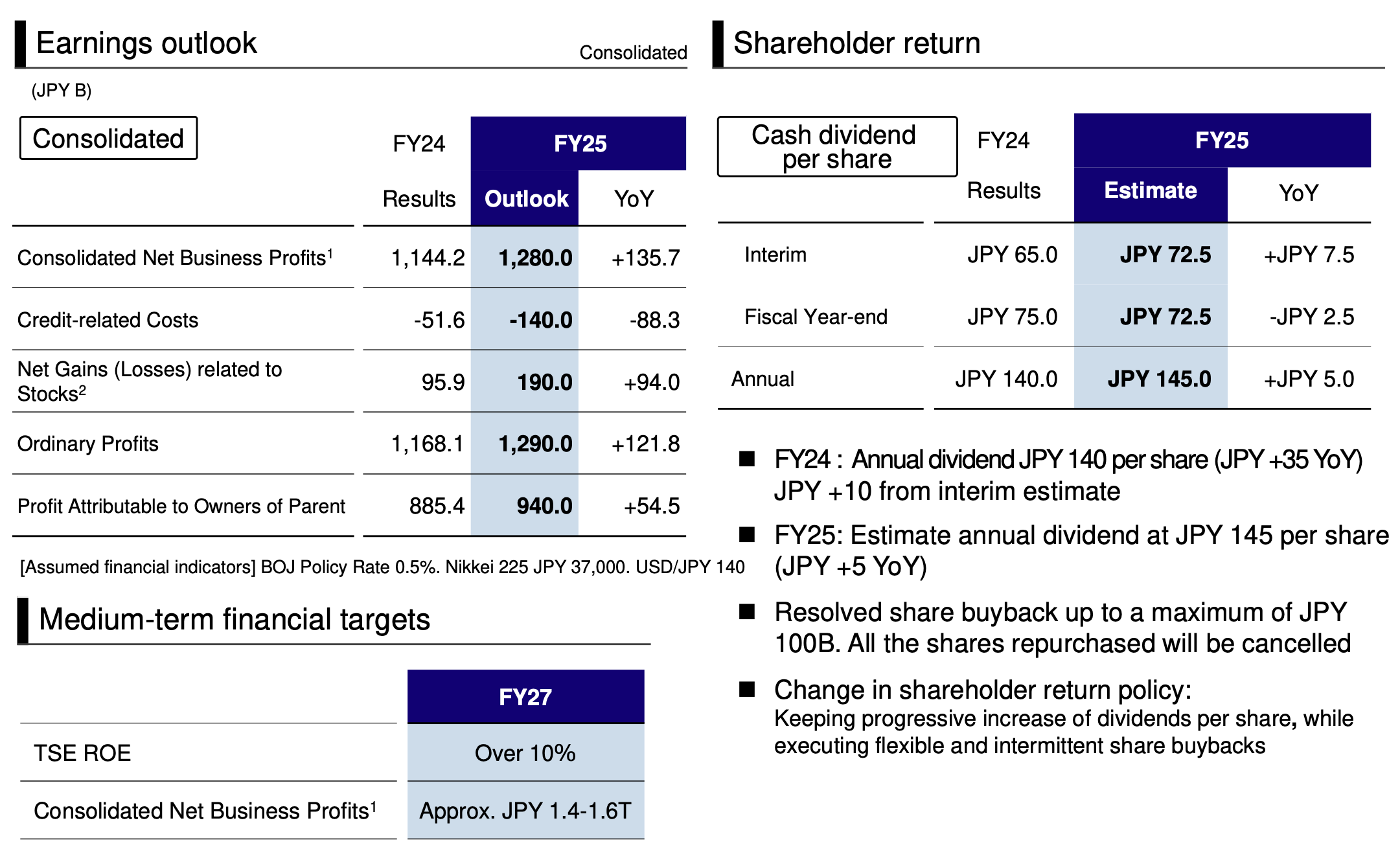

Looking ahead to FY25, Mizuho anticipates steady growth despite the uncertainties in the business environment. The organization projects Consolidated Net Business Profits of JPY 1.28T, representing a YoY increase of JPY +135.7B. In addition, Mizuho forecasts Profit Attributable to Owners of Parent to reach JPY 0.94T, reflecting a YoY increase of JPY +54.5B. However, Mizuho also recognizes the importance of operating its business with due consideration of potential downside risks, given the current economic climate.

Mizuho has also set new medium-term financial targets for FY27, demonstrating its long-term vision and commitment to sustainable growth. The organization aims to achieve a TSE ROE of over 10% and Consolidated Net Business Profits of approximately JPY 1.4~1.6T. These ambitious goals reflect Mizuho's confidence in its ability to navigate the challenges ahead and capitalize on emerging opportunities.

