MUFG to Establish a Universal Bank in the European Union

The strategic positioning of Japanese financial institutions within the European Union has changed substantially in the decade following the global financial crisis, further accelerated by the United Kingdom’s withdrawal from the European Union (Brexit). Within this shifting geopolitical and regulatory environment, Mitsubishi UFJ Financial Group (MUFG)—Japan’s largest financial institution—has executed a meticulous calibration of its legal entity structure to ensure continuity of access to the Single Market while optimizing capital efficiency and regulatory compliance. At the heart of this European strategy lies MUFG Bank (Europe) N.V. (MBE), a distinct legal entity domiciled in the Netherlands.

The analysis of MBE's structural identity reveals a dual-track strategy: utilizing a fully capitalized Dutch subsidiary to passport commercial banking services across the European Economic Area (EEA), while simultaneously retaining direct branches of the Japanese parent bank in specific jurisdictions to leverage the colossal balance sheet of the global group. Furthermore, MBE is being transformed from a specialized commercial lender into a "Universal Bank" through the impending absorption of MUFG’s securities operations—a move that signifies the maturation of MUFG’s European business model into a fully integrated financial services platform. Pursuant to relevant approvals, this realignment is planned for the 2026/27 fiscal year.

1. The Macro-Structural Hierarchy: Positioning within Mitsubishi UFJ Financial Group

To accurately locate MUFG Bank (Europe) N.V., one must first navigate the overarching architecture of Mitsubishi UFJ Financial Group, a Global Systemically Important Bank (G-SIB) subject to the rigorous supervision of the Japanese Financial Services Agency (FSA) and international standards bodies. The group operates through a holding company structure, Mitsubishi UFJ Financial Group, which sits at the apex of the corporate hierarchy. Beneath this listed entity lie the core operating subsidiaries, primarily divided into banking, trust banking, and securities verticals.

1.1 The Line of Control and Ownership

The ownership lineage of MBE is linear, reflecting a clear chain of command designed to facilitate capital flow and strategic alignment.

- Ultimate Parent: Mitsubishi UFJ Financial Group (Tokyo).

- Intermediate Parent: MUFG Bank (Tokyo).

- Subject Entity: MUFG Bank (Europe) N.V. (Amsterdam).

It is a critical distinction that MBE is a direct, wholly-owned subsidiary of MUFG Bank, the commercial banking arm, rather than a direct subsidiary of the holding company. This structural nuance is vital for credit analysis; MBE is legally tethered to the core banking unit, benefiting from the operational support and implied parental guarantee of one of the world's largest bank balance sheets. Unlike a branch, however, MBE is a separate legal person with its own equity capital, its own board of directors, and its own regulatory reporting obligations. This "subsidiary" status creates a ring-fenced pool of capital and liquidity within the Eurozone, satisfying the requirements of the European Central Bank (ECB) and De Nederlandsche Bank (DNB) for a resolvable, locally supervised entity.

