MUFG First Quarter FY3/2026 Financial Results

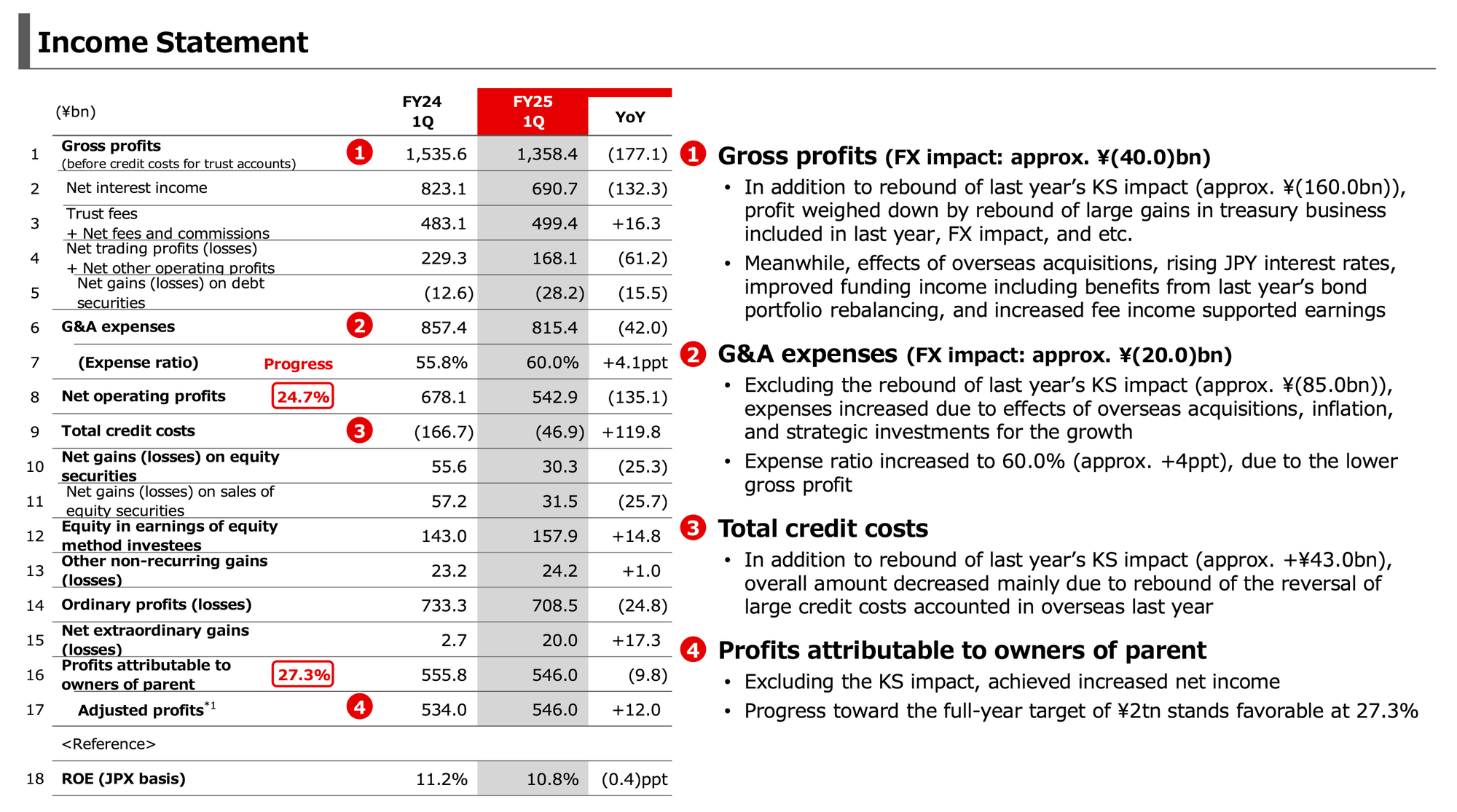

Mitsubishi UFJ Financial Group (MUFG) reported a Profit Attributable to Owners of Parent (Net Income) of ¥546.0 billion for the first quarter of the fiscal year ending March 31, 2026 (Q1 FY25). While this figure represents a modest 1.8% year-over-year (YoY) decline on a reported basis, a more telling metric is the adjusted result, which shows a ¥12.0 billion YoY increase after accounting for the prior-year technical impact of changing a subsidiary's closing period. This performance puts the Japanese megabank on a favorable trajectory, having achieved 27.3% of its ambitious ¥2.0 trillion full-year net income target. Basic Earnings Per Share (EPS) for the quarter was ¥47.55, holding nearly flat from ¥47.50 in the prior-year period.

The quarter's financial narrative is one of profound contradiction. The resilient bottom line was not a function of robust operational revenue growth. Instead, it was achieved by skillfully offsetting significant top-line headwinds with powerful, albeit potentially lower-quality, tailwinds. Gross Profits fell by a substantial ¥177.1 billion YoY to ¥1,358.4 billion, while Net Operating Profits (NOP), a key measure of core earnings, declined by an adjusted ¥56.3 billion YoY to ¥542.9 billion. These declines were primarily driven by two factors: the normalization of exceptionally strong treasury gains recorded in the prior year and a significant negative foreign exchange (FX) impact as the Yen strengthened materially against the US Dollar (from 161.07 to 144.81 JPY/USD over the year).

These headwinds were decisively counteracted by a massive ¥119.8 billion positive YoY swing in Total Credit Costs, which shifted from a large provision in Q1 FY24 to a net reversal in Q1 FY25. Additional support came from the strategic benefits of last year's bond portfolio rebalancing and the positive, and growing, impact of rising domestic interest rates. The market and analyst consensus reflects this complexity, with the general sentiment described as "neutral-to-positive". Analysts acknowledge the strong credit trends and bottom-line stability but express caution regarding the weakness in top-line revenue and a collapse in comprehensive income, suggesting the stock is likely to be "range-bound" in the near term.

Ultimately, MUFG demonstrated commendable strategic management in a volatile macroeconomic environment. However, the quality of earnings this quarter is a valid concern due to the heavy reliance on a credit cost reversal. The critical challenge for the remainder of the fiscal year will be to translate its strategic initiatives—particularly the repositioning of its bond portfolio and capitalizing on domestic rate hikes—into sustainable, high-quality growth in its core customer-facing businesses. Meeting its lofty annual target will require a significant acceleration in core profitability, as relying on similar one-off benefits is not a sustainable path.

