Morningstar's Analysis of the NISA Market

The year 2025, the second following Japan's landmark NISA reforms, saw a massive and steady flow of capital into the market, with total net inflows reaching approximately ¥14.2 trillion. However, this headline figure masks the year's defining characteristic: a profound qualitative shift in how that capital is being allocated. 2025 was the year the Japanese retail investor's behavioral maturity began to catch up with the NISA system's ambitious structural evolution. The two pivotal trends were the strategic expansion of the NISA framework to encompass all generations and a tangible shift in investor behavior towards diversification and long-term discipline. This report analyzes these developments by dissecting NISA system amendments and examining detailed 2025 fund flow data to provide a comprehensive outlook for financial professionals.

1. The Strategic Evolution of the NISA Framework

The latest amendments to the NISA system represent a fundamental expansion of its mission. The framework is evolving from a tool primarily designed for the working generation's asset accumulation into a comprehensive, lifelong platform intended to support the financial well-being of all Japanese citizens, from infancy to retirement.

1.1 The Introduction of "Kodomo NISA" for Young Investors

A cornerstone of this strategic expansion is the "Kodomo NISA," set to launch in January 2027. This new account structure is designed to facilitate early-stage, long-term asset formation for minors.

Key Features of Kodomo NISA:

- Target Age Group: 0 to 17 years.

- Annual Investment Limit: ¥600,000.

- Lifetime Tax-Free Limit: ¥6,000,000.

- Withdrawal Rules: Withdrawals are prohibited until the child reaches age 12. Thereafter, funds can be withdrawn for educational purposes, provided the child consents.

- Transition at Adulthood: The account automatically converts into a standard Tsumitate (Systematic Investment) NISA when the holder turns 18.

The strategic implications of this new framework are significant. It will create a diverse range of investor profiles with varying time horizons—from an 18-year-plus horizon for a newborn to a sub-10-year horizon for a child whose parents are saving for university tuition. This diversity necessitates a broader array of suitable investment products that extend beyond pure-equity index funds to include allocation-type and lower-risk strategies.

A key challenge for financial institutions arises from the system's structure. As investments within the Kodomo NISA fall under the Tsumitate quota, they are commission-free. This will naturally limit opportunities for direct, in-person advisory services. Consequently, the onus will be on institutions to develop robust, intuitive fund comparison tools and provide comprehensive educational resources to empower guardians and young investors to make appropriate, self-directed choices aligned with their specific goals and risk tolerance.

1.2 Broadening the "Tsumitate" Investment Scope

To support the system's expanded generational role, the scope of eligible investments for the Tsumitate quota has been broadened. The framework now includes bond-centric funds to cater to investors with shorter time horizons or lower risk appetites, such as older individuals or those using the new Kodomo NISA. Additionally, two new designated indices have been added: the Yomiuri Stock Price Index and the JPX Prime 150 Index.

However, a critical evaluation suggests the immediate market impact of these changes may be muted. The expansion to bond funds is likely to be limited initially; as of December 2025, only 11 generally available active bond funds meet the strict eligibility criteria for the Tsumitate quota regarding asset size, track record, and consistent inflows.

Furthermore, the stated rationale for the addition of the new indices—that they have "wide acceptance by market participants"—is questionable when examined against current asset levels. As of December 2025, funds tracking the JPX Prime 150 Index held ¥27.1 billion in assets under management, while those tracking the Yomiuri Stock Price Index held just ¥2.5 billion. While inclusion in the Tsumitate NISA may spur future growth, the low starting figures suggest that the selection criteria for designated indices require greater clarification.

These structural changes to the NISA framework provide the context for understanding the actual flow of capital within the system.

2. Quantitative Analysis of 2025 Fund Flows

While NISA-eligible funds continued to dominate capital inflows in 2025, the year's trends reveal a more nuanced story of market normalization and emerging investor preferences. The initial surge following the 2024 reforms gave way to a more measured, yet still robust, pace of investment.

