Money Forward's Q3: A Strategic Pivot Masks Underlying Weakness in Core Business

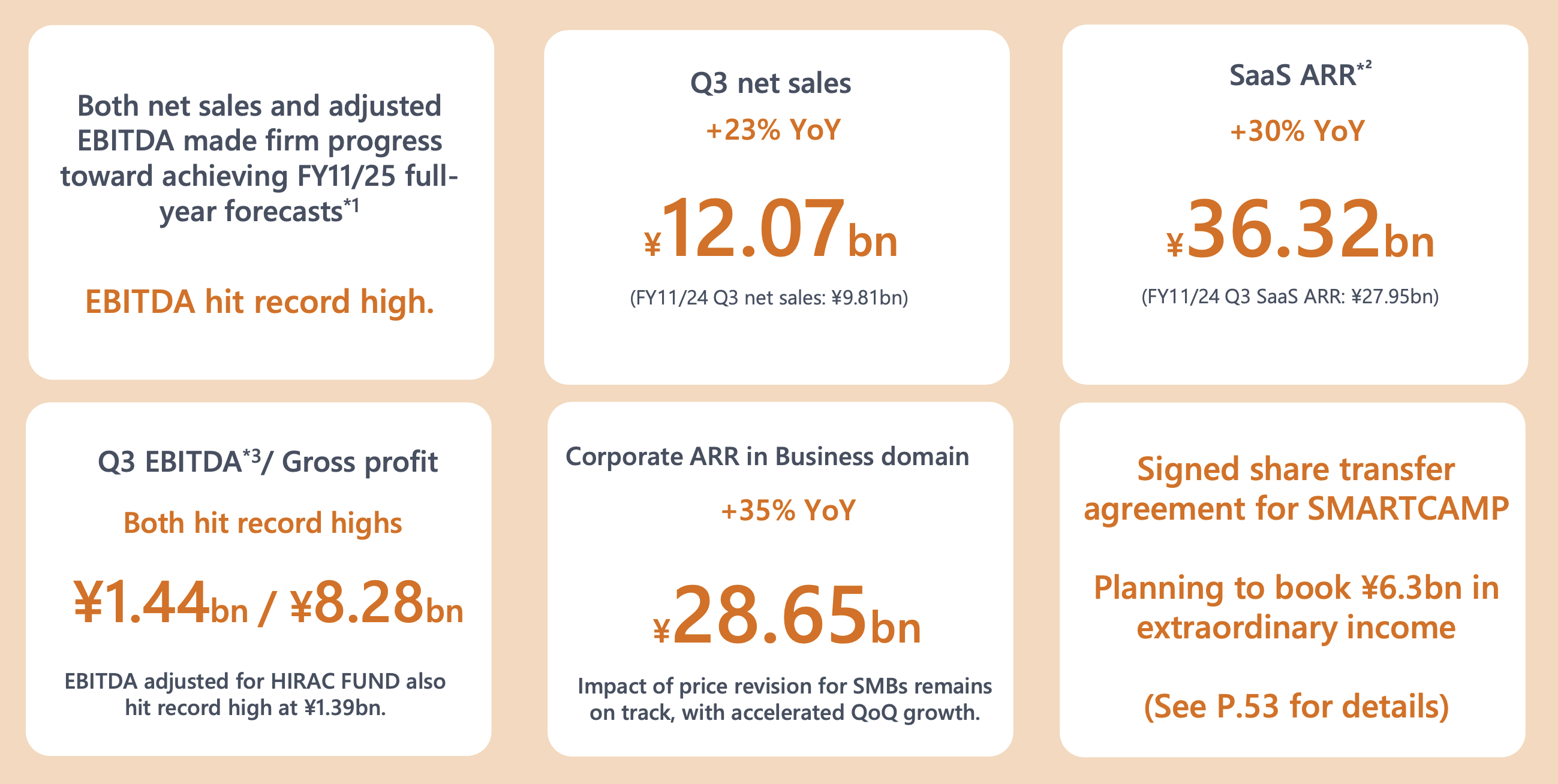

Money Forward (3994.T) reported a mixed set of third-quarter results that revealed a company in the midst of a profound strategic transformation. While net sales for the period ending August 31, 2025, fell short of market expectations, a sharp focus on cost discipline allowed the company to significantly beat profit forecasts. The quarter was defined by a series of bold corporate maneuvers, including the divestiture of a major subsidiary and key acquisitions, signaling a deliberate pivot from a "growth-at-all-costs" model to one prioritizing profitability and a sharpened focus on its core enterprise software business.

Beneath the headline numbers, however, a deeper analysis reveals a critical vulnerability: the company's growth in its core Small and Medium-sized Business (SMB) segment was driven entirely by price revisions, masking what appears to be a stagnant or even slightly negative underlying organic performance. In response, Money Forward is aggressively reallocating capital towards a higher-margin "Digital Worker" strategy, leveraging acquisitions and a newly unveiled Artificial Intelligence (AI) vision to build its next engine of growth. This strategic overhaul, while promising, now faces the crucial test of execution as the company navigates a more challenging market environment.

Headline Financial Performance: Cost Discipline Trumps Sluggish Sales

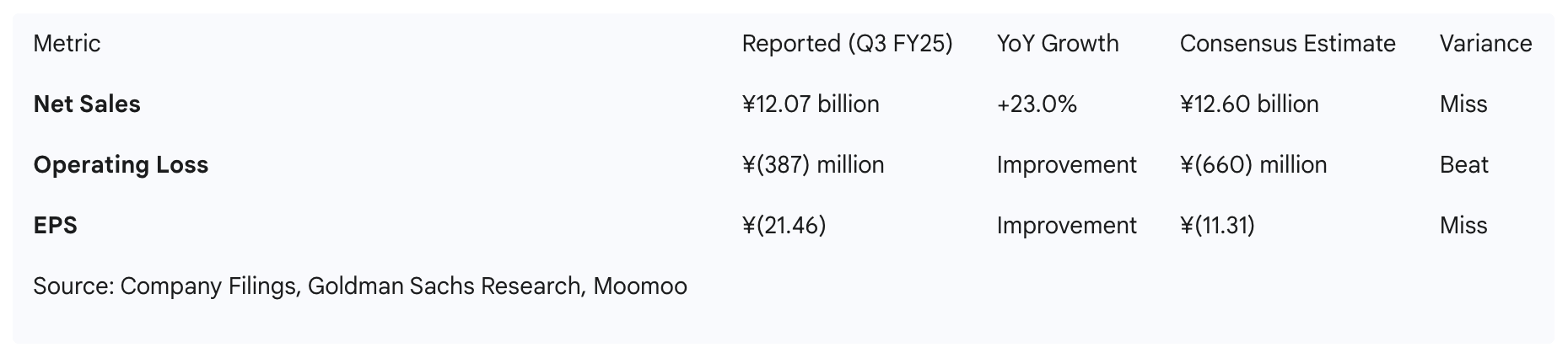

Money Forward's third-quarter financial results painted a bifurcated picture of a company successfully managing its bottom line even as top-line momentum showed signs of slowing. The company posted consolidated net sales of ¥12.07 billion, representing a 23.0% year-over-year (YoY) increase. However, this figure fell short of the Bloomberg consensus estimate of ¥12.6 billion, indicating that sales are trending below both market expectations and the company's full-year guidance.

In stark contrast, the company demonstrated significant progress on profitability. It reported an operating loss of ¥387 million, a substantial improvement from the ¥1.01 billion loss recorded in the same quarter of the previous year. This result was considerably better than the consensus forecast of a ¥660 million loss, highlighting the effectiveness of recent cost-containment efforts. This bottom-line outperformance was further reflected in the company's record-high quarterly EBITDA, which reached ¥1.44 billion. The corresponding EBITDA margin improved dramatically to 12%, a significant jump from 6% in the preceding quarter.

This divergence between a top-line miss and a bottom-line beat was not a coincidence but the outcome of deliberate policy choices. The improved profitability was attributed to "stricter hiring practices" and a renewed focus on "increased cost efficiency," particularly in marketing expenditures. Advertising costs for the quarter were held to ¥1.47 billion, a decrease of 2.4% YoY, marking a clear departure from the aggressive spending patterns of previous high-growth phases.

The context surrounding this shift is critical. The broader industry is grappling with the end of a major tailwind related to Japan's new invoice system, leaving it without significant new growth drivers. Concurrently, the company disclosed in its Q&A session that it maintains "close IR communication" with an activist shareholder (ValueAct) who has filed a large-shareholding report in July 2025. This combination of a tougher macroeconomic environment and potential investor pressure appears to have catalyzed a fundamental strategic pivot. The third-quarter results, therefore, represent more than just effective cost management; they signal a conscious move away from chasing growth at any cost toward a more disciplined and profitable operational model.

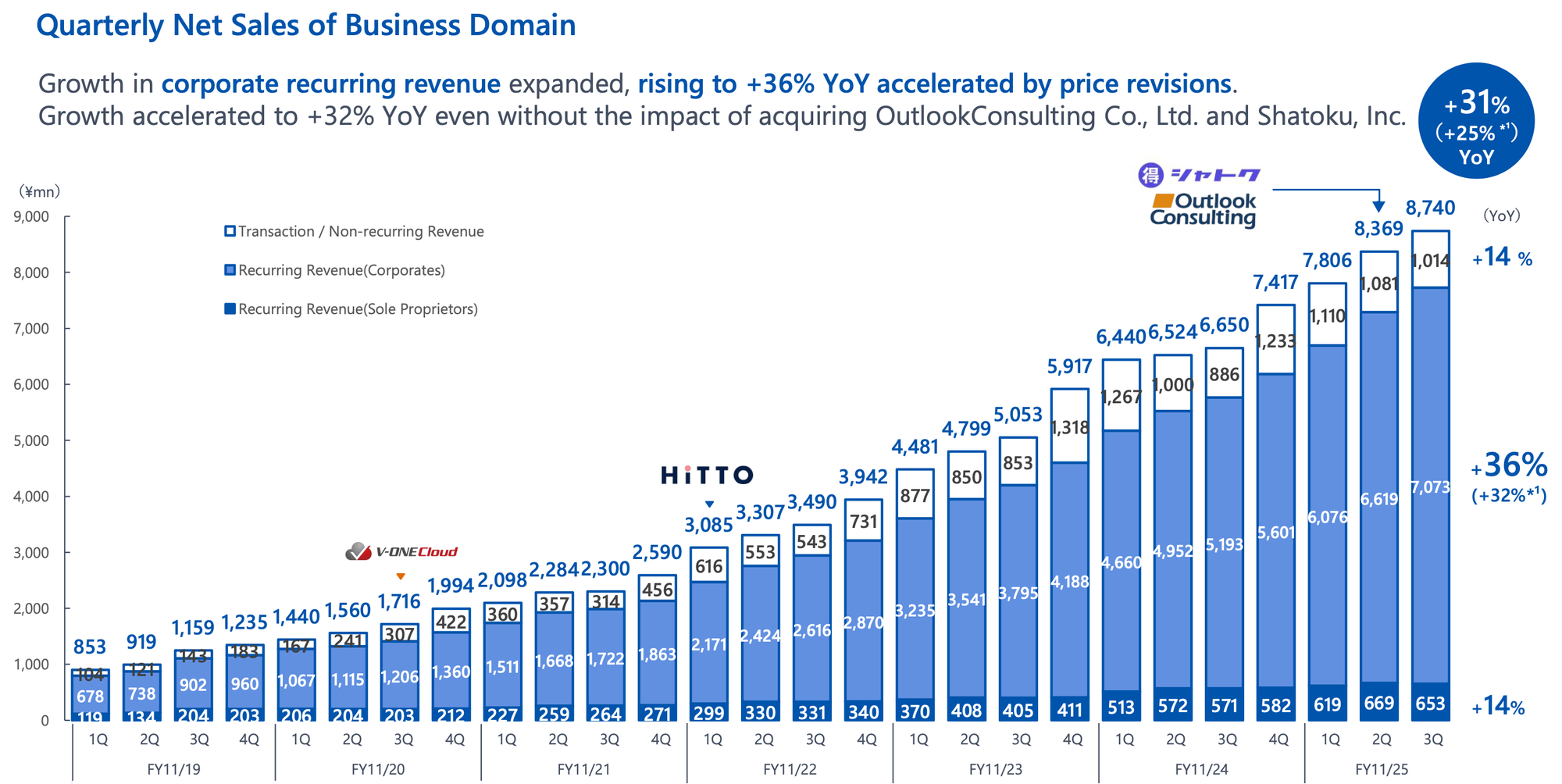

Deep Dive: The Business Domain Engine