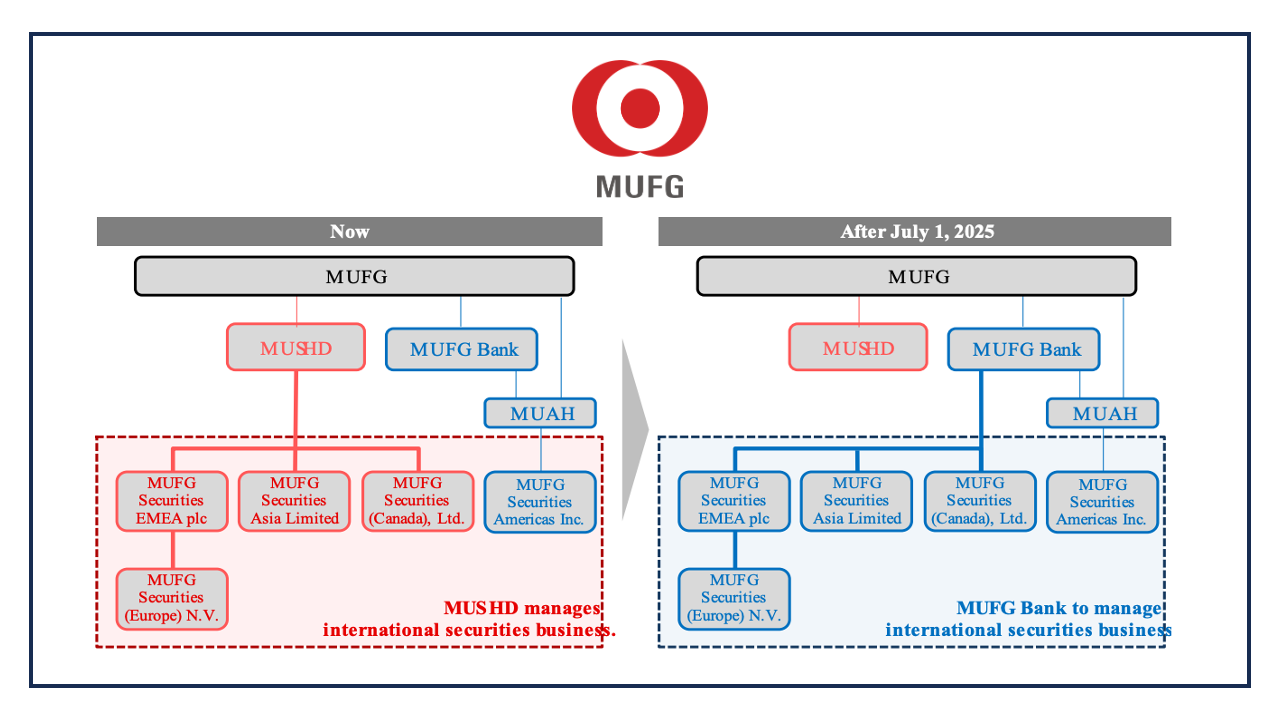

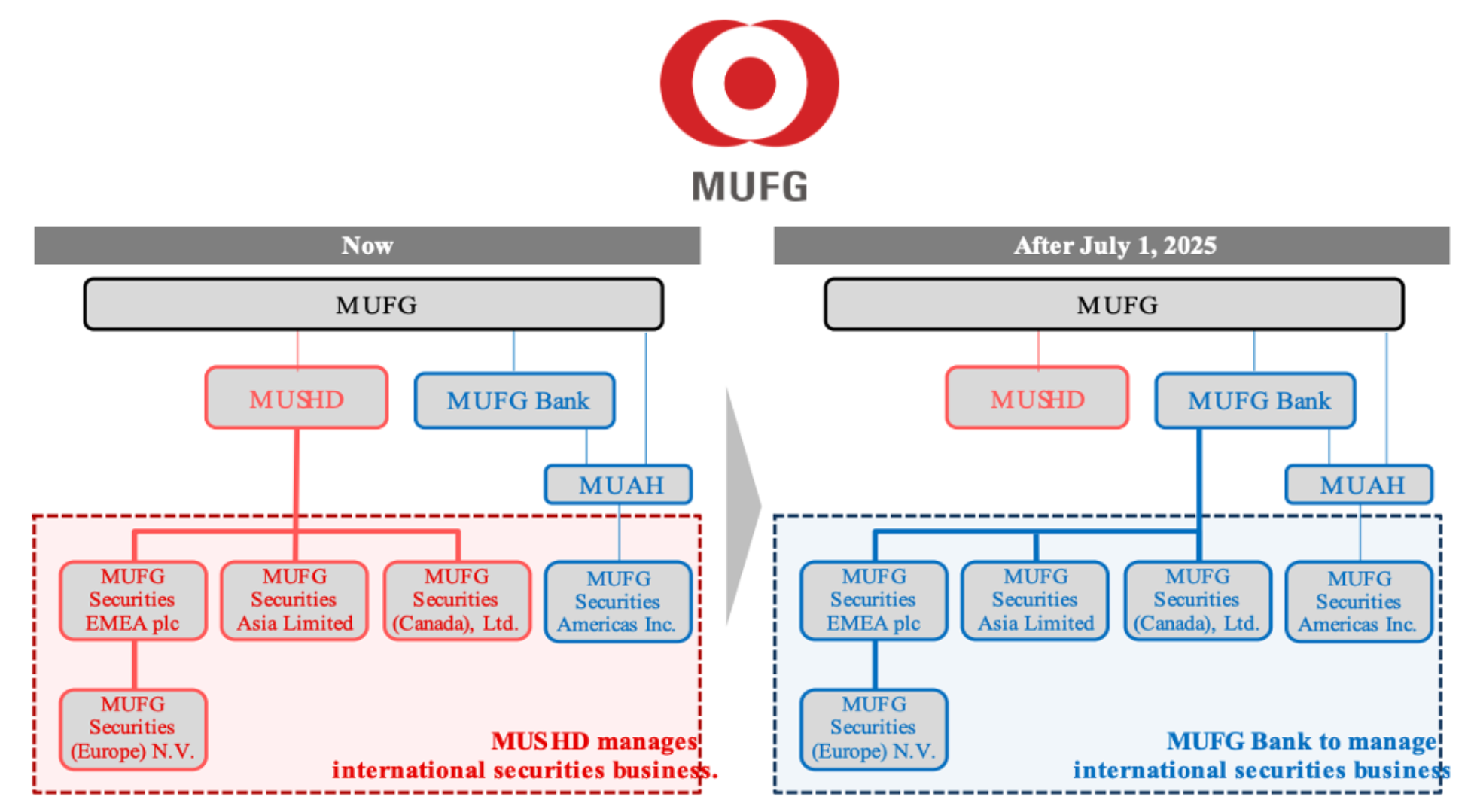

1.2 The Global Reorganization of the Securities Vertical

A significant structural realignment has been executed in 2025, directly impacting the context in which MBE operates. Traditionally, MUFG’s global operations were siloed: the commercial bank (MUFG Bank) and the securities business (Mitsubishi UFJ Securities Holdings - MUSHD) operated as parallel verticals under the holding company. This separation was often mirrored in overseas markets, leading to fragmented client service where a corporate client had to deal with separate legal entities for lending (Bank) and bond issuance (Securities).

However, in a move to create a more integrated "Global Corporate & Investment Banking" (GCIB) model, MUFG Bank has acquired 100% of the shares of the overseas securities subsidiaries—including MUFG Securities EMEA plc and MUFG Securities (Europe) N.V.—which were previously owned by MUSHD. This shift transformed the securities entities from "cousins" of the commercial bank into direct "siblings" or subsidiaries of the commercial bank.

For MBE, this reorganization is the precursor to an even deeper integration: the merger of the EU securities entity directly into the EU banking entity to form a Universal Bank. This strategic trajectory confirms that MBE is not merely a static asset but the designated survivor entity for MUFG’s consolidated European ambitions.

2. Legal Entity Architecture of MUFG Bank (Europe) N.V.

The specific legal attributes of MBE define its governance obligations, its liability profile, and its operational capabilities.