I. Consolidated Financial Performance: A Deep Dive into Profit & Loss Drivers

Gross Profits Analysis: Unpacking the ¥177.1 Billion Decline

MUFG's top-line revenue faced considerable pressure during the quarter, with Gross Profits falling 11.5% YoY to ¥1,358.4 billion. This ¥177.1 billion decline was the result of a confluence of factors, dominated by technical accounting effects and market normalization rather than a fundamental deterioration in the core client franchise.

The primary drivers of this decline were threefold. First, a significant technical headwind arose from the "rebound of KS impact," which refers to the high comparison base set in the prior year from an accounting gain related to making Bank of Ayudhya (Krungsri) a fully consolidated subsidiary. This non-operational, one-time event accounted for an approximate ¥160.0 billion of the YoY decline. Second, the Global Markets division, specifically its Treasury operations, had an exceptionally strong performance in Q1 FY24. The normalization of these large gains in the current quarter was a major contributor to the profit decline. Third, adverse foreign exchange movements, driven by a stronger Yen, had a direct negative translation effect on overseas profits, reducing Gross Profits by an estimated ¥40.0 billion.

These substantial headwinds were partially mitigated by positive underlying trends. The bank benefited from the initial effects of rising JPY interest rates following the Bank of Japan's policy shift, improved funding income stemming directly from last year's strategic bond portfolio rebalancing, and steady growth in fee income from customer segments.

Net Operating Profits (NOP): The Mid-Line Squeeze

NOP, a crucial measure of core profitability from ongoing operations, fell to ¥542.9 billion. On an adjusted basis to exclude the KS impact, this represents a YoY decrease of ¥56.3 billion, clearly illustrating the flow-through effect of the gross profit decline before the benefit of non-operational items.

A breakdown on a managerial accounting basis reveals a divergence in performance. The customer-facing segments collectively contributed a solid +¥33.1 billion to NOP (excluding FX), demonstrating the health of the core franchise. This was more than offset by a -¥43.7 billion drag from the Global Markets business, highlighting the market-facing pressure during the quarter. The impact of rising JPY interest rates provided a significant tailwind of approximately +¥50.0 billion, while FX fluctuations created a headwind of roughly -¥20.0 billion.

General & Administrative (G&A) expenses decreased by ¥42.0 billion on a reported basis to ¥815.4 billion. However, this figure is misleading. When excluding the high base from the prior-year KS impact, expenses actually increased due to the consolidation of overseas acquisitions, inflationary pressures, and strategic investments for future growth. Consequently, the Expense Ratio deteriorated by 4.1 percentage points to 60.0%, signaling negative operating leverage as gross profits fell more steeply than costs.

Net Income: The Decisive Impact of Credit Costs and Strategic Gains

The earnings narrative pivots dramatically at the bottom line. Despite the top-line and NOP weakness, adjusted Net Income attributable to owners of parent rose by ¥12.0 billion YoY to reach ¥546.0 billion. This resilience was almost entirely driven by items below the NOP line.

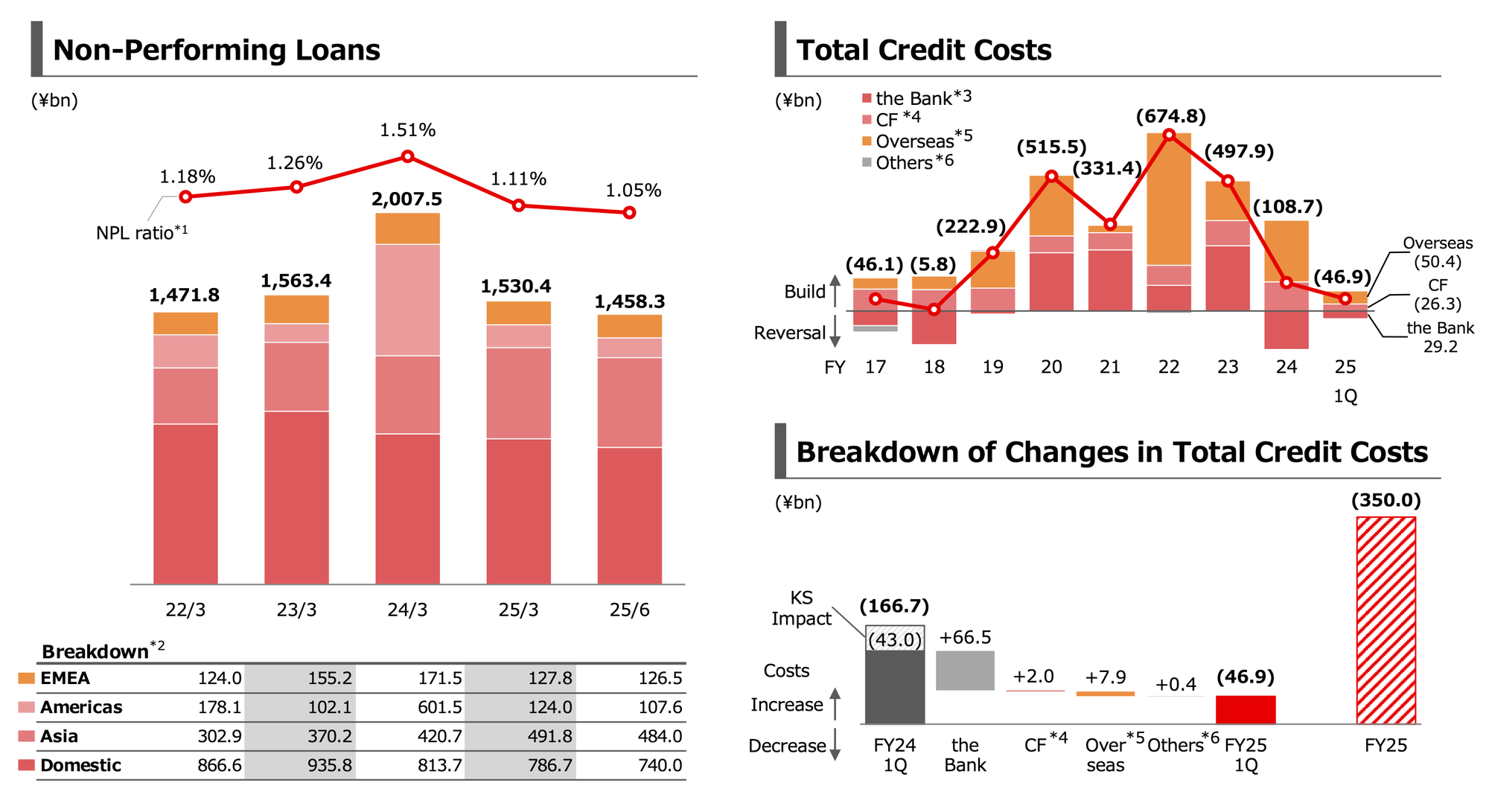

The hero of the quarter was Total Credit Costs. This line item produced the single largest positive contribution, with a remarkable ¥119.8 billion YoY improvement. The metric swung from a ¥166.7 billion cost in Q1 FY24 to a ¥46.9 billion reversal (a net gain) in Q1 FY25. This significant reversal was primarily attributed to the "rebound of the reversal of large credit costs accounted in overseas last year," indicating an improvement in the outlook for specific overseas loan portfolios that had previously required heavy provisioning.

