Morningstar's Analysis of the Japanese Asset Management Industry

The Japanese asset management industry, long characterized by the dominance of large, domestic financial conglomerates, is in the midst of a profound transformation. A confluence of regulatory reforms, shifting investor preferences, and the emergence of new product categories is reshaping the competitive dynamics. For any professional seeking to navigate or compete in this evolving market, a clear understanding of these forces is no longer optional—it is critical. This analysis deconstructs the key trends, competitive hierarchy, and performance metrics that define the landscape today.

The key drivers reshaping the Japanese fund market include:

- Dominance of Incumbents: Large Japanese financial groups continue to command substantial market share by leveraging their powerful, captive domestic sales networks. Asset management arms of these groups have historically benefited from distribution through affiliated banks and brokerage houses.

- Growth of Foreign Asset Managers: Foreign firms are steadily expanding their footprint in Japan. This growth is propelled by three primary factors: improved governance in the fund selection process by local distributors, a rising investor appetite for overseas assets, and the increasing use of foreign managers as sub-advisors for funds offered by Japanese firms.

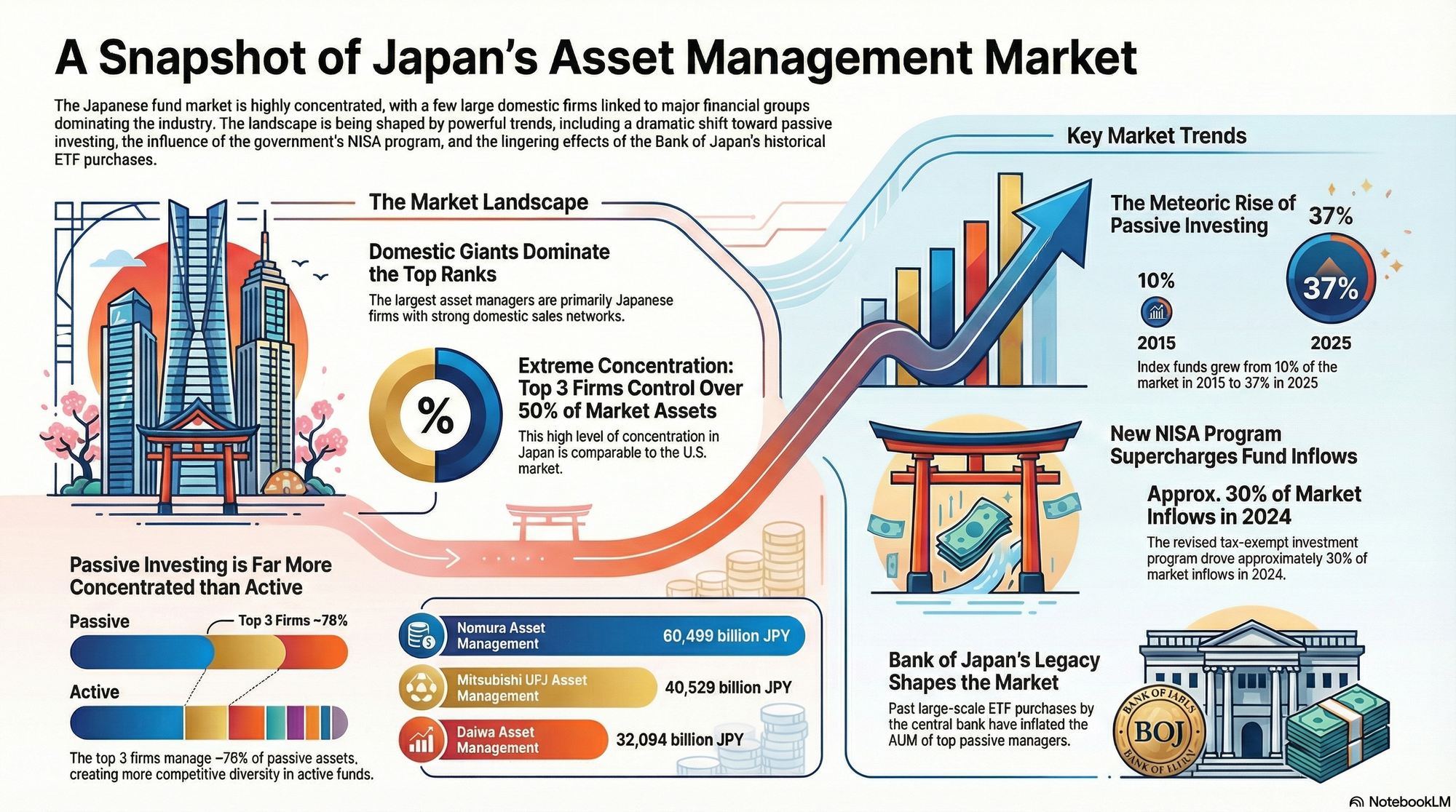

- The Passive Investing Surge: The market has witnessed a dramatic shift towards passive strategies. The market share of index funds has surged from just 10% in 2015 to 37% as of September 2025. This growth is fueled by strong demand for low-cost investment products and the expansion of online sales channels that favor these funds.

- The "New NISA" Catalyst: The comprehensive reform of the Nippon Individual Savings Account (NISA) program in 2024 has acted as a powerful catalyst for growth, significantly boosting inflows into the fund market. Investments made through NISA accounts now constitute approximately 30% of the market's total net inflows.

- The Bank of Japan's Lingering Influence: The historical Exchange-Traded Fund (ETF) purchasing program by the Bank of Japan (BoJ) has left a lasting impact. By concentrating trillions of yen in ETFs managed by a handful of large domestic firms, the program has created a distortion in market share figures that persists today.

These powerful undercurrents are fundamentally altering the structure of the market. We will now examine the competitive hierarchy and concentration among the industry's key players.

