Monex Group Second Quarter Financial Results

Monex Group delivered a period of robust growth and significant strategic progress in the second quarter of the fiscal year ending March 2026. The performance was characterized by sequential revenue and profit growth across all four of the company's business segments, prompting CEO Yuko Seimei to assess it as a "relatively solid quarter." This broad-based strength underscores the resilience of the Group's diversified business portfolio and its effective execution against stated strategic objectives.

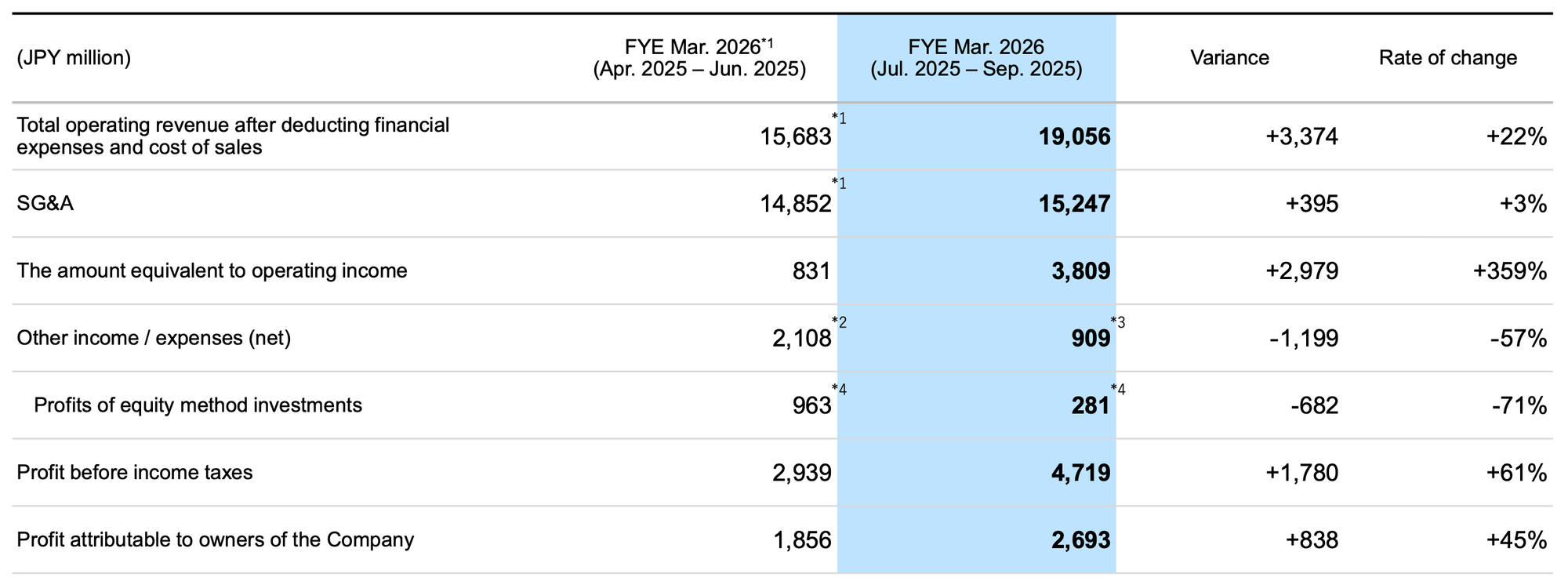

The consolidated financial results reflect this positive momentum, with key metrics showing substantial quarter-over-quarter (QoQ) improvement.

- Net Operating Revenue: JPY 19.056 billion, a 22% increase QoQ.

- Pre-tax Profit: JPY 4.719 billion, a significant rise from JPY 2.939 billion in the prior quarter.

- Quarterly Net Income Attributable to Owners: JPY 2.693 billion, a 45% increase QoQ.

- Adjusted EBITDA: JPY 6.268 billion, an 80% increase QoQ. This newly disclosed metric is intended to provide a clearer view of the Group's cash flow generation capabilities.

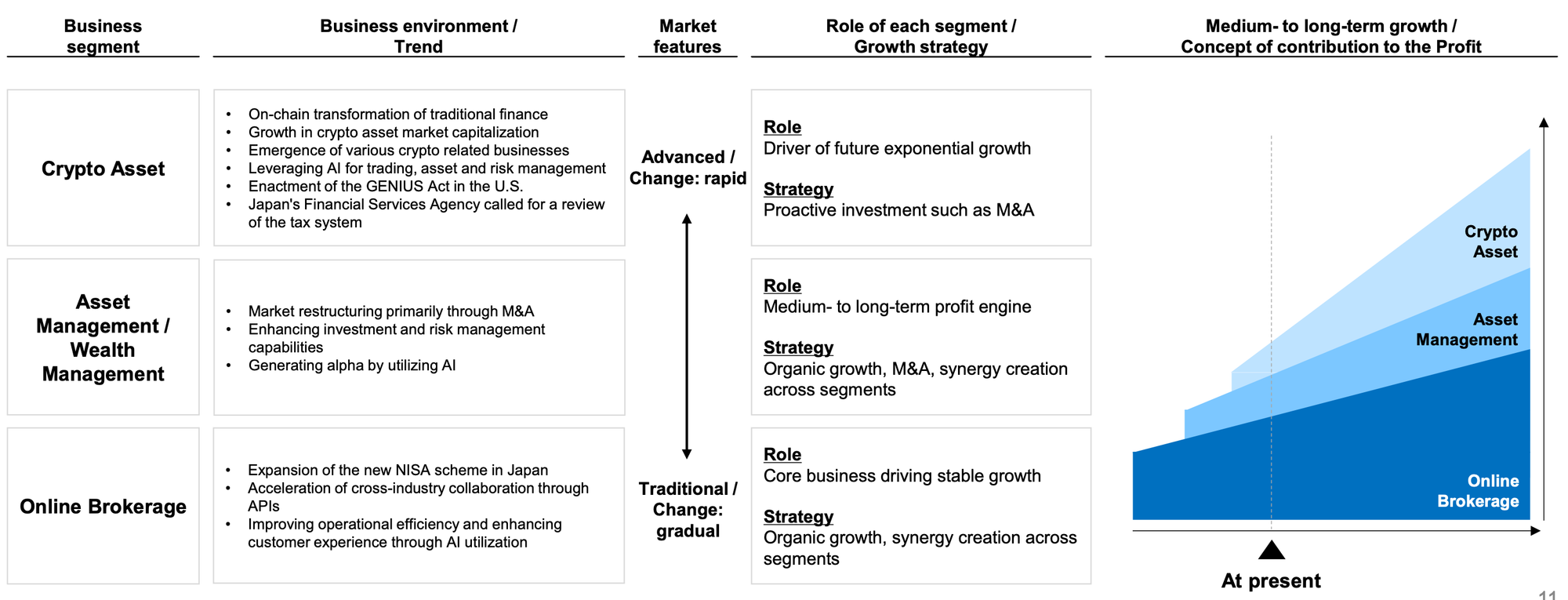

This performance aligns with the Group's clear, three-pronged corporate strategy. The Online Brokerage business serves as a stable foundation and "cash cow," generating consistent returns. The Asset Management segment is being actively cultivated as a new pillar of growth. Finally, the Crypto Asset business is positioned as the primary driver of future "discontinuous growth," designed to capture the transformative potential of a tokenized global economy. This strategy was evident in the quarter's results, with the record performance at TradeStation demonstrating the strength of the Online Brokerage cash cow, while success fees from the Monex Activist Fund showcased the growing power of the Asset Management pillar.

Progress on Stated Commitments and Shareholder Returns

Delivering on stated commitments is fundamental to building and maintaining investor confidence. During the second quarter, Monex Group made tangible progress on its strategic promises, executing key growth investments while simultaneously reinforcing its dedication to shareholder returns. These actions demonstrate a disciplined approach to capital allocation, balancing future growth with immediate value delivery.

Strategic Growth Investments

The Group undertook several key investment and acquisition activities to strengthen its long-term competitive positioning:

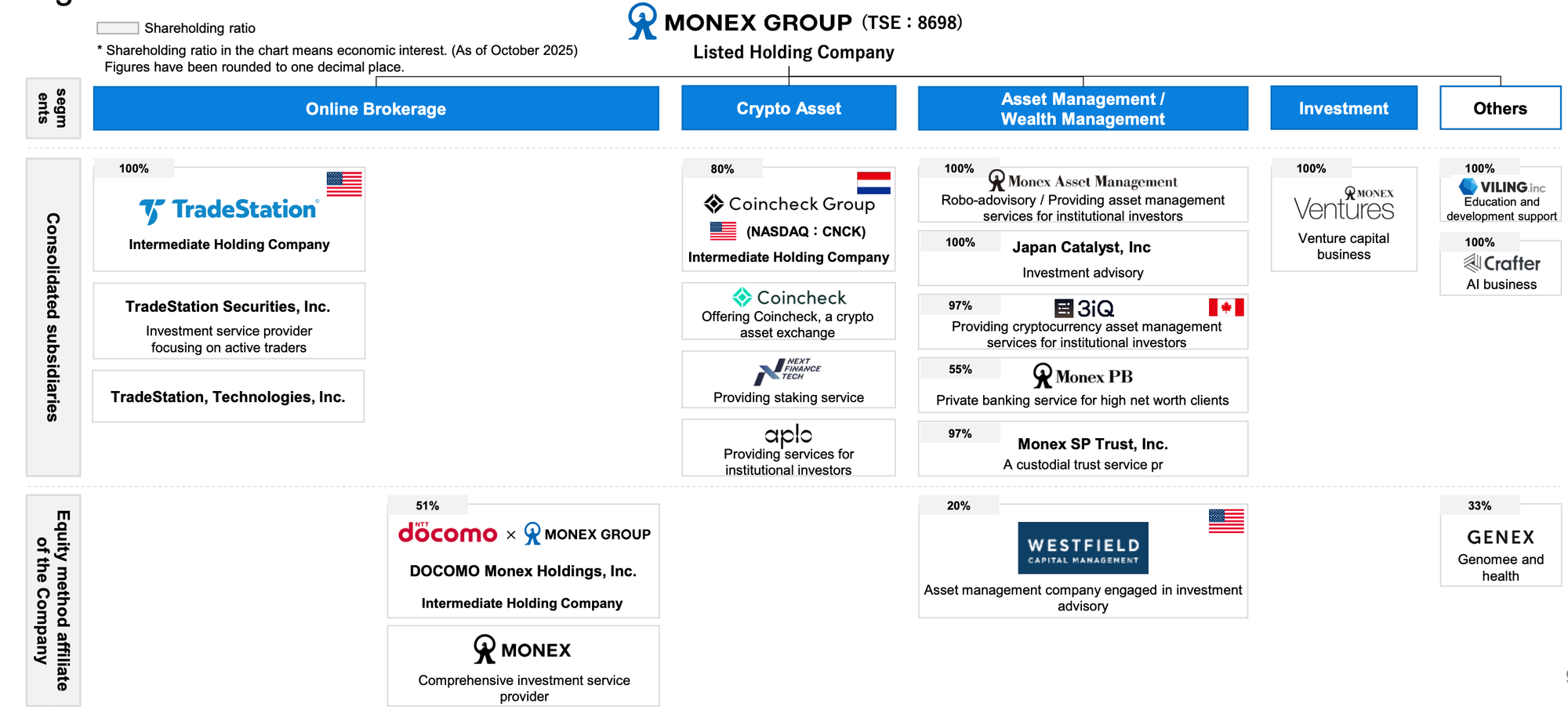

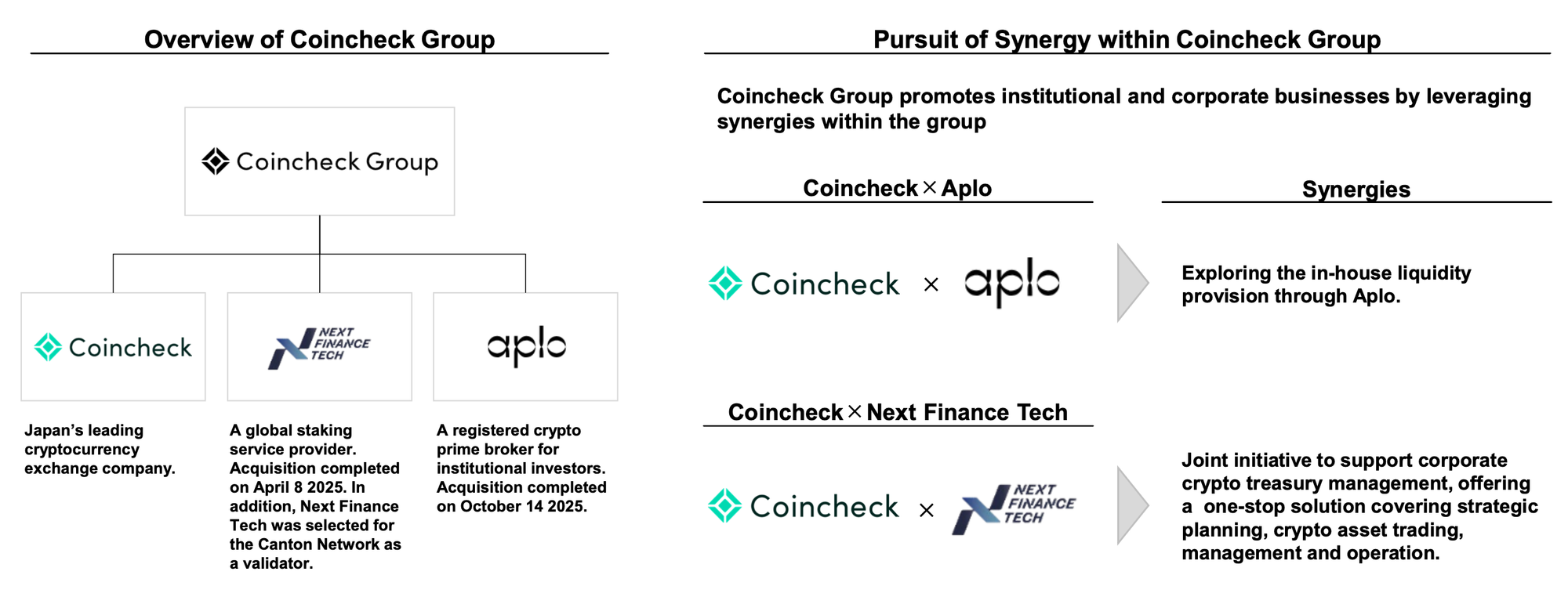

- Coincheck Group's Acquisition of Aplo: On October 14, Coincheck Group completed its acquisition of Aplo, a French crypto asset prime broker. This strategic move strengthens Coincheck's institutional and corporate business capabilities by creating powerful synergies, such as Aplo serving as a key liquidity provider. This positions the Group to effectively serve a more sophisticated client base as the market for digital assets matures.

