Money Forward Reports Full FY2025 Results

Money Forward (TSE: 3994) is a prominent Japanese FinTech company providing a comprehensive suite of Software-as-a-Service (SaaS) solutions for both businesses and individuals. As a leader in Japan's digital transformation landscape, the company is at a pivotal stage, balancing aggressive market expansion with an increasing focus on sustainable profitability. This analysis will dissect the company's recent financial performance for the fiscal year ended November 30, 2025, evaluate its core strategic direction, and assess its future outlook to determine its investment potential.

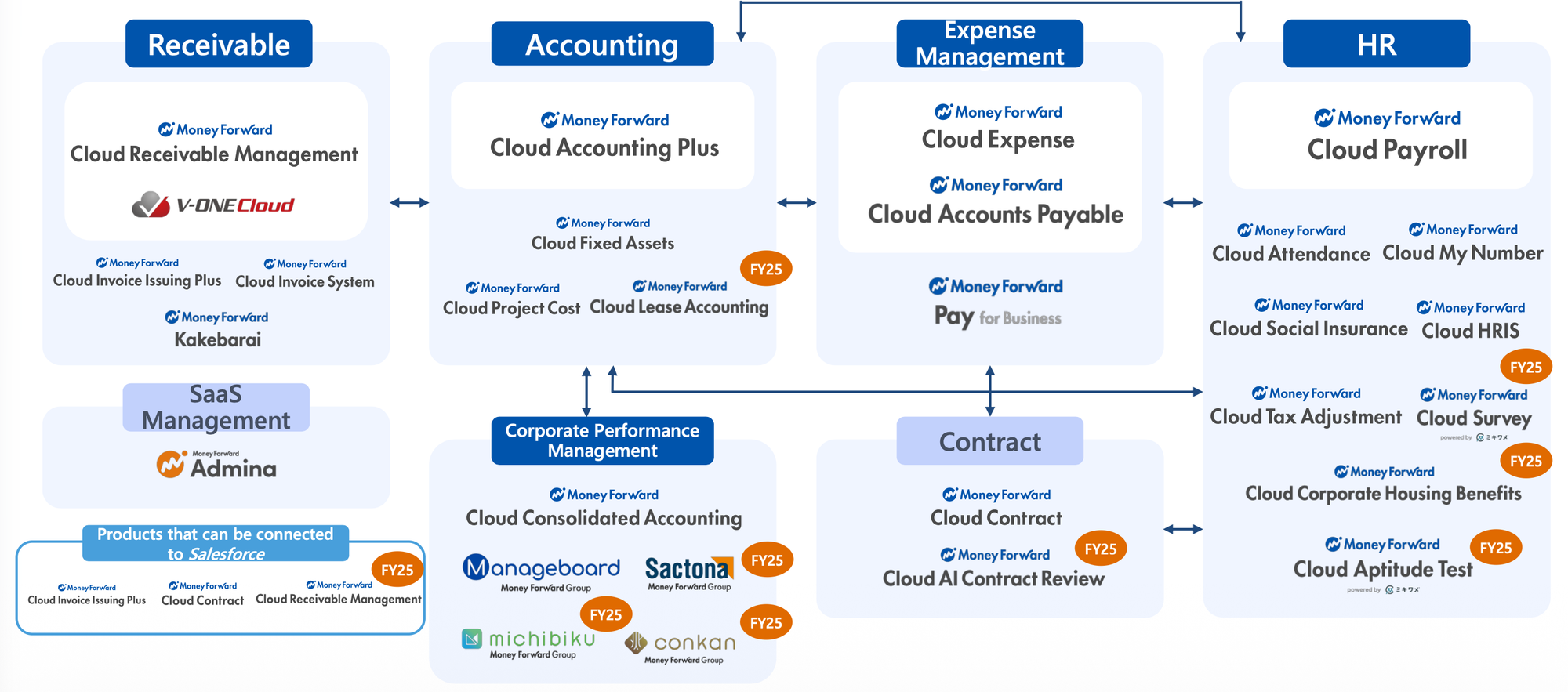

Money Forward operates across several distinct domains, each targeting a specific market segment with a tailored suite of digital tools:

- Business: This segment's flagship offering is "Money Forward Cloud," a comprehensive back-office SaaS solution designed for businesses. It provides a modular, "Composable ERP" platform covering accounting, expense management, HR, payroll, and invoicing, enabling companies to digitize and streamline their administrative functions.

