MUFG FY3/25 Financial Results

MUFG concluded the fiscal year ended March 31, 2025, showcasing a complex picture of both challenges and notable successes. While Net Operating Profits experienced a decrease, the institution witnessed a remarkable surge in customer segments, demonstrating the effectiveness of its customer-centric strategies. This year marked a pivotal point in MUFG's strategic trajectory, with initiatives aimed at enhancing long-term profitability taking center stage, impacting the immediate figures.

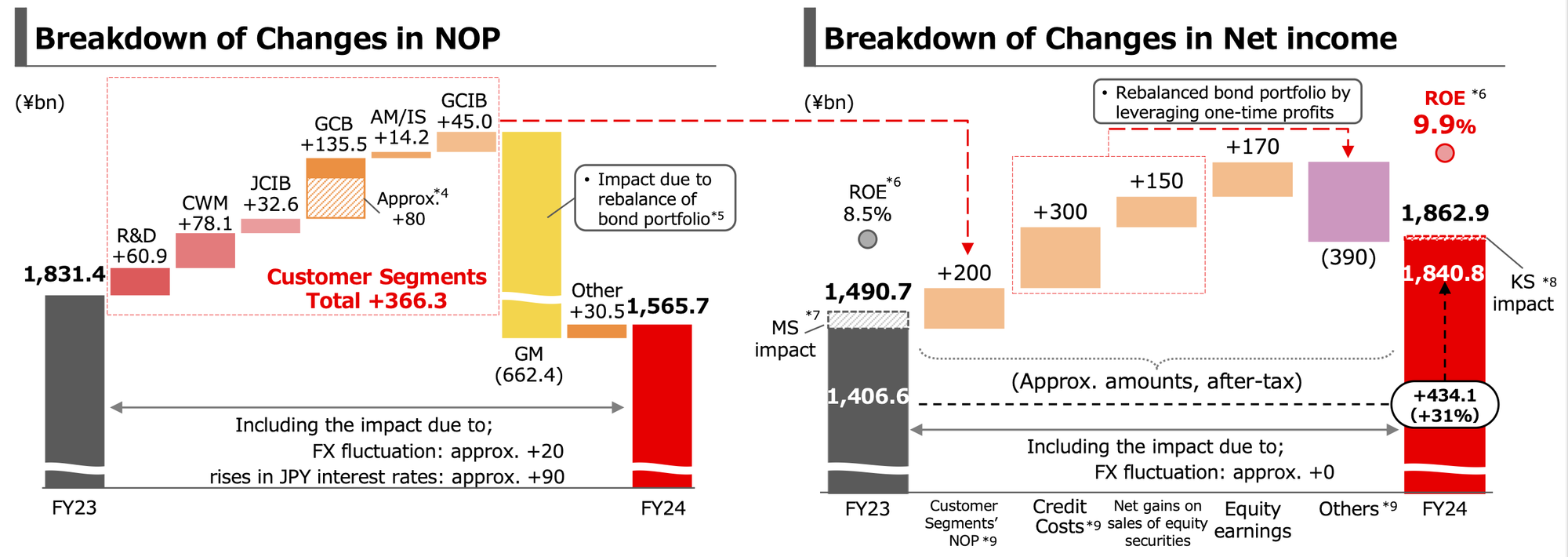

The Net Operating Profits reached ¥1,591.1 billion, a decrease of ¥252.5 billion year-over-year. This result reflected a conscious decision to prioritize future earnings potential, through activities like the strategic rebalancing of the bond portfolio, impacting present profits for anticipated future gains. Despite this overall reduction, a significant bright spot emerged within customer segments, which saw a substantial rise of approximately 20% year-over-year, amounting to ¥366.3 billion.

The Net Income for MUFG reached a staggering ¥1,862.9 billion, marking an increase of ¥372.1 billion from the previous fiscal year. This extraordinary achievement, the highest since MUFG's establishment, was fueled by the impressive growth within customer segments and other favorable factors. Furthermore, the institution achieved a return on equity (ROE) of 9% in the initial year of the Mid-Term Business Plan (MTBP), indicative of progress towards the mid-to-long term ROE target of 9-10%.