2.1 Domicile and Corporate Form

MUFG Bank (Europe) N.V. is incorporated under the laws of the Netherlands.

- Statutory Name: MUFG Bank (Europe) N.V.

- Legal Form: Naamloze Vennootschap (N.V.).

- Registered Office: Strawinskylaan 1887, 1077 XX Amsterdam, The Netherlands.

- Chamber of Commerce (KvK) Number: 33132501.

The choice of the Naamloze Vennootschap structure—essentially a public limited liability company—is standard for major financial institutions in the Netherlands. While the term "public" implies the capacity to issue shares to the public, in MBE's case, the shares are closely held by the Japanese parent. This corporate form imposes strict requirements regarding capital protection, shareholder rights, and the publication of annual accounts, ensuring a high degree of transparency. The bank operates under a full banking license granted by the DNB, which is "passported" outwards to other EU member states, allowing it to provide cross-border services without establishing separate subsidiaries in each country.

2.2 The Subsidiary Network within MBE

MBE itself acts as a sub-holding company for a small cluster of entities, creating a localized consolidation group.

- MUFG Funding (UK) Limited: A wholly-owned subsidiary based in the United Kingdom. This entity is typically utilized for specific funding activities, such as the issuance of commercial paper or medium-term notes, leveraging English law which is often preferred by international investors for debt securities. Its existence post-Brexit as a subsