Mizuho First Quarter FY3/2026 Financial Results

Mizuho Financial Group has delivered a nuanced set of results for the first quarter of fiscal year 2025 (ending June 30, 2025), characterized by a stark divergence between its core business segments and a surprisingly bullish revision to its full-year guidance.

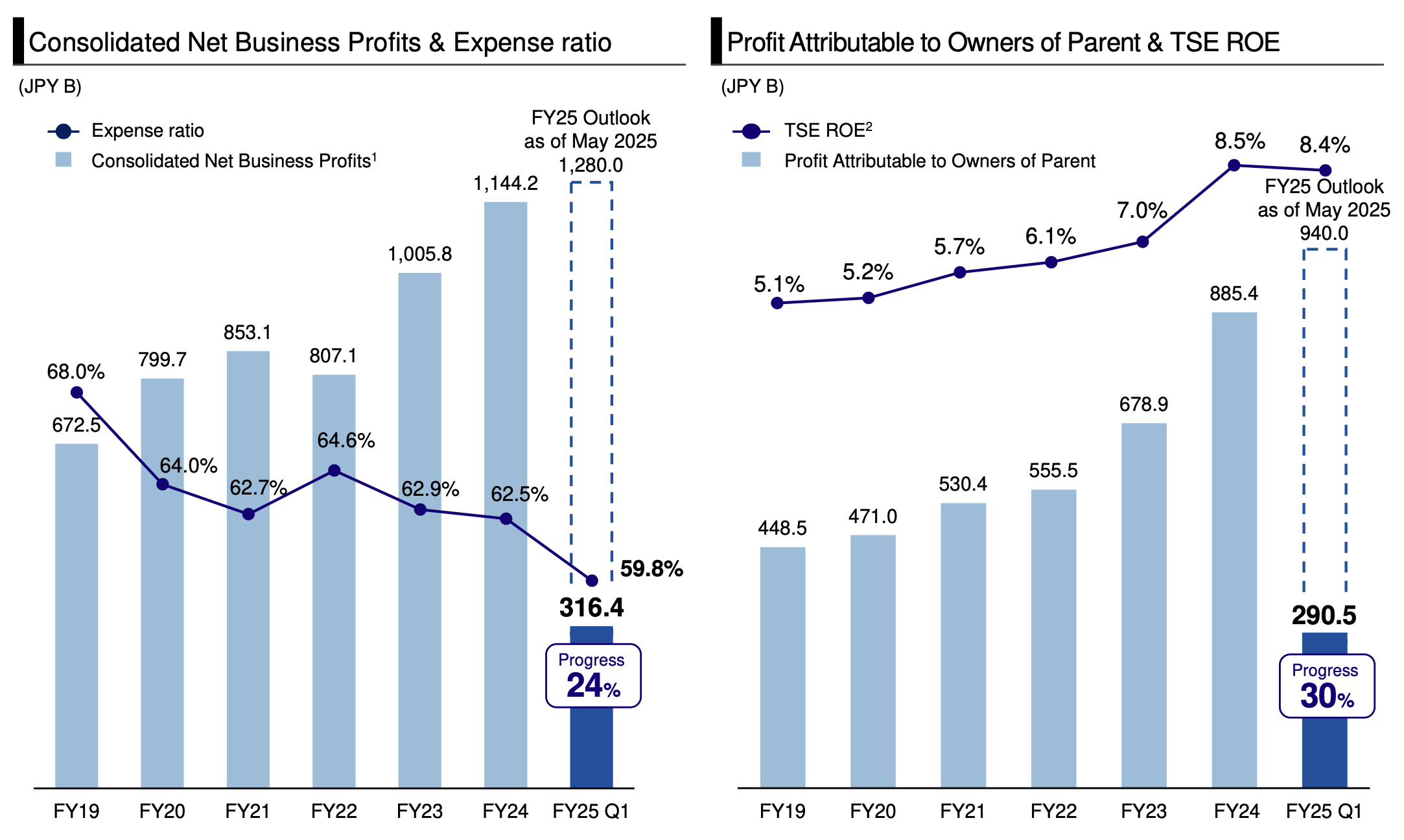

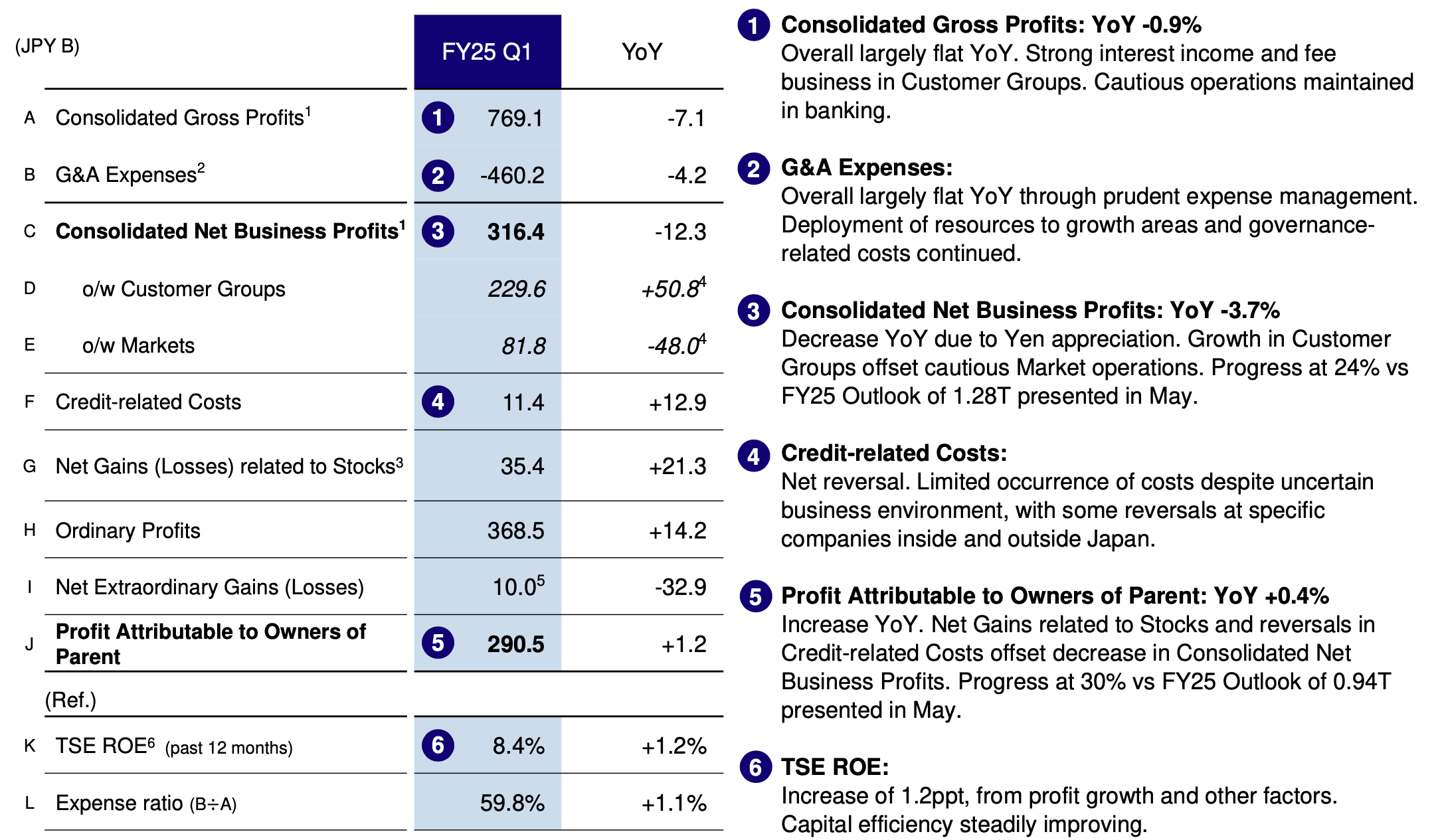

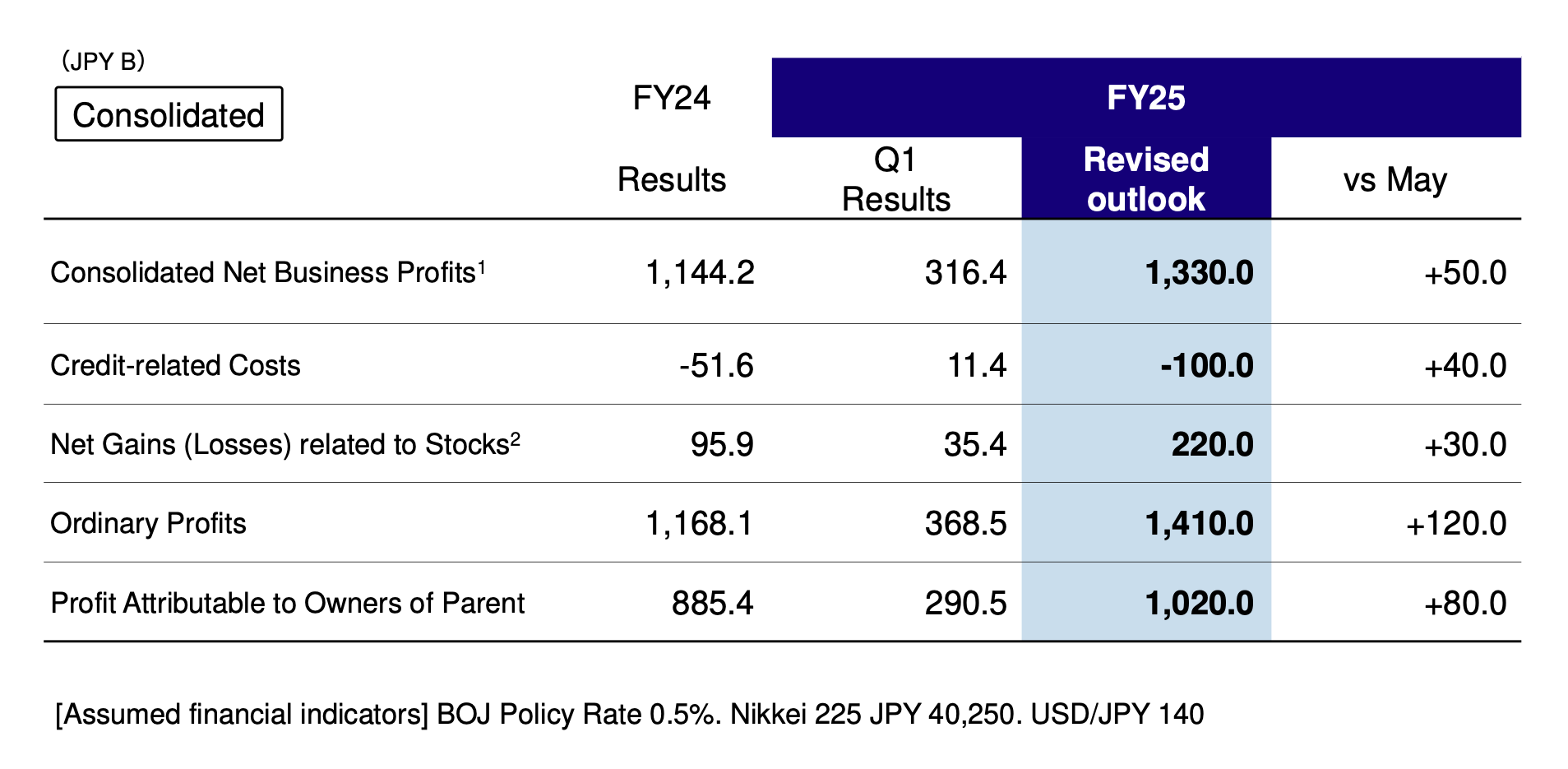

While Profit Attributable to Owners of Parent posted a marginal year-over-year (YoY) increase of 0.4% to JPY 290.5 billion, this figure was flattered by non-recurring items. A more telling metric, Consolidated Net Business Profits—a proxy for core operational earnings—declined by 3.7% YoY to JPY 316.4 billion, reflecting significant headwinds in the group's market-facing activities and the adverse impact of a strengthening yen.

Despite this superficial weakness in core profitability, the quarter's defining event was management's decisive upward revision of its full-year FY2025 earnings forecast. The target for Profit Attributable to Owners of Parent was raised by a substantial 8.5%, from JPY 940 billion to JPY 1.02 trillion. This move, described by market observers as "surprising" for a first-quarter announcement, signals a powerful undercurrent of confidence from management that transcends the quarter's headline noise, and comes as competitor SMBC Group deferred any decisions on earnings revisions to the fiscal half-year point.

This report will analyze this apparent "confidence gap" between the quarter's low-quality earnings and management's optimistic forward outlook. The central thesis is that Mizuho's leadership is looking past the transient, market-driven volatility and focusing on the powerful, accelerating momentum within its core customer-facing franchises. The quarter revealed a tale of two distinct businesses: the Markets Group, which was deliberately de-risked in the face of macroeconomic uncertainty, and the Customer Groups, which delivered exceptional growth. The robust performance of the Retail, Corporate, and Global Corporate banking segments, which saw their combined Net Business Profits surge by JPY 50.8 billion YoY, provides tangible validation of the firm's long-term strategic investments in its domestic alliance with Rakuten Group and its global expansion via the Greenhill acquisition.

Management's guidance revision is, therefore, a forward-looking statement. It asserts that the structural earnings power being built in these core franchises will more than compensate for the cyclical headwinds and yen strength that impacted Q1. For investors, the key takeaway is that Mizuho is pivoting from a phase of defensive restructuring and de-risking to one of confident, strategy-led growth, with a clearer and accelerated path toward its long-term profitability and valuation targets.

Financial Performance Analysis: A Tale of Two Segments

A. Consolidated Results Deep Dive: Unpacking the Headline Figures

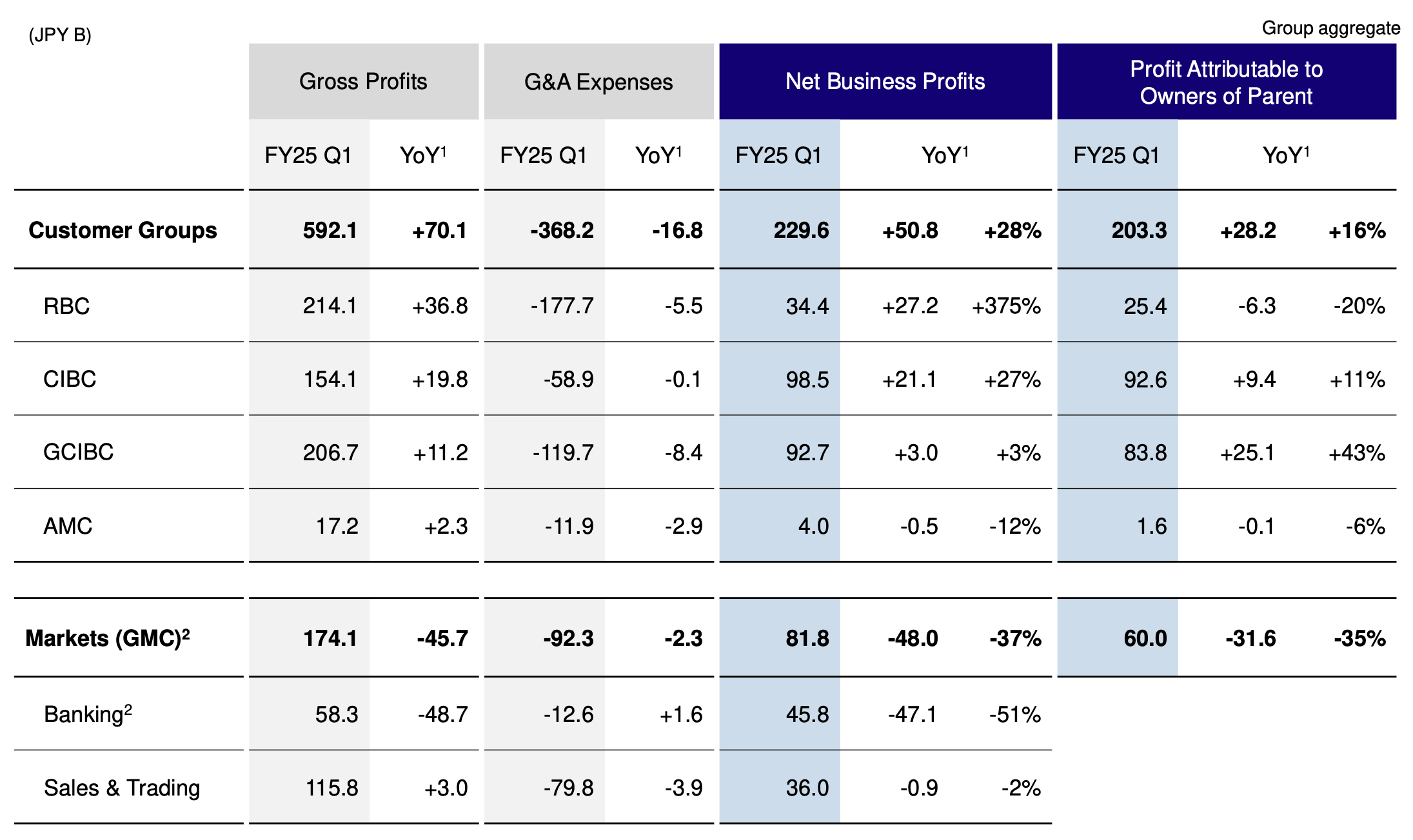

A granular examination of Mizuho's consolidated income statement for the first quarter reveals a complex interplay of operational pressures and non-operating tailwinds. The top-line figure, Consolidated Gross Profits, registered a minor decline of 0.9% YoY to JPY 769.1 billion. The firm's commentary attributes this to the strength in its customer-facing fee and interest income businesses being offset by a deliberately "cautious" stance in its banking and treasury operations amid an uncertain market environment.