Performance by Business Segment

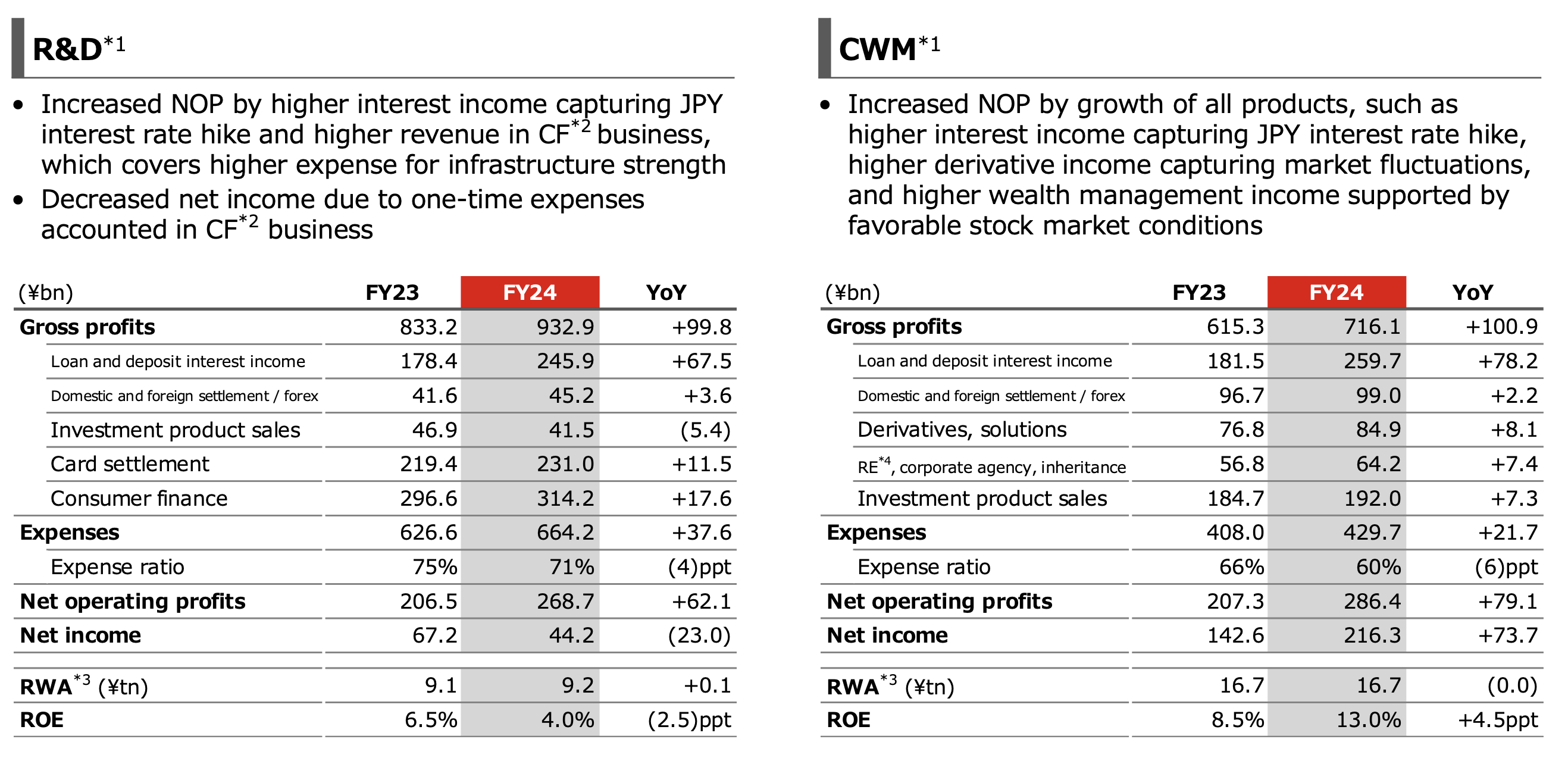

The Retail and Digital Business Group (R&D) demonstrated strength, with increased Net Operating Profits driven by higher interest income due to Japan's rising interest rates, and elevated revenue within the consumer finance (CF) sector. However, the net income for R&D contracted due to one-off expenses within CF. In contrast, the Commercial Banking & Wealth Management (CWM) segment experienced a boost in Net Operating Profits due to a surge in wealth management, as well as higher derivative income. Both interest rate income and favorable market conditions drove this impressive growth.