Furthermore, management's strategic actions provided a substantial boost. The benefits from last year's bond portfolio rebalancing contributed an estimated +¥80.0 billion to Net Income on an after-tax basis, a direct and tangible result of repositioning the balance sheet for a new interest rate environment. Finally, earnings from equity method investees, which notably includes Morgan Stanley, increased by a healthy ¥14.8 billion to ¥157.9 billion, providing another solid pillar of support to the bottom line.

II. Analysis of Core Business Segments: Identifying Growth Engines and Areas of Pressure

A granular look at MUFG's business segments reveals a clear divergence in performance. The domestic, customer-centric businesses served as the primary growth engine, benefiting from the changing interest rate environment, while market-facing and certain overseas operations faced significant headwinds.

Customer-Centric Segments: The Core Growth Engine

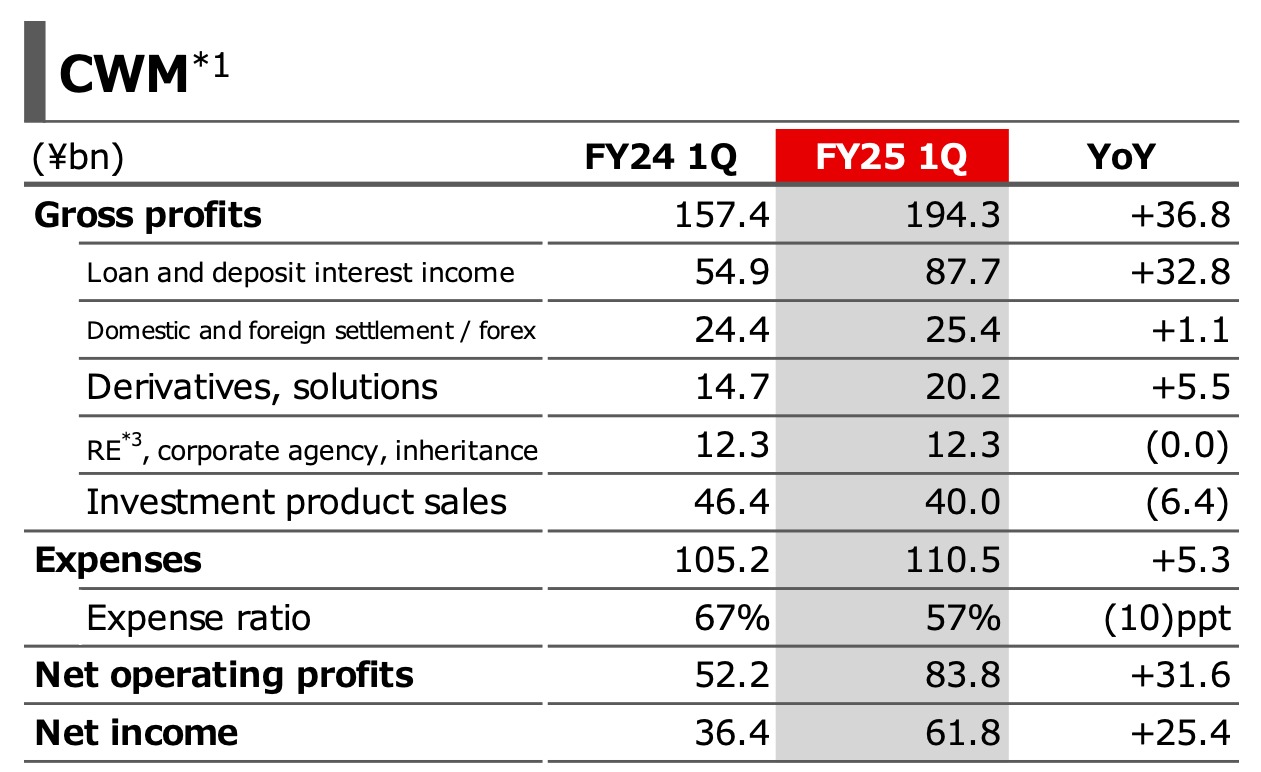

The standout performer of the quarter was the Commercial Banking & Wealth Management (CWM) group. Its Net Operating Profits surged by an impressive ¥31.6 billion YoY to ¥83.8 billion. This growth was powered almost entirely by a ¥32.8 billion increase in loan and deposit interest income, providing the first tangible evidence that the end of Japan's negative interest rate policy is a powerful earnings catalyst for MUFG. The segment also demonstrated strong operating leverage, with its expense ratio improving dramatically by 10 percentage points to 57%. The performance of the CWM segment is not merely a one-off success; it serves as a critical bellwether for the "Rising JPY Rates" thesis. Its continued strength will be the most important indicator of whether this major strategic tailwind is materializing as management and investors anticipate.