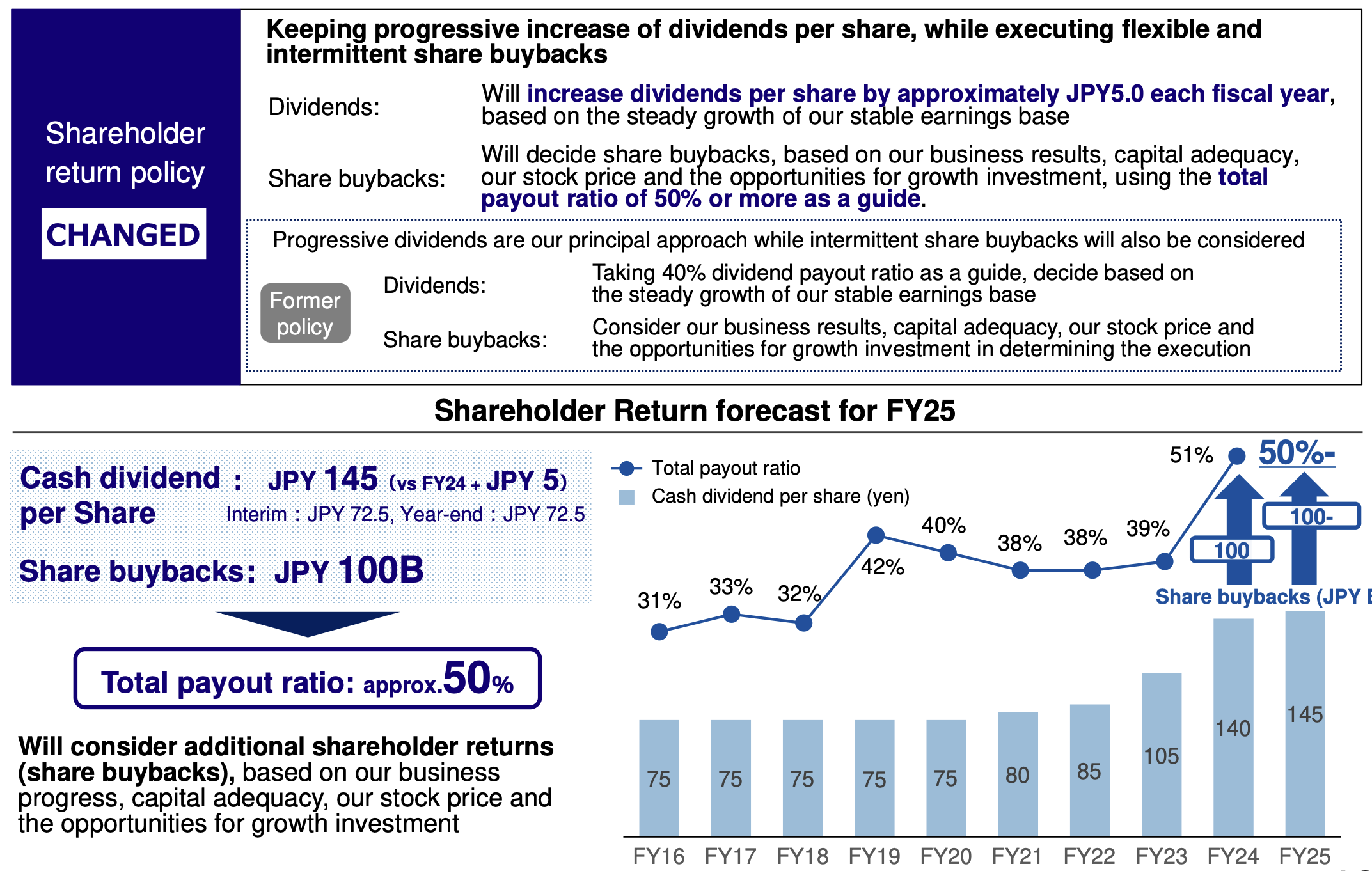

To further enhance shareholder value, Mizuho has implemented a shareholder return policy that includes both annual dividends and share buybacks. For FY24, the organization has increased its annual dividend by JPY +10 from the interim estimate, resulting in a total dividend of JPY 140 per share. Looking ahead to FY25, Mizuho estimates a dividend of JPY 145 per share, marking the fifth consecutive year of dividend increases. The organization is also committed to executing share buybacks up to a maximum of JPY 100B, providing additional value to its shareholders. Mizuho's shareholder return policy reflects its commitment to sharing its success with its investors and rewarding their continued support.