Mizuho Third Quarter Financial Results

Mizuho Financial Group’s performance through the third quarter of fiscal year 2025 represents a significant point in the Group’s medium-term trajectory. Achieving the 90% progress mark toward full-year profit targets as of December 31, 2025, Mizuho has established a formidable earnings buffer. This quarter serves as a vital barometer for institutional investors, confirming that the Group’s pivot toward a "normal interest rate" environment is yielding sustainable operating leverage and providing the capital necessary to accelerate shareholder returns.

1. Fiscal Performance Benchmarking vs. November Guidance

Mizuho’s third-quarter results demonstrate significant outperformance relative to its historical run rate, providing high visibility into the final fiscal quarter. The Group has effectively insulated its full-year outlook from potential Q4 volatility by front-loading earnings through both core operational growth and tactical asset management.

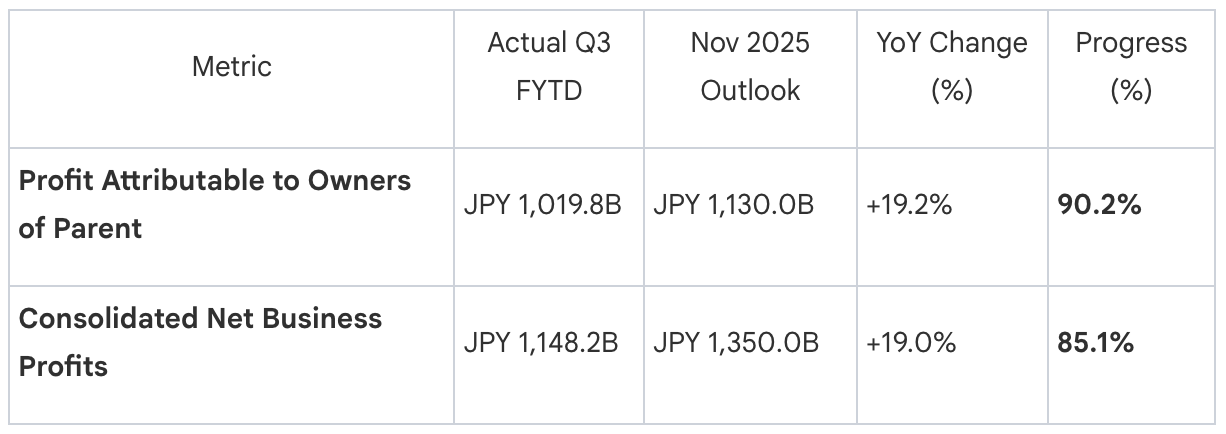

1.1 MHFG Performance Benchmarking (Q3 FYTD)

1.2 Execution Efficiency & Analytical Transformation

The 19.2% YoY growth in bottom-line profit reflects a distinct quality of earnings, though investors should note the discrepancy between bottom-line progress (90.2%) and core Net Business Profit progress (85.1%). While the core banking engine is performing robustly, the bottom line has been significantly accelerated by non-recurring items, specifically a JPY 56.2B gain from the cancellation of the Employee Retirement Benefit Trust and JPY 160.0B in net gains related to stocks (excluding ETFs). This JPY 1.02T profit achievement provides a massive defensive cushion, allowing Mizuho to navigate potential geopolitical disruptions or FX fluctuations in the final quarter with minimal risk to its guidance.

2. Revenue Architecture and Segment Profitability Drivers

The shifting macroeconomic landscape, defined by the Bank of Japan’s (BOJ) policy rate hikes, has fundamentally recalibrated the Group’s revenue mix. Mizuho is successfully transitioning toward a margin-driven growth model, supported by a resurgence in domestic lending profitability and disciplined expansion in fee-based wealth management.

- Net Interest Income (NII) Dynamics: Domestic NII has served as a primary tailwind. While the return on loans in Japan rose to 1.08% (up from 0.76% in FY24), the more critical metric for analysts is the domestic Loan and Deposit Rate Margin, which expanded to 0.89%. This demonstrates Mizuho's success in repricing its asset book faster than its liability base despite the cost of deposits moving to 0.19%.

- Non-Interest Income Evaluation: Consolidated Gross Profits saw a JPY 317.7B YoY increase, supported by a JPY 103.5B rise in Net Fee and Commission Income. Notably, the Markets division contributed JPY 302.0B to the total, maintaining momentum despite volatile trading conditions.

- Segment Deep-Dive:

- Retail & Business Banking (RBC): Net Business Profits surged 86% YoY to JPY 148.2B. This was driven not only by rate hikes but by a structural shift in the fee business; Individual Wealth Management Assets in Custody reached JPY 68.5T (+JPY 4.3T YoY), signaling sustainable revenue growth beyond net interest margins.

