Mizuho Second Quarter Financial Results

Mizuho Financial Group's results for the first half of fiscal year 2025 (FY25 H1) reveal a company operating with significant positive momentum. The strong performance, coupled with an upward revision of its full-year profit outlook and an aggressive stance on shareholder value, signals a confident and assertive strategy. These results are not merely cyclical; they reflect a deliberate transformation that presents a direct and accelerating challenge to competitors in the global financial landscape.

Mizuho's management has distilled their performance into four key messages that encapsulate their current trajectory:

- Strong Results, Solid Outlook: Mizuho has raised its FY25 Profit Outlook to JPY 1.13 trillion, a substantial increase of JPY 190 billion compared to its May forecast, based on robust H1 performance.

- Aggressive Shareholder Returns: In response to these strong results, the company has announced an additional JPY 200 billion share buyback, underscoring a firm commitment to enhancing shareholder value.

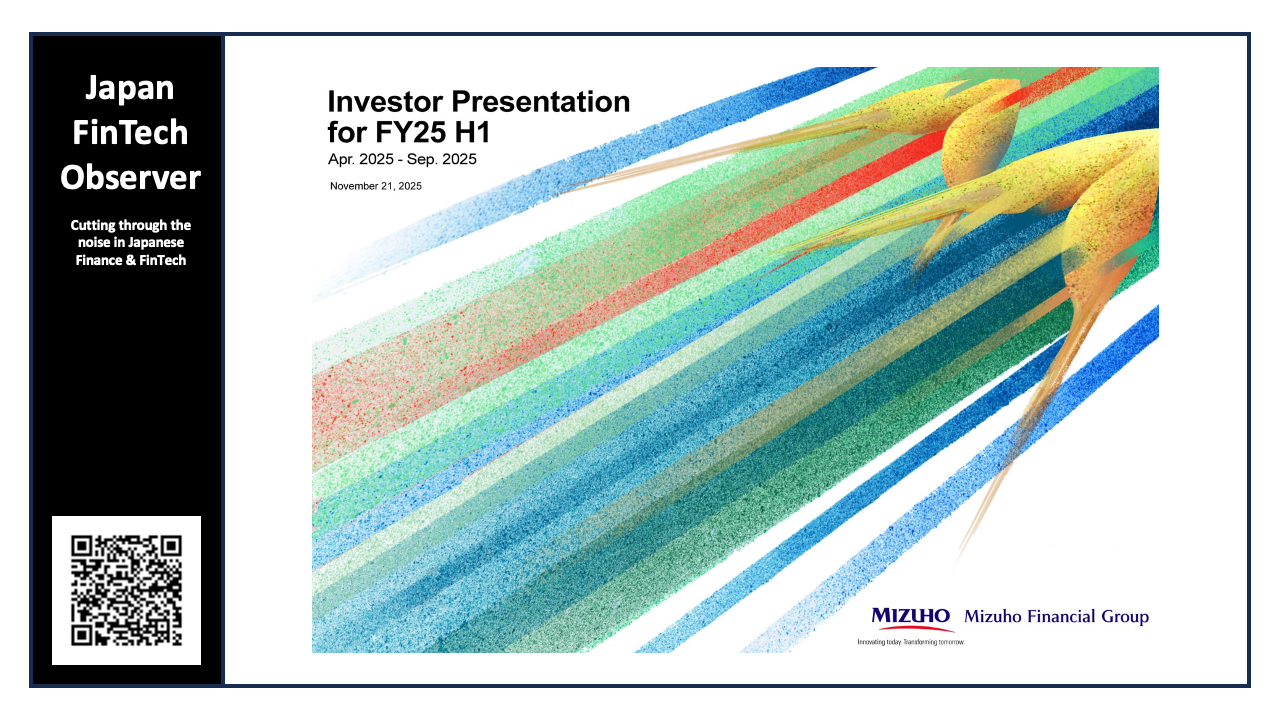

- Record Market Valuation: The firm's market capitalization has reached an all-time high of JPY 12.4 trillion, which management views as a direct reflection of its profound transformation.