With General and Administrative (G&A) Expenses at JPY 460.2 billion, the expense ratio rose to 59.8%, a 1.1 percentage point increase from the prior year quarter, but well below the 62.5% recorded for the full fiscal year 2024. This performance is not merely a short-term measure but the result of a multi-year strategic effort to optimize the firm's cost base. The FY24 investor presentation detailed long-term initiatives that have reduced the number of domestic branches by 25% (between FY18 and FY23) and the employee headcount by 20% (between March 2017 and March 2023), while simultaneously leveraging technology like AI to streamline processes. The largely flat G&A expense line in Q1 is the direct fruit of this labor, providing a crucial buffer against top-line volatility. This operational leverage is a key enabler of management's strategic flexibility, creating a stable cost base that allows the firm to absorb market shocks and gives leadership the confidence to look through short-term revenue fluctuations.

The pressure on the top line, combined with disciplined costs, resulted in Consolidated Net Business Profits falling 3.7% YoY to JPY 316.4 billion. This decline was primarily driven by the downturn in the Markets group and the impact of a stronger yen on the translation of overseas earnings. However, this result represented 24% of the original full-year guidance of JPY 1.28 trillion, a solid run-rate that laid the groundwork for the subsequent forecast revision.

The journey from core profits to the bottom line was significantly aided by non-operating items. Credit-related costs recorded a net reversal of JPY 11.4 billion, a stark contrast to the costs incurred in the prior year and a positive swing of JPY 12.9 billion. Furthermore, Net Gains related to Stocks contributed JPY 35.4 billion, a YoY increase of JPY 21.3 billion. These two items were the primary factors that bridged the gap between declining core profits and a slightly positive bottom line.

Ultimately, Profit Attributable to Owners of Parent landed at JPY 290.5 billion, a marginal 0.4% YoY increase. Crucially, this figure represented 30% of the initial FY25 outlook of JPY 940 billion, providing clear and compelling arithmetic justification for management's decision to raise its full-year target.

B. Segment Analysis - The Customer-Facing Growth Engine

The standout story of the quarter was the exceptional performance of Mizuho's customer-facing segments, which collectively serve as the firm's primary growth engine. This performance provides the strongest evidence for management's optimistic outlook, demonstrating that its core strategic initiatives are delivering tangible results.

The Retail & Business Banking Company (RBC) was the star performer, with Net Business Profits exploding by an astonishing 375% YoY to reach JPY 34.4 billion. This remarkable growth is a direct reflection of several strategic pillars firing in unison. Firstly, the "Improving customer experience" strategy, which includes enhancing digital channels like the Mizuho Direct app (which saw a 60% increase in active users vs. FY22), is clearly resonating with clients. Secondly, the domestic interest rate environment has become more favorable. Following the Bank of Japan's policy normalization, Mizuho's loan and deposit rate margin in its domestic operations expanded to 1.07% in Q1, up from 0.76% a year prior, directly boosting net interest income. Lastly, and perhaps most importantly, the deep strategic alliance with Rakuten Group appears to be transitioning from a conceptual framework into a material profit driver. While the contribution is not explicitly quantified, the combination of stellar RBC results and the strategic focus on initiatives like "MiRal Wealth Partners" (a joint venture to provide face-to-face financial consulting to Rakuten's online client base) and integrated payment services strongly suggests that the planned synergies are materializing. The explosive growth in RBC is the most compelling evidence to date that this alliance is successfully converting Rakuten's vast digital user base into high-value banking and wealth management clients for Mizuho, validating a cornerstone of its domestic growth strategy.

The Corporate & Investment Banking Company (CIBC), which serves Mizuho's domestic corporate clients, also delivered a robust performance. Net Business Profits grew by a strong 27% YoY to JPY 98.5 billion. This result is a testament to the success of the strategy to be the primary partner for Japanese companies, capturing a greater share of their corporate finance activity. The macroeconomic environment in Japan has seen an increase in capital expenditure and M&A activity as companies look to enhance efficiency and expand. Mizuho has capitalized on this trend, with its domestic solutions business fees showing solid growth in the quarter.

The Global Corporate & Investment Banking Company (GCIBC) posted a more modest 3% YoY growth in Net Business Profits to JPY 92.7 billion. The segment's performance was a story of regional divergence. The Americas business continued its strong trajectory, with non-interest income growing solidly, reflecting the successful integration of Greenhill and the expansion of Mizuho's advisory and capital markets capabilities in the highly competitive U.S. market. This was, however, partially offset by weaker performance in other regions and the negative impact of yen appreciation on translated profits.

C. Segment Analysis - Markets Group Under Pressure

In stark contrast to the buoyant performance of the customer-facing divisions, the Global Markets Company (GMC) faced a challenging quarter. The segment's Net Business Profits fell sharply by 37% YoY to JPY 81.8 billion, acting as the primary drag on the group's overall core profitability.

A closer look reveals that the weakness was almost entirely concentrated in the "Banking" sub-segment, which houses treasury and balance sheet investment activities. This unit saw its profits collapse by 51% YoY to JPY 45.8 billion. The "Sales & Trading" (S&T) business, which is more client-focused, proved far more resilient, with profits declining by a mere 2% to JPY 36.0 billion.

This dramatic decline in the Markets Group's profitability is not a sign of a strategic misstep or a failure in risk management. On the contrary, it appears to be the intended consequence of a deliberate and prudent risk management decision. The FY24 investor presentation explicitly laid out a strategy of de-risking and maintaining a "conservative approach to risk taking in bond portfolio" in the face of "looming uncertainty" surrounding global interest rates and trade policy. Management learned lessons from past crises and has prioritized building a "sound portfolio" and preparing "for the worst".

The Q1 results show this policy being executed faithfully. The commentary of "cautious operations" in the banking book is the direct manifestation of this defensive posture. Faced with high uncertainty from Bank of Japan policy, global trade tensions, and yen volatility, management made a conscious choice to reduce risk exposure in its proprietary investment book, even at the cost of sacrificing potential short-term trading gains. The relative stability of the client-driven S&T business further validates this interpretation, indicating a strategic pivot towards less capital-intensive, fee-generating activities that are more insulated from balance sheet volatility. The poor result in the Markets Group is therefore a feature, not a bug, of Mizuho's current strategy. It is the cost of the "insurance policy" the firm has taken out against macroeconomic turmoil, providing the P&L stability that allows the high-growth customer segments to flourish and underpins the confidence behind the full-year guidance upgrade.

Strategic Execution and Forward Outlook

A. Decoding the Upgraded FY2025 Guidance

The most significant development of the quarter was Mizuho's decision to substantially upgrade its full-year earnings guidance for FY2025. This move is more than a simple revision of numbers; it represents a fundamental shift in management's messaging from cautious defense to confident offense.

The new forecast raises the target for Consolidated Net Business Profits by JPY 50 billion to JPY 1.33 trillion and, more critically, lifts the outlook for Profit Attributable to Owners of Parent by JPY 80 billion, or 8.5%, to JPY 1.02 trillion. This upgrade is based on a more optimistic assumption for the domestic stock market, with the Nikkei 225 average now forecast at JPY 40,250 for the year, up from the JPY 37,000 assumed in May. The assumptions for the BOJ policy rate (0.5%) and the USD/JPY exchange rate (140) remain unchanged.

This action stands in sharp contrast to the defensive tone of the FY24 results presentation just three months prior, which was replete with warnings about "looming uncertainty" and "conservative adjustments" due to risks like US tariffs. The pivot to a more bullish stance is underpinned by the tangible evidence from the Q1 results. The powerful earnings momentum demonstrated by the core Customer Groups (+JPY 50.8 billion YoY in Net Business Profits) provided management with hard data validating their strategic direction and a higher, more reliable base of recurring earnings.

The upgrade is a calculated move based on this dual foundation. First, the proven, recurring strength in the core customer business provides a higher floor for earnings. Second, the more optimistic view on the stock market provides a larger non-operating cushion, with the forecast for "Net Gains (Losses) related to Stocks" increasing from JPY 190 billion to JPY 220 billion. Management is signaling that it now has the operational firepower and the market tailwinds to confidently pursue its growth targets, marking a clear inflection point for the company and its investors.

B. Progress on Core Strategic Pillars

The first quarter results serve as a crucial progress report on Mizuho's key long-term strategic initiatives, and the evidence suggests that the execution is proceeding successfully on multiple fronts. The firm's overarching approach can be viewed as a "barbell" strategy, balancing high-growth, fee-intensive international ambitions with the fortification of its stable, mass-market domestic base. The Q1 results indicate both ends of this barbell are performing well.

On one end, the Global CIB business, enhanced by the Greenhill acquisition, continues to make steady progress. The strategic goal is to establish Mizuho as a top 10 global CIB, leveraging the Greenhill platform to expand its M&A advisory value chain and deepen relationships with global clients. The GCIBC segment's performance in the Americas, where non-interest income saw healthy growth in Q1, is a positive leading indicator that the integration is bearing fruit and expanding Mizuho's capabilities in the world's largest investment banking market.

On the other end of the barbell, the strategy to revitalize the domestic retail franchise through the Rakuten alliance is delivering spectacular results. As detailed previously, the 375% YoY surge in RBC profits is a powerful demonstration that the combination of Mizuho's trusted brand and physical presence with Rakuten's enormous digital ecosystem is a winning formula. Initiatives that drive growth in NISA accounts and digital banking users are translating directly into higher profitability, creating a stable and growing source of domestic earnings. The simultaneous success of these two distinct initiatives—one international and institutional, the other domestic and retail—is highly significant. It showcases a well-diversified strategy that is not reliant on a single growth driver, providing a powerful combination of growth and stability that reduces the firm's overall risk profile.

Finally, the strong profit outlook reinforces the sustainability of Mizuho's enhanced shareholder return policy. The new framework, announced with the FY24 results, commits to a progressive dividend increase of approximately JPY 5.0 per share each year, supplemented by flexible share buybacks guided by a total payout ratio of 50% or more. The FY25 plan already includes a dividend of JPY 145 per share and a JPY 100 billion buyback program. The upward revision to the full-year profit forecast provides greater confidence that these returns are not only sustainable but could potentially be enhanced if business momentum continues.

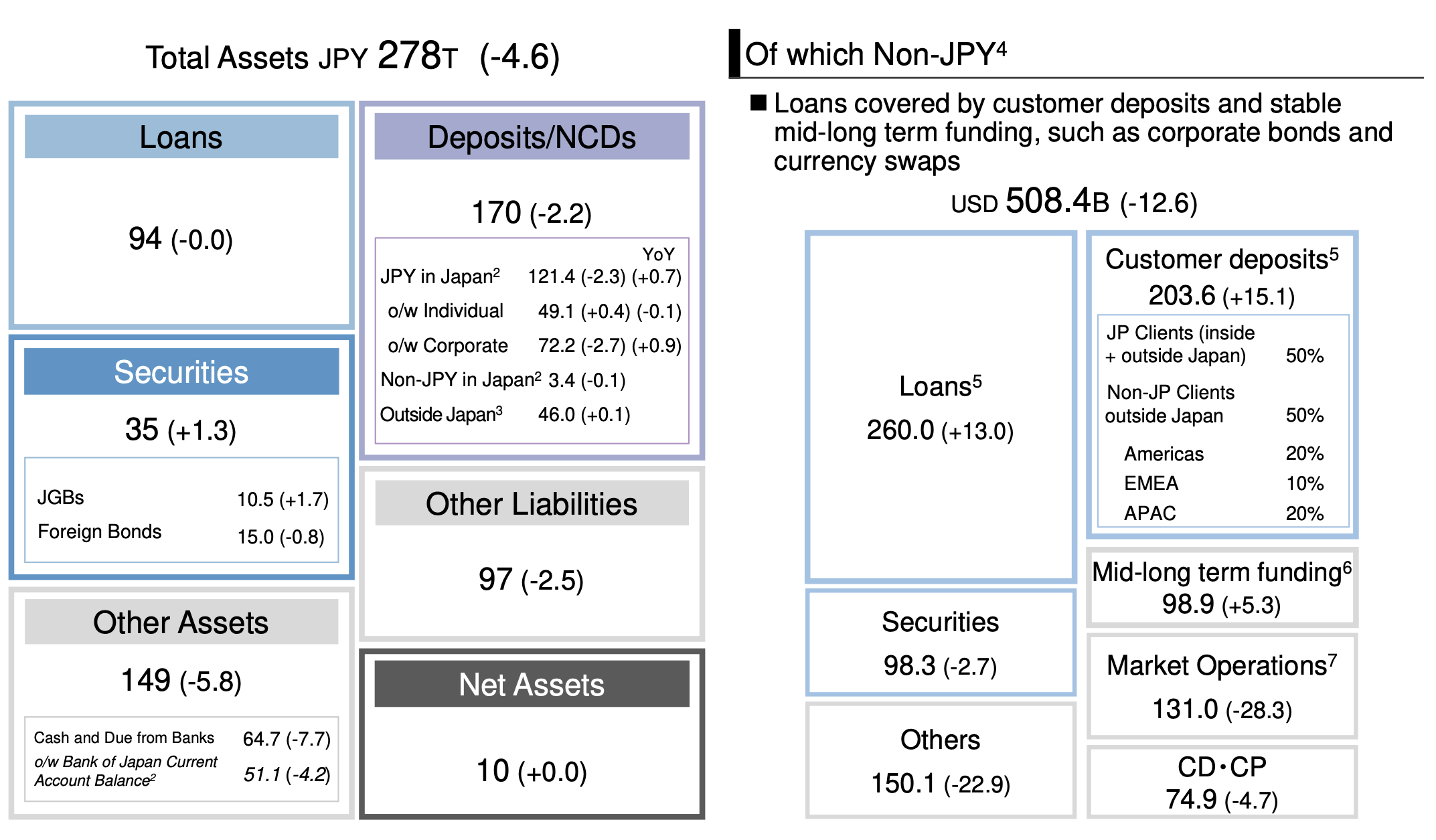

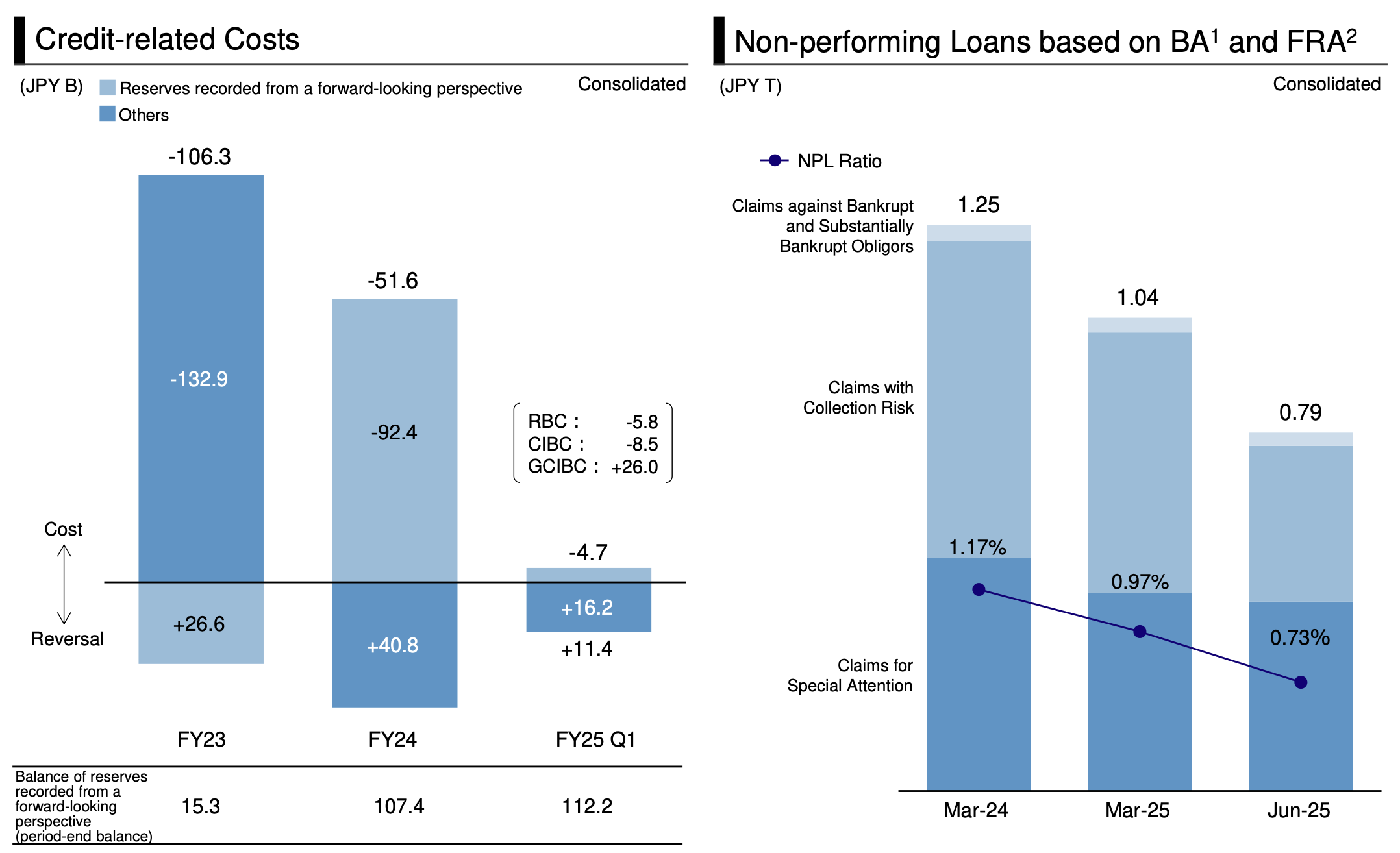

C. Balance Sheet Fortitude and Risk Posture

Underpinning Mizuho's strategic ambitions is a fortified balance sheet and a demonstrably prudent approach to risk management. The asset quality metrics for the first quarter were exceptionally strong. The net reversal of JPY 11.4 billion in credit-related costs was a significant positive surprise. This should not be viewed as mere good fortune, but rather as the direct payoff from the conservative, forward-looking provisioning strategy executed in FY24. During that record-profit year, management proactively recorded JPY 92.4 billion in forward-looking reserves to prepare for "looming uncertainty" and potential tariff impacts. This action created a substantial P&L cushion. When the feared downside risks did not fully materialize in Q1, this over-reserving allowed for a release of provisions, flattering the quarter's earnings and demonstrating a sophisticated, through-the-cycle approach to risk management.

This prudence is further evidenced by the continued improvement in the non-performing loan (NPL) ratio, which fell to a very healthy 0.73% as of June 2025, down from 0.97% in March 2025 and 1.17% a year prior. The balance of reserves against potential future losses also remains robust at JPY 112.2 billion.

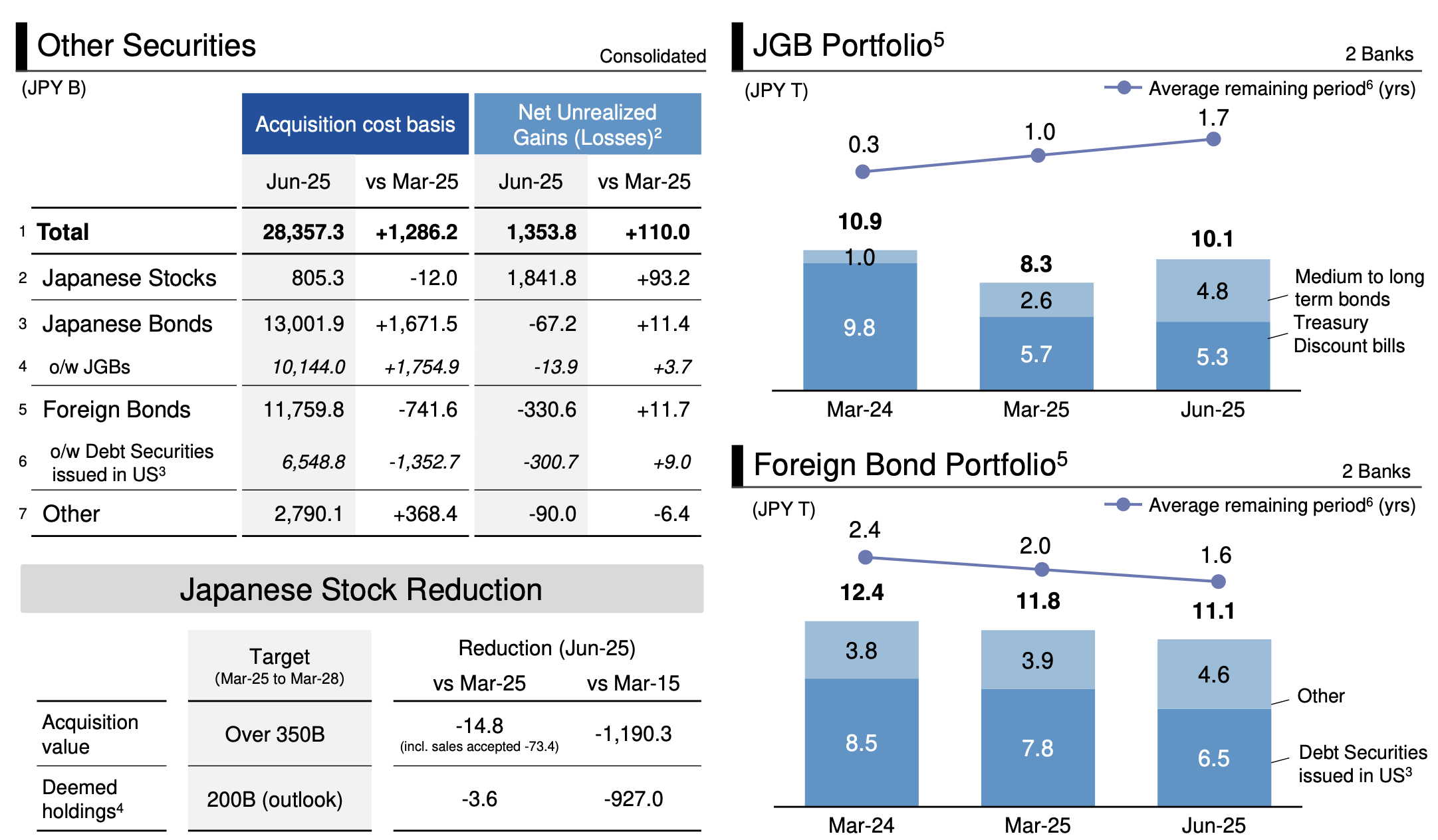

Management of the securities portfolio also reflects this conservative stance. The average remaining period of the JGB portfolio remains short, minimizing sensitivity to interest rate fluctuations. The strategic reduction of cross-shareholdings, a key governance and capital efficiency initiative, is also on track. The bank sold JPY 14.8 billion (acquisition value) of listed stocks in Q1, making steady progress toward its three-year goal of reducing the portfolio by over JPY 350 billion. Capital adequacy remains strong, with the Common Equity Tier 1 (CET1) ratio standing at 10.3% as of March 2025, comfortably within the target operating range of mid-9% to 10%. This strong capital base and pristine asset quality provide the solid foundation necessary for the firm to pursue its growth strategies and enhance shareholder returns.

The Macroeconomic Landscape: Headwinds and Tailwinds

Mizuho's performance and strategic decisions in the first quarter were shaped by a complex and often contradictory macroeconomic environment, comprising a cautious central bank, volatile global trade and currency markets, and a bifurcated domestic economy.

The Bank of Japan (BOJ) has remained a source of caution. In its June 2025 Monetary Policy Meeting, the board opted to maintain its policy rate at 0.5%, citing the need to assess the economic impact of US tariff policy before proceeding with further normalization. While the central bank is continuing its gradual tapering of JGB purchases, its overall dovish stance presents a headwind to Mizuho's earnings, as the bank's medium-term profit targets are partially predicated on a rising domestic interest rate environment.

The global trade and foreign exchange environment was the most significant source of uncertainty. The looming threat of US tariffs on Japanese goods was a key risk highlighted by management in its FY24 outlook, and this uncertainty continued to weigh on sentiment during the quarter. Concurrently, the foreign exchange market was volatile. The US dollar weakened against the yen during the quarter, with the USD/JPY rate falling from an average of around 149 in March to approximately 144 by the end of June. This stronger yen creates a direct headwind for Mizuho, reducing the value of its substantial overseas profits when translated back into its reporting currency.

The domestic Japanese market presented a mixed picture. On one hand, the equity market showed remarkable resilience. After hitting a low in April amid the initial shock of US tariff announcements, the Nikkei 225 index staged a strong recovery through May and June, entering technical bull market territory and surpassing the 40,000-point level. This provided a tailwind for Mizuho's own stock portfolio. On the other hand, the broader economy struggled. Q2 GDP growth forecasts were revised downward, with some economists predicting growth as low as 0.2%, and the Ministry of Finance's Q2 Business Outlook Survey showed "very poor results".

This disconnect between the gloomy macroeconomic data for Japan and Mizuho's strong performance in its domestic customer businesses (RBC and CIBC) is particularly revealing. While the overall economy stagnated, Mizuho's domestic loan-related income and fee businesses grew robustly. This divergence strongly implies that Mizuho is not simply benefiting from a macroeconomic tailwind but is actively taking market share from its competitors. The strategic investments in the Rakuten alliance and the enhanced value proposition for corporate clients are enabling Mizuho to grow even when the overall economic pie is not expanding. This makes the investment case for Mizuho less dependent on a broad Japanese economic recovery and more reliant on its own continued ability to execute its superior strategy.

Investment Thesis and Recommendations

A. Valuation in Context: The Path to a 1.0x P/B Ratio

Mizuho's valuation remains a central part of the investment thesis. Like its Japanese megabank peers, the stock has historically traded at a significant discount to its tangible book value, a reflection of years of low profitability and returns on equity. Management has explicitly addressed this, setting a clear strategic goal to achieve a TSE Return on Equity (ROE) of over 10% by FY27, which they believe is the key to unlocking a valuation re-rating toward a Price-to-Book (P/B) ratio of 1.0x or higher, in line with global peers.

At the end of FY24, Mizuho's TSE ROE stood at 8.5%, a solid result but still short of the double-digit target. The upgraded FY25 profit guidance of JPY 1.02 trillion is a critical catalyst that materially accelerates the timeline to achieving this goal. A profit of this magnitude would likely push the firm's ROE well into the 9% range for FY25, placing the 10% target within striking distance, potentially as early as FY26.

The market values banking institutions based on their sustainable return on equity. By demonstrating a clearer and faster path to a 10%+ ROE, Mizuho makes a much more compelling case for a significant P/B re-rating. The guidance upgrade should therefore be viewed not just as an earnings update, but as the most powerful signal management could send that they are on track to close the long-standing valuation gap with global competitors. It transforms the 10% ROE target from a long-term aspiration into a credible, medium-term objective.

B. Key Risks to Monitor

Despite the positive outlook, several significant risks could derail the investment thesis:

- Geopolitical and Trade Risk: An escalation of US-Japan trade friction remains the most potent external threat. Punitive tariffs could directly harm the profitability of Mizuho's corporate clients, leading to higher credit costs, and could force the Bank of Japan to delay its monetary policy normalization, suppressing interest income.

- Execution Risk: The firm's "barbell" strategy is ambitious and complex. Any missteps in the ongoing integration of Greenhill in the competitive US market, or a failure to fully capitalize on the synergies of the Rakuten alliance, could undermine the key growth drivers. Management has acknowledged challenges, such as the need to continuously improve sales practices and develop talent, which require persistent focus.

- Market and FX Volatility: The global macroeconomic environment remains fragile. A sharp, unexpected downturn in global equity markets or a rapid, uncontrolled appreciation of the yen beyond current expectations could severely impact the Markets group's profitability and the value of overseas earnings, potentially forcing management to revise its optimistic guidance downward.

C. Concluding Analysis and Forward View

Mizuho Financial Group presents a compelling investment case at a clear inflection point. The firm is successfully transitioning from a multi-year phase of defensive restructuring and de-risking to a new era of confident, strategy-led growth. The first quarter's surprising upgrade to the full-year guidance, while superficially supported by volatile, non-recurring items, is fundamentally underpinned by the tangible success of its core strategic pillars.

The outperformance of its domestic franchise, supercharged by the innovative alliance with Rakuten, and the steady progress of its global CIB ambitions, anchored by the Greenhill acquisition, demonstrate that its "barbell" strategy is working effectively. This diversified approach, combined with a fortified balance sheet and a prudent risk posture, has allowed the bank to navigate a complex macroeconomic environment and gain market share even in a weak domestic economy.

While significant external risks from global trade and monetary policy persist, Mizuho's demonstrated ability to execute its unique strategy has put it on an accelerated path toward its crucial 10%+ ROE target. This progress is the primary catalyst that can unlock a significant re-rating of its valuation. For investors, the thesis is clear: Mizuho's proven strategic execution appears poised to continue, creating a clear pathway to unlock substantial shareholder value in the coming fiscal years.