MUFG Third Quarter Financial Results

Mitsubishi UFJ Financial Group (MUFG) has demonstrated exceptional strategic resilience through the first nine months of FY2025, navigating a pivot in the domestic macroeconomic environment characterized by yield curve steepening and the initial stages of JPY net interest margin (NIM) expansion. The group’s revised net income target of ¥2.1 trillion is a benchmark of MUFG’s transformed earning power.

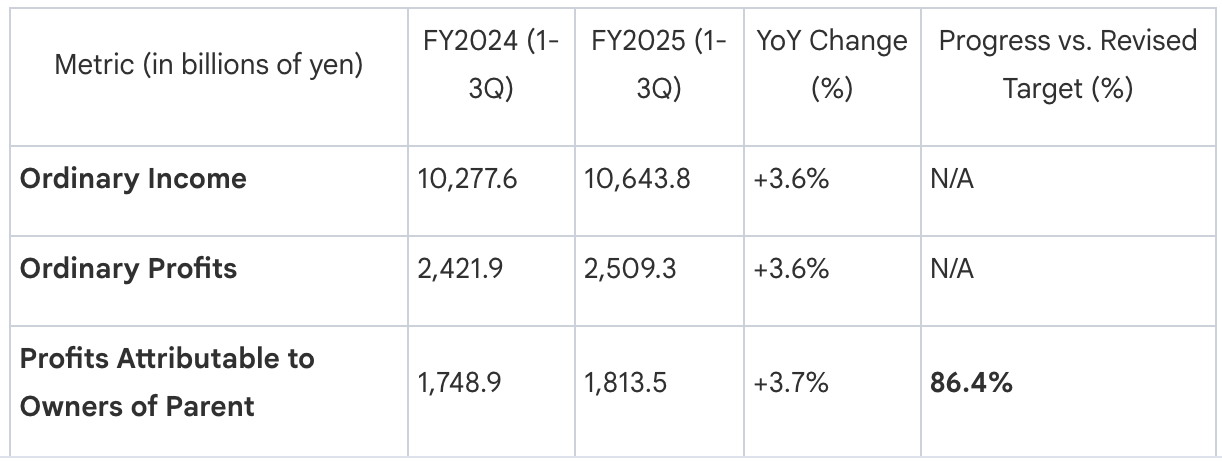

As of the third quarter ending December 31, 2025, MUFG reported a profit attributable to owners of the parent of ¥1,813.5 billion, achieving an 86.4% progress rate against the full-year target. This performance is historically significant; current profit levels are nearly double the peak of ¥1.1 trillion recorded in FY2014, signaling that the group has entered a new era of capital efficiency.

Consolidated Financial Results Comparison (1-3Q)

This trajectory confirms that MUFG is operating at a historic peak. The transition from the "Solid Progress" phase to a definitive pursuit of the ¥2.1 trillion target is underpinned by robust operational drivers, particularly the successful capture of JPY interest rate shifts and sophisticated global balance sheet management.

1. Analysis of Net Operating Profits (NOP) and Core Revenue Drivers

Net Operating Profit (NOP) remains the most accurate barometer of MUFG’s core lending and service-based health. For the 1-3Q period, the group delivered a total NOP of ¥1,905.9 billion, a substantial increase of ¥275.0 billion year-over-year.

1.1 NIM Expansion and Strategic Rebalancing

The growth was fundamentally led by the Customer Segment, which added ¥155.7 billion to NOP. Crucially, analytical synthesis reveals that ¥120.0 billion of this increase was directly attributable to the capture of rising JPY interest rates, reflecting the group’s sensitivity to the Bank of Japan’s policy shifts.

Furthermore, the bond portfolio rebalancing executed in the prior fiscal year has paid significant dividends. By aggressively managing duration positioning and flushing out low-yield holdings, the group has successfully enhanced the yield-generating capacity of its portfolio. This proactive duration management allowed MUFG to mitigate the volatility inherent in foreign bond markets while positioning the balance sheet to benefit from domestic rate normalization.