- Improving Profitability Metrics: Profitability is steadily improving, with a past 12-month TSE Return on Equity (ROE) of 9.3%, approaching the medium-term target of over 10%. Management has clearly stated its goal of taking Earnings Per Share (EPS) back to historical highs.

These headline figures are underpinned by a disciplined approach to financial management and risk posture, which provides the foundation for Mizuho's growth initiatives.

Evaluation of Financial Health and Risk Posture

Assessing the stability of a Mizuho's portfolio and the rigor of its risk management is strategically vital. A sound financial base is the prerequisite for pursuing aggressive growth and delivering on ambitious shareholder promises. This section evaluates the quality of Mizuho's assets and its proactive measures to mitigate risk, which together enable its current strategic offensive.

Portfolio Soundness and Asset Quality

Mizuho's portfolio demonstrates a clear emphasis on quality and a significant reduction in historical risk concentrations.

- Credit Exposure Quality: Approximately 70% of Mizuho's credit exposure is rated Investment Grade, a standard maintained both within Japan and in its international operations. This high-quality composition is centered on large and mid-cap corporates, covering approximately 80% of listed companies in Japan.

- Portfolio De-risking: The group has dramatically reduced its exposure to high-risk assets. A stark example is the LBO underwriting position outside Japan, which has been cut from USD 12.5 billion before the Global Financial Crisis to just USD 1.2 billion as of March 2025.

- Forward-Looking Provisions: As of September 2025, total forward-looking reserves stood at JPY 108.5 billion. The net reversal in credit-related costs of JPY 32.3 billion for FY25 H1 indicates that current portfolio health is strong, allowing the firm to unwind previous provisions.

Capital Adequacy

Mizuho maintains a sound capital position that is well within its stated operational targets. As of September 2025, the CET1 capital ratio (excluding Net Unrealized Gains) was 10.4%. This sits comfortably within the firm's operational range of "mid 9-10% to mid 10-11%," providing sufficient buffer to support growth investments and shareholder returns.

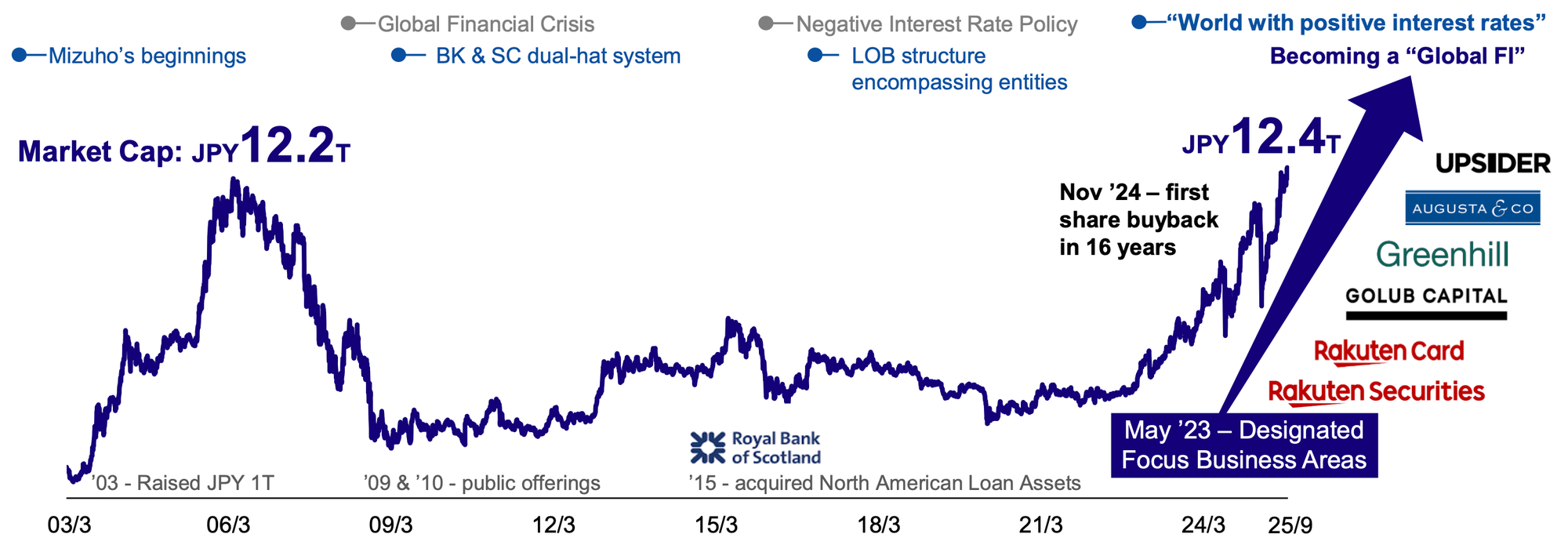

Management of Cross-Shareholdings

The firm is actively reducing its strategically held cross-shareholdings, a key focus for investors. The stated goal is to reduce the market value of these holdings to less than 20% of Net Assets. To achieve this, Mizuho has set a reduction target of over JPY 350 billion between March 2025 and March 2028, signaling a continued commitment to improving capital efficiency.

This stable financial base is not just a defensive posture; it is the war chest funding their aggressive expansion in the Americas, directly challenging for market share.

Analysis of Core Strategic Pillars and Growth Engines

Mizuho has designated several "Focus Business Areas" that serve as its primary engines for growth and value creation. A close examination of the performance within these segments is critical to identifying Mizuho's key competitive advantages, areas of strategic concentration, and potential weaknesses.