- Home: Centered around the "Money Forward ME" service, this segment provides a market-leading personal financial management (PFM) and asset management application for individuals. The platform allows users to aggregate accounts from various financial institutions to visualize and manage their personal finances.

- X: This division focuses on providing custom development services for financial institutions. It leverages Money Forward's technological expertise to build bespoke asset management tools and passbook applications for banks and other corporate clients.

- Finance: This segment offers financial services that complement its core SaaS platforms, including solutions such as "Money Forward Pay for Business" and the B2B settlement service "Money Forward Kakebarai."

- SaaS Marketing: This segment operates "BOXIL SaaS," a comparison and information website that helps businesses discover and select appropriate SaaS solutions, creating a synergistic marketing channel.

This overview of Money Forward's strategic positioning provides the context for a detailed examination of its recent financial results.

1. Analysis of Financial Performance (FY2024–FY2025)

A thorough analysis of the company's recent financial statements is critical to understanding its operational effectiveness and financial stability. This evaluation covers key profitability metrics, balance sheet health, and cash flow generation during the fiscal year ended November 30, 2025 (FY2025), in comparison to the prior year (FY2024).

1.1 Consolidated Operating Results

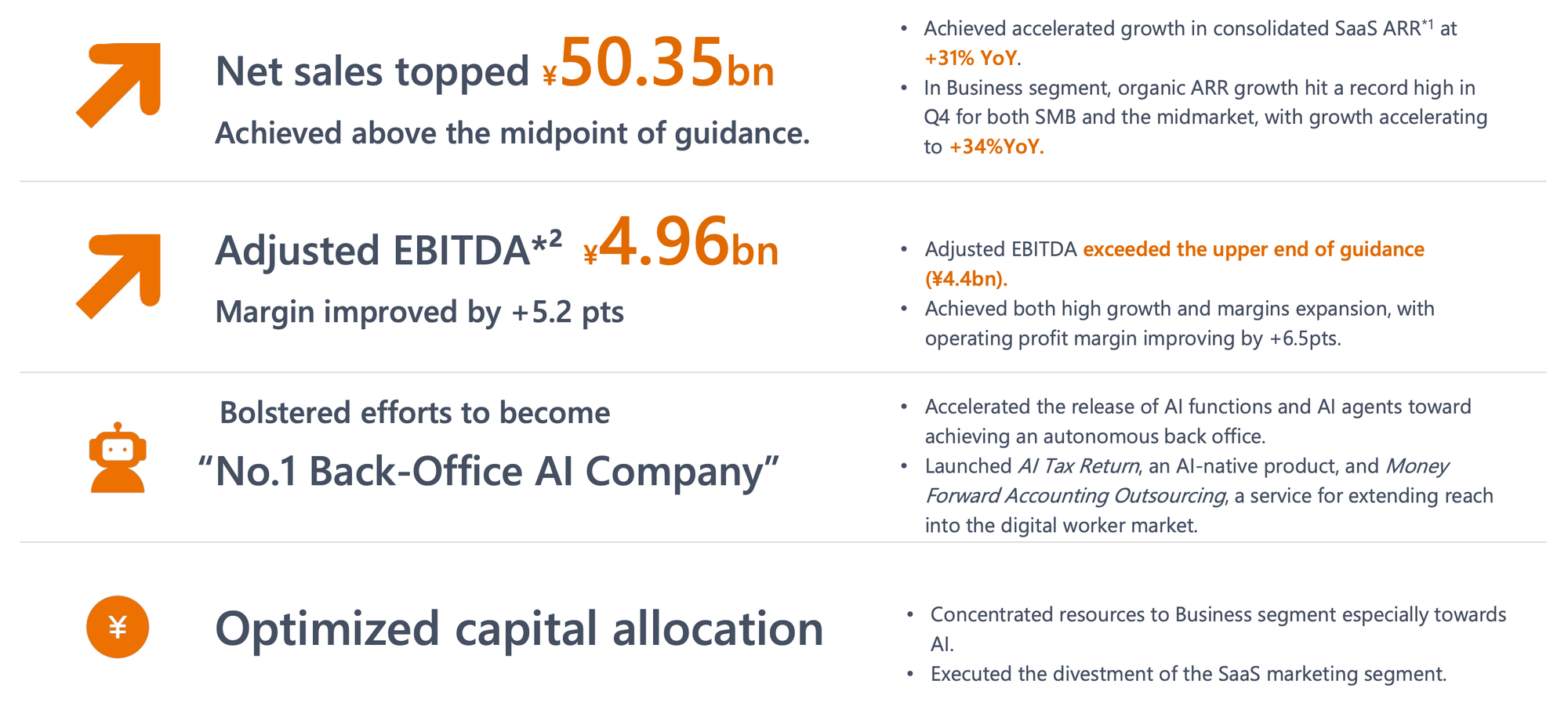

Money Forward demonstrated robust top-line growth and a significant improvement in profitability during FY2025. While core operations are strengthening, the reported net profit was heavily influenced by a one-time gain from a strategic divestiture.

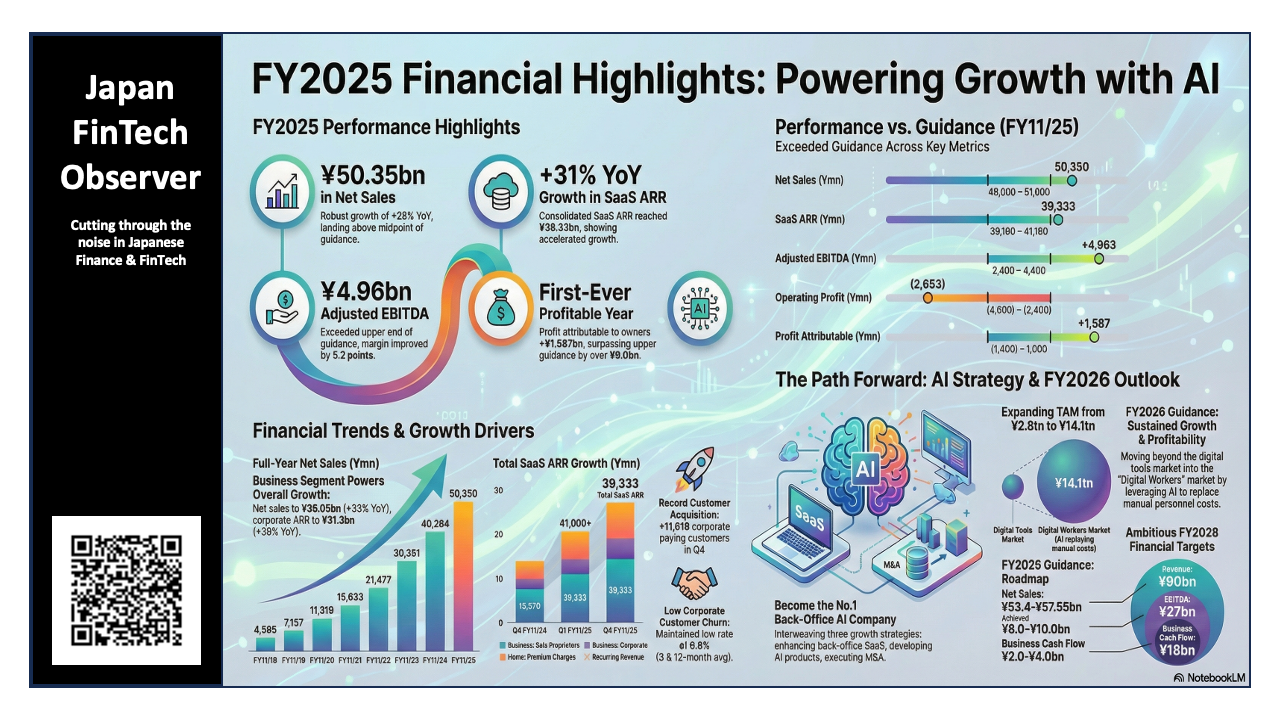

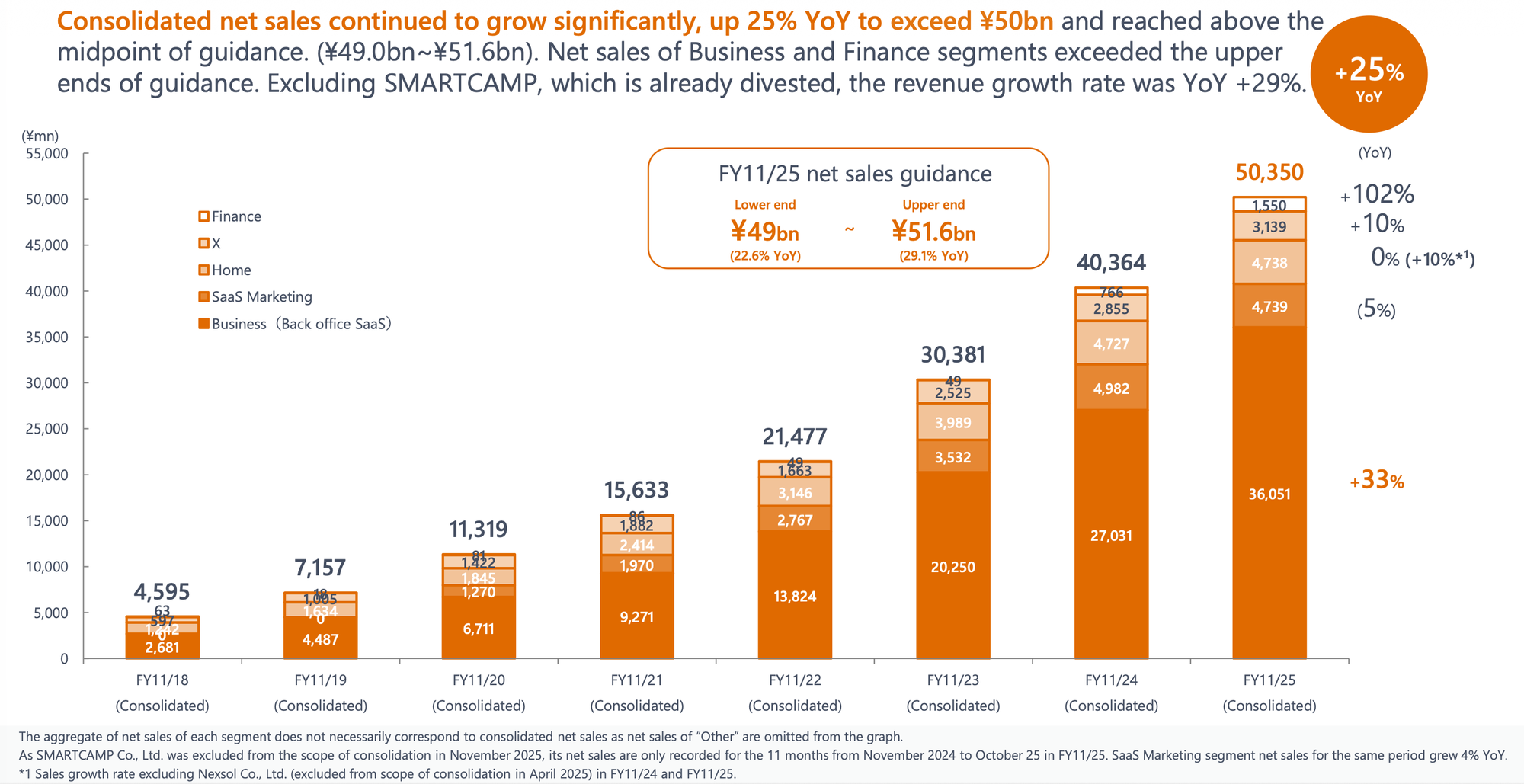

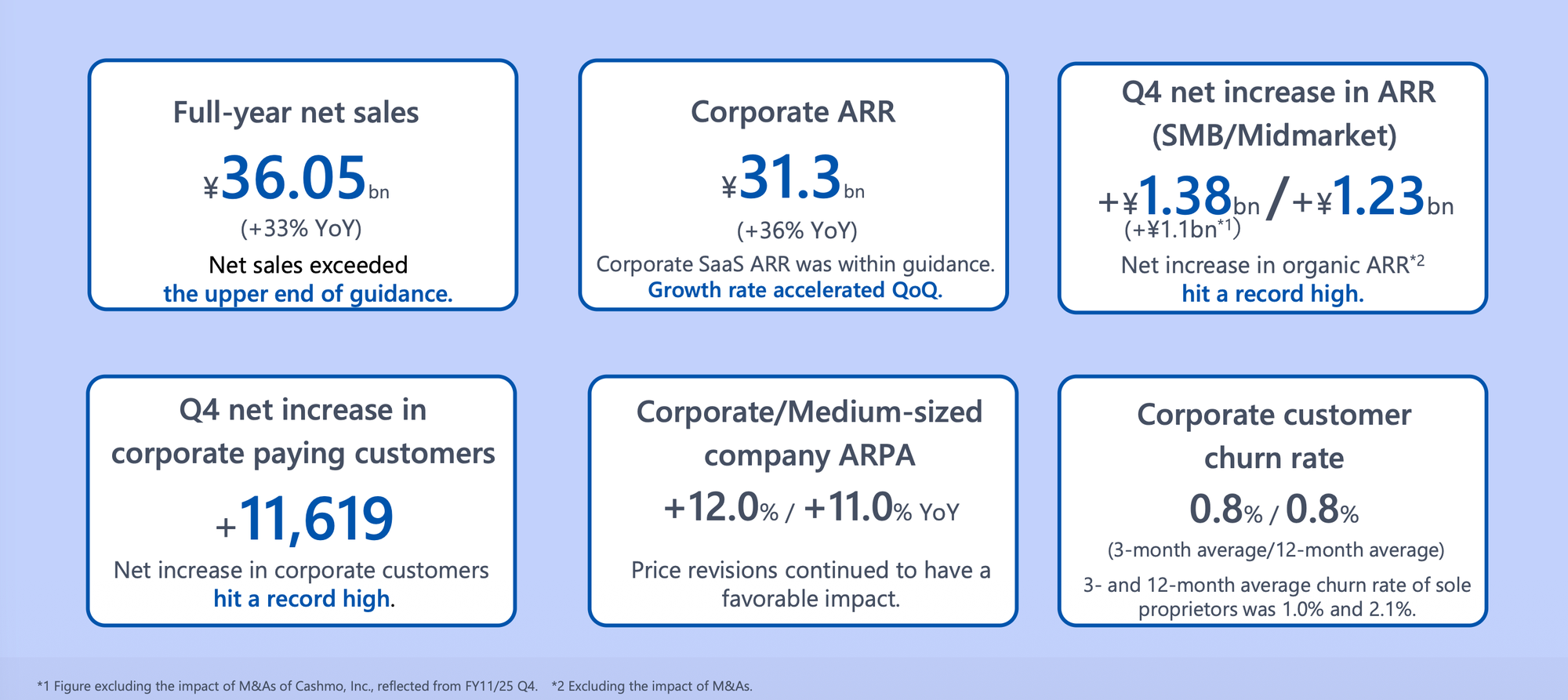

The 24.7% year-on-year growth in Net sales reflects the successful expansion across all business segments, particularly in the core Business and Home SaaS offerings. This is further validated by the impressive 31.1% growth in SaaS Annual Recurring Revenue (ARR), a key indicator of the underlying health and scalability of the subscription-based business model.