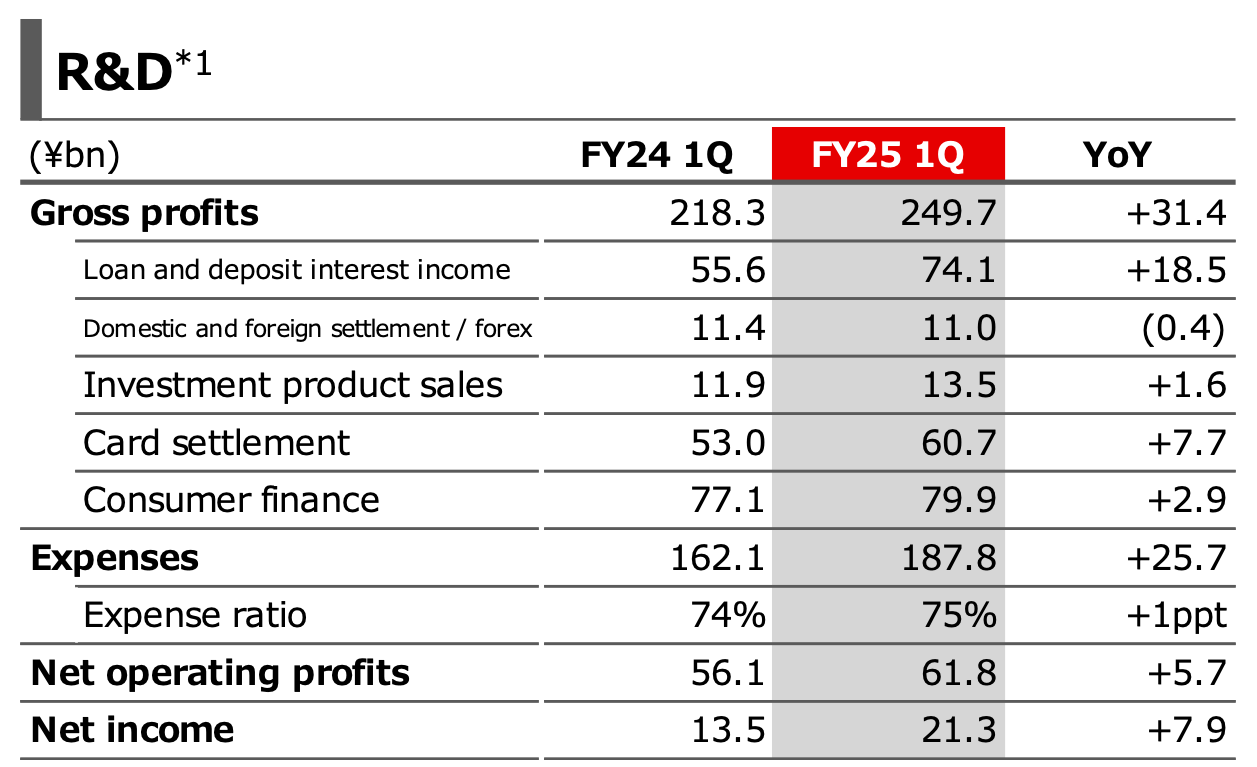

The Retail & Digital (R&D) business also delivered steady growth, with NOP rising ¥5.7 billion to ¥61.8 billion. Performance was well-balanced, with loan and deposit income increasing by ¥18.5 billion and investment product sales contributing an additional ¥7.7 billion, though these gains were partially offset by higher strategic expenses.

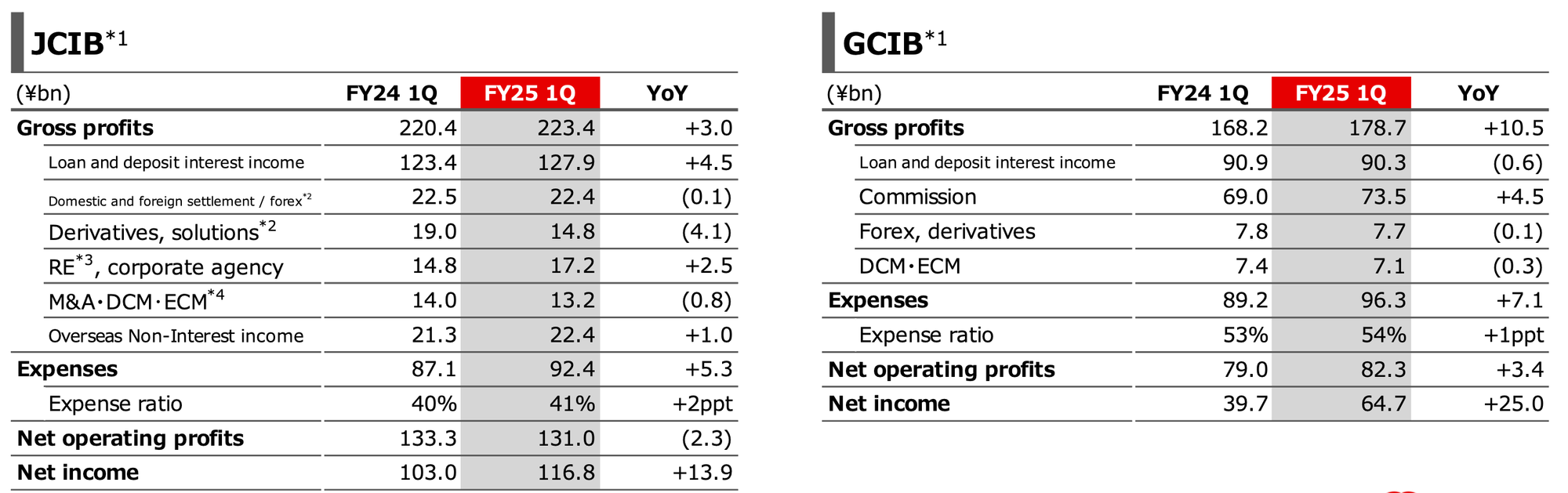

The corporate banking franchises, Japanese Corporate & Investment Banking (JCIB) and Global Corporate & Investment Banking (GCIB), delivered solid, stable results. JCIB's NOP saw a slight dip of ¥2.3 billion, while GCIB's NOP grew by ¥3.4 billion. More importantly, both segments saw healthy growth in net income (+¥13.9 billion for JCIB, +¥25.0 billion for GCIB), likely aided by the group-wide improvement in credit costs, underscoring the stability of their large corporate client relationships.