1. The Titans of Japan: Analyzing Market Share and Concentration

An analysis of Assets Under Management (AUM) and market concentration provides a clear snapshot of the competitive hierarchy within the Japanese fund market. These metrics not only reveal the current leaders but also illuminate the significant barriers to entry that new or smaller players face. The data underscores a market where a few giants hold disproportionate influence.

Top 10 Asset Managers by AUM

The market is led by Nomura Asset Management, with an impressive 60.5 trillion JPY in AUM. This dominance is heavily skewed towards passive strategies, a feature common among the top tier. A high concentration in passive funds (70-80% of total AUM) at Nomura, Daiwa, and Amova is a direct result of the Bank of Japan’s historical ETF purchasing program. The central bank's massive holdings, exceeding 80 trillion JPY, are concentrated in ETFs managed by these firms, significantly inflating their passive AUM and overall market share. In a crucial contrast, the fourth titan, Mitsubishi UFJ Asset Management, exhibits more organic passive growth. Its expansion is driven primarily by retail investor demand for its ultra-low-cost "eMAXIS Slim" index fund series, a trend accelerated by the New NISA program.

This dynamic creates a high degree of market concentration. The top three firms alone control just over 50% of the entire Japanese fund market. This level of concentration is comparable to the U.S. market, where the top three firms (Vanguard, BlackRock, and Fidelity) also hold approximately 50% of total assets. However, the Japanese figures are uniquely shaped by past monetary policy, creating a competitive landscape influenced by central bank intervention as much as by investor choice.

While AUM reveals the current leaders, a look at fund flows shows which firms are building the most momentum for the future.

2. Growth Engines: Dissecting Fund Flows and Competitive Momentum

While Assets Under Management provide a static view of market leadership, net fund flow rates are a crucial dynamic indicator of competitive momentum and future shifts in market share. This analysis reveals which firms and investment strategies are most successfully attracting new capital from Japanese investors in both the short and long term.

Short-Term Momentum (1-Year Net Inflows)

Over the past year, smaller, more specialized firms have demonstrated remarkable growth, though a large incumbent has also performed strongly.