The most dramatic shift occurred in profitability. The company recorded a significant swing from a net loss of (¥6,330) million in FY2024 to a net profit of ¥1,587 million in FY2025. This turnaround, which makes a direct year-on-year percentage calculation irrelevant, was not driven by core operations but by extraordinary income. The Consolidated Statement of Income reveals a "Gain on sale of shares of subsidiaries and associates" of ¥6,248 million. This one-time gain masks a continued operating loss at the GAAP level, making Adjusted EBITDA the more relevant metric for assessing the underlying operational health of the business during this growth phase.

Adjusted EBITDA, which grew an exceptional 166.2% year-on-year, offers a clearer view of core operational health. This metric, which abstracts from non-cash expenses and one-time items, signals a significant improvement in the underlying profitability and efficiency of the company's primary business activities.

1.2 Financial Position

The company's balance sheet expanded significantly in FY2025, reflecting continued investment in growth through both organic development and acquisitions.

- Total assets grew from ¥106,191 million to ¥127,567 million. A key driver of this increase was a substantial rise in Intangible assets, which climbed from ¥17,046 million to ¥26,834 million. This was primarily due to increases in Goodwill (from ¥3,381 million to ¥6,731 million) and Software (from ¥10,637 million to ¥13,614 million), underscoring the company's M&A activity and investment in technology.

- Total liabilities increased from ¥61,516 million to ¥71,701 million. The company holds both short-term borrowings (¥5,254 million) and long-term borrowings (¥10,994 million) to finance its operations and strategic investments.

- The Equity-to-asset ratio saw a slight decrease from 33.3% to 32.0%. This modest decrease in the equity-to-asset ratio is expected for a company in an aggressive growth and acquisition phase, as both assets (through M&A) and liabilities (through borrowings to fund investment) are growing at a faster rate than retained earnings.

1.3 Cash Flow Analysis

The FY2025 cash flow statement reveals a critical improvement in operational cash generation, though overall cash reserves decreased due to heavy investment activity.

- Cash flows from operating activities saw the most significant improvement, executing a crucial turnaround from a net use of (¥4,761) million in FY2024 to generating ¥1,496 million in cash in FY2025. This was achieved despite a continued operating loss, primarily due to strong cash collection from customers (reflected in a ¥3,575 million increase in Contract liabilities) and high non-cash depreciation charges (¥4,118 million).

- Cash flows from investing activities resulted in a net use of (¥10,339) million, reflecting the company's aggressive investment strategy. Major outflows included the "Purchase of intangible assets" (¥8,318 million) and "Purchase of shares of subsidiaries" (¥3,683 million), which were partially offset by "Proceeds from sale of shares of subsidiaries" (¥6,997 million).

- Cash flows from financing activities provided ¥4,570 million in net cash. Key inflows included proceeds from long-term borrowings, share issuance to non-controlling interests in subsidiaries, and partnership proceeds.

These financial results are a direct consequence of the company's strategic initiatives aimed at capturing market share and building a comprehensive digital ecosystem.

2. Strategic Initiatives and Segment Performance

Money Forward's financial performance is the result of focused strategic decisions and strong execution in its key markets. The company's growth is propelled by a multi-pronged strategy that includes enhancing its core product offerings, expanding its market presence, and pursuing strategic acquisitions.

2.1 Business Segment: Driving Corporate Growth

The Business segment remains the primary engine of the company's expansion.

- Over the past four years, Money Forward's company-wide revenue has grown at a CAGR of +35%, with the Business segment leading this growth at a CAGR of +40%.

- The company is successfully targeting the midmarket with its "Composable ERP" strategy. This model allows customers to adopt individual modules of the "Money Forward Cloud" suite as needed and integrate them with existing systems, facilitating a gradual and flexible transition to the cloud.

- This strategy has cemented a strong market position, evidenced by the fact that 84% of Japan’s top 100 accounting firms had introduced Money Forward's cloud accounting modules as of 2025.

- In a move to align value with cost, the company initiated price updates for "Money Forward Cloud Subscription Plans for SMBs" starting from June 1, 2025. This revision is a response to new regulatory requirements, ongoing function development, and inflationary pressures on development costs.