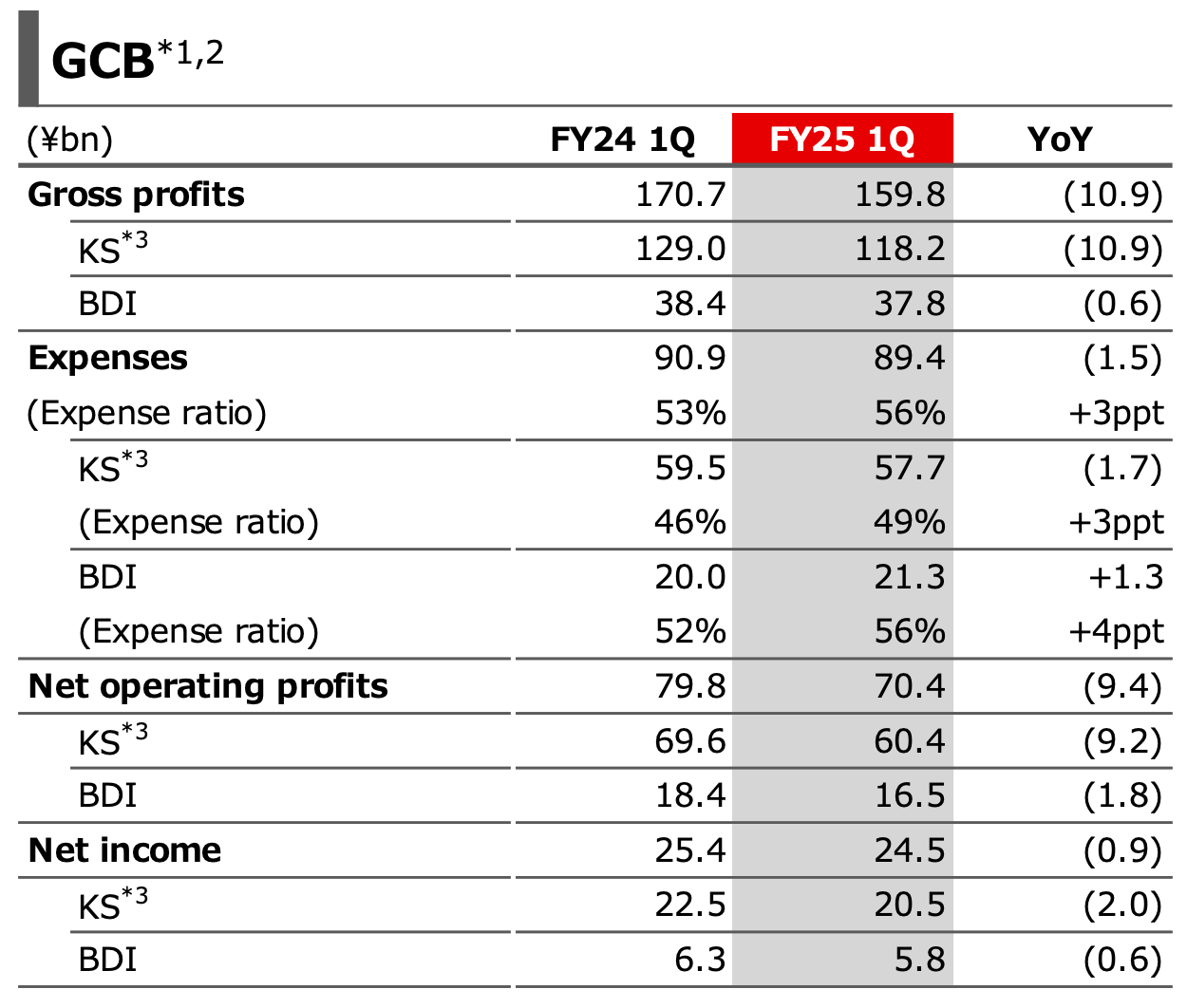

Global Commercial Banking (GCB): Headwinds from Overseas Subsidiaries

The GCB segment, which houses major strategic subsidiaries like Krungsri (KS) in Thailand and Bank Danamon (BDI) in Indonesia, faced a more challenging quarter. NOP for the segment declined by ¥9.4 billion to ¥70.4 billion. This performance was dragged down by both KS, whose NOP fell by ¥9.2 billion, and BDI, whose NOP on an entity basis fell by ¥1.8 billion. These results reflect a more difficult operating environment in key Southeast Asian markets, compounded by the negative impact of FX translation on reported earnings.

Asset Management & Investor Services (AM/IS): A Tale of Two Businesses

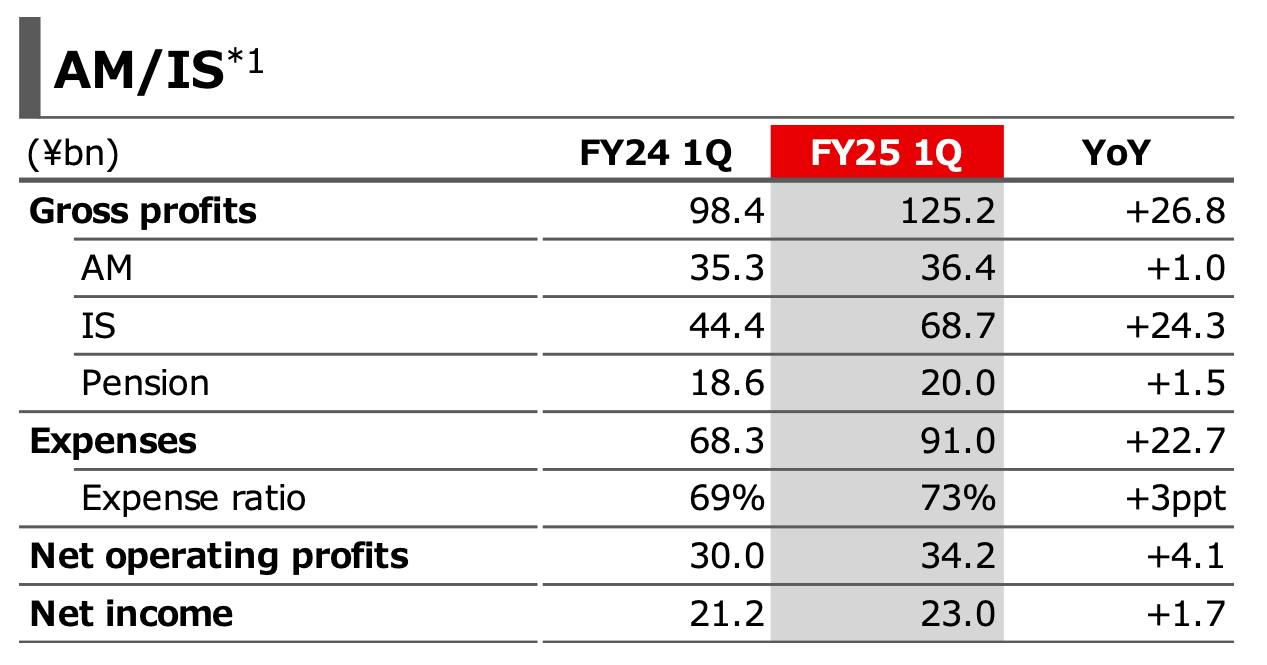

The AM/IS group reported a modest NOP increase of ¥4.1 billion to ¥34.2 billion. However, this headline figure masks a significant underlying trend. Gross profits for the segment surged by ¥26.8 billion, a gain driven almost entirely by a ¥24.3 billion increase in the Investor Services (IS) sub-segment. This strong top-line growth was largely consumed by a corresponding ¥22.7 billion rise in expenses, resulting in the muted NOP gain. The traditional Asset Management (AM) business, meanwhile, remained flat.

