MUFG Second Quarter Financial Results

As Japan's largest megabank, Mitsubishi UFJ Financial Group (MUFG) occupies a central position in both the domestic and global financial landscape. The company's recent disclosure of strong half-year financial results for the fiscal year ending March 2026 provides a clear window into its current operational momentum and strategic progress. This analysis examines these results in detail, evaluates the company's upwardly revised full-year guidance and shareholder return policy, and assesses the key strategic initiatives intended to drive long-term value.

Based on a comprehensive review of MUFG's performance and forward-looking strategy, the MUFG investment thesis is positive. This thesis is underpinned by several key drivers:

- Robust Core Performance: MUFG demonstrated significant strength in its customer-facing segments, with broad-based growth in Net Operating Profits (NOP) across key divisions. This core operational strength is complemented by a favorable interest rate environment and a recovery in treasury income.

- Enhanced Shareholder Returns: Management has signaled strong confidence by significantly increasing its dividend forecast and announcing a historically large share repurchase program, resulting in a total payout ratio of 64% and delivering tangible value directly to investors.

- Strategic Execution and Market Tailwinds: The company is making measurable progress on its Medium-Term Business Plan, particularly in digital innovation and sustainable finance. Furthermore, MUFG is well-positioned to benefit from anticipated monetary policy shifts, such as the potential Bank of Japan (BOJ) rate hike forecasted for early 2026.

The following sections will provide a detailed examination of the financial results and strategic pillars that support this investment thesis.

Analysis of H1/FY2026 Financial Performance

Analyzing the half-year results for the period ending September 30, 2025, is critical to understanding MUFG's current trajectory. These figures offer the most recent evidence of the company's operational health, its ability to execute on its strategic plan, and its resilience in the prevailing global economic environment. The performance in the first half of the fiscal year ending March 31, 2026 (H1/FY26) was exceptionally strong, significantly outpacing the initial full-year targets.