Global Corporate & Investment Banking (CIB): The Primary Growth Driver

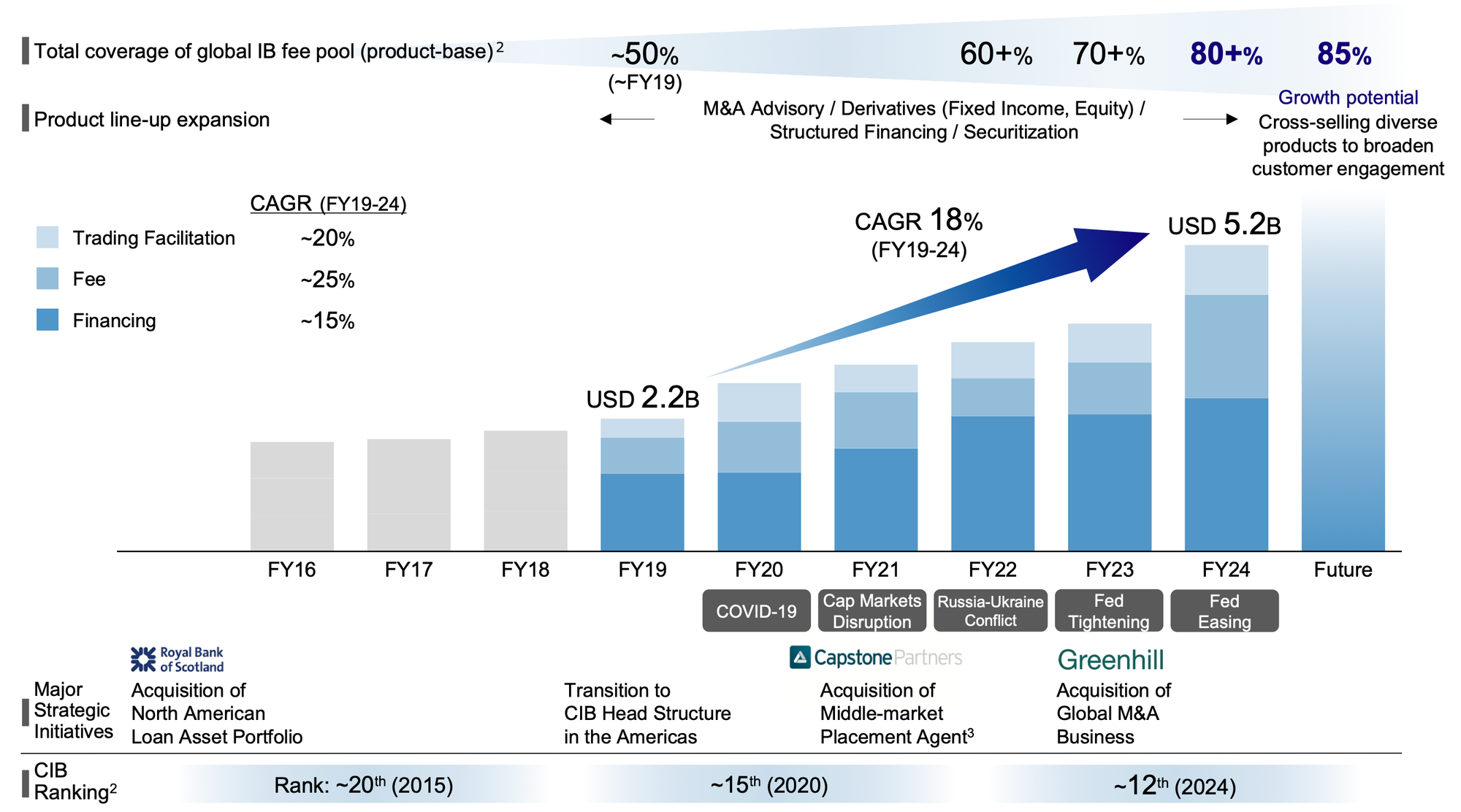

The Global CIB business, particularly its Americas division, stands out as Mizuho's most powerful growth driver. The strategy has been to build a fully-integrated, resilient CIB model through both organic growth and strategic acquisitions, moving the firm up the global league tables. Their success in the Americas CIB market, driven by a deliberate 'buy-and-build' strategy, is the most significant competitive threat Mizuho currently poses.

Key performance metrics for the Americas CIB business demonstrate its impressive momentum:

- Revenue Growth: The division has achieved a 20% Compound Annual Growth Rate (CAGR) in gross profits between FY19 and FY24, showcasing sustained high growth through various market cycles.

- Market Position: Mizuho has steadily climbed the ranks in the Americas CIB fee pool, moving from approximately 20th in 2015 to 12th in 2024.

- Revenue Diversification: Mizuho Americas has cultivated a balanced revenue stream with modest reliance on volatile trading activities. This structure provides greater revenue stability and resilience to market volatility compared to peers who are more reliant on sales & trading.

- Synergies from M&A: The recent acquisition of Greenhill is already enhancing Mizuho's capabilities in large, complex investment banking deals. This is evidenced by the sharp increase in total advisory fees for their top 10 deals, which grew from USD 22 million in FY22 to USD 96 million in FY24.

This CIB momentum, particularly the successful integration of Greenhill, is directly aimed at capturing higher-margin advisory business where competitors have historically held an advantage.