- Increased Ownership of 3iQ: Monex Group increased its ownership stake in 3iQ Digital Holdings from 67% to 96.8%. This decisive action enhances management flexibility and facilitates deeper integration of 3iQ's digital asset management expertise across the Group.

Commitment to Shareholder Returns

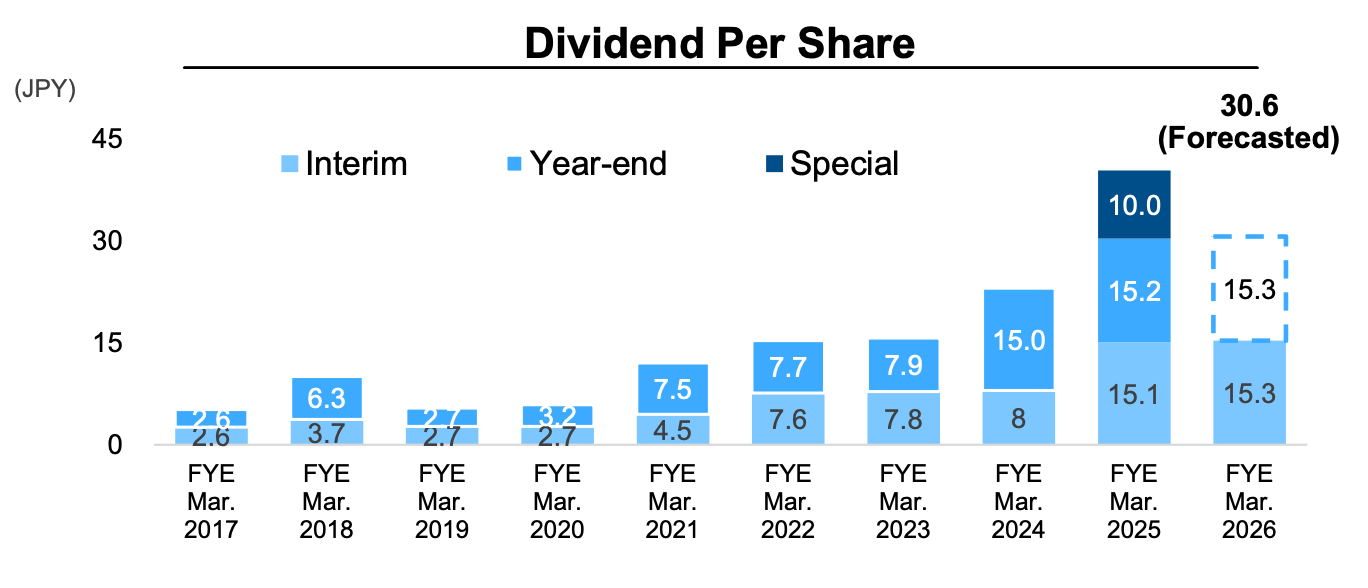

Monex Group maintained its commitment to a progressive dividend policy, reinforcing its focus on delivering value to its shareholders.

- An interim dividend of JPY 15.3 per share was announced for the fiscal year.

- This represents a tangible increase in the ordinary dividend. Excluding the prior period's special dividend of JPY 10, the ordinary dividend has increased by JPY 0.1 per share from JPY 15.2, signaling a consistent commitment to growing shareholder distributions.

This disciplined execution of both growth initiatives and shareholder returns provides a strong foundation for the detailed segment performance that follows.

Analysis of Segment Performance

A core strength of Monex Group's performance in Q2 was the universal growth across its business portfolio. All four segments—Online Brokerage, Crypto Asset, Asset & Wealth Management, and Investment—achieved sequential growth in both revenue and operating profit. This demonstrates the health and potential of the Group's diversified strategy, where each segment contributes to a resilient and dynamic whole.

Online Brokerage: The Stable Foundation

As the Group's core business and "cash cow," the Online Brokerage segment provides the stable financial foundation that enables investment in high-growth areas. In Q2, this segment delivered a strong performance, driven by record results at TradeStation and steady expansion at Monex Securities.