2.2 Home Segment: Dominant Market Presence

In the consumer market, Money Forward has established a commanding leadership position.

- The "Money Forward ME" service user base has topped 17.8 million users. The application is ranked as the No.1 PFM app and asset management app in Japan in terms of user base and brand recognition, and it boasts the largest coverage among PFM products in Japan.

- To further monetize this user base and enhance value, the company announced a price revision for the "Money Forward ME Premium Service," effective August 5, 2025. Concurrently, it introduced a new function allowing users to earn redeemable V Points for engaging with the app, a move designed to deepen user engagement.

2.3 Corporate Development and M&A Strategy

Acquisitions are a core component of Money Forward's growth strategy. During the fiscal year, the company's scope of consolidation changed significantly, with 11 companies newly included and 4 companies excluded. The most notable transaction was the strategic divestiture of SMARTCAMP. This high volume of M&A activity underscores Money Forward's inorganic growth strategy, aimed at rapidly acquiring technological capabilities, engineering talent, and customer bases to accelerate its ecosystem build-out. However, it also introduces significant integration risk and places a premium on management's ability to successfully consolidate these disparate assets.

These strategic initiatives set the stage for the company's forward-looking financial targets and guidance.

3. Future Outlook and Management Guidance

Management's forward-looking statements provide critical insight into the company's strategic priorities and expected performance. Money Forward has outlined ambitious financial forecasts for the upcoming fiscal year and its longer-term targets, signaling a continued emphasis on high-growth investment.