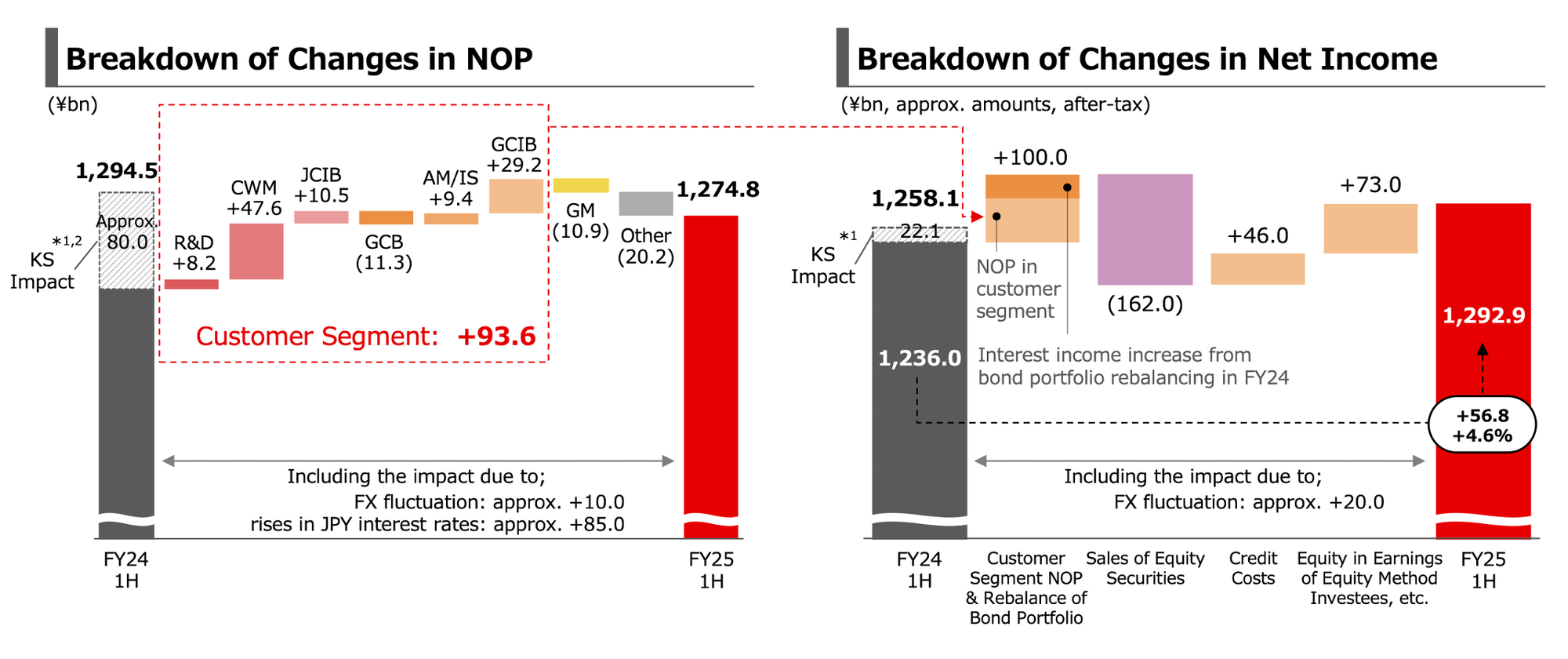

The headline financial results underscore this powerful momentum.

The primary drivers behind this strong performance are multifaceted, reflecting both successful internal execution and favorable market conditions:

- Customer Segment Strength: Net Operating Profits from customer segments grew by a significant ¥93.6 billion, with particularly strong, broad-based growth across key divisions including Retail & Digital (R&D), Commercial Banking & Wealth Management (CWM), Japanese Corporate & Investment Banking (JCIB), and Global Corporate & Investment Banking (GCIB).

- Net Interest Income Growth: The bank benefited from the dual impact of rising JPY interest rates, which improved lending spreads, and the positive effects of the bond portfolio restructuring undertaken in the previous fiscal year.

- Fee and Treasury Income: Fee income demonstrated solid growth, increasing 10% year-over-year for the first half. Concurrently, treasury income, which had declined in the first quarter, recovered strongly in the second quarter, further bolstering profits.

- Equity Method Contributions: Income from equity-method investees was a standout contributor, increasing by a substantial 48% year-over-year. This was driven primarily by the strong and consistent performance of its U.S.-based strategic partner, Morgan Stanley (MS).

- One-Off Gains: The results were also bolstered by notable one-off gains, including approximately ¥27 billion from the JACCS equity stake increase and ¥20 billion related to the consolidation of Tidlor by its affiliate, Bank of Ayudhya.

This robust first-half performance, driven by both core operations and favorable one-offs, provided management with clear justification to upgrade its full-year outlook and enhance capital returns, signaling conviction that the current momentum is sustainable.

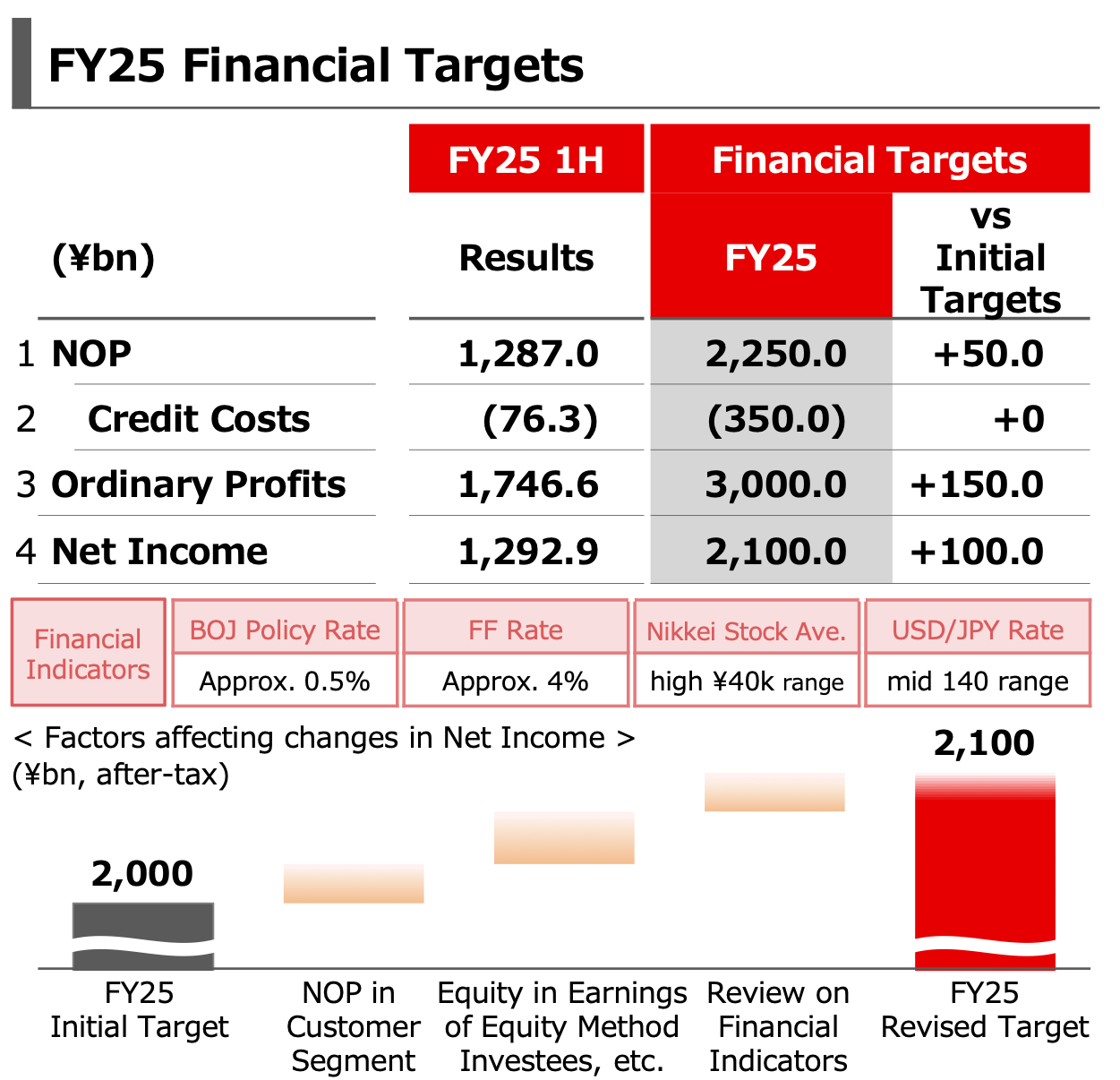

Revised Full-Year Guidance and Enhanced Shareholder Returns

An upward revision to corporate guidance, especially when paired with an increase in shareholder returns, is a powerful signal of management's confidence in the company's sustained profitability and operational strength. MUFG's revised forecasts and capital return policies reflect the strong first-half results and a positive outlook for the remainder of the fiscal year.

The company has raised its earnings target for the fiscal year ending March 31, 2026, by ¥100 billion.

