Mizuho Investor Presentation

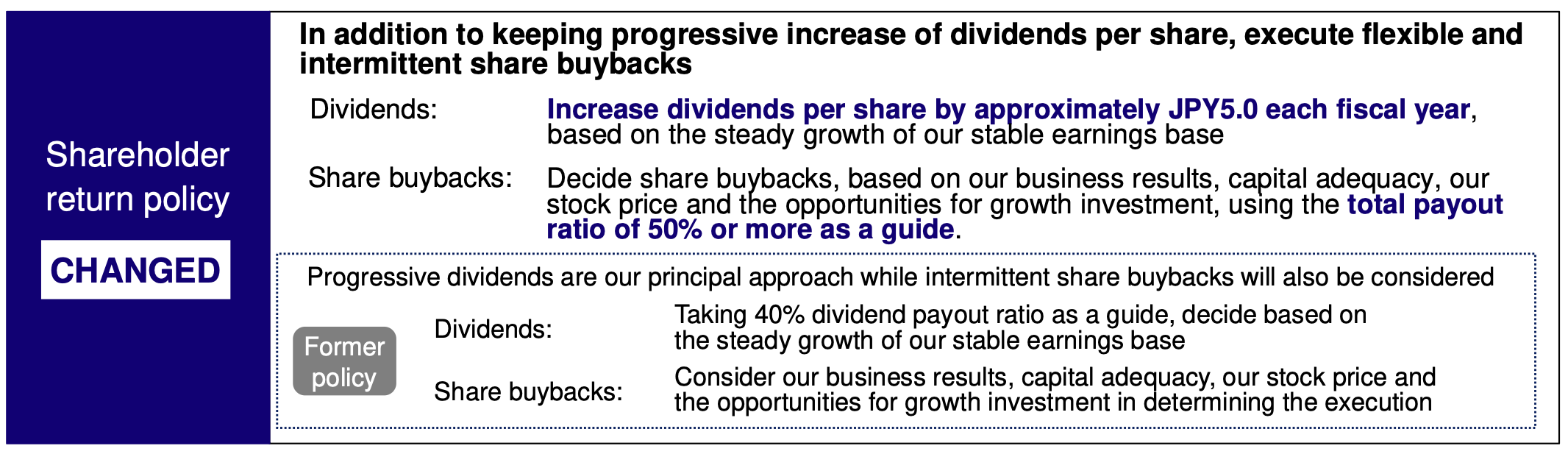

When Mizuho released its earnings announcement on May 15, the market response was rather muted, with the closing price down 2% on May 16th while the TOPIX was flat, despite a positive surprise: the introduction of a new shareholder return strategy focused on increasing dividends and targeting a payout ratio of 50% or more. The muted initial response may have been related to the inclusion of an estimated JPY 110bn impact related to tariffs in the next fiscal year's net profit guidance of JPY 940bn, possibly creating a perception of undue caution given the company’s relatively stable operations.

However, following the investor presentation on May 20, Mizuho's stock price experienced a notable increase with the closing price up 3% on May 20, and the opening price up 4% on May 21, while the broader market remained flat. Given the change in sentiment, we picked some highlights from the investor presentation that might have induced a higher confidence level in Mizuho.

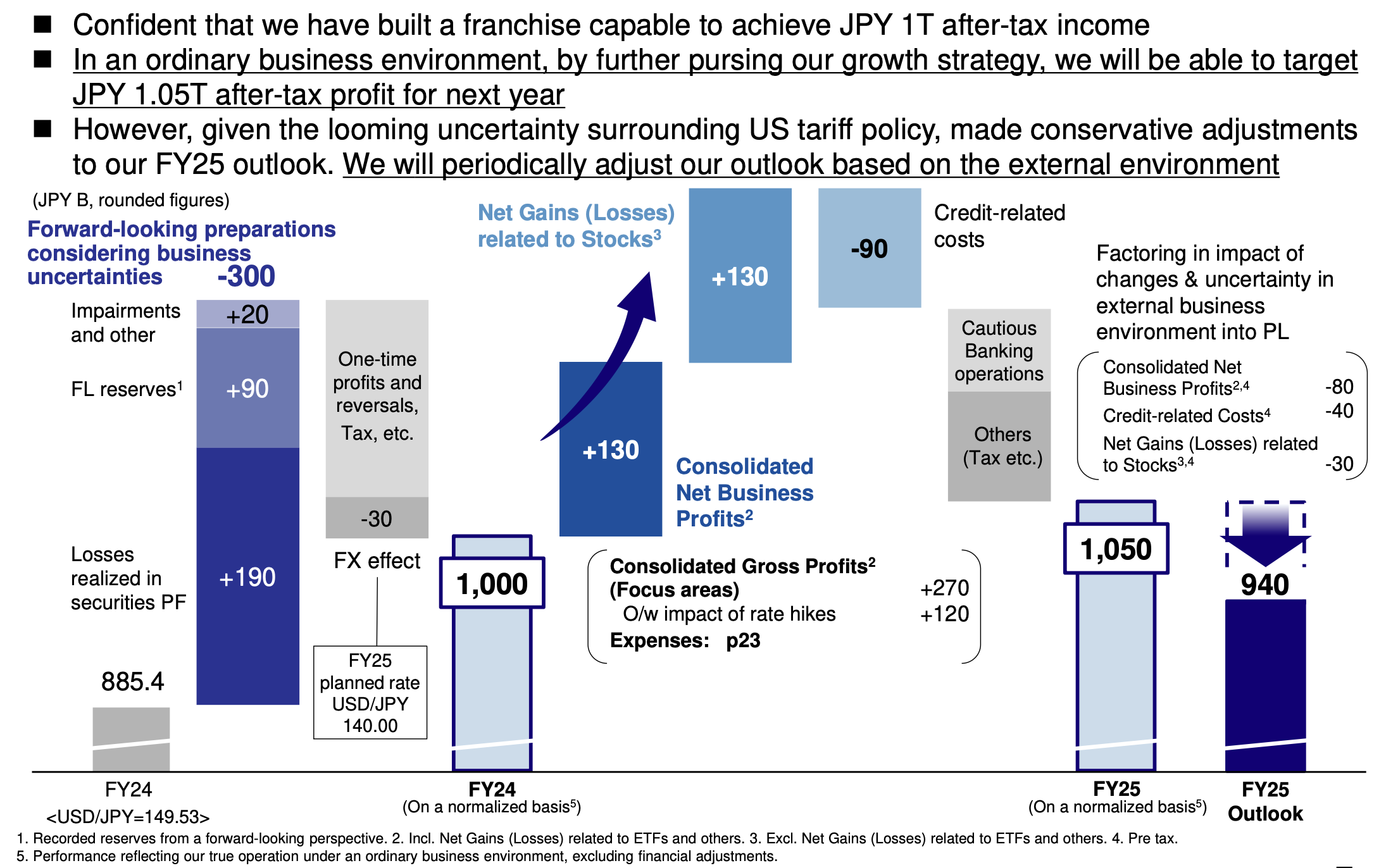

Reasoning behind conservative projections and opportunities for upside

Management attributed the assumed JPY 110bn tariff impact in their guidance to a slowdown in domestic and international equity and mergers & acquisitions activity through mid-April. However, with markets now recovering, they pointed to possible upside potential relative to the provided guidance and added that if tariff-related challenges diminish, upside might be realized in the second quarter, or even as early as the first. Alongside pursuing growth opportunities, they also emphasized resilience to negative market movements due to a robust business model, balance sheet, and bond holdings.

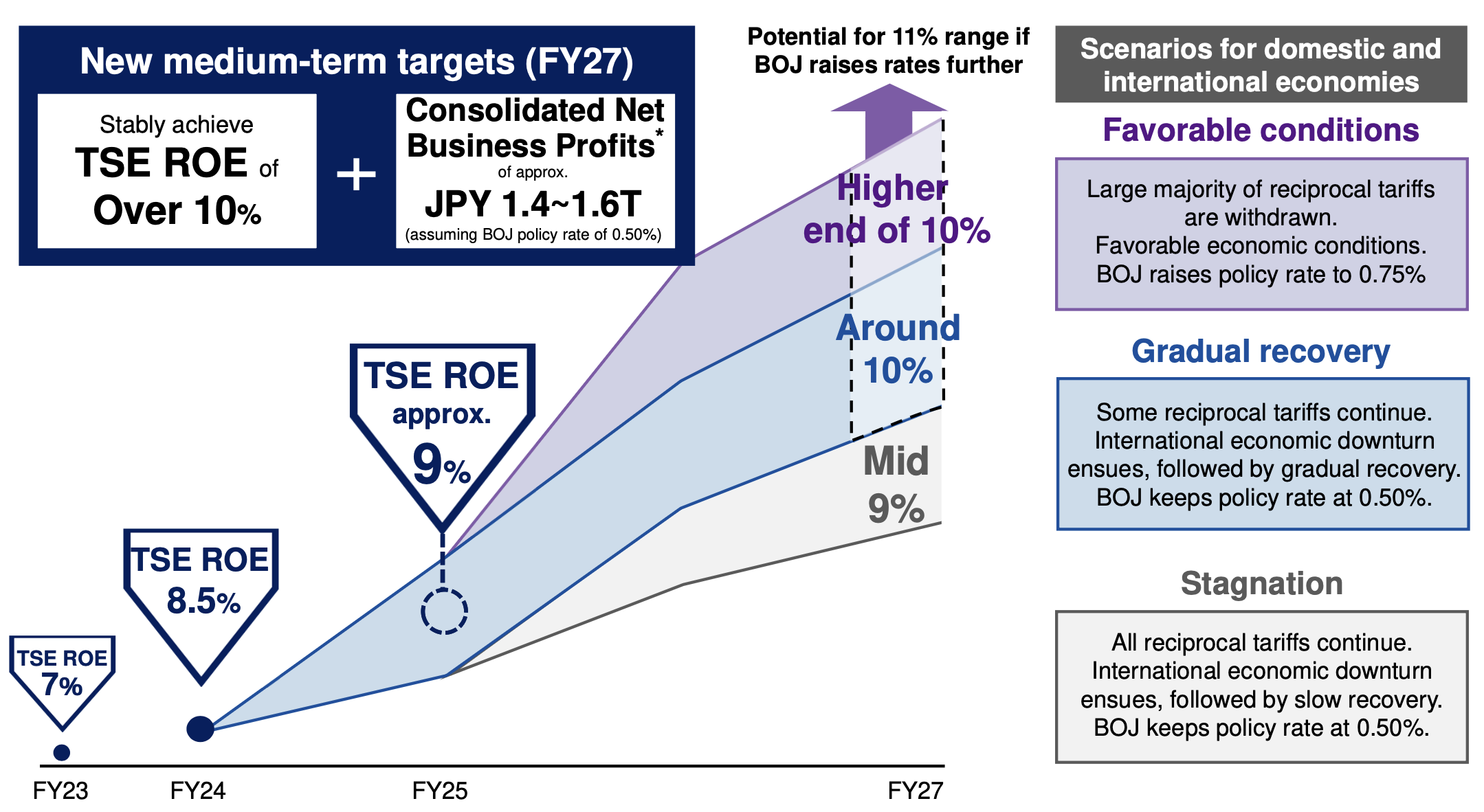

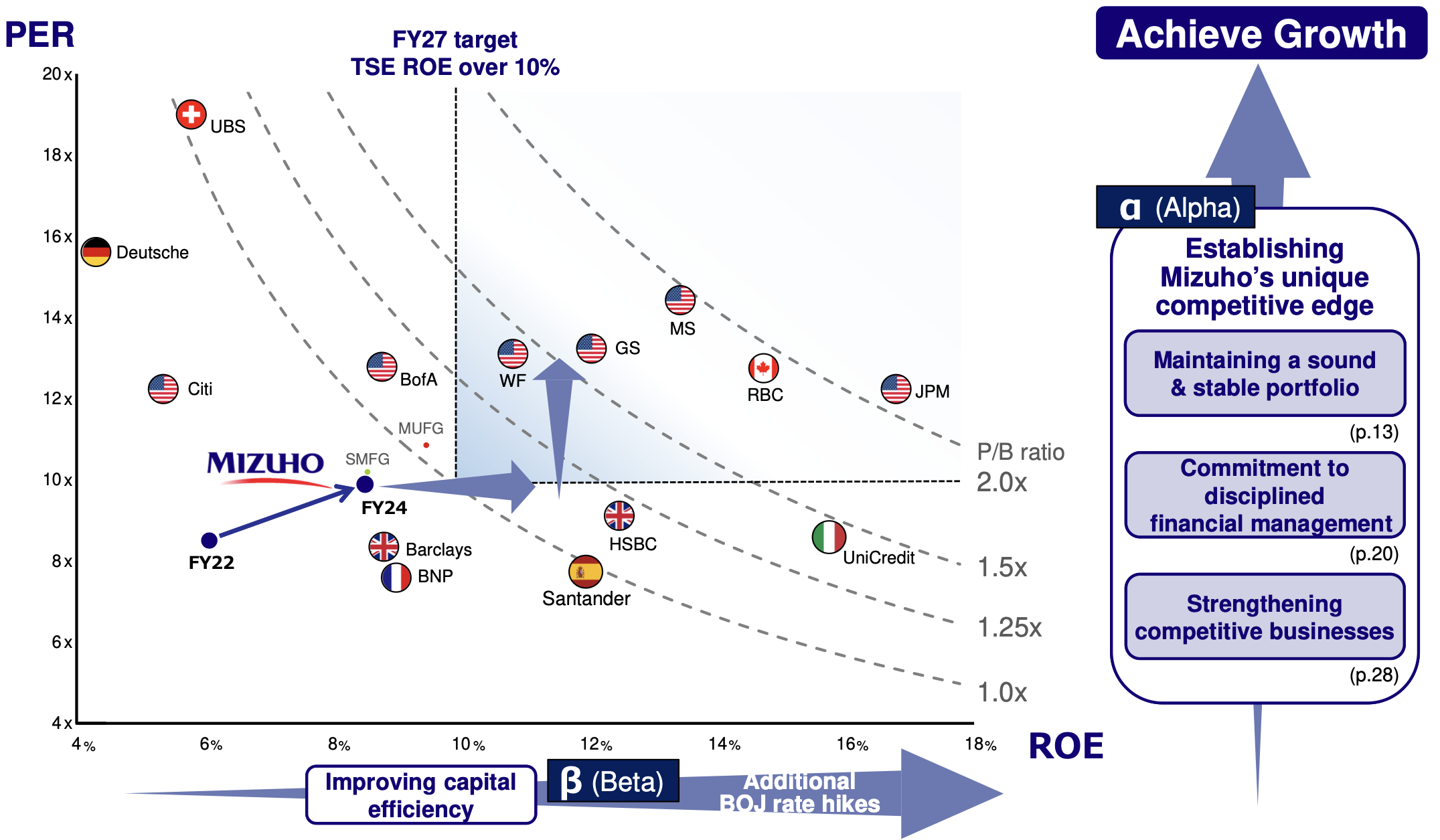

Future ROE Target

In their latest earnings release, the company set a new target for achieving an ROE of over 10% by the end of the next fiscal year. During the briefing, the company shared scenario analyses illustrating how this target could be achieved, revealing potential for even greater returns: achieving roughly 10% ROE if the central bank's rate remains at 0.5%, potentially reaching the higher end of 10% if the rate is raised to 0.75%, and potentially surpassing 11% with further rate increases.

The CEO also underscored a commitment to enhancing ROE to attain a P/B ratio of 1.0x, and ultimately aiming for 1.5x or above by improving the Return-on-Equity (ROE) and Price-Earnings-Ratio (PER) to levels comparable to international peers, while managing a well-structured and stable portfolio, practicing prudent financial management, and fortifying core business operations.