TradeStation Performance

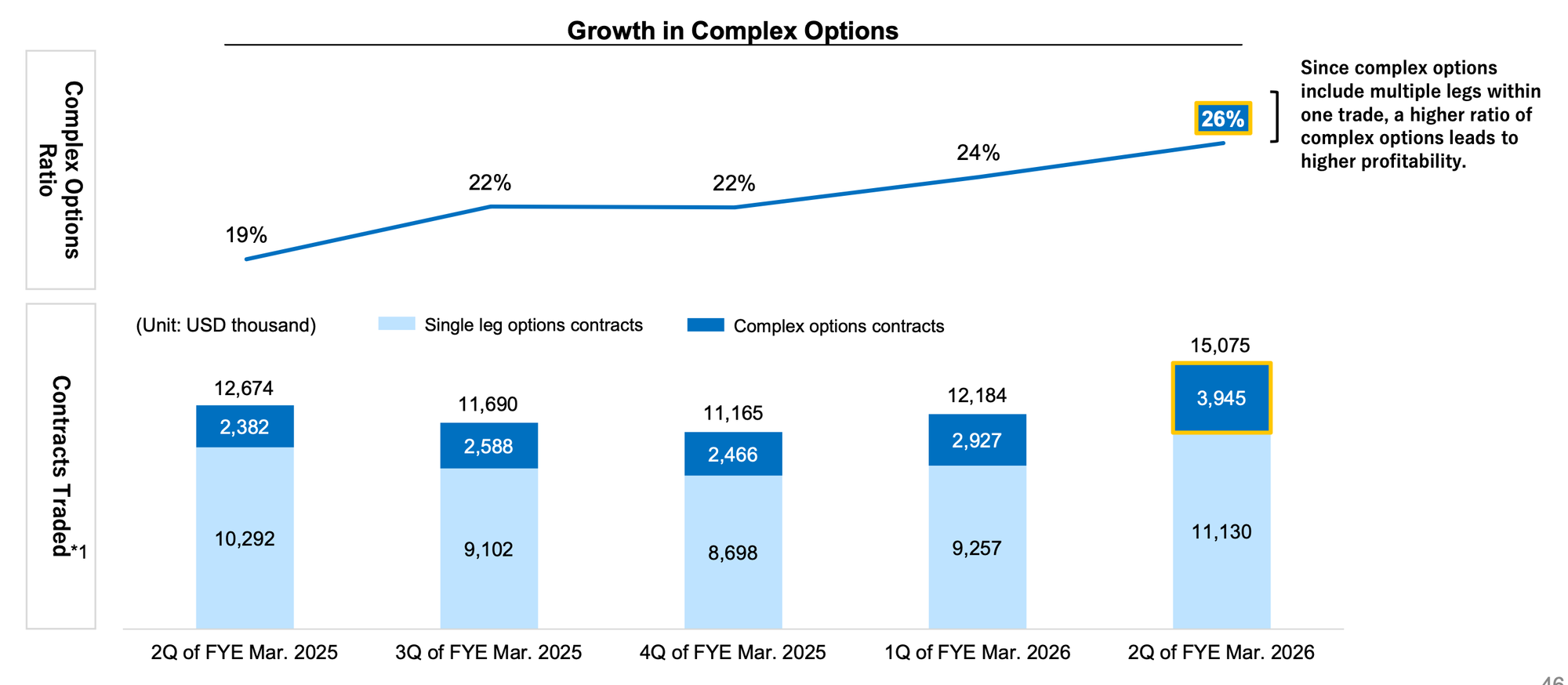

TradeStation achieved record-high quarterly revenue and operating income in US dollar terms, underscoring its robust operational capabilities.

- The record results were driven by active trading in equities and options, coupled with steady growth in its stock lending business. This strength successfully offset a decline in futures Daily Average Revenue Trades (DARTs) and the margin impact of lower interest rates.

- A key highlight was the significant growth in complex options trading. This trend is a key positive indicator, demonstrating that TradeStation is successfully attracting and retaining a sophisticated, high-value segment of "ultra-active traders," which supports margin expansion and long-term platform loyalty.

