MUFG, Kodansha and CREDEUS Launch Japan Creative Works No. 1 Investment LP

Mitsubishi UFJ Financial Group, its consolidated subsidiaries MUFG Bank, and Mitsubishi UFJ Trust and Banking, Kodansha and CREDEUS have launched a new initiative for creating Japanese entertainment titles.

This initiative is the first of its kind in Japan to bring together financial and Japanese entertainment companies. It aims to create a new way of raising funds for the creation of entertainment titles that are the pride of Japan, and to deliver high-quality entertainment produced by talented Japanese creators to fans around the world.

Through this initiative, the partners aim to become an option for creating new works that enables the Japanese entertainment industry to advance into the future.

Background

Japanese entertainment titles have fans all over the world, with overseas sales in 2023 estimated to have expanded 128% from the previous year to 5,776.9 billion yen. This achievement is the result of the many years of work by Japanese creators, and it is said to be an investment genre of great interest to foreign sovereign wealth funds.

On the other hand, in a digital society, there is borderless competition that transcends national boundaries across industries, including the entertainment industry. Overseas, entertainment companies receiving massive funding from national governments and major corporations are rapidly emerging. In addition to conventional approaches, new funding methods and business models are needed for their productions to be able to compete with Japanese ones. Entertainment is a promising industry in which Japan has a strong global presence. To survive global competition, it is important to establish new alliances that transcend industry boundaries.

Outline of the Initiative

MUFG, Kodansha, and CREDEUS aim to build a system and business model for creating new entertainment titles by leveraging their respective strengths.

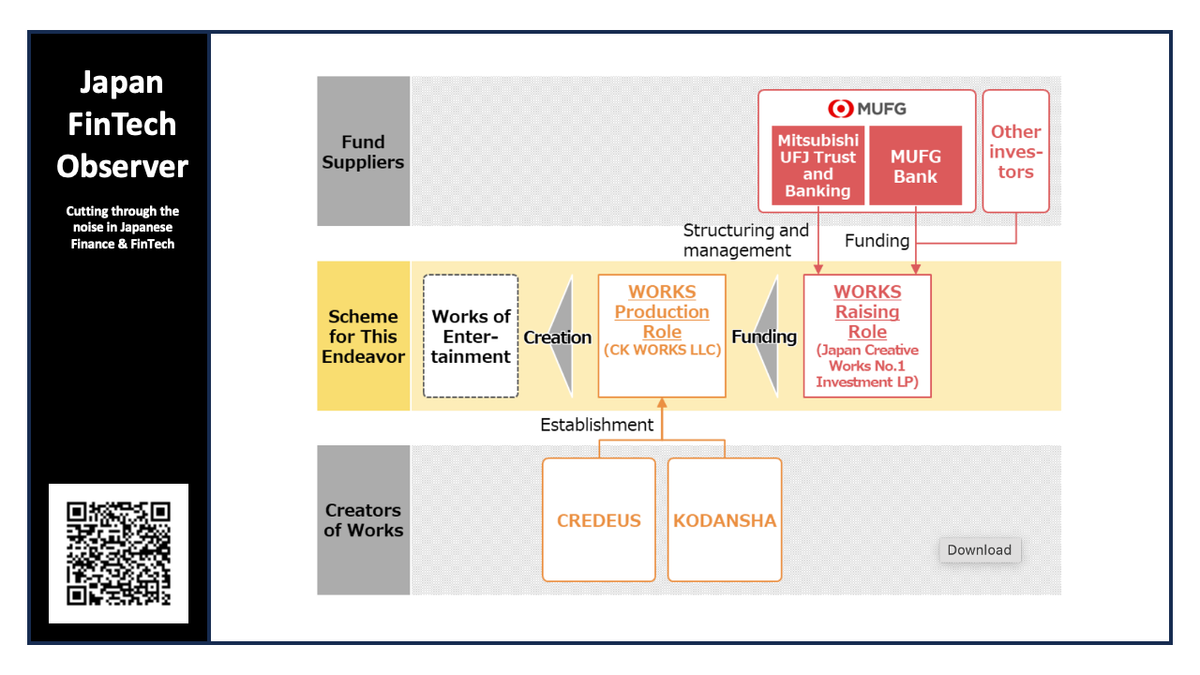

In this initiative, WORKS Production Role (CK WORKS, a limited liability company established by Kodansha and CREDEUS) will play the role of creating world-class titles, and WORKS Raising Role (Japan Creative Works No. 1 Investment LP organized and managed by MUFG’s Mitsubishi UFJ Trust and Banking with MUFG Bank among its investors) will raise and provide funds for the creation of entertainment titles.

Features of the initiative

The initiative’s WORKS Raising Role is characterized by all funding being provided for theatrical live-action film series based on works published by Kodansha, with transparent management of production funds through a GK-TK scheme (an investment scheme combining a limited liability company and a silent partnership).

Meanwhile, the WORKS Production Role will make it possible to secure substantial funding from the start of production on the first film in a series, enabling even projects that require a large production budget to be produced smoothly, limiting gaps between films to deliver them to fans while their enthusiasm is hot. The partners are also planning to set up a reward system for successful creators.

This initiative is unprecedented for both the financial and entertainment industries in scale and the scheme used. It was realized through collaboration among MUFG’s subsidiaries MUFG Bank and Mitsubishi UFJ Trust and Banking, Kodansha, and CREDEUS, with a common objective. By combining finance and entertainment, they aim to create new value.

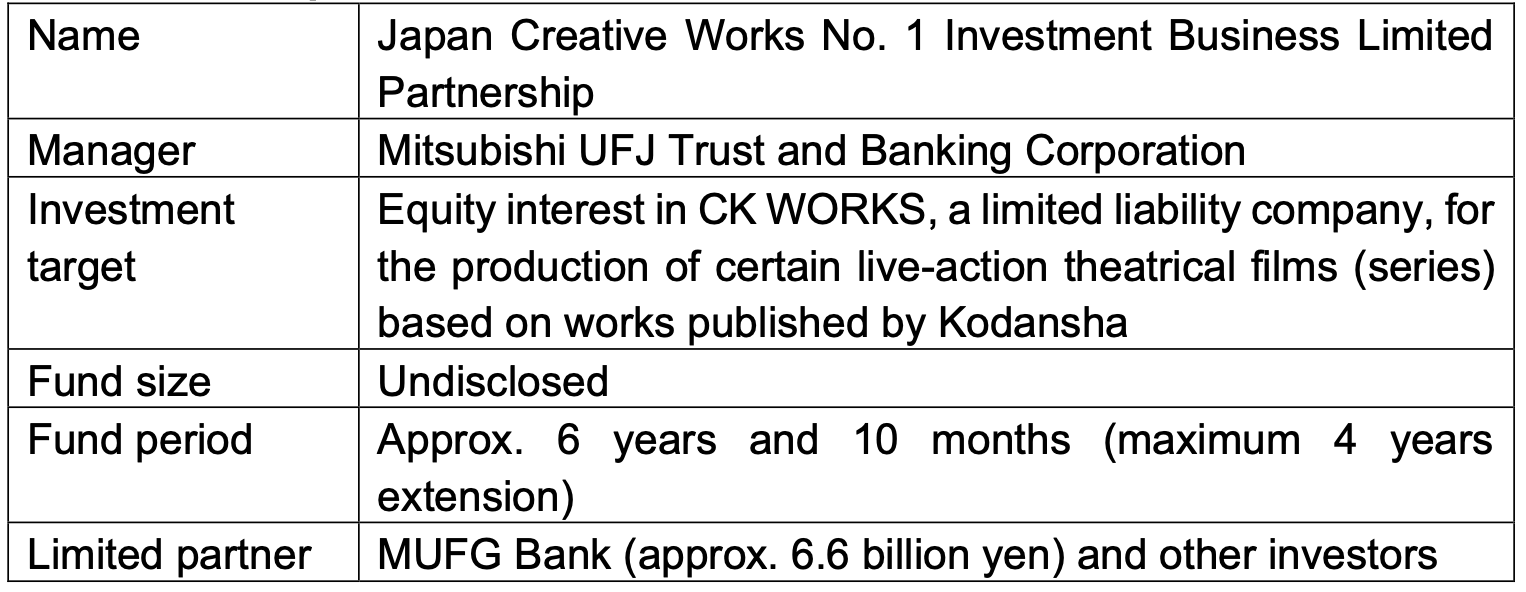

Overview of Japan Creative Works No. 1 Investment LP

Mitsubishi UFJ Trust and Banking, an affiliate of Japanese megabank MUFG, will manage the fund. MUFG Bank will also invest in the fund. Financial institutions, video production companies, authors, and publishers will work together to design the fund, aiming to compensate film producers and provide returns to investors. MUFG will also invite active creators to serve as advisors, making use of their knowledge of the entertainment business that conventional financial institutions do not possess.

This aims to enable investors to expect returns comparable to existing alternative investment assets, such as real estate and private equity, for entertainment titles whose success is usually difficult to judge, while the use of film production funds through a GK-TK scheme also enables transparent investment management.