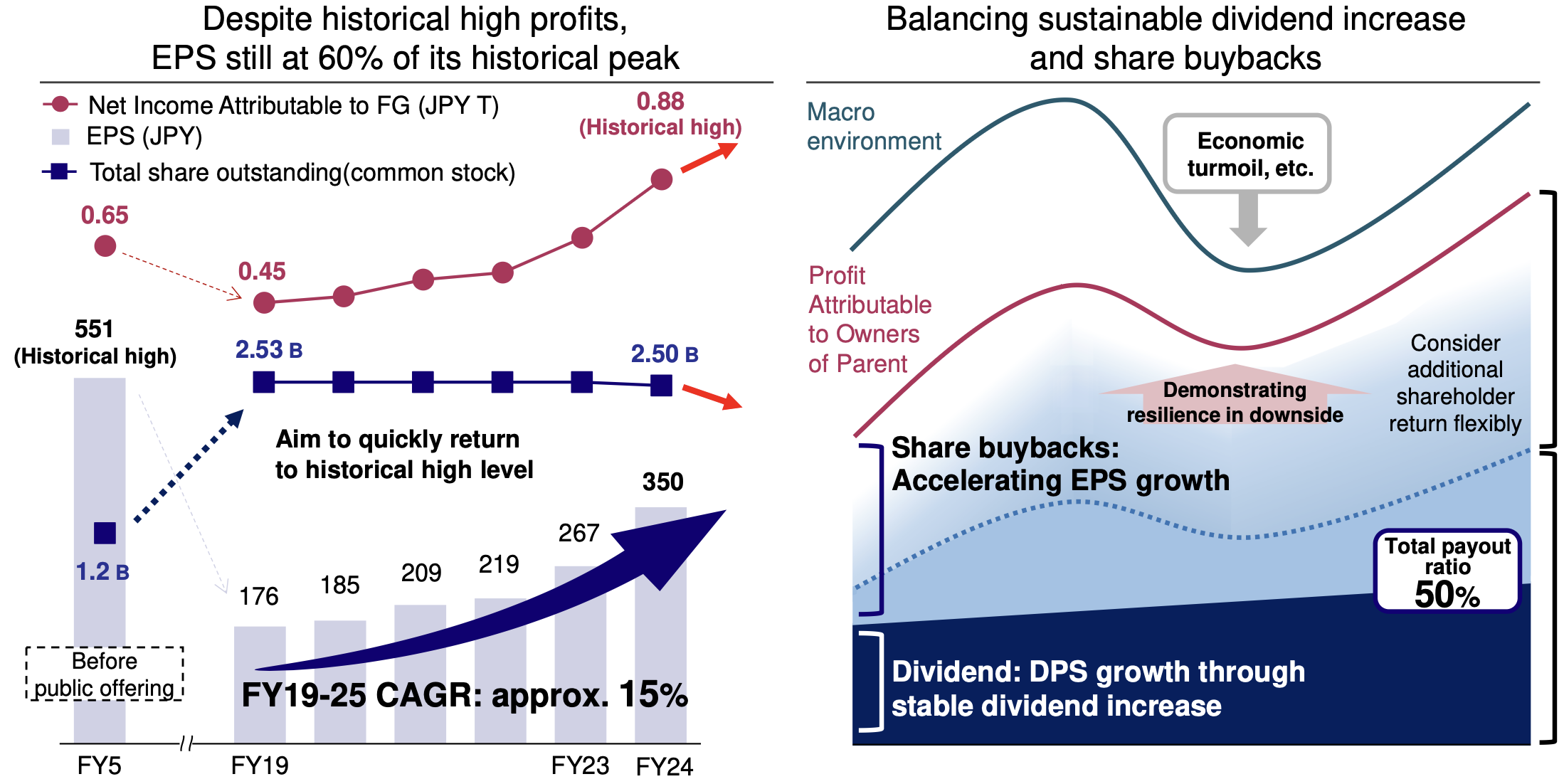

Dedication to Growing EPS

Despite announcing a 50% or higher payout ratio and rising dividends, the company also emphasized that they are attentive to the existing EPS level from before the public offering, similar to what informed the decision to restart share repurchases in the second quarter (the first such action in 16 years).

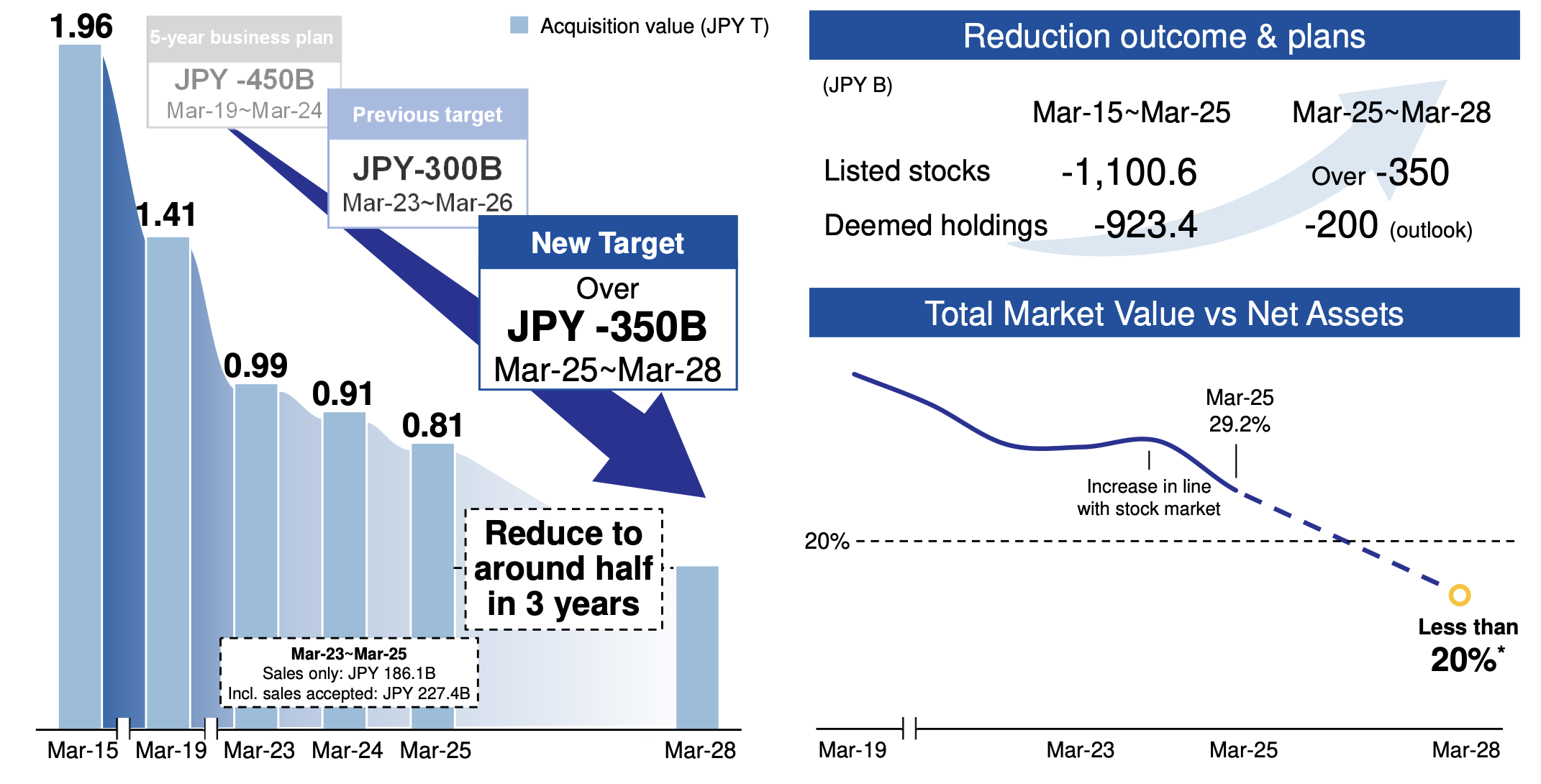

Management also introduced a new objective for cutting back on strategic shareholdings, with plans to reduce these holdings by JPY 350bn during the next three years.