2.1 Macro Fund Flow Dynamics

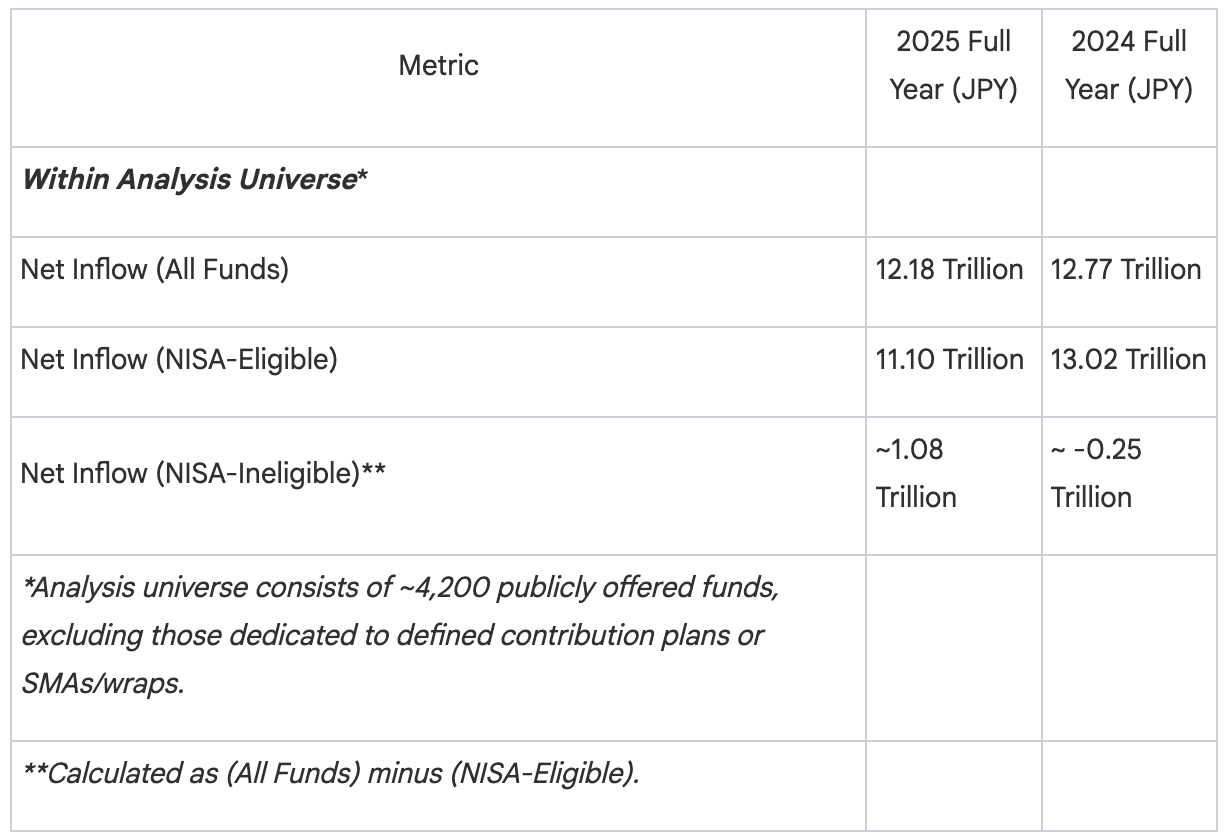

Total net inflows into Japanese investment trusts remained strong in 2025, though they saw a slight decrease from the record-breaking levels of the previous year. This moderation can be attributed to a mid-year slowdown caused by rising global market uncertainty. A significant development was the reversal in flows for NISA-ineligible funds, which shifted from net outflows in 2024 to significant net inflows in 2025, capturing approximately ¥1.08 trillion in new capital.

2.2 Leading Funds and Enduring Investor Preferences

The core of NISA investing remains anchored in low-cost, passive strategies. The two dominant funds that led inflows in 2025 were "eMAXIS Slim All-Country" and "eMAXIS Slim US Stock (S&P500)." Together, these two powerhouses attracted a combined annual net inflow of over ¥4.4 trillion, demonstrating a continued and deeply entrenched investor preference for broad market exposure at minimal cost.

This trend is further confirmed by the composition of the most popular investments. In 2025, index funds represented 14 of the top 30 funds by net inflow, an increase from 12 funds in 2024.

2.3 The Market for Newly Launched Funds

The market for new products remained vibrant in 2025, with 254 new funds launched, collectively attracting a total of ¥1.26 trillion in net inflows within their first two months of operation.

Analysis of the most successful launches reveals that investor capital is being drawn to new products that offer clear value propositions. For instance, the "T. Rowe Price Capital Appreciation Fund" attracted significant assets by giving Japanese investors access to a highly-rated international strategy that holds a "Gold" Morningstar Medalist Rating in the U.S. market. Similarly, the "Nomura Japan Value Select Investment" succeeded by leveraging the proven domestic track record of a manager already recognized for strong performance on other funds. While the market remains receptive to new products, success is now clearly tied to demonstrable expertise and established credibility.