- Corporate & Investment Banking (CIBC): Recorded 24% growth (JPY 335.9B), fueled by a JPY 39.2B increase in non-interest income from domestic corporate solution businesses.

- Global Markets (GMC): A tale of two halves, with the Banking division up 74% (JPY 181.1B) while Sales & Trading declined 11% (JPY 120.9B), illustrating effective ALM management in a rising rate environment.

- Operational Discipline: Operating leverage widened as revenue growth significantly outpaced the JPY 133.4B expansion in G&A expenses (driven by growth investments). Consequently, the Expense Ratio improved to 57.3% from 59.4% YoY.

3. Asset Quality and Securities Portfolio Resiliency

Credit cost management and portfolio duration remain the central pillars of balance sheet stability as interest rates normalize. Mizuho's Q3 results indicate a de-risking of the credit book and a highly defensive posture in the bond markets.

- Credit Cost Analysis: Total credit-related costs shifted to a JPY 52.3B expense from a JPY 38.5B reversal in the prior year. This reflects conservative management via increased forward-looking reserves and the absorption of costs from specific corporate events.

- Non-Performing Loan (NPL) Assessment: Asset quality has remained remarkably resilient despite tighter monetary policy. The NPL ratio improved to 0.75% (Dec-25) from 0.97% (Mar-25). This drop suggests that Japanese corporates are managing higher borrowing costs without a deterioration in solvency.

- Bond Portfolio Sensitivity:

- JGB/ALM Portfolio: Mizuho successfully navigated rising domestic rates; Net Unrealized Gains for the entire banking portfolio (ALM + Bonds) remained positive and continued to improve through January 2026.

- Foreign Bonds: Net Unrealized Losses remained flat through "cautious operations" and "appropriate hedging," reflecting disciplined position management within a controlled range.

- Strategic Rationale (Equity Reduction): The Group reduced Japanese stock holdings by JPY 73.7B (acquisition value) during the period. This is a critical strategic recycling of capital; the divestment of cross-shareholdings effectively funds the Group’s aggressive shareholder return tranches while reducing net asset volatility.

4. Capital Management and Shareholder Value Strategy

Mizuho's capital strategy has evolved into a mandate for ROE expansion, utilizing a surplus of capital to drive a "stable, progressive" dividend and a record-breaking buyback program.

- Share Buyback Expansion: In February 2026, Mizuho announced a JPY 100B additional buyback, the third tranche of the fiscal year (following May’s JPY 100B and November’s JPY 200B). This brings the FY25 total to JPY 400B, signaling management's high confidence in the Q4 landing.

- Payout Ratio Synthesis: The Total Payout Ratio (TPR) has seen a dramatic escalation, reflecting a fundamental alignment with institutional shareholder interests:

- May 2025: 49%

- November 2025: 58%

- February 2026: 67% (Estimated)

- Dividend Sustainability: The annual dividend estimate of JPY 145.00 (up JPY 5.00 YoY) remains firm. This progressive stance is supported by the 90% profit achievement, ensuring the payout is well-covered by earnings.

- ROE Analysis: The Group achieved a TSE ROE of 9.6% (a 0.9ppt increase YoY). Crucially, this metric includes unrealized gains/losses on securities, providing a transparent look at the Group’s true capital efficiency. This continues a multi-year upward trend from just 5.1% in FY19, narrowing the valuation gap against global peers.

5. Strategic Conclusion and Institutional Outlook

Mizuho Financial Group enters the final quarter of FY25 in a position of undeniable operational and financial strength. The convergence of favorable domestic rate dynamics and disciplined capital recycling has created a high-visibility path toward exceeding full-year targets.

5.1 Critical Takeaways for Institutional Investors

- Exceptional Execution Visibility: Reaching 90% of the JPY 1.13T profit target by Q3 virtually guarantees a full-year beat, assuming stable market conditions.

- Structural Efficiency Gains: The expansion of the domestic loan/deposit margin to 0.89% and the drop in NPL ratio to 0.75% indicate a healthier, more profitable core balance sheet.

- Shareholder Alignment: The leap to a 67% payout ratio and the JPY 400B total buyback demonstrate a commitment to ROE improvement that is top-tier within the Japanese banking sector.

5.2 Risk vs. Opportunity Matrix

While forward-looking risks such as geopolitical disruptions and currency fluctuations persist, they are largely mitigated by the Group's cautious bond hedging and the massive earnings buffer created in the first nine months. The reduction of cross-shareholdings remains a primary opportunity for further capital flexibility.

5.3 Final Statement

Based on the 90.2% achievement of the JPY 1.13T profit target, Mizuho is poised to deliver its strongest fiscal performance in recent history. The Group’s ability to generate high-quality earnings while simultaneously improving its TSE ROE to 9.6% marks it as a compelling value-creation story in the current BOJ tightening cycle.