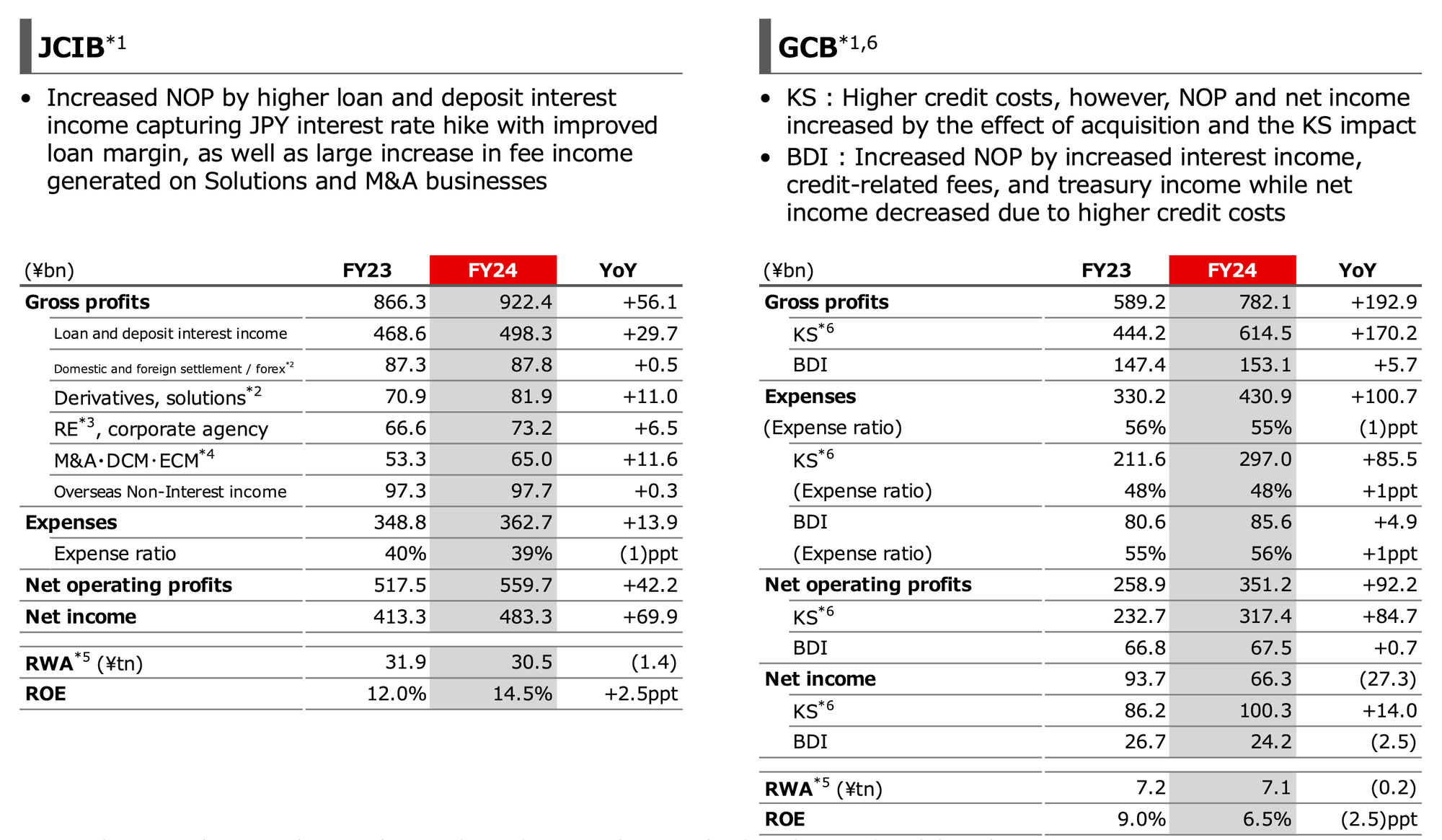

The Japanese Corporate & Investment Banking Business Group (JCIB) increased earnings through increased fee income and improved loan margins, generated by the rise in Japanese interest rates. This segment benefitted from Solutions and M&A activities. Conversely, the Global Commercial Banking Business Group (GCB) demonstrated a mixed performance. Increased acquisition and the KS impact contributed to the profits, but higher credit costs suppressed some of the gains. It also experienced increased net income and net operating profits, although net income was suppressed by higher credit costs. Increased interest income and credit-related fees drove profits, but net income was suppressed by elevated credit costs.

