MUFG and Krungsri Forge Alliance with Philippines DTI and Security Bank to Accelerate ASEAN Cross-Border Innovation

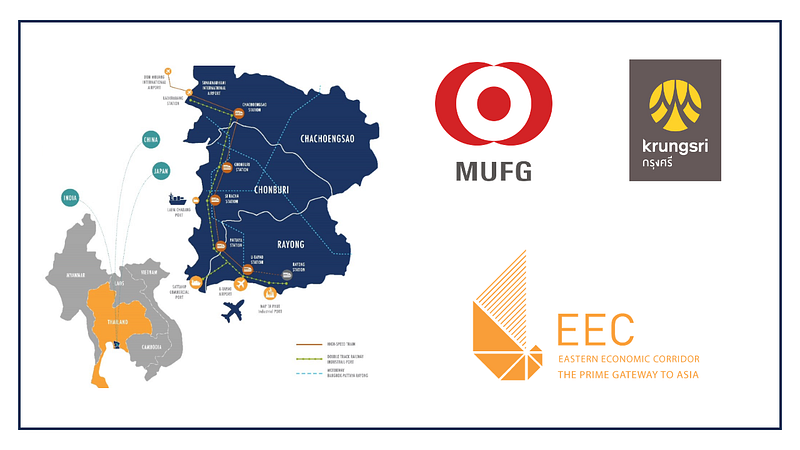

Bank of Ayudhya (Krungsri) and its parent company, Mitsubishi UFJ Financial Group (MUFG), have formalized a four-way strategic partnership with the Philippines’ Department of Trade and Industry (DTI) and Security Bank Corporation. The Memorandum of Understanding (MOU), executed in Manila, aims to stimulate the regional digital economy by creating a cross-border corridor for startup capital and market expansion across Japan, Thailand, and the Philippines.

The collaboration leverages the balance sheets and networks of Japan’s largest financial group and Thailand’s fifth-largest lender to support the ASEAN startup ecosystem. The initiative is further backed by the banks' respective corporate venture capital (CVC) arms, MUFG Innovation Partners (MUIP) and Krungsri Finnovate, signaling a concrete channel for equity investment into emerging tech firms.

Strategic Rationale

The partnership addresses the growing demand for digital transformation among the established corporate sector in the region. According to Bunsei Okubo, Krungsri’s Head of Japanese Corporate Banking, over 1,600 Japanese companies currently operate in the Philippines. This alliance intends to bridge these legacy incumbents with agile startups offering solutions in digitization and sustainability.

"Krungsri is committed to supporting the regional expansion of Japanese and Thai companies across ASEAN," Okubo stated, noting that the partnership complements existing advisory services like "Krungsri ASEAN LINK."

Operational Framework

The MOU outlines three core pillars to drive growth:

- Market Expansion: Utilizing the extensive banking networks of MUFG and Krungsri to help Philippine startups penetrate international markets.

- Capacity Building: Launching accelerator and exchange programs designed to upskill entrepreneurs in sustainable business management.

- Capital Access: Organizing business matching activities to facilitate direct investment and commercial partnerships between startups and regional corporates.

Regional Synergy

Security Bank, a key lender in the Philippines, views the partnership as a mechanism to multiply capabilities by combining policy leadership from the DTI with private sector financial reach.

"Through this collaboration, Security Bank plays an important role in connecting startups with corporates, enabling pilots, partnerships, and investments," said John Cary Ong, Executive Vice President at Security Bank.

Nylah Rizza D. Bautista of the Philippine DTI added that the agreement strengthens the role of the nation's "AI and Startup Center" as a regional innovation hub, specifically targeting market access and investor matching.

This agreement marks a continuation of MUFG’s broader strategy to deepen its footprint in Southeast Asia by integrating its partner banks into a cohesive network capable of serving both traditional industrial clients and the high-growth digital sector.