Monex provides update on Coincheck De-SPAC transaction

Coincheck Group (CCG), a consolidated subsidiary of Monex Group, which will be a holding company of Coincheck, is working closely with…

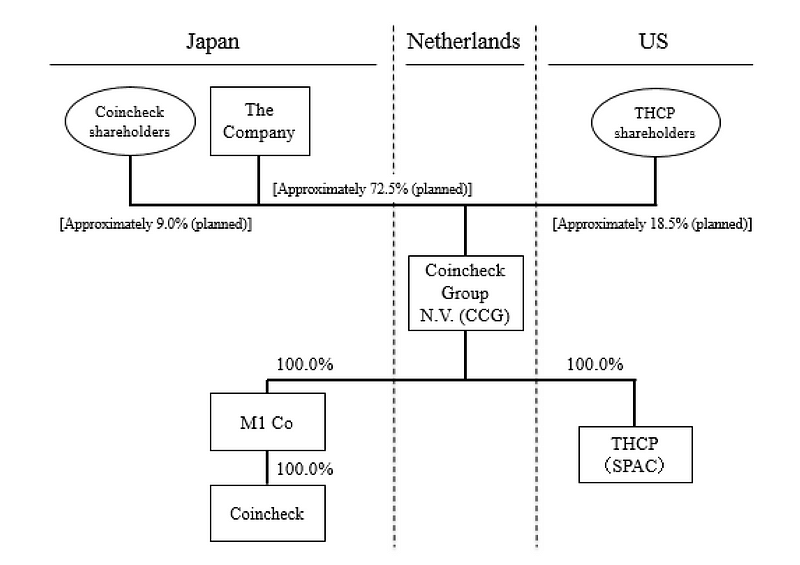

Coincheck Group (CCG), a consolidated subsidiary of Monex Group, which will be a holding company of Coincheck, is working closely with Thunder Bridge Capital Partners IV, Inc. (THCP), a special purpose acquisition company (SPAC) publicly listed on the Nasdaq Global Market, to complete the previously announced merger which will result in CCG becoming a publicly listed company on Nasdaq pursuant to the Business Combination Agreement, dated March 22, 2022 and previously amended May 31, 2023 and May 28, 2024, among CCG and certain of its affiliates and THCP.

The listing of CCG on Nasdaq through the CCG De-SPAC Transaction will enable Monex Group and CCG to raise funds from public investors and utilize Nasdaq-listed shares as consideration for potential acquisitions and as compensation for current and future talents, thereby further expanding their Web3 and crypto asset business and further developing their talented employee base. The companies intend to continue their efforts toward completing the CCG De-SPAC Transaction in accordance with the Business Combination Agreement.

As previously announced in the press release dated March 22, 2022, “Coincheck Group B.V. to become public on the Nasdaq through a De-SPAC with Thunder Bridge Capital Partners IV, Inc.”, if CCG shares meet certain future performance targets, the Company, the other shareholders of Coincheck and TBCP IV, LLC, THCP’s sponsor, would receive additional shares of CCG. Specifically:

- The Company and the other shareholders of Coincheck would receive an aggregate of 25,000,000 shares of CCG, and the Sponsor would receive 1,182,639 shares of CCG, if CCG’s closing share price equal or exceeds US$12.50 over any twenty (20) trading days within the preceding thirty (30) consecutive trading days prior to the fifth anniversary of the closing of the merger, and;

- The Company and the other shareholders of Coincheck would receive an additional 25,000,000 shares of CCG, and the Sponsor would receive an additional 1,182,639 shares of CCG, if CCG’s closing stock price equals or exceeds US$15.00 during the same period (the “Earn-out Price Adjustment”).

However, in order to reduce potential future dilution of CCG shares associated with the Earn Outs, the Company and other shareholders of Coincheck, and the Sponsor have decided to amend the Business Combination Agreement, effective October 8, 2024, to remove the Earn-out Price Adjustment.

Please follow us to read more about Finance & FinTech in Japan, like hundreds of readers do every day. We invite you to also register for our short weekly digest, the “Japan FinTech Observer”, on Medium, on LinkedIn, or on Substack.

We also provide a daily short-form Japan FinTech Observer news podcast, available via its Podcast Page. Our global Finance & FinTech Podcast, “eXponential Finance” is available through its own LinkedIn newsletter, or via its Podcast Page.

Should you live in Tokyo, or just pass through, please also join our meetup. In any case, our YouTube channel and LinkedIn page are there for you as well.