1.2 Operational Efficiency

The group’s efficiency remains a pillar of its strategy. While General & Administrative (G&A) expenses rose to ¥2,563.2 billion, this was largely a function of external factors, including an approximate +¥30.0 billion FX impact, overseas acquisitions, and global inflation. Despite these headwinds, the expense ratio improved from 58.3% to 57.3%. This 1.0 percentage point reduction is a critical indicator of MUFG's ability to scale revenue faster than its cost base through digital transformation and streamlined operations.

2. Segmental Performance: Global Markets and Digital Business Transformation

MUFG’s segmental agility has been paramount in capitalizing on diverging global economic cycles. The following business groups provided the momentum for the Q3 results:

- Global Markets: This segment achieved a massive turnaround, led by a strategic swing in Treasury performance.

- Core Differentiator: Treasury NOP executed a significant reversal, moving from a loss of ¥7.3 billion in FY2024 to a gain of ¥165.0 billion in FY2025. This was the primary engine of the Markets group, driven by superior duration management and interest rate positioning.

- Commercial Banking & Wealth Management (CWM): Growth was robust, with NOP rising by ¥70.7 billion.

- Core Differentiator: The segment’s performance was anchored by ¥81.7 billion in loan/deposit interest income growth, the lion's share of its profit increase, demonstrating effective NIM capture in the domestic corporate sector.

- Retail & Digital Business (R&D): NOP increased by ¥18.4 billion through the "Real x Remote x Digital" strategy.

- Core Differentiator: A strategic shift toward high-margin digital channels and automated service models is successfully lowering the cost-to-serve while maintaining customer engagement across remote platforms.

3. Asset Quality, Credit Costs, and Capital Efficiency

MUFG continues to maintain a high-quality balance sheet, evidenced by a Non-Performing Loan (NPL) ratio of 0.98%, a marked improvement from 1.11% in March 2025.

3.1 Credit Costs and Technical Adjustments

Total credit costs were reported at ¥219.7 billion, remaining within the group’s initial outlook. However, a granular technical analysis reveals a specific "KS Impact" (Krungsri) resulting from a change in the closing period of consolidated financials. This adjustment accounted for ¥160.5 billion of the overseas credit cost increase. Excluding this technical variance, the underlying credit environment remains stable.

3.2 RWA Optimization: Equity Holdings Strategy

MUFG is aggressively pursuing a reduction in equity holdings to improve capital efficiency and adhere to its Medium-Term Business Plan (MTBP).

- Progress: Cumulative sales reached ¥362 billion (acquisition cost basis).

- Strategic Revision: The group has increased its total expected sales target for the MTBP period to ¥557 billion, moving toward the final ¥700 billion goal.

- The "So What?": This is a deliberate Risk-Weighted Asset (RWA) optimization strategy. By divesting these shares, MUFG is reducing market risk exposure and freeing up capital for redeployment into growth-accretive investments or shareholder returns.

3.3 Loan Dynamics

Total loans rose to ¥131.8 trillion, an increase of ¥8.9 trillion from March 2025. While overseas growth was ¥6.7 trillion, ¥3.4 trillion was due to FX translation. Excluding currency effects, the underlying overseas loan growth of ¥3.3 trillion reflects healthy demand in international markets.

4. Strategic Outlook and Future Implications

MUFG’s "Solid" health is reinforced by its strategic partnerships. Equity in earnings of equity method investees contributed ¥582.9 billion to ordinary profits. Of this, the partnership with Morgan Stanley remains the cornerstone, contributing ¥465.6 billion to the group's net income.

4.1 Strategic Priorities for Q4 and Beyond

Based on the 1-3Q data, the following strategic priorities should ensure continued outperformance:

- NIM Expansion Capture: Aggressively manage domestic deposit and lending spreads as JPY rates continue to trend upward to maximize net interest income.

- RWA Management & Capital Velocity: Maintain the momentum of equity holding divestments to further optimize the group's ROE, which currently sits at 11.5%.

- Global Treasury Optimization: Continue the disciplined management of the bond portfolio duration to protect gains against future shifts in global yield curves.

4.2 Final Assessment

With an 86.4% progress rate and a Treasury segment that has successfully pivoted from a loss-making to a profit-generating engine, MUFG is exceptionally well-positioned to reach its ¥2.1 trillion net income target. The group's current trajectory suggests it is on track for a record-breaking fiscal year.