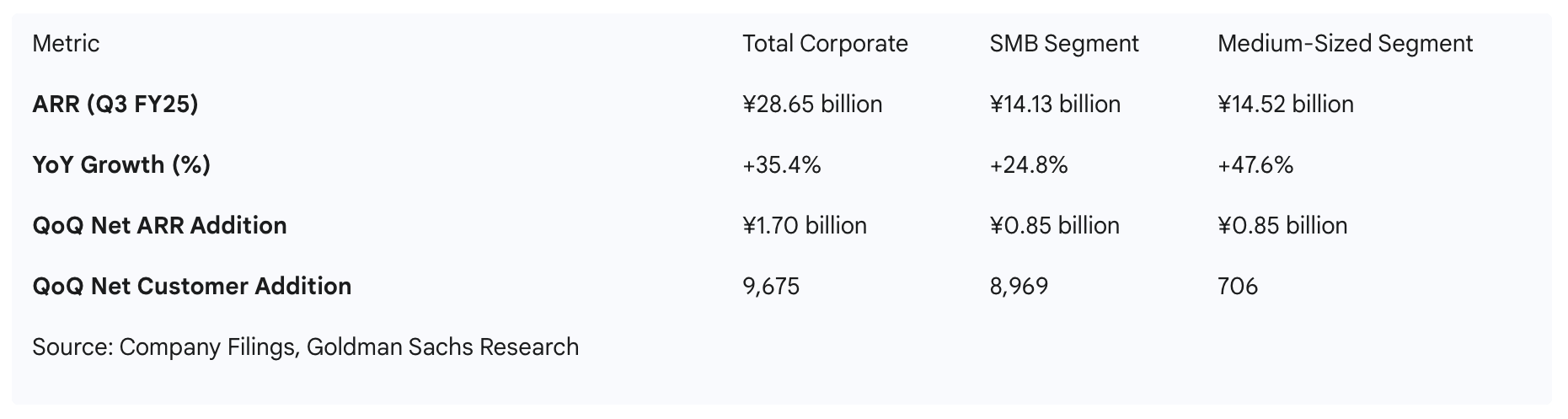

The Business domain remains the primary engine of Money Forward's growth, posting quarterly net sales of ¥8.74 billion, a 31% YoY increase. On an organic basis, excluding recent acquisitions, growth was a still-healthy 25%. The segment's Corporate Annual Recurring Revenue (ARR) growth accelerated to 35% YoY, reaching a total of ¥28.65 billion. However, a closer examination of its two key sub-segments—SMBs and medium-sized enterprises—reveals two very different performance narratives.

The Price Revision Paradox in the SMB Segment

On the surface, the SMB segment appeared to perform well, with its ARR growing to ¥14.13 billion as YoY growth accelerated to 24.8%. The net addition to ARR in the third quarter was ¥850 million. However, this headline figure conceals a crucial weakness.

The price revision for SMB plans, which took effect in June 2025, was the sole driver of this growth. According to both company management and external analysis, the price hike contributed over ¥900 million to ARR during the quarter. A simple calculation reveals the underlying trend: a net ARR increase of ¥850 million minus a price-hike impact of over ¥900 million implies that the organic performance of the segment—the net result of new customer acquisition, upsells, and churn—was slightly negative.