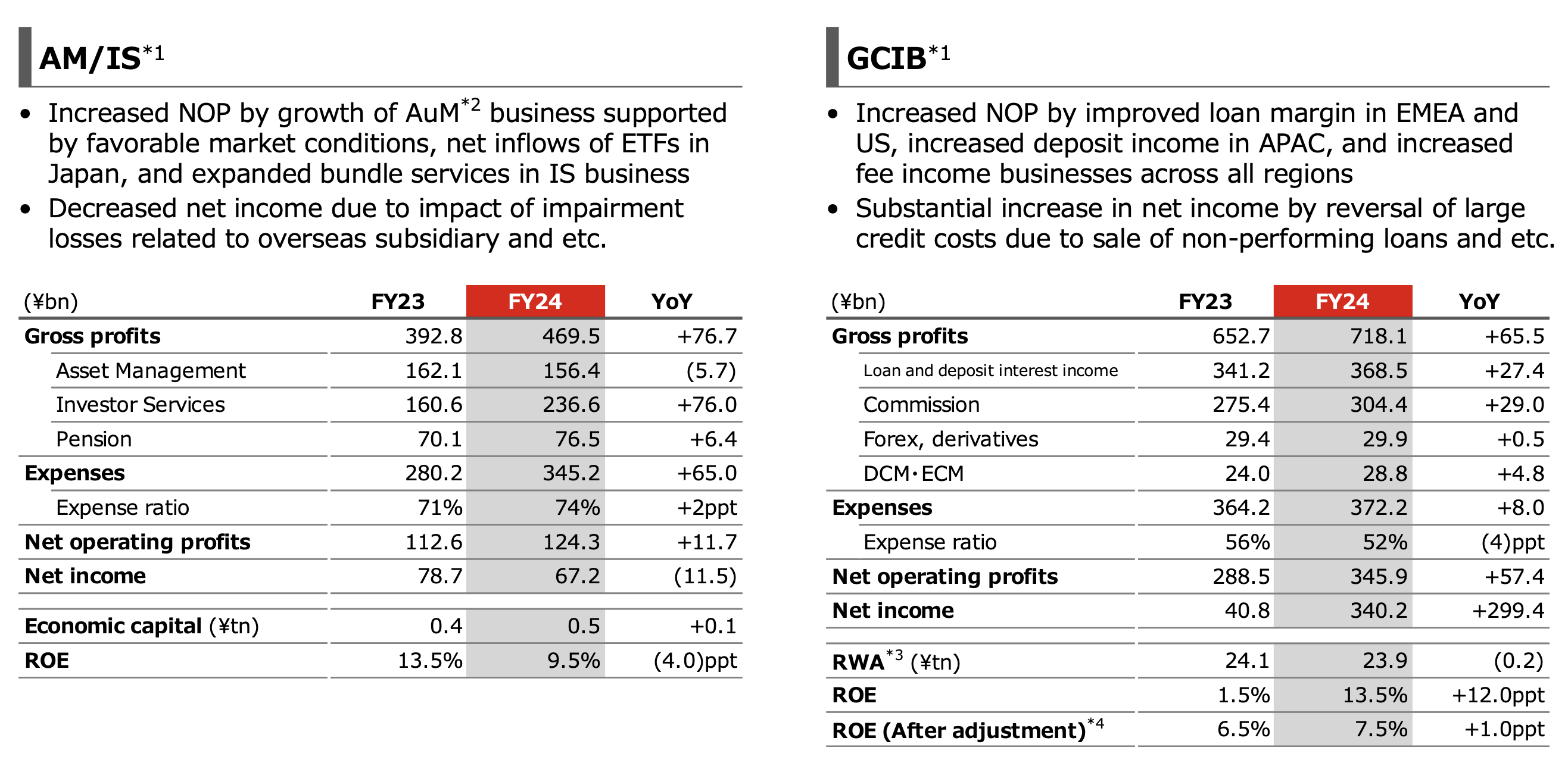

The Asset Management and Investor Services (AM/IS) segment saw Net Operating Profits increase due to AuM growth, but impairment losses overseas decreased net income. The Global Corporate and Investment Banking (GCIB) also boosted NOP due to improved loan margin, along with increased deposit and fee income. Substantial increase in net income through the reversal of large credit costs contributed to this boost.