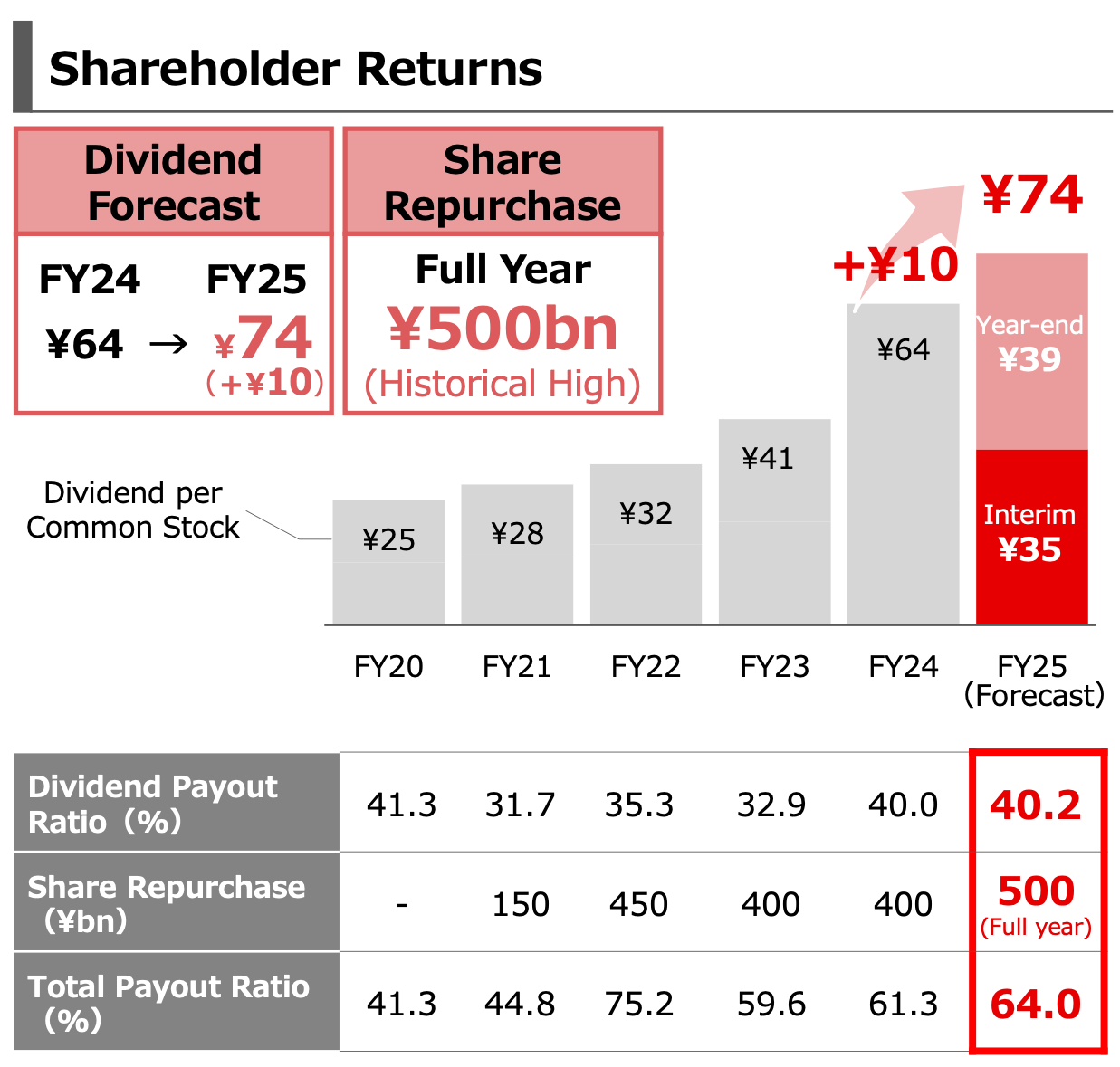

In conjunction with the upgraded profit outlook, MUFG announced a significantly enhanced shareholder return policy, underscoring its commitment to capital discipline and returning value to investors.

- Increased Dividend: The annual dividend forecast has been raised to ¥74.00 per share. This represents a ¥10.00 increase from the ¥64.00 paid in the previous fiscal year and is ¥4.00 higher than the initial forecast of ¥70.00. This aligns with the company's target dividend payout ratio of approximately 40%.

- Share Repurchase Program: A new ¥250 billion share buyback was announced for the second half of the year. This brings the full-year total repurchase program to a historical high of ¥500 billion.

- Total Payout Ratio: The combination of the increased dividend and the substantial share buyback results in a total payout ratio of 64% for the fiscal year, an unequivocal signal of both capital discipline and management’s confidence in the earnings outlook.

These financial forecasts are not merely reactive but are driven by a clear set of underlying strategic initiatives designed to foster long-term, sustainable growth.

Strategic Initiatives and Long-Term Growth Trajectory

While recent financial results are a strong indicator of current health, a comprehensive investment view requires an assessment of the strategic pillars intended to drive future growth and value creation. MUFG's Medium-Term Business Plan (MTBP) is built on three core pillars, and the company is demonstrating measurable progress across each.

- Expand & Refine Growth Strategies: MUFG is successfully expanding its customer base and deepening relationships. The launch of the new "M-tto" service brand in the domestic retail market has yielded impressive results, with new account openings increasing approximately 1.2 times year-over-year and new card issuances doubling over the same period.

- Social & Environmental Progress: The company is making steady progress toward its sustainable finance goals. By the end of H1/FY26, MUFG had achieved a cumulative total of ¥48.6 trillion in sustainable financing, nearly halfway to its ambitious target of ¥100 trillion by the fiscal year ending in 2030.

- Transformation & Innovation: MUFG is actively pursuing its objective of becoming an "AI-Native Company." A strategic collaboration with OpenAI is central to this effort, which includes rolling out ChatGPT Enterprise internally and exploring new AI-integrated services. The company is on track to implement over 250 distinct AI use cases by the end of fiscal year 2026 (ending March 31, 2027).

Looking beyond the current MTBP, MUFG has articulated a clear path toward its mid-to-long-term Return on Equity (ROE) target of approximately 12%. This growth is expected to be fueled by a combination of organic initiatives, inorganic investments, and favorable environmental factors.

- Organic Growth: Key targets include doubling fee income from its Origination & Distribution (O&D) business and achieving 1.6x growth in profit from its Asia business.

- Inorganic Growth: The company has designated specific areas for strategic investment, focusing on Asset Management & Investor Services (AM/IS), expansion in Asia and the U.S., and Digital capabilities.