- Top 3 Performers (1-Year Net Inflow Rate):

- Asahi Life Asset Management: 87.3%

- Invesco Asset Management: 65.3%

- Okane no Design: 34.0%

The drivers behind this growth are diverse. Asahi Life Asset's exceptional inflow rate was primarily driven by a single popular active fund sub-advised by WCM Investment Management, which attracted 92 billion JPY in net inflows. Invesco's success is tied to continued strong demand for its flagship global equity fund. Among the ten largest firms, Mitsubishi UFJ Asset Management stands out with a robust 19% growth rate, fueled predominantly by inflows into its low-cost "eMAXIS Slim" index fund series, a popular choice for investors utilizing the New NISA program.

Long-Term Trends (5-Year Net Inflows)

The five-year data reveals a clearer strategic pattern, highlighting the ascendance of low-cost passive providers and the consistent success of select foreign managers.

- Top 3 Performers (5-Year Net Inflow Rate):

- au Asset Management: 3,536%

- Mirae Asset (Global X): 2,842%

- Invesco Asset Management: 2,114%

The strategic implications are clear. Firms that have focused on providing low-cost index funds—such as au Asset, Mirae Asset, Rakuten Asset Management, and SBI Asset Management—have achieved transformational growth, heavily influenced by the tailwinds of the NISA program. Concurrently, foreign asset managers have demonstrated powerful and sustained momentum. The success of firms like Capital Group and Invesco is particularly staggering; Capital Group's cumulative net inflow over five years was about 7 times its AUM from five years ago, and Invesco's was more than 22 times. This proves their ability to consistently gather assets, cementing their position as significant players in the market.

This bifurcation in growth drivers leads directly to an examination of the two distinct competitive arenas: passive and active management.

3. The Passive Revolution vs. The Active Arena

The seismic shift from active to passive investing is the defining competitive battleground in the Japanese asset management industry. This trend has created two distinct market structures with vastly different levels of concentration and opportunity. This section deconstructs the competitive dynamics within both the passive and active segments.

The Passive Market Landscape

The concentration of power observed in the broader market becomes even more acute within the passive segment. The competitive field is dominated by a few key players, with the top three firms by passive AUM—Nomura Asset Management, Mitsubishi UFJ Asset Management, and Daiwa Asset Management—commanding approximately 66% of all passive assets.

A unique feature of this landscape is the role of the Bank of Japan's historical ETF purchases. This program was the primary force that concentrated assets within firms like Nomura, Daiwa, and Amova Asset Management, whose passive AUM was massively inflated as a result. This contrasts sharply with the U.S. passive market, which is also highly concentrated (Vanguard and BlackRock hold ~66% of passive assets) but was shaped by market competition and investor choice, not direct central bank intervention. As noted, Mitsubishi UFJ's growth in the passive space is more organic, driven largely by retail investor demand for its popular and low-cost eMAXIS Slim series of index funds.

The Active Market Landscape

In stark contrast to the passive segment, the active management market is comparatively fragmented and competitive.

- The top five firms hold 43% of active AUM. This concentration level is similar to the U.S. active market (46%) but significantly higher than the more fragmented EMEA region (20%).

This lower concentration in the active space signifies greater competitive opportunities for a wider range of asset managers. While still challenging, the active arena offers a more accessible entry point for firms to differentiate themselves and capture market share compared to the highly consolidated passive segment.

Beyond market share, a deeper look at product quality and performance reveals which managers are truly delivering for investors.

4. Measuring Manager Quality: A Performance-Based Assessment

Moving beyond the sheer scale of AUM and the momentum of fund flows, this section evaluates asset managers on the crucial dimensions of product quality, risk-adjusted returns, and long-term investor outcomes. Using Morningstar's proprietary metrics, we can identify which firms are not just the biggest, but also among the best.