This stagnation was compounded by a product mix shift. The high-ARPA (Average Revenue Per Account) automated bookkeeping service, 'STREAMED,' experienced a seasonal net decrease in ARR. This not only created a drag on total ARR but also suppressed the segment's overall ARPA, which grew just 2.1% YoY despite the price increase. The entire net growth of this core segment, therefore, relied on charging existing customers more, a finding that points to potential market saturation, intensifying competition from rivals like freee, or a significant post-invoice demand lull.

Sustained Momentum in the Mid-Market

In contrast to the challenges in the SMB space, the medium-sized enterprise segment continued to demonstrate robust and healthy growth, validating the company's strategic focus on moving upmarket. ARR for this segment surged to ¥14.52 billion, a powerful 48% YoY increase (38% on an organic basis).

This growth was well-balanced. The net addition of paying customers accelerated quarter-over-quarter, with 706 new companies added. Furthermore, ARPA for medium-sized companies grew by a strong 13.8% YoY, indicating successful cross-selling of additional products and services to the existing customer base. This combination of strong customer acquisition and increasing revenue per customer highlights a much healthier and more sustainable growth profile compared to the SMB segment.

Strategic Overhaul: Sharpening Focus and Reallocating Capital

The third quarter marked the beginning of a comprehensive strategic overhaul at Money Forward, characterized by a series of interconnected corporate actions designed to streamline operations, concentrate resources, and pivot the business model toward higher-margin services. These moves appear to be part of a cohesive capital reallocation strategy aimed at transforming the company's long-term value proposition.

The SMARTCAMP Divestiture

The most significant move was the agreement to transfer 100% of the shares of its subsidiary, SMARTCAMP, which constitutes the SaaS Marketing domain, to a fund managed by Marunouchi Capital. The transaction, scheduled to close on November 4, 2025, is expected to generate an extraordinary income of approximately ¥6.3 billion in the fourth quarter, with total cash proceeds exceeding ¥7 billion. Management stated the rationale was twofold: to optimize the group's capital allocation and to allow SMARTCAMP greater operational freedom to serve a broader market, including Money Forward's competitors, and pursue its own IPO.

New Alliances for Peripheral Growth

Simultaneously, Money Forward is de-risking its non-core assets through strategic partnerships. For its 'Home' domain, which houses the popular personal finance management app "Money Forward ME," the company established a joint venture with SMBC Group. This alliance aims to integrate payment and other financial functions into the app, accelerating its growth while reducing Money Forward's direct capital burden. For its 'X' domain, which focuses on co-development projects with financial institutions, the company is actively exploring similar capital and business alliances with strategic partners.

The "Digital Worker" Gambit: From Tools to Services

The capital unlocked by these divestitures and partnerships is being redeployed into a new strategic initiative: a push into the accounting Business Process Outsourcing (BPO) market. Money Forward frames this as a ¥13.3 trillion "Digital Worker" opportunity, representing a significant move up the value chain from selling software tools to providing tech-enabled services. This strategy is being executed through targeted M&A:

- Cashmo: The acquisition of this Japan-based accounting agency provides Money Forward with an established BPO operation and a high-ARPA service model, with monthly fees around ¥200,000 per client.

- Whipplewood CPAs PC: The acquisition of this U.S.-based accounting outsourcing firm is a strategic play to gain access to cutting-edge AI tools and operational know-how from the more advanced U.S. market, which can then be applied to enhance the Japanese BPO business.

These are not isolated events. The company is liquidating a non-core asset for a large cash infusion, which management has explicitly earmarked for M&A within its core business domain. The subsequent acquisitions create a new, high-margin service line that directly addresses the growth and margin pressures evident in the SMB SaaS market. This represents a textbook capital reallocation strategy designed to build a more profitable and defensible long-term business model.

The AI Frontier: Building the Next Growth Vector

Underpinning the pivot to a "Digital Worker" model is an ambitious new AI strategy. The company formally announced its "Money Forward AI Vision 2025," with the goal of becoming the number one back-office AI service provider in Japan. This vision is already translating into a new class of products designed to automate complex and burdensome tasks.