The quantitative data shows what investors bought in 2025; a closer look at the asset class and category-level data reveals why.

3. Dissecting Key Shifts in Investor Behavior

Beyond the headline numbers, the 2025 fund flow data reveals the significant maturation of the Japanese retail investor. Three core behavioral shifts became evident over the year: a clear pivot to diversification, a marked retreat from speculative themes, and the adoption of a more disciplined, long-term mindset.

3.1 The Clear Pivot Towards Asset Diversification

While equity funds remained the dominant destination for capital, with over ¥10.9 trillion in net inflows, 2025 was marked by a growing trend towards diversification. Investors demonstrated a clear interest in spreading risk beyond pure equities, pouring significant new capital into:

- Allocation-type funds: ¥1.317 trillion in net inflows.

- "Other" assets (including gold-related funds): ¥0.8 trillion in net inflows.

This broadening of horizons, however, was selective. Within the analysis universe, both Bond funds (-¥622.8 billion) and REIT funds (-¥208.0 billion) continued to experience net outflows. This indicates that while investors are actively seeking to diversify, they are bypassing traditional fixed-income and real estate vehicles in favor of multi-asset strategies and alternative assets like commodities. This nascent but clear demand for multi-asset strategies prefigures the product needs that will become critical with the launch of the Kodomo NISA, suggesting that financial institutions have a ready market for the very solutions the system's expansion will demand.

3.2 A Marked Retreat from Thematic Investing

The investment landscape of 2025 stood in stark contrast to the previous year. The thematic investing fervor of 2024, which was heavily concentrated in semiconductor and India-focused funds, subsided dramatically.

The evidence for this shift is compelling: in 2025, not a single semiconductor or India-focused fund ranked among the top 30 for net inflows. Furthermore, the Technology Sector and India Equity categories were among those with the largest net outflows for the year. This represents a clear move away from short-term, performance-chasing behavior toward building broader, more fundamentally allocated portfolios.

3.3 Evidence of an Emerging Long-Term Mindset

Two key data points reveal a powerful change in investor discipline and a growing embrace of long-term principles.

- Return Gap Analysis: For the top 30 funds by inflow in 2025, only two exhibited an "Investor Return" (which accounts for the timing of investor purchases and sales) that was lower than their "Total Return" (a simple buy-and-hold return). This strongly suggests that, on average, investors largely avoided poor market timing, held their positions, and did not panic-sell during periods of volatility.

- Behavior During Market Highs: Historically, Japanese retail investors have exhibited a pattern of counter-cyclical selling, taking profits as the market rises. This pattern was broken in Q4 2025. As the Japanese stock market reached new highs, domestic large-cap growth funds experienced net inflows.

These data points reveal a growing investor understanding that attempting to time the market rarely leads to better outcomes and demonstrate an increasing willingness to stay invested for the long term, which is the foundational principle of the NISA program. These behavioral shifts indicate a market that is intellectually and temperamentally ready for the NISA system's expanded role.

4. Conclusion and Strategic Outlook

The Japanese investment landscape in 2025 was defined by the powerful dual evolution of both the NISA system and the investors using it. As the framework expanded its mission to become a universal tool for lifelong financial planning, investors demonstrated a corresponding maturation in their behavior, moving toward more disciplined and diversified strategies.

The year's developments can be summarized by three overarching trends:

- Systemic Expansion: The NISA framework is definitively broadening its role to become a universal tool for lifelong asset formation. The upcoming "Kodomo NISA" will create new demands for a wider range of investment products and sophisticated, accessible investor support tools.

- Behavioral Maturation: Investors showcased a clear shift towards prudent asset diversification, a disciplined retreat from the speculative thematic investing that characterized 2024, and a greater focus on long-term holding, even during periods of market strength.

- Enduring Core Principles: Despite the trend towards diversification, low-cost, passively managed equity funds remain the bedrock of NISA investing, serving as the core holding for a vast number of portfolios.

Looking forward, as the NISA system continues to evolve into a platform for "all generations," investors will be increasingly required to construct portfolios suited to their specific life stages and risk profiles. Success in this new environment will depend on moving beyond simple reliance on past performance. Leveraging objective, forward-looking metrics, such as the Morningstar Medalist Rating, will be critical for effective fund selection and building resilient, long-term portfolios.