Monex Securities Performance

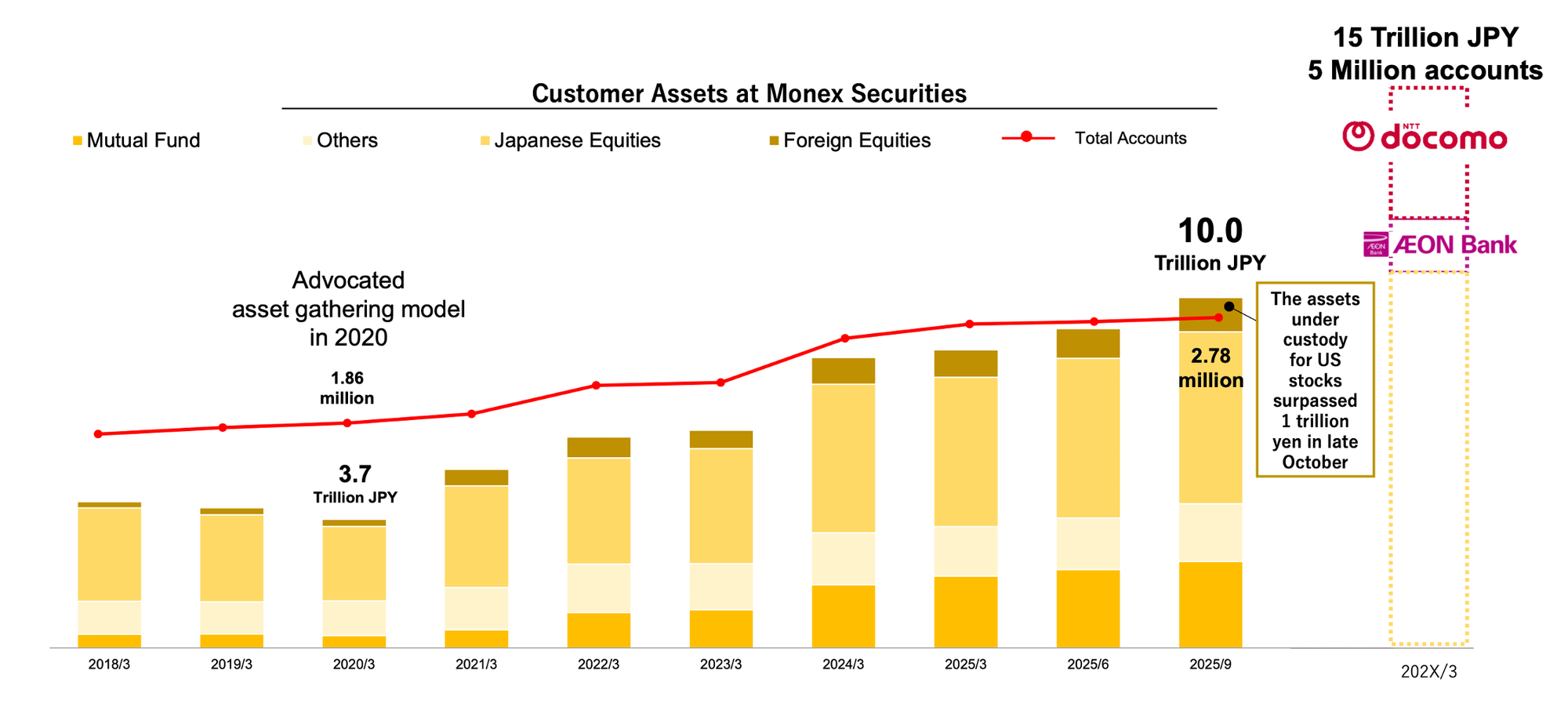

Monex Securities continued its steady growth trajectory, achieving several key milestones while navigating operational challenges.

- The company's customer assets under custody exceeded JPY 10 trillion, and its assets under custody in US equities surpassed JPY 1 trillion, reflecting a strong and growing client base.

- This stable growth is significantly supported by the successful strategic partnership with NTT DOCOMO, which has been instrumental in driving an increase in investment trust balances.

- However, the segment's equity-method profit contribution was reduced by approximately JPY 250 million. This was due to compensation expenses related to an unauthorized trading incident, an issue the company is actively addressing with enhanced, phishing-resistant security measures like passkeys.

Crypto Asset: Capturing Future Growth

Positioned as the engine for future exponential growth, the Crypto Asset segment demonstrated a significant turnaround in Q2, returning to profitability and advancing its strategic M&A objectives.

After reporting a loss in the previous quarter, the Coincheck Group achieved a quarterly net income attributable to owners of JPY 296 million. This recovery was driven by a combination of favorable market conditions and disciplined operational management:

- Favorable Market Conditions: A more active crypto market environment led to significant growth in trading profit.

- Cost Optimization: Other expenses decreased by JPY 235 million QoQ, a reduction attributed mainly to lower professional fees at Coincheck Group.

- Staking Income: Net staking income—the difference between revenue received and the portion shared with customers—increased by JPY 134 million.

- Other Income: The segment's bottom line was further supported by a gain from the reversal of a warrant liability fair value loss and a reimbursement related to the previous NEM litigation.

The segment's M&A strategy, exemplified by the acquisition of Aplo, aligns with the Group's vision of building a global, multi-asset platform. This strategy anticipates a future where all traditional assets are tokenized, positioning Coincheck at the forefront of this financial evolution.

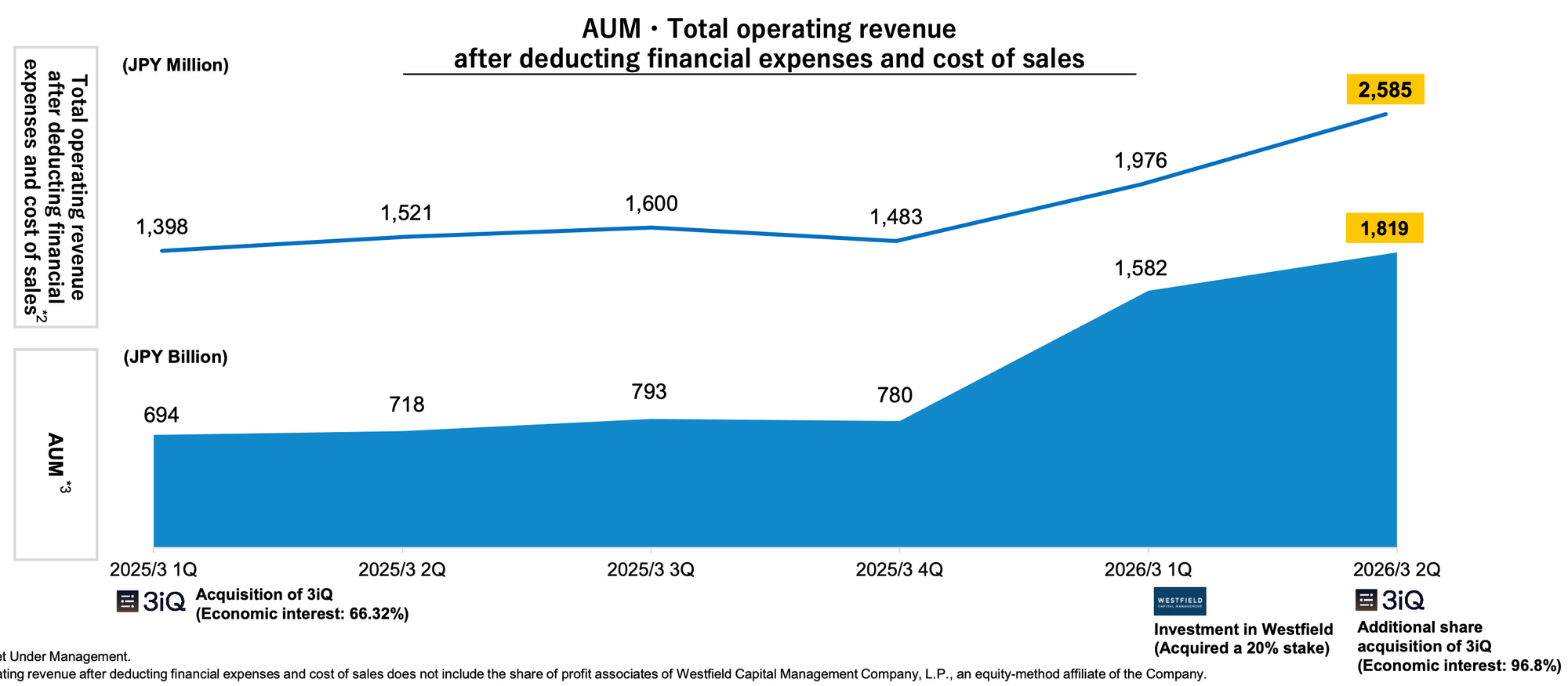

Asset & Wealth Management: A New Pillar of Growth

The Asset & Wealth Management segment is a key growth engine for the Group, and its assets under management (AUM) and revenue continued to grow steadily in Q2.

- Monex Activist Fund (MAF): The fund's strong performance was the primary contributor to the segment's JPY 600 million revenue increase, driven by the continued recognition of significant success fees.

- 3iQ Digital Holdings: AUM at 3iQ continues to grow at a compound annual growth rate (CAGR) of 78%. Its ETFs were also notably included in benchmark indices, expanding their reach and appeal.

- Monex Asset Management: This division's AUM surpassed JPY 900 billion, demonstrating consistent organic growth.

Despite a strong operating income of JPY 795 million, the segment's net income attributable to owners was JPY 73 million. This difference is attributable to specific, non-cash accounting impacts related to the investment in Westfield Capital Management:

- An amortization charge of JPY 430 million for identifiable intangible assets. This figure represents six months' worth of amortization booked in Q2, with future quarters expected to carry half this amount.

- A valuation loss of JPY 311 million related to the fair value assessment of a contractual earn-out liability, reflecting Westfield's strong performance and the increased likelihood of future payments.

Investment Business

The Investment Business segment performed positively, recognizing valuation gains across multiple portfolio companies. This resulted in a quarterly net income of JPY 200 million.

The collective strength across these four segments highlights the success of the Group's diversified model, which is further amplified by its most critical strategic partnership.

Key Partnership Analysis: The NTT DOCOMO Synergy

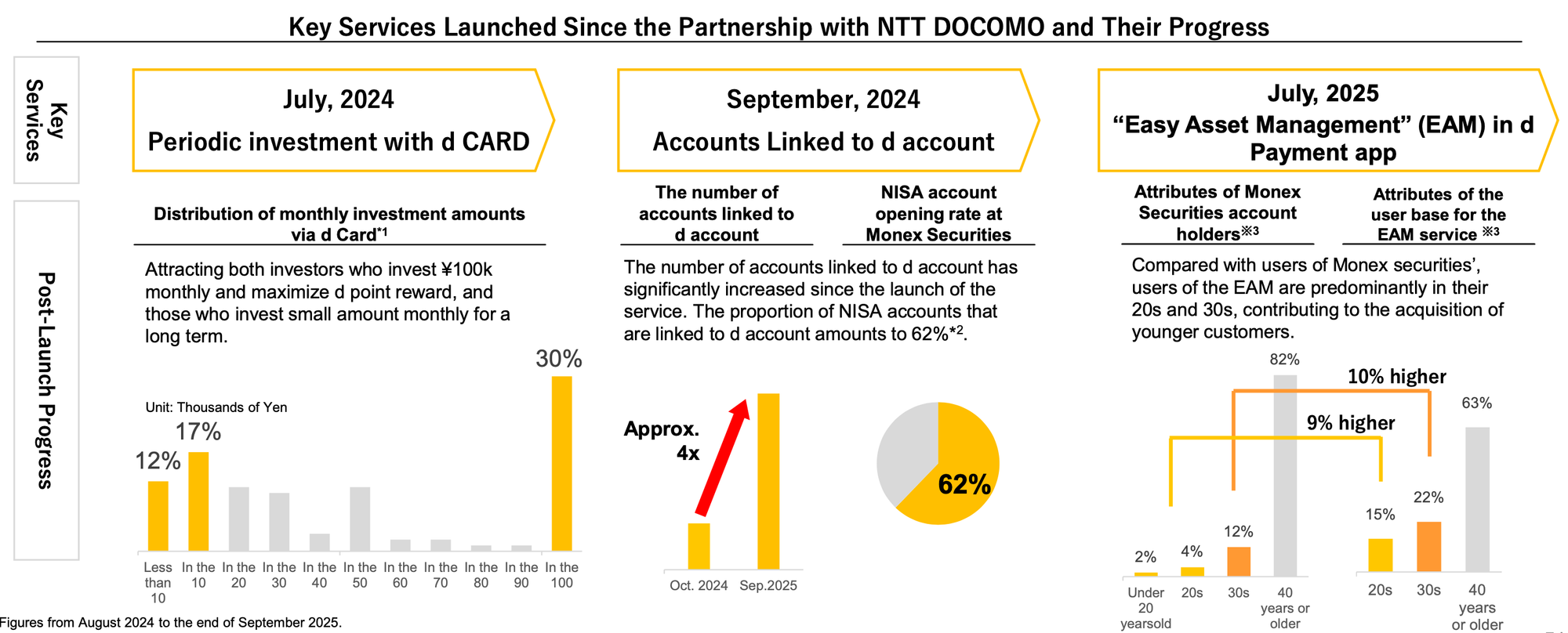

The capital and business alliance with NTT DOCOMO, initiated in January 2024, is a cornerstone of Monex Securities' growth strategy. The partnership has been highly effective in attracting a new, younger demographic of investors and driving tangible growth in key business metrics, confirming its role as a powerful catalyst for customer acquisition and engagement.

A data-driven analysis of the partnership's outcomes reveals clear and accelerating success across multiple fronts:

- Accelerated Service Adoption:

- The number of users for the "d Card Savings" service increased approximately 9-fold between August 2024 and September 2025.

- The number of Monex Securities accounts linked to a "d Account" grew approximately 4-fold between October 2024 and September 2025.

- Attracting and Retaining High-Value Customers:

- Higher NISA Penetration: The NISA account opening rate for new clients who link their d Account is 62%, significantly higher than the 40% rate for unlinked clients. This suggests the partnership is successfully encouraging new investors to make Monex their primary brokerage.

- Increased Activation: The activation rate for clients with linked d Accounts is 65%, which is 8 percentage points higher than the overall rate of 57%, indicating a more committed and engaged user base.

- Targeting New Demographics:

- The "Easy Asset Management" service, accessible within the "d Payment" app, is successfully attracting a younger audience. The service has a 10% higher proportion of users in their 20s and 30s compared to the overall Monex Securities account holder demographic.

In summary, the partnership is successfully expanding Monex Securities' customer base into new demographics and deepening engagement with existing clients, serving as a key and ongoing catalyst for growth.

Financial Health and Forward Outlook

The strong Q2 performance and tangible progress on strategic initiatives have reinforced Monex Group's financial health and illuminated a clear path for future growth. The company is well-positioned to capitalize on emerging opportunities while proactively managing challenges in the evolving financial landscape.

To provide investors with a more accurate picture of its financial strength, management has introduced Adjusted EBITDA as a new key performance indicator. This metric is designed to offer a clearer view of the company's "true earning power" and actual cash flow generation, which can be obscured by non-cash items such as the amortization of intangible assets and the nuances of equity-method accounting.

Looking ahead, Monex Group is focused on leveraging key opportunities while mitigating potential risks.

Opportunities

- Group Synergies: The Group is actively pursuing synergies between its companies, such as leveraging Next Finance Tech to support corporate crypto treasury operations and capitalizing on 3iQ's strategic expansion into Middle Eastern markets.

- Product Growth: The continued expansion of high-profitability products, such as complex options trading at TradeStation, remains a key focus for driving organic growth.

Challenges & Mitigations

- Cybersecurity: In response to phishing activity targeting Monex Securities, the company introduced passkeys on October 31. This provides stronger, phishing-resistant authentication for clients. Management expects that related compensation costs will decline significantly from November onward as this superior security measure is adopted.

- Market Development: The institutional investor market for crypto assets in Japan remains in its early stages. To navigate this, Coincheck's current strategy is to build a foundational business by focusing on supporting corporate clients first. This approach allows the company to develop expertise and infrastructure in preparation for the future entry of institutional players.

Ultimately, Monex Group's strategic direction is clear and consistent. The company reaffirms its commitment to achieving an ROE target of 15%. This will be accomplished by continuing to leverage the stable, cash-generative brokerage business to fund strategic expansion in the high-growth Asset Management and Crypto Asset segments. This growth will be pursued through a disciplined combination of organic initiatives and strategic M&A, ensuring the Group remains agile and well-positioned to create sustainable long-term value for its shareholders.