During the quarter, the company released a series of "AI agents," including:

- AI Invoice Download Agent: This tool automatically detects invoice receipt emails, logs into various supplier websites to download the invoice files, and creates corresponding payment requests within 'Money Forward Cloud Accounts Payable'.

- Entertainment Expense Reimbursement Agent: This agent integrates with the communication tool Slack, allowing employees to submit expenses by simply uploading a receipt. AI then analyzes the image, extracts key data, and auto-populates the expense report.

- AI Contract Review: A new service that uses AI supervised by lawyers to automatically review legal contracts, identify potential risks, and suggest amended clauses.

Currently, these advanced features are being offered at no additional charge, primarily to mid-sized companies, as a strategy to drive adoption and demonstrate value. The company is exploring future monetization models, including usage-based billing or optional add-on fees.

Crucially, the AI and BPO strategies are two sides of the same coin. The AI agents are not merely features to enhance existing SaaS products; they are the enabling technology for the new BPO business. The explicit goal of the Whipplewood acquisition in the U.S. is to "leverage and experiment with cutting-edge Al tools" and apply that knowledge back in Japan. The long-term plan is to "accelerate labor efficiency in BPO operations through the use of Al". By acquiring human-powered BPO firms and systematically augmenting or replacing manual work with its proprietary AI agents, Money Forward aims to create a highly scalable and profitable service offering that fundamentally reshapes its business model.

Financial Health, Outlook, and Management Commentary

The company's strategic shift toward profitability is already yielding tangible results in its financial health. In the third quarter, Money Forward achieved positive cash flow from operating activities of ¥707 million (excluding the impact of its 'Pay for Business' segment), a first for the company. This milestone was driven by the record EBITDA performance and a seasonal increase in contract liabilities, notably from the newly acquired Outlook Consulting.

Looking ahead, management expressed confidence in its full-year forecast. Despite the sluggishness in Q3, they expect growth to accelerate in the fourth quarter and are "not concerned about failing to meet the full-year revenue target". Furthermore, full-year EBITDA is now expected to reach the upper end of the previously guided range of ¥2.5 billion to ¥4.5 billion.

A significant milestone is on the horizon. Thanks to the ¥6.3 billion extraordinary gain anticipated from the SMARTCAMP sale, management stated there is a "possibility that the net profit for this fiscal year will be positive". This would mark the first time in the company's history that it has posted a full-year net profit, a powerful narrative that underscores the success of its new, disciplined strategy.

Market Perspective and Valuation Context

The market's reaction to the third-quarter announcement reflected the mixed nature of the results. The report was a clear miss on consensus estimates for revenue (¥12.07B vs. est. ¥12.65B) and earnings per share (-¥21.46 vs. est. -¥11.31). On October 16, the day following the announcement, the stock traded at ¥5,254.

Analyst commentary has centered on what is described as a "classic growth-versus-valuation debate". While Money Forward's projected revenue growth of 19.5% per year is expected to outpace the broader Japanese market, the company remains unprofitable on an operating basis and commands a premium valuation. Its price-to-sales ratio of 6.3x is significantly higher than the industry average of 2.1x. Despite these concerns, the overall analyst consensus remains a 'Buy,' with an average target price of ¥6,189.

The competitive landscape provides further context for Money Forward's strategic pivot. A Goldman Sachs report maintained a 'Buy' rating on competitor Obic Business Consultants, citing its high profit growth, while reiterating a 'Sell' rating on freee due to its slower pace of profit growth resulting from heavy investment to combat competition. This suggests that Money Forward's shift toward cost discipline is a timely move that the market may reward, especially when compared to rivals who are still in a high-spend phase.

Ultimately, the market appears to be looking past the messy underlying organic growth in the core SMB segment and is instead pricing the stock based on the credibility of the new strategic narrative. The vision of a more focused company with a clear path to profitability, a streamlined portfolio, and a massive new growth opportunity in AI-enabled BPO is compelling. The key risk, as highlighted by analysts, is whether the company can execute this ambitious transformation effectively enough to justify its persistent premium valuation.