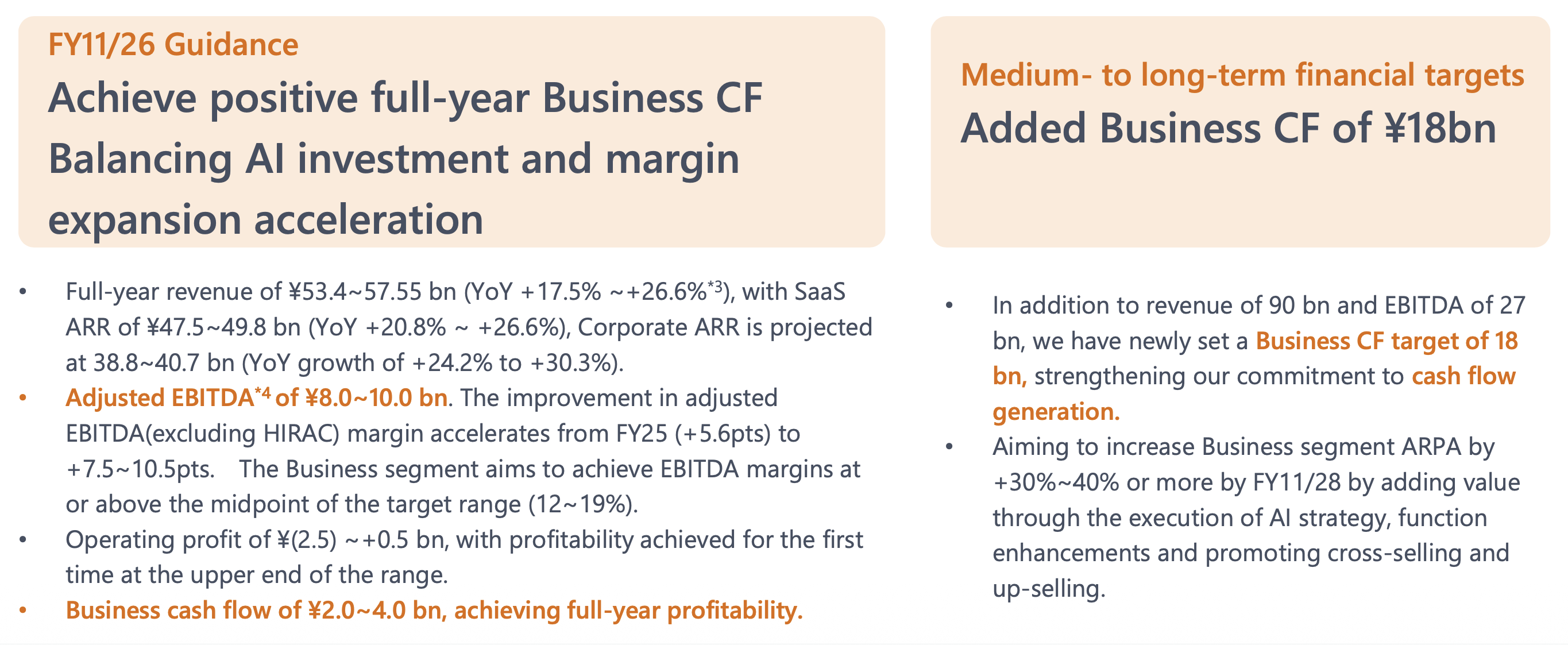

3.1 FY2026 Consolidated Financial Forecasts

For the fiscal year ending November 30, 2026, management has provided guidance that reflects a strategic decision to reinvest in growth, which is expected to result in GAAP-level losses despite strong underlying business momentum.

Metric | FY2026 Forecast Range (¥ millions) | Year-on-Year Change (vs. FY2025) |

Net sales | 53,400 ~ 57,550 | +6.1% ~ +14.3% |

SaaS ARR | 47,500 ~ 49,800 | +20.8% ~ +26.6% |

Adjusted EBITDA | 8,000 ~ 10,000 | +61.2% ~ +101.5% |

Operating profit | (2,500) ~ 500 | - |

Profit attributable to owners of parent | (5,200) ~ (2,200) | - |

Management's guidance signals a clear and deliberate strategic choice: prioritizing accelerated market share capture and ARR growth over short-term GAAP profitability. The projected return to an Operating loss of (¥2,500) to ¥500 million and a net loss of (¥5,200) to (¥2,200) million is attributed to planned increases in operating expenses, with "Advertising and promotion expenses" forecast at 9.5–11.5% of net sales and "personnel expenses and outsourcing expenses" at 57.0–61.0% of net sales. Investors should view the projected losses not as an operational failure, but as a calculated reinvestment of capital to solidify long-term market leadership.

Crucially, the top-line forecast is impacted by recent divestitures. Management notes that excluding the two divested companies, the underlying year-on-year growth for net sales is projected to be significantly higher at +17.5% to +26.6%.

3.2 Medium- to Long-Term Targets

Money Forward has set ambitious long-term goals that underscore its confidence in its growth trajectory and future profitability.

- The company's medium-term target for FY2028 is to achieve net sales of over ¥90 billion and EBITDA of over ¥27 billion.

- The longer-term ambition is to reach a highly profitable state with an EBITDA margin of 40% or more.

Recent progress supports this trajectory. In FY2025, the company achieved a +5.2 percentage point improvement in its consolidated EBITDA margin and reached full-year profitability on an EBITA*¹ (EBITDA minus depreciation) basis, demonstrating tangible progress toward its long-term profitability goals.

4. Concluding Assessment

Money Forward presents a compelling investment case as a high-growth SaaS leader navigating a strategic transition. The company is successfully balancing aggressive investment for market expansion with an emerging focus on improving core profitability.

The core investment thesis is built on several key strengths: robust top-line growth, impressive expansion in SaaS ARR, a dominant market position in both its business and consumer segments, and rapidly improving operational profitability as measured by Adjusted EBITDA. However, investors must also consider the primary risks. The company's official forecast for FY2026 projects a return to GAAP-level losses, driven by a deliberate strategy of high reinvestment in marketing and personnel to fuel future growth. Furthermore, the company's expansion is partly reliant on a dynamic M&A strategy, which carries inherent risks related to integration and valuation.

Ultimately, Money Forward represents a classic growth-stage technology investment. The company is prioritizing scale and market leadership today with the clearly stated goal of achieving significant profitability in the medium to long term. As noted in the company's own cautionary statements, these forecasts are based on currently available information, and actual results may differ due to a variety of factors, representing the inherent risk in any forward-looking assessment.