MUFG Bank Deploys LayerX’s AI Platform to Streamline Management of Complex Financial Products

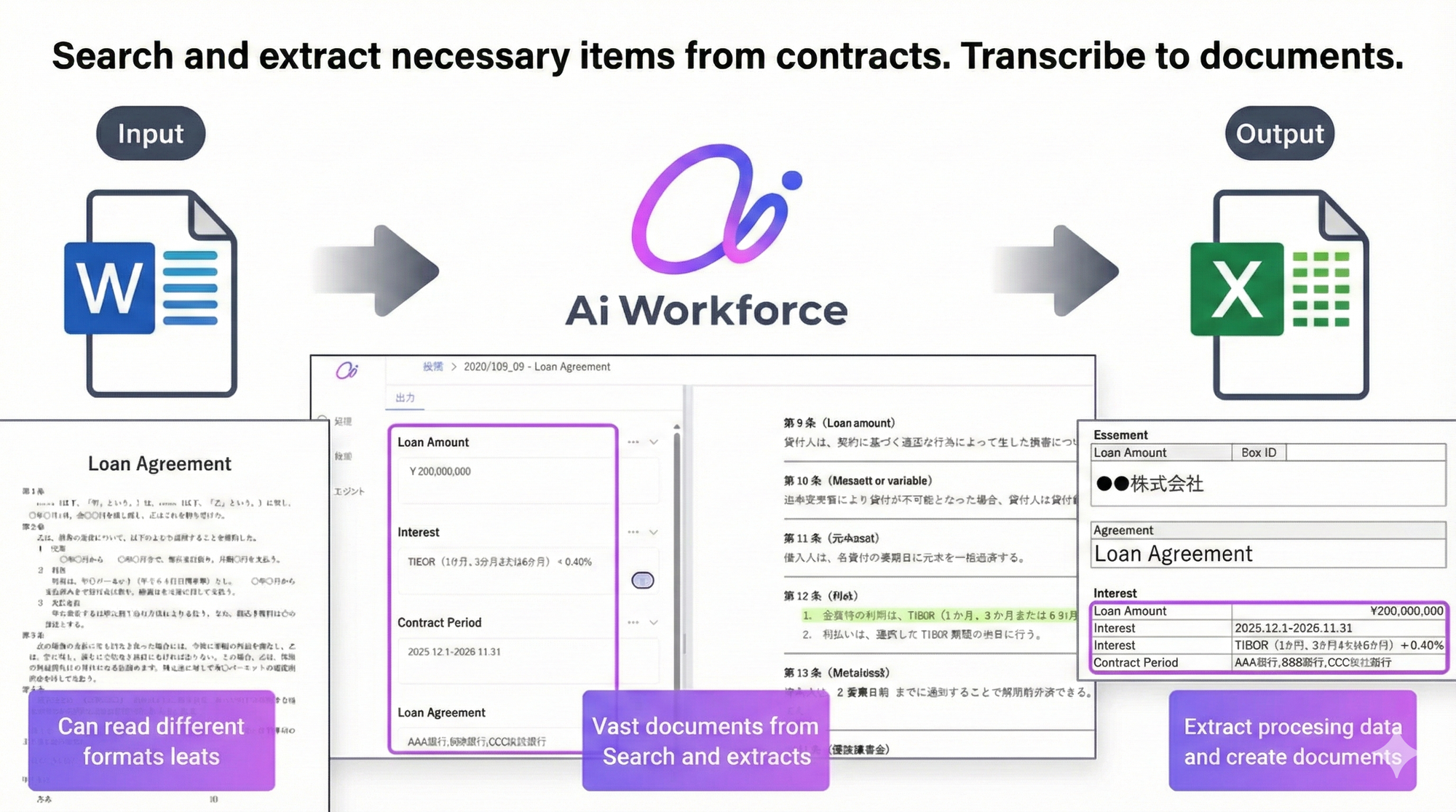

Mitsubishi UFJ Bank (MUFG Bank) has adopted LayerX's "Ai Workforce" platform to overhaul operations within its Solution Products Division (SPD). The implementation marks a significant shift toward digitizing the lifecycle of highly specialized financial instruments, from initial proposals through to mid-term management.

Addressing the Complexity of Specialized Finance

MUFG Bank’s SPD handles a sophisticated portfolio, including syndicated loans, real estate finance, M&A finance, and securitization. These products generally involve complex structures and unique operational requirements that legacy systems have struggled to accommodate, leaving the bank reliant on labor-intensive manual processes.

LayerX’s "Ai Workforce" was selected for its ability to flexibly design and execute workflows that require parsing diverse contract formats and extracting specific information, a capability deemed essential for improving productivity while maintaining the rigorous standards required in high-level finance.

Key Operational Improvements

The deployment focuses on automating data extraction and enhancing knowledge sharing across the division:

- Streamlined Mid-term Management: The system automatically extracts critical data from loan agreements and synthesizes it into management formats. By cross-referencing output data with the specific source clauses in the original contracts, the bank has improved the speed and accuracy of handovers to middle and back-office teams.

- Faster Real Estate Appraisal Analysis: The AI extracts approximately 100 distinct data points from real estate appraisal reports, which vary in format by appraisal firm. This automation has cut the time required for credit rating operations by 50%, reducing a task that previously took 60 minutes of manual entry to roughly 30 minutes.

- Enhanced Knowledge Sharing: The platform indexes past proposals and contracts, tagging them with specific attributes such as deal scheme, asset type, and negotiation history. This allows teams to leverage institutional knowledge, comparing past terms and applying insights from similar cases to accelerate and improve the quality of new proposals.

Future Outlook

Currently implemented in five pilot groups within the SPD, MUFG Bank intends to expand the use of "Ai Workforce" to other groups within the division. The bank aims to achieve an "End-to-End" reform of its business processes—covering everything from origination to redemption—and is exploring the use of the platform for drafting contracts and conducting document reviews.

About the Technology

"Ai Workforce" is an AI platform designed to combine autonomous agents with stable workflow automation. It specializes in processing unstructured documents (PDF, Word, Excel) and is utilized to break down data silos between departments by enabling continuous automation of diverse tasks.