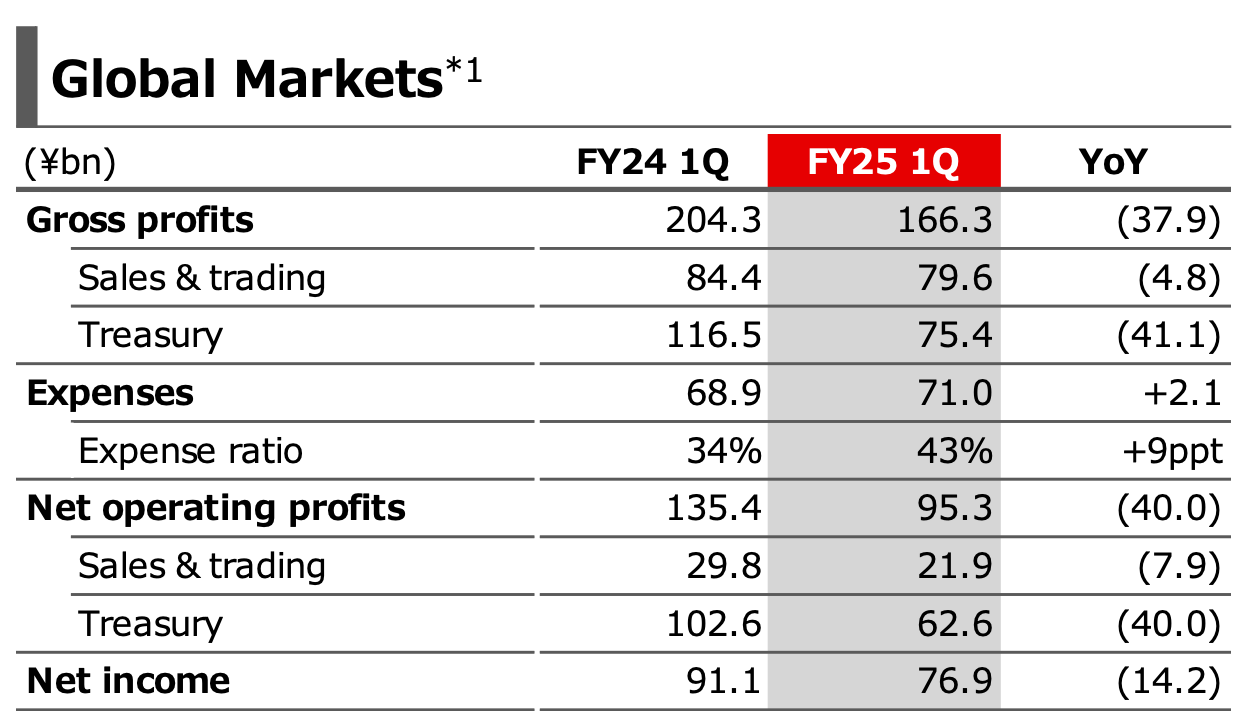

Global Markets: The Epicenter of Volatility

The Global Markets business experienced the most significant downturn and was the primary source of the group's top-line weakness. NOP for the segment plummeted by ¥40.0 billion YoY to ¥95.3 billion. This decline was almost entirely attributable to the Treasury business, where NOP fell by ¥40.0 billion as it normalized from the exceptionally high gains recorded in the prior year. The Sales & Trading business also saw its NOP decline by ¥7.9 billion, reflecting a more challenging market environment compared to the previous year.

III. Balance Sheet Condition and Asset Quality: A Foundation of Prudence and Strength

MUFG's balance sheet and asset quality metrics reflect a period of active strategic repositioning and continued prudence. The bank is clearly preparing for a new interest rate regime while maintaining a robust risk profile.