Analysis of Morningstar Medalist Ratings

The forward-looking Morningstar Medalist Rating (Gold, Silver, Bronze) assesses a fund's potential to outperform its peers. The data reveals a clear and powerful driver of high ratings in Japan.

- Core Finding: Low fund fees are a primary determinant of achieving a high Medalist Rating.

- Key Example: Among the top 10 largest firms, BlackRock stands out with 68% of its funds earning a high rating. This achievement is particularly significant when framed against the average of approximately 30% for the top 10 firms and just 21% for all 60 firms in this report. BlackRock's success is a direct result of its extensive lineup of low-cost iShares ETFs, whose fee advantage is a critical factor in the rating methodology.

- Active Excellence: While low fees are critical, active managers with strong, research-driven cultures can also excel. Capital Group, which won the 2025 Morningstar Award for Best Asset Manager in Japan, is a prime example. Reflecting its disciplined investment culture, over three-quarters of its funds in Japan hold a high Medalist Rating.

Success Rate and Product Strategy

The "Success Rate" metric measures the percentage of a firm's funds that have both survived (not been liquidated) and delivered above-median risk-adjusted returns over time. This provides a practical measure of how well a firm's product lineup has served investors.

- Key Insight: Firms with a more focused and curated fund lineup—typically offering fewer than 50 funds—tend to achieve higher success rates. This disciplined approach contrasts with the strategy of frequently launching and subsequently liquidating trendy or thematic funds, which can negatively impact a firm's overall success rate.

Average Morningstar Star Rating

The 1-to-5 Star Rating provides a quantitative assessment of a fund's historical performance, adjusted for risk and fees. A firm's average rating across its lineup offers a clear view of its past performance track record.

- Key Finding: As with the Medalist Ratings, firms offering low-cost index funds tend to have higher average Star Ratings, underscoring the strong link between low fees and superior long-term, risk-adjusted results.

- Standout Performers: Among large managers, Fidelity is a top performer. A notable standout is Aozora Investment Trust, which boasts an exceptional 4.0 average Star Rating. Its success is attributed to a partnership with Dimensional Fund Advisors and its systematic, rules-based active strategies that have consistently delivered strong risk-adjusted returns.

This performance analysis leads to a final consideration of the structural challenges and future trajectory of the industry.

5. Outlook and Key Challenges

The Japanese asset management industry is at a pivotal juncture. While experiencing dynamic growth fueled by regulatory reform and a new wave of retail investing, the market continues to grapple with persistent structural challenges. The competitive environment is being reshaped by new forces, but the influence of incumbents and historical policy interventions remains significant.

Key challenges and future trends shaping the industry include:

- The Disclosure Deficit: A significant challenge for the market is the limited information disclosure regarding investment teams, key decision-makers, and manager succession planning. This lack of transparency can create an information gap between managers and investors, potentially undermining trust, particularly for active funds.

- High Product Concentration: A majority of Japan's largest asset managers have their AUM heavily concentrated in just a few flagship funds. For firms like Nomura Asset Management (70% in top 5 funds) and AllianceBernstein (96%), this reliance is stark. Much of this concentration is a legacy of the BoJ's holdings in a small number of large ETFs. This contrasts with firms like Asset Management One (30%), which exhibit a more diversified product shelf.

- The Nascent Active ETF Market: Introduced in 2023, the active ETF market represents a potential new frontier for growth and product innovation. However, it remains in its infancy. As of September 2025, there are only 19 active ETF listings with a total net asset value of approximately 65 billion JPY, indicating the market is still in its earliest stages.

The Japanese fund industry is a market defined by the collision of modernizing forces with entrenched, market-distorting legacies. The powerful rise of low-cost passive investing, accelerated by the New NISA program, is creating unprecedented opportunities and empowering a new generation of investors. Simultaneously, the historic power of incumbent financial groups and the structural impact of the Bank of Japan's past interventions continue to shape the competitive terrain. Successfully navigating the future of this market will require a keen understanding of this central tension—between the emerging opportunities of a more open market and the structural realities that define Japan's unique transition.