- Impact from BOJ Rate Hikes: MUFG anticipates a significant positive impact from a normalization of Japanese monetary policy. A potential BOJ policy rate hike from 0.5% to 1.0% is estimated to increase profits by approximately +¥360 billion.

The successful execution of these high-level strategies is dependent on the performance of the individual business units that constitute the group.

Business Segment Performance Review

A segment-level review is essential for understanding the specific sources of profitability and identifying which parts of the business are driving growth. This granular view provides critical insight into the resilience and diversification of MUFG's overall corporate structure. The performance across MUFG's primary business groups in 1H FY26 was broadly positive, with particularly strong results in customer-centric divisions.

Business Group | 1H FY26 Net Operating Profits (NOP) | Year-over-Year (YoY) Change |

Retail & Digital (R&D) | ¥133.2 billion | + ¥7.5 billion |

Commercial Banking & Wealth Management (CWM) | ¥172.1 billion | + ¥49.1 billion |

Japanese Corporate & Investment Banking (JCIB) | ¥289.2 billion | + ¥15.8 billion |

Global Commercial Banking (GCB) | ¥142.2 billion | - ¥11.9 billion |

Global Corporate & Investment Banking (GCIB) | ¥181.5 billion | + ¥14.3 billion |

Asset Management & Investor Services (AM/IS) | ¥72.8 billion | + ¥10.2 billion |

Global Markets | ¥204.7 billion | - ¥8.4 billion |

The standout performers were clearly in the core banking segments. The Commercial Banking & Wealth Management (CWM) group delivered the largest NOP increase of ¥49.1 billion, driven by higher interest income capturing the rise in JPY rates, as well as robust growth in solution-based income from key event deals. The Retail & Digital (R&D) segment also posted a solid NOP increase of ¥7.5 billion, benefiting from higher interest income and growth in its consumer finance business. In the corporate space, Global Corporate & Investment Banking (GCIB) grew NOP on the back of a significant expansion in fee income from project finance and acquisition finance deals. The primary challenges were seen in the Global Markets group, which saw a slight NOP decline due to difficult conditions in fixed income trading, and the Global Commercial Banking (GCB) segment. The notable strength in the CWM and R&D segments, in particular, serves as direct evidence that the strategic focus on the 'M-tto' service brand and deeper wealth management engagement, as outlined in the MTBP, is translating into tangible profit growth.

The robust profitability across MUFG's core customer segments is underpinned by a fortress balance sheet, which provides the stability and capital capacity essential for funding both strategic growth and the newly enhanced shareholder return program.

Balance Sheet and Capital Adequacy Analysis

For a globally significant financial institution like MUFG, a strong balance sheet and robust capital ratios are the bedrock of stability, regulatory compliance, and the capacity for future growth and shareholder returns. MUFG's position as of September 2025 reflects a healthy and resilient financial foundation.

Key balance sheet components include:

- Total Loans: The loan book stood at ¥124.8 trillion, with overseas loans increasing by ¥2.0 trillion since March 2025, indicating continued international business expansion.

- Total Deposits: The deposit base remained vast at ¥227.2 trillion, providing a stable and low-cost funding source.

- Investment Securities: The balance of available-for-sale securities was ¥60.7 trillion.

MUFG's asset quality remains sound, and its capital position is comfortably within its target ranges.

- Asset Quality: Total credit costs for the first half of the year were a modest ¥76.3 billion, indicating benign credit conditions. The consolidated non-performing loan (NPL) ratio was a low 1.01% as of September 2025.

- Capital Adequacy: The bank's Common Equity Tier 1 (CET1) ratio was 14.08%. Excluding unrealized gains on available-for-sale securities, the CET1 ratio stood at 10.5%, placing it at the upper end of the MTBP target range of 9.5-10.5% and demonstrating a strong capital buffer.

This pristine asset quality, with credit costs tracking at only 21% of the full-year forecast, provides a crucial buffer and underpins management’s confidence in raising its earnings guidance.

Conclusion

Mitsubishi UFJ Financial Group's strong performance in the first half of the fiscal year ending in March 2026, underscored by its upgraded full-year guidance and enhanced shareholder return program, demonstrates significant operational momentum. The bank's core customer segments are performing well, and it is effectively capturing the benefits of a changing interest rate environment. While macroeconomic risks persist, MUFG's clear progress on its strategic initiatives in digital transformation, AI adoption, and sustainable finance positions it well for future growth. Combined with a solid balance sheet and a favorable valuation, the analysis supports a positive investment outlook for the company.