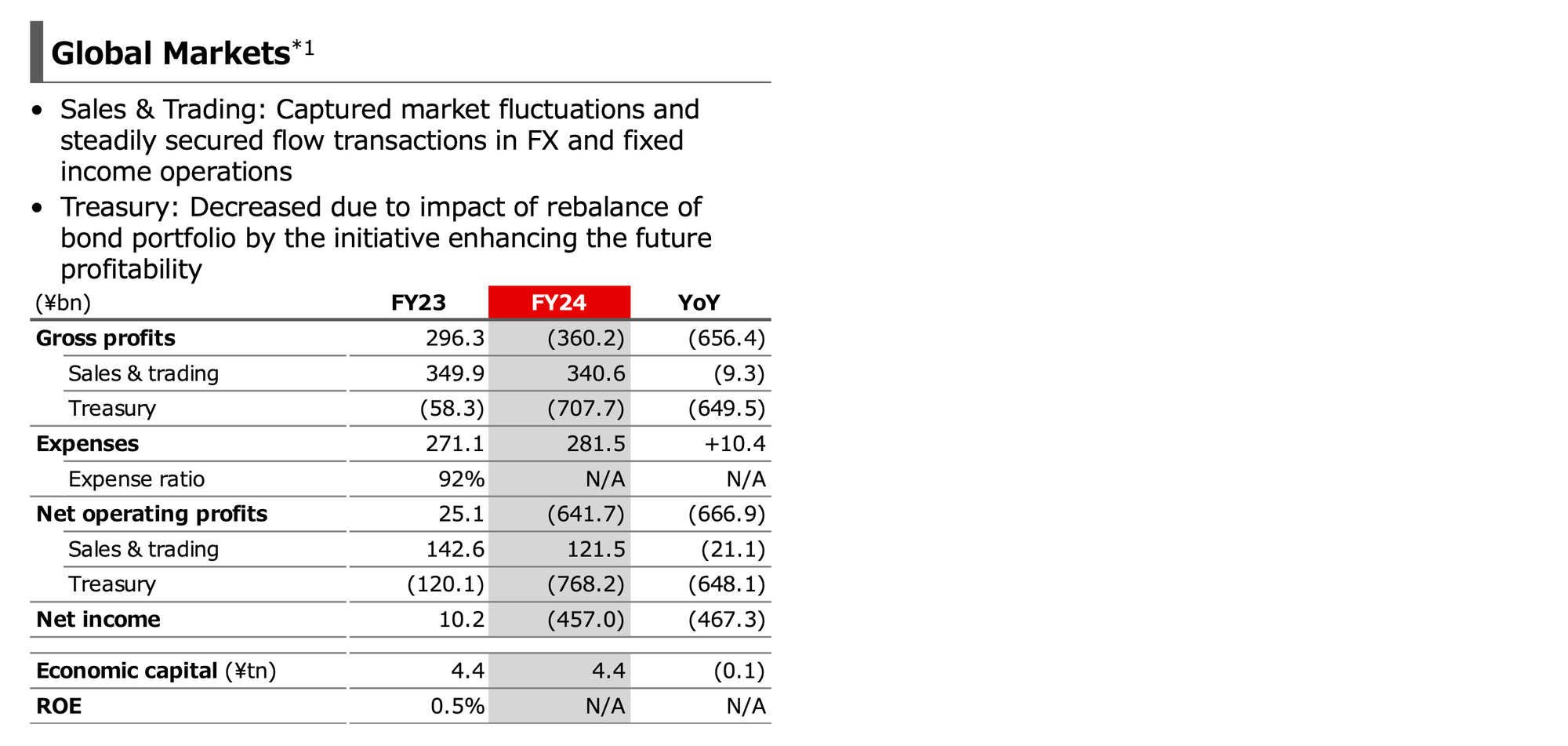

Global Markets, however, faced considerable headwinds. Sales and trading captured market fluctuations, however treasury was impacted by the impact from bond portfolio rebalancing. As such, MUFG decreased earnings from this segment.

Financial Targets and Shareholder Returns

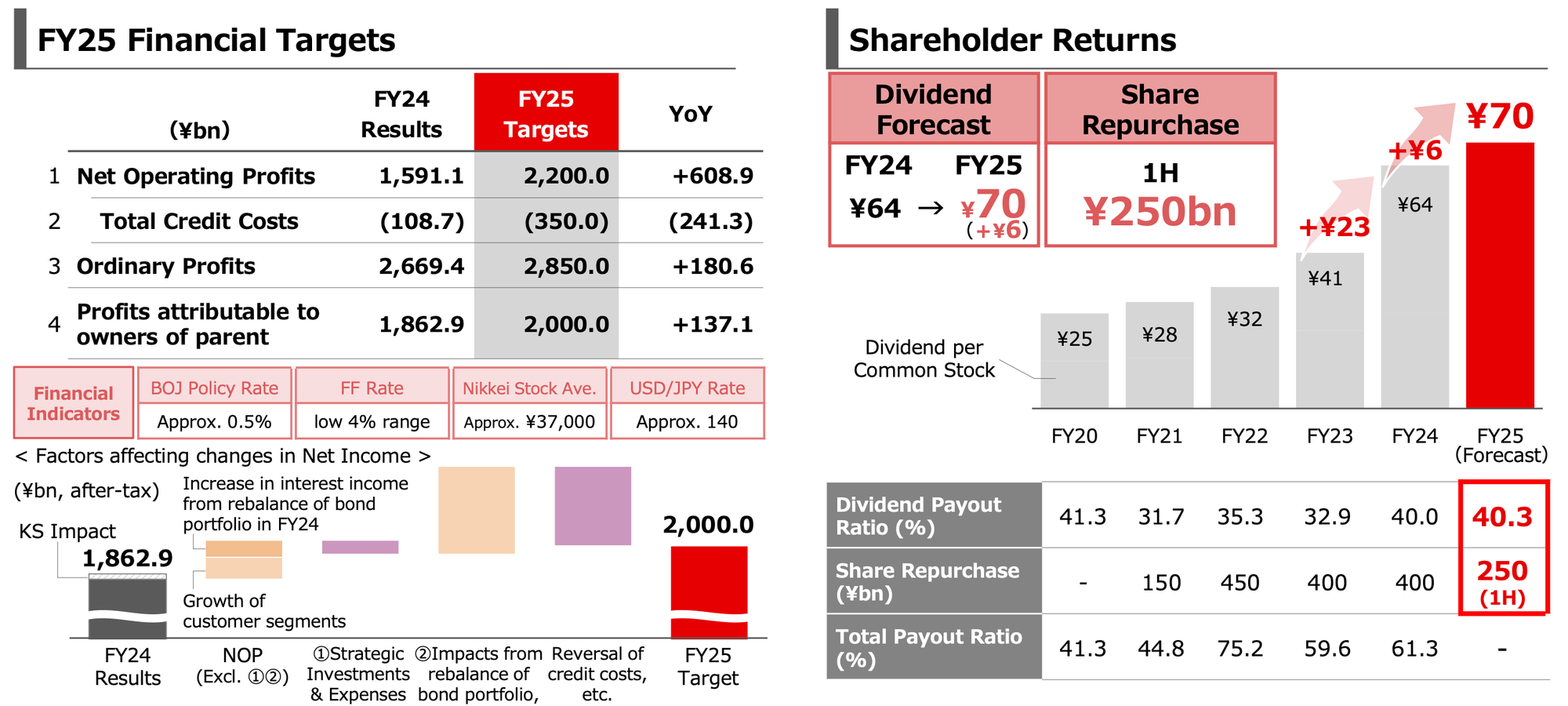

Looking ahead, MUFG outlined ambitious financial targets for the fiscal year 2025, demonstrating their commitment to growth and value creation. The institution aims to reach a net income of ¥2.0 trillion, a historic milestone that would approach an ROE of 10%. This target is set amidst an environment of considerable uncertainty, requiring MUFG to navigate complex geopolitical and economic conditions effectively. The strategic assumption underlying this ambition involves continued progress in trade policy negotiations and stable global supply chains.

MUFG recognizes the importance of shareholder returns and committed to rewarding investors in the coming fiscal year. An annual dividend of ¥70 per share is anticipated, representing an increase of ¥6 year-over-year. Demonstrating its commitment to shareholder value, MUFG has approved a repurchase of common stock up to ¥250 billion during the first half of fiscal year 2025.

Impact of New Trade Policies

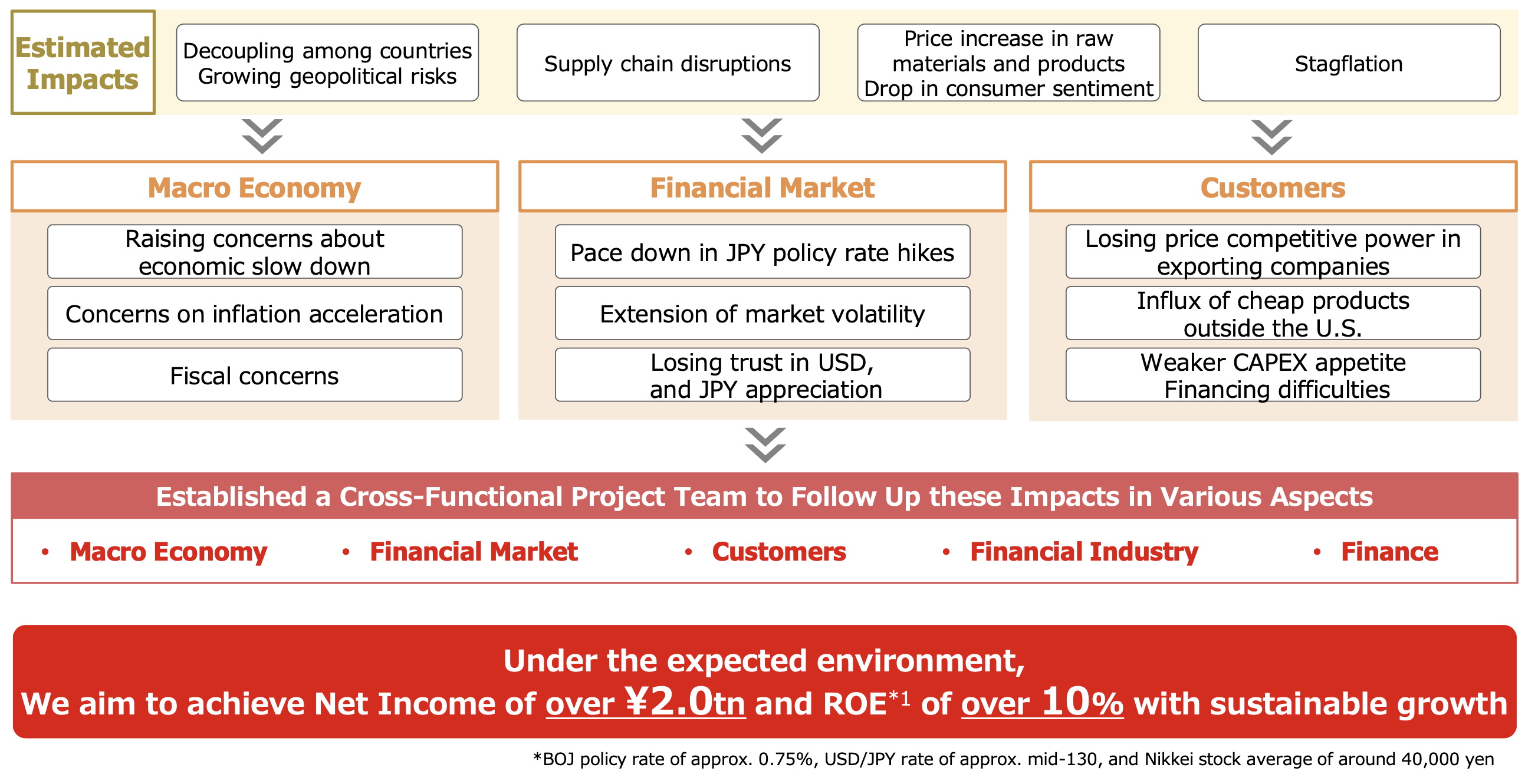

MUFG recognizes the uncertainty arising from new trade policies enacted by various countries and has taken active measures to mitigate this risk. They have established a cross-functional project team to follow up these impacts in various sectors including the Macro Economy, Financial Market, Customers, Financial Industry, and Finance. MUFG’s goal remains, even under the effects of these policies, to continue to reach a net income of ¥2.0tn and a ROE of over 10%.

Capital Adequacy

MUFG exhibits a strong Capital Adequacy, with the CET1 and Tier 1 ratios increasing. MUFG’s CET1 ratio (including unrealized gains) is 14.18%, with the Tier 1 ratio being even higher. As such, MUFG is prepared to mitigate future uncertainties by maintaining a strong capital position.