Loan and Deposit Portfolio: Modest Growth and Shifting Dynamics

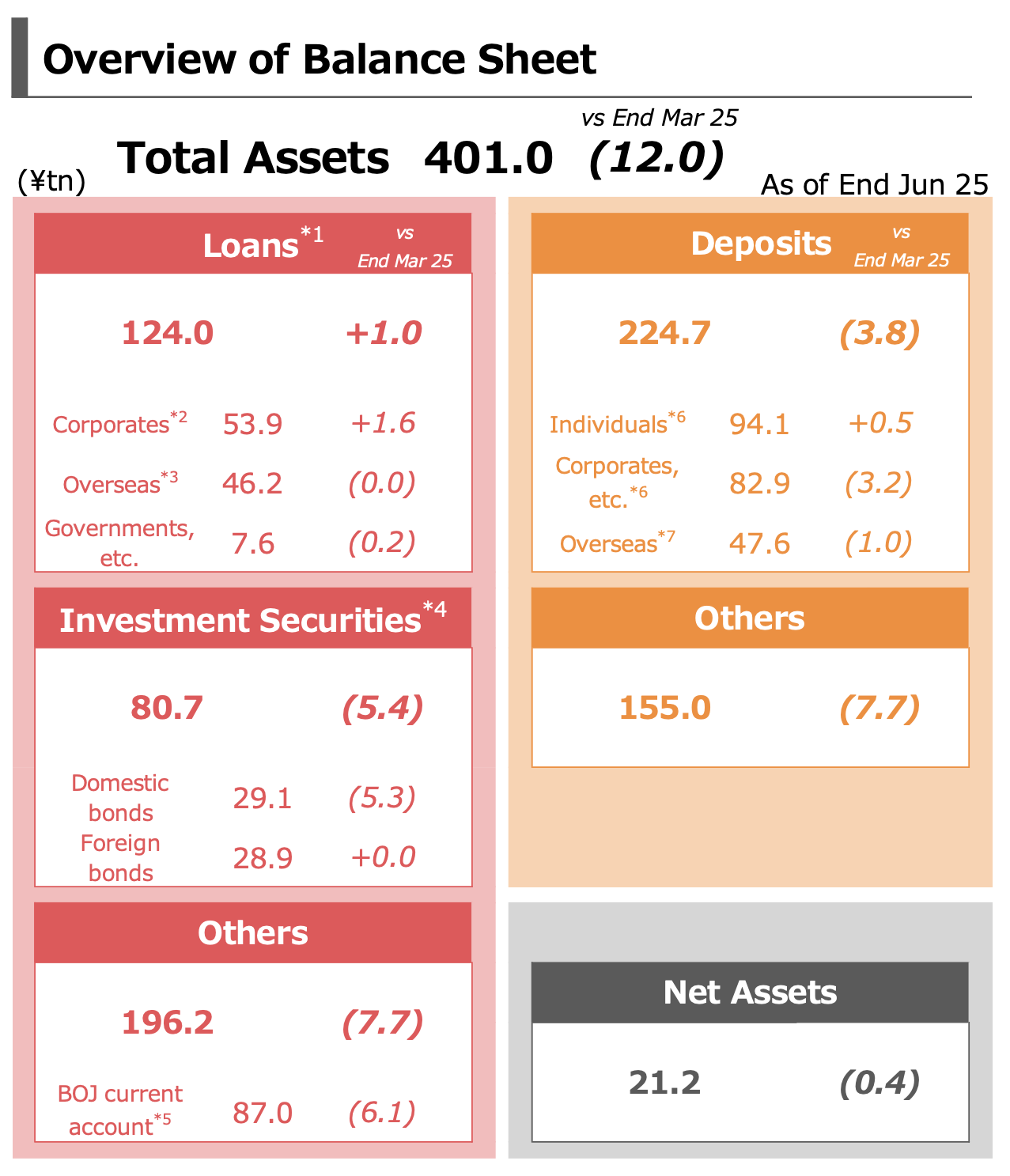

Total loans grew by a modest ¥1.0 trillion from the end of March 2025 to stand at ¥124.0 trillion at the end of June. This growth was driven entirely by the domestic portfolio (+¥1.3 trillion), particularly in lending to small and medium-sized enterprises (SMEs), indicating solid domestic credit demand. In contrast, overseas loans were flat, though they registered a slight increase of ¥0.2 trillion when excluding FX impacts. On the funding side, total deposits decreased by ¥3.8 trillion to ¥224.7 trillion, a move primarily attributable to outflows from corporate (-¥3.2 trillion) and overseas (-¥1.0 trillion) accounts, while the individual deposit base remained resilient with a slight increase of ¥0.5 trillion. A critical positive trend is the widening of domestic lending spreads. The difference between the average lending rate and deposit rate increased to 0.95% in the first quarter, a direct result of rising rates and a core driver of the improved profitability seen in the CWM segment.

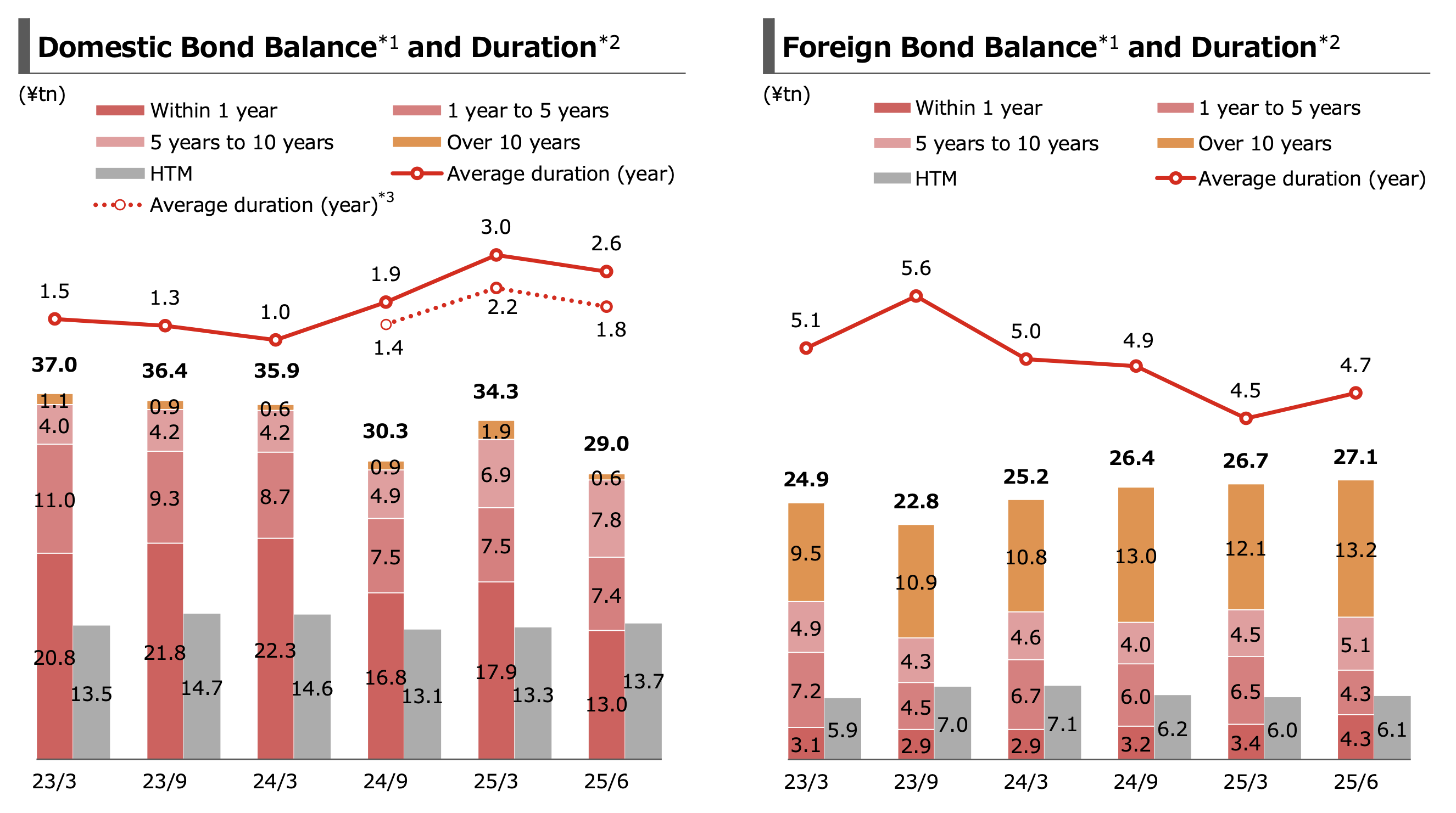

Investment Securities Strategy: Proactive Repositioning for a New Era

The bank is undertaking an aggressive and proactive de-risking of its balance sheet to mitigate interest rate sensitivity. This is most evident in the sharp reduction of its domestic bond portfolio, which was cut by ¥5.86 trillion during the quarter. Japanese Government Bonds (JGBs) accounted for nearly the entire reduction, with holdings falling by ¥5.74 trillion. In tandem, the average duration of the domestic available-for-sale (AFS) bond portfolio was shortened significantly, from 1.9 years to 1.4 years, further reducing its vulnerability to rising rates.

This rebalancing strategy is a double-edged sword. While it is a strategically vital move to avoid future capital losses and reinvest proceeds into higher-yielding assets, it is also the direct cause of the significant drag on Comprehensive Income. As the bank sells low-yielding bonds, the remaining fixed-rate securities in its AFS portfolio must be marked-to-market. In a rising rate environment, the value of these bonds falls, creating unrealized losses that flow through Other Comprehensive Income (OCI) and reduce total net assets. This reflects a conscious trade-off: MUFG is sacrificing short-term book value to generate higher, more sustainable Net Interest Income in the future.

Despite these pressures, the overall AFS securities portfolio still carried a net unrealized gain of ¥2.32 trillion as of June 30, 2025. This buffer is provided almost entirely by the massive ¥2.54 trillion in unrealized gains on the bank's domestic equity portfolio. In line with its long-term strategy, MUFG also continued to unwind its strategic cross-shareholdings, with total expected sales during the current Mid-Term Business Plan now increased to ¥531 billion.

Asset Quality: A Pillar of Strength

Asset quality remains a clear pillar of strength for the group. The consolidated Non-Performing Loan (NPL) ratio continued its steady downward trend, improving to 1.05% from 1.11% in March 2025, a level described by analysts as being near post-Global Financial Crisis lows. Total NPLs stood at ¥1,458.3 billion. As detailed previously, the most significant P&L driver for the quarter was the shift in Total Credit Costs to a ¥46.9 billion net reversal, a stark contrast to the ¥166.7 billion cost in the prior year. This was primarily driven by the improved outlook for certain overseas loan portfolios.

IV. Strategic Outlook, Analyst Sentiment, and Shareholder Value

Management Guidance and Forecast

Despite the mixed results and top-line pressures, MUFG's management has confidently maintained its full-year net income target of a record ¥2.0 trillion. Having achieved ¥546.0 billion, or 27.3%, of this goal in the first quarter, the target appears mathematically achievable. However, the critical uncertainty lies in the composition of future earnings. The bank cannot rely on a ~¥120 billion tailwind from credit cost reversals each quarter. Therefore, achieving the remaining ~¥1.45 trillion will require a significant acceleration in Net Operating Profit. This growth must come from the core customer segments capitalizing on wider lending spreads and the full-year benefits of the rebalanced investment portfolio.

Capital Return Policy: A Signal of Confidence

Reinforcing its confident outlook, management reiterated its plan for a full-year dividend of ¥70 per share, to be paid via interim and year-end dividends of ¥35 each. This represents a material increase from the prior fiscal year and serves as a strong signal of the board's confidence in the full-year earnings trajectory. As noted by one analyst, this commitment to shareholder returns helps to "offset headline weakness" in the quarterly results.

Market and Analyst Reaction: A Cautious Consensus

The prevailing sentiment among external analysts is one of cautious neutrality. While acknowledging the resilient bottom line, they remain wary of the underlying revenue weakness and the quality of the quarter's earnings. The most detailed external analysis available rates the quarter "neutral-to-positive" but suggests the stock is likely to be "range-bound" in the near term.

Key analyst takeaways highlight this duality. On the positive side, the bank beat consensus expectations on credit-cost relief, demonstrated improving asset quality with an NPL ratio near historic lows, showed tangible benefits from widening domestic spreads, and signaled confidence with a strong dividend plan. On the negative side, analysts pointed to the weak top-line revenue, a significant drop in trading profit, the collapse in comprehensive income which highlights market sensitivity, and a thin reported equity-to-asset ratio. The reported Gross Profit of ¥1.358 trillion appears to have missed at least one analyst's revenue forecast of ¥1.416 trillion, corroborating the theme of revenue weakness.

Forward-Looking Risks and Opportunities

Looking ahead, MUFG faces a clear set of opportunities and risks:

- Opportunities: The primary opportunity lies in capitalizing on the full impact of JPY rate hikes, as the benefits to net interest income have yet to be fully realized and should continue to build throughout the year. Sustaining the momentum in the CWM and R&D customer segments is crucial to improving overall earnings quality.

- Risks: Global market volatility remains a key risk, with the Global Markets division being a significant source of earnings variability. While asset quality is currently pristine, a sharp downturn in the global or domestic credit cycle could quickly reverse the trend of credit cost reversals, removing a major pillar of support for the bottom line. Finally, further strengthening of the Yen would continue to act as a headwind on the translation of overseas profits.

V. Concluding Analysis and Strategic Recommendations

MUFG's first-quarter performance was a masterclass in navigating a complex and contradictory environment. Management successfully utilized non-operational levers—most notably a massive reversal of prior credit provisions—to engineer a stable bottom-line result that keeps its ambitious annual target within reach. This tactical success, however, masked significant underlying pressure on core revenues from normalizing trading gains and adverse FX movements. The proactive and aggressive rebalancing of the bond portfolio is a strategically sound, albeit temporarily painful, move to position the bank for a future of higher domestic interest rates. The quarter's results were therefore a testament to prudent risk and balance sheet management rather than stellar operational performance.

Based on this comprehensive analysis, the following strategic recommendations are offered for stakeholders:

- Monitor the Source of Profits: The primary focus for the next three quarters should be on the quality of earnings. Investors should look for a clear shift in profit drivers away from one-off credit cost reversals and towards sustainable growth in Net Operating Profit, driven by the customer-facing segments (CWM, R&D).

- Track Net Interest Margin (NIM) and Spreads: The domestic lending spread is a critical Key Performance Indicator (KPI). Its continued expansion will be the clearest evidence that the bank is successfully capitalizing on the new monetary policy environment in Japan.

- Evaluate Overseas Performance: The Global Commercial Banking (GCB) segment, containing strategic assets KS and BDI, underperformed this quarter. Monitoring the turnaround in these key growth markets is essential for evaluating the long-term success of the bank's geographic diversification strategy.

In conclusion, the quarter earns a neutral rating. While management's strategic direction is sound and their confidence in the full-year outlook is reassuring, the heavy reliance on lower-quality earnings drivers in Q1 places the burden of proof squarely on the next three quarters to deliver the sustainable, core operational growth needed to validate their ambitious targets.