MUFG Revises Earnings Target and Dividend Forecast

After the market close on April 30, 2025, MUFG announced that it has revised its earnings target for profits attributable to owners of parent and its year-end dividend forecast for the fiscal year ending March 31, 2025, both previously announced on November 14, 2024, to take into account recent business performance trends. This is the second upward revision to MUFG's full-year earnings target and year-end dividend forecast for the fiscal year ended March 31, 2025.

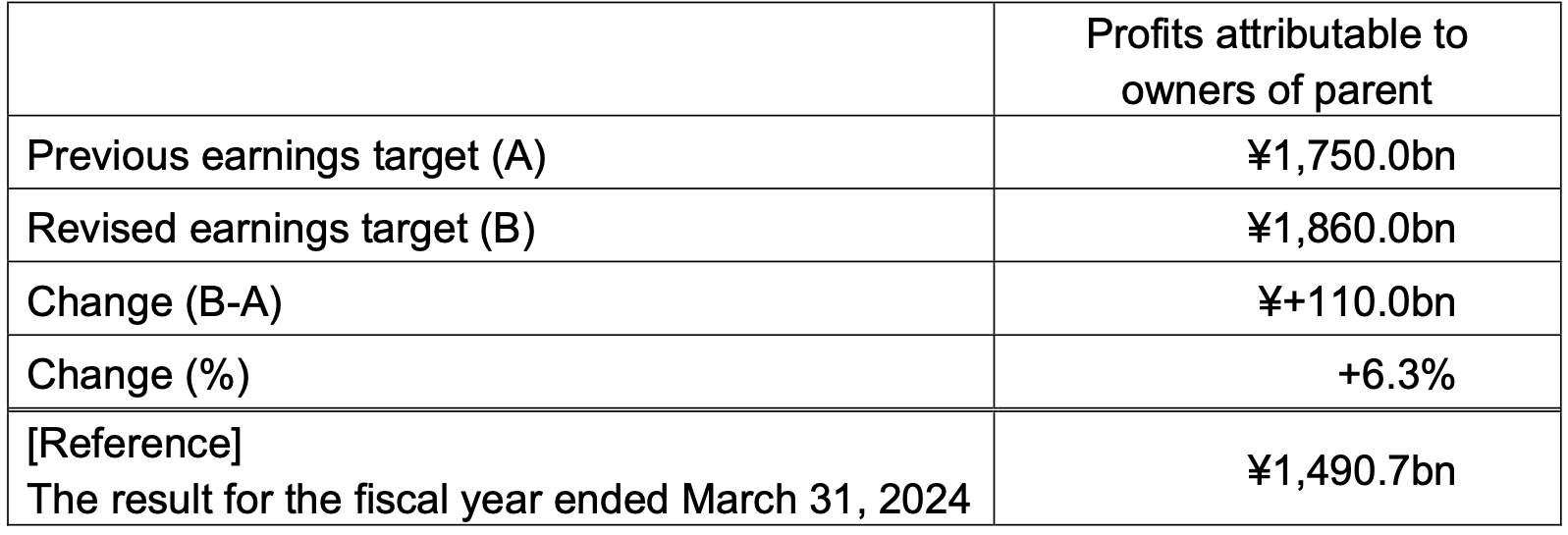

Revision of Earnings Target

However, market expectations had already moved ahead of the conservative guidance, and the revised earnings target merely moved the needle towards - and in fact still below - the consensus of JPY 1,900bn, hence the stock did not show much of a reaction.

As of the market close on May 2, 2025, MUFG quotes approximately 22.5% below its 52-week high achieved as recently as mid-March, impacted by the now confirmed delay in Bank of Japan policy normalization and policy rate increases, as well as the strengthening Japanese Yen (about 4% of net income per JPY 10 appreciation versus the USD).

Reasons for the Revision

MUFG recorded one-time profits such as the sale of equity holdings and large reversals of loan loss provisions. Utilizing these profits, MUFG undertook measures to rebalance its bond portfolio from a balance sheet management perspective, aiming to enhance future profitability. As a result, it is expected that net operating profits will decrease by ¥360 billion from the basis of MUFG's previous earnings target, although the performance of customer segments grew steadily.

On the other hand, due to reversals of loan loss provisions and the strong performance of Morgan Stanley, MUFG's equity method investee, ordinary profits are expected to increase by ¥160 billion from the basis of its previous earnings target.

Consequently, MUFG has upwardly revised the earnings target for profits attributable to owners of parent by ¥110 billion, setting it at ¥1,860 billion.

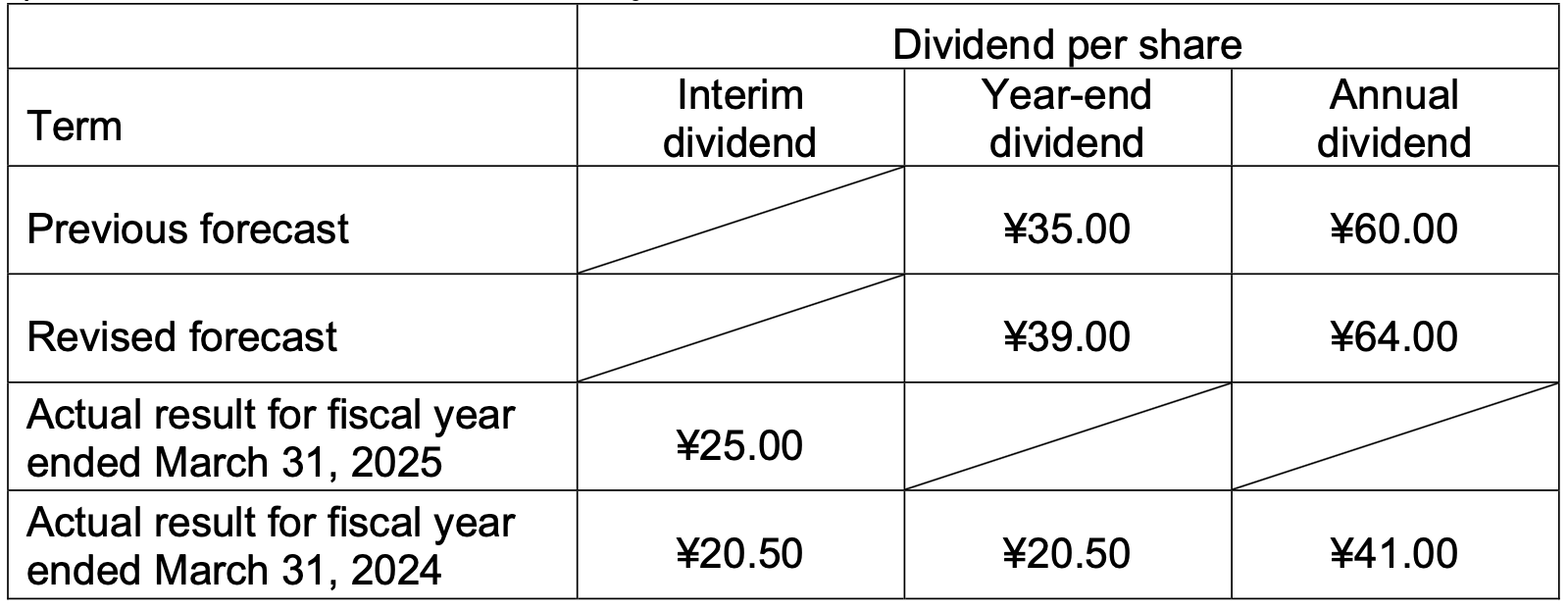

Revision of Dividend Forecast

Reasons for the Revision

MUFG continuously seeks to improve shareholder returns, focusing on dividends in the pursuit of an optimal balance between solid equity capital and strategic investment for growth. Regarding dividends, MUFG aims for a stable and sustainable increase in dividend per share through profit growth. In the MTBP, MUFG will maintain a disciplined capital management approach with a target dividend payout ratio of approximately 40%.

Based on these policies and the revision of the earnings target, MUFG has revised its year-end dividend forecast for the fiscal year ended March 31, 2025 from ¥35.00 to ¥39.00 per share. As a result, the annual dividend for the fiscal year ended March 31, 2025 is forecast to be ¥64.00 per share.