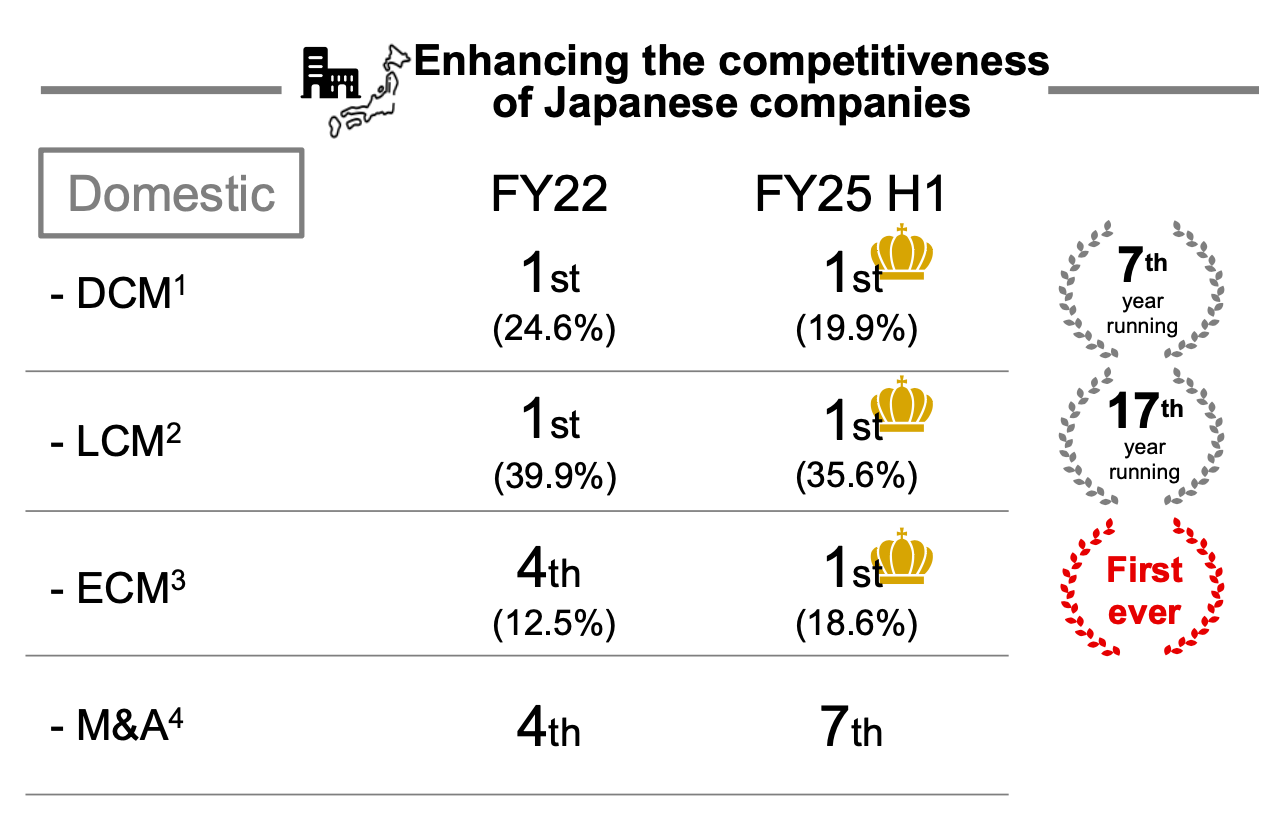

Domestic Strength: Enhancing the Competitiveness of Japanese Companies

While global expansion is a priority, Mizuho continues to leverage its profound corporate customer base in its home market. The firm holds a commanding position in Japanese investment banking league tables and is showing strong growth momentum.

Domestic IB League Table Rankings (FY25 H1)

Key growth metrics for this domestic segment in FY25 H1 further highlight its strength:

- Gross Profits: The segment delivered 11% year-over-year (YoY) growth. This 11% YoY growth was led by impressive performance in the Corporate & Investment Banking (CIBC) and Retail & Business Banking (RBC) sub-segments, which grew 74% and 29% respectively.

- Startup Support: Investments and loans to startups increased by 13% YoY, indicating a focus on capturing future growth drivers of the Japanese economy.

- Corporate Action Pipeline: Within the mid-cap (RBC Corporate) business, the pipeline for large deals has grown at a 16% CAGR, suggesting future revenue growth.

Their dominance in domestic capital markets provides a stable, high-margin profit base that subsidizes their more aggressive global expansion efforts.

Retail & Wealth Management: Progress and Persistent Challenges

Mizuho's efforts in the Japanese retail and wealth management sectors show steady progress, particularly in customer acquisition for digital and investment products. However, management candidly acknowledges persistent challenges that represent potential competitive vulnerabilities.

Key accomplishments for FY25 H1 include:

- Gross Profits: The Asset & Wealth Management segment grew profits by 12% YoY, while the Improving Customer Experience segment grew by 8% YoY.

- Customer Growth: NISA (Nippon Individual Savings Account) accounts grew 14% YoY, and the Monthly Active Users (MAU) for online banking increased 12% YoY.

Despite this progress, Mizuho has identified several key challenges to address:

- Revenue Quality: There is "still room to increase ratio of stable revenue," suggesting a continued reliance on more transactional income sources.

- Wealth Management Capabilities: Management notes a need to "improve consulting skills of our RMs" and better "align resources," pointing to ongoing efforts to elevate their wealth management value proposition.

- Asset Management Capabilities: A stated need for "Enhancing in-house AM capabilities and product development" indicates a gap that competitors with stronger product suites can exploit.

The strategic alliance with Rakuten represents Mizuho's most significant move to address these challenges and accelerate its transformation in the mass retail segment.

Strategic Alliances and Inorganic Growth Assessment

Mizuho is not relying solely on organic growth. The firm is aggressively using strategic partnerships and targeted acquisitions to rapidly acquire new capabilities, access new customer segments, and bolster its focus areas. Dissecting the rationale and impact of these deals provides insight into Mizuho's long-term competitive game plan.

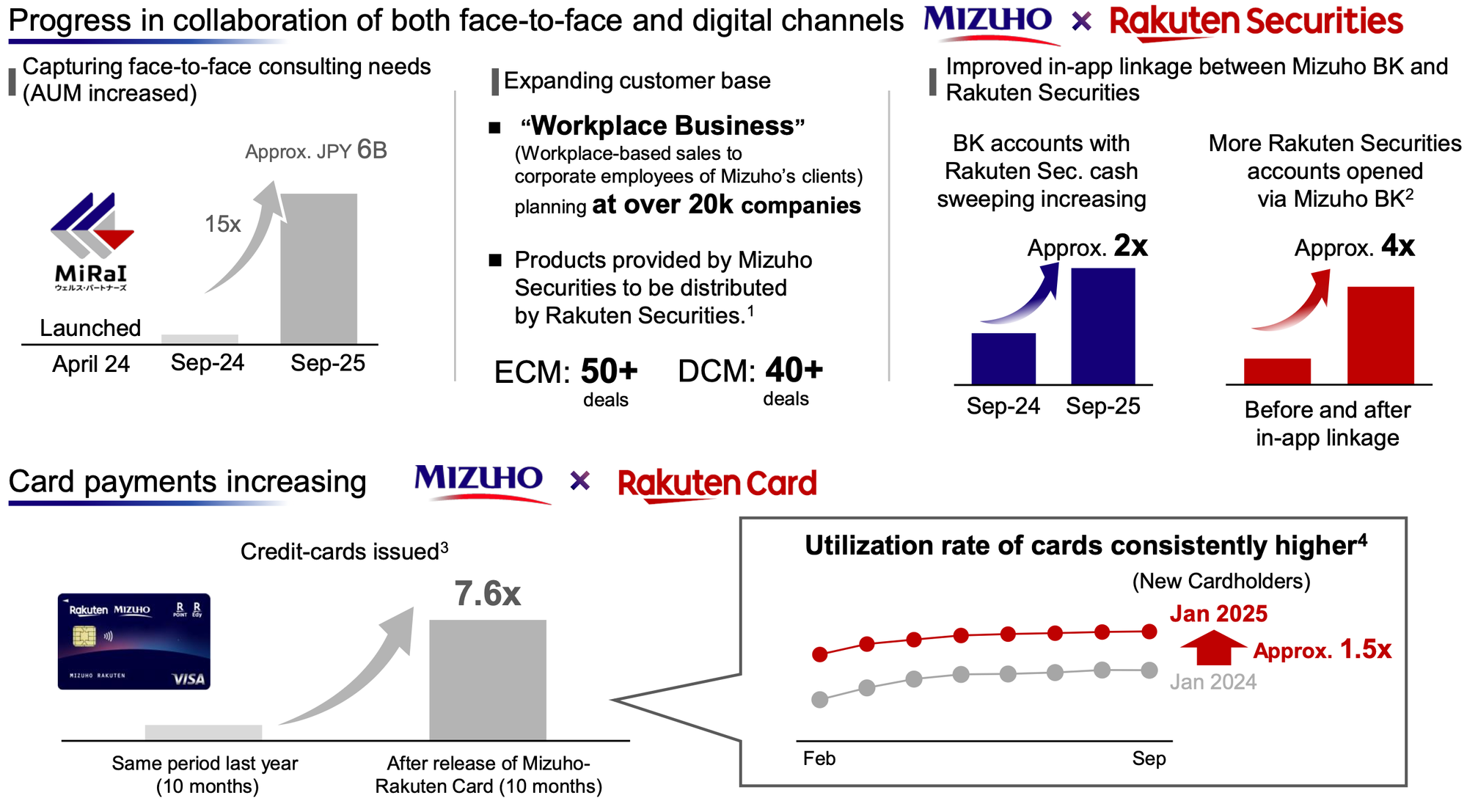

The Rakuten Alliance: A Bet on Ecosystem Integration

The cornerstone of Mizuho's retail strategy is its deep alliance with Rakuten Group. This partnership is designed to bridge Mizuho's established base of 22 million retail customers with Rakuten's massive digital ecosystem of approximately 100 million IDs. The primary goal is to attract a younger, digital-native demographic that Mizuho has traditionally struggled to capture and to integrate banking services more seamlessly into customers' daily consumer activities.

Early results from the collaboration are promising and indicate positive initial traction:

- Customer Acquisition: Following the integration of Rakuten Securities balances into the Mizuho banking app, the number of new Rakuten Securities accounts opened via Mizuho Bank has seen an "Approx. 2x" increase.

- Payment Services: The issuance of credit cards has surged 7.6x after the release of the co-branded Mizuho-Rakuten Card.

- Face-to-Face Consulting: The alliance has successfully captured face-to-face consulting needs, accumulating approximately JPY 6 billion in Assets Under Management (AUM) since November 2022.

While still in its early stages, this alliance aims to develop a significant long-term competitor in the retail market by creating a powerful digital ecosystem that will be difficult to match.

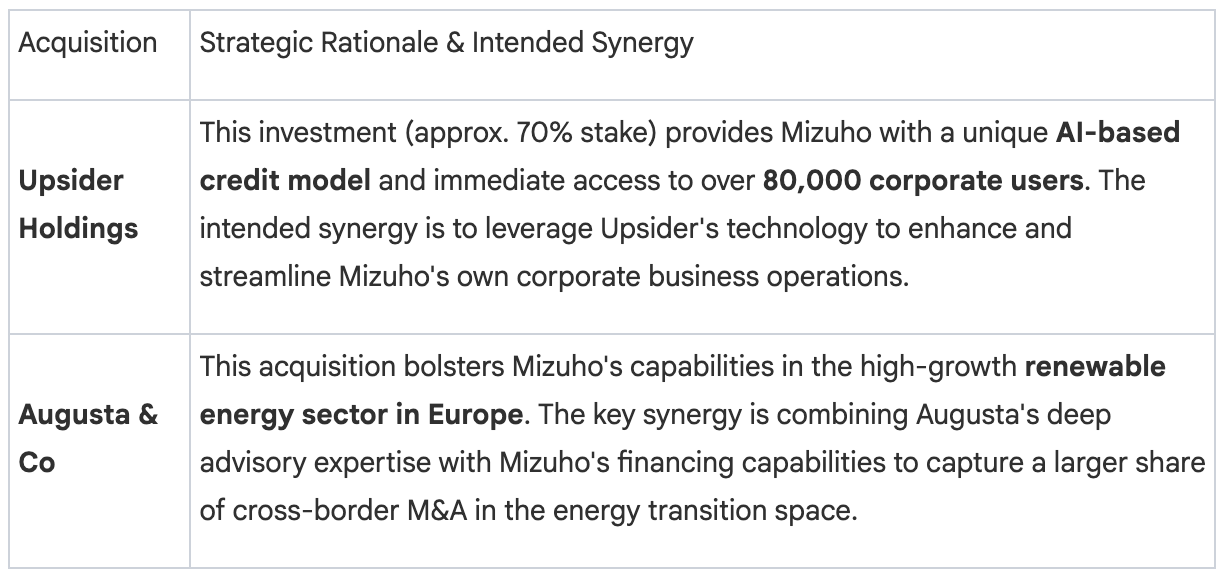

Fintech and Niche Capability Acquisitions

Mizuho is also making targeted acquisitions to acquire specialized expertise and technology.

These strategic moves are not isolated bets but are directly integrated into the firm's broader objective of improving profitability, market perception, and ultimately, shareholder returns.

Shareholder Value and Capital Management Strategy

Mizuho's capital management strategy is a core component of its investment thesis, designed to signal confidence, financial discipline, and a commitment to delivering superior returns. This section evaluates the firm's shareholder return policies and its progress toward key valuation targets, which directly impact its competitive standing and cost of capital.

Shareholder Return Policy

Mizuho has implemented a clear and aggressive policy for returning capital to shareholders, which has been a key driver of investor confidence.

- Share Buybacks: The firm has executed a cumulative JPY 300 billion in share buybacks during FY25 (JPY 100B announced in May, followed by an additional JPY 200B in November).

- Dividend Policy: The dividend policy is based on progressive increases of JPY 5.00 per share each fiscal year. For FY25, the estimated annual dividend is JPY 145.00 per share.

- Payout Ratio: Based on the new earnings outlook, the FY25 total payout ratio is 58%, comfortably above the company's guiding principle of 50% or more.

Progress Towards P/B Ratio of 1.5x

Mizuho's primary valuation goal is to achieve a Price-to-Book (P/B) ratio of 1.5x. The firm has made significant progress, with its P/B ratio improving from 0.53 in FY22 to 1.18 in FY25 H1. However, a comparison with global peers shows that Mizuho still trails many major US and European competitors.

The strategy to close this gap is twofold, focusing on improving both ROE and the Price-to-Earnings (PER) ratio. This will be driven by:

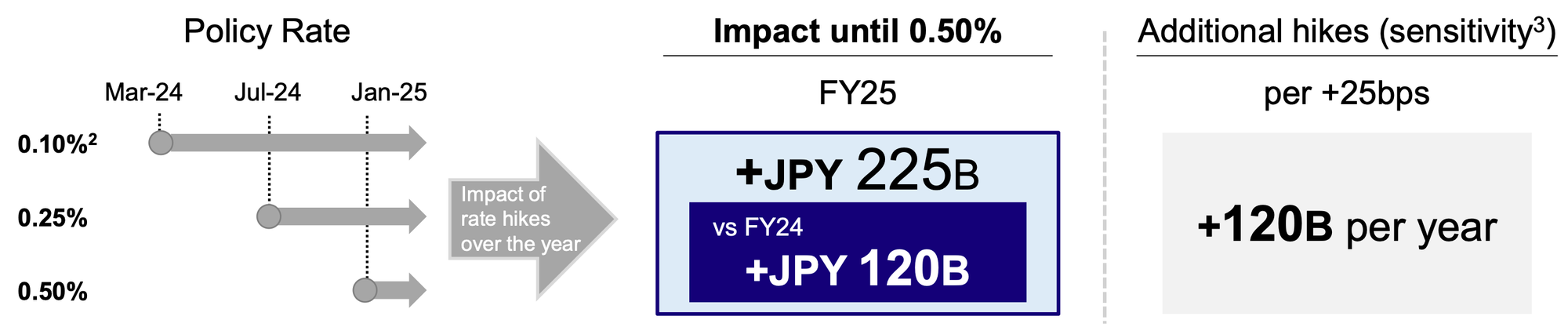

- Beta (Market Factors): Benefiting from macroeconomic tailwinds such as anticipated Bank of Japan (BOJ) rate hikes.

- Alpha (Unique Advantages): Generating superior returns by establishing and strengthening the unique competitive edges within its designated focus business areas.

This disciplined approach to capital management provides a clear narrative for investors and underpins the firm's overall competitive position.

Synthesis: Competitive Strengths and Potential Vulnerabilities

This analysis reveals a competitor that is executing a clear strategy from a position of renewed financial strength. Mizuho is leveraging its disciplined capital management and robust CIB engine to fund targeted investments in technology, high-growth sectors, and strategic partnerships aimed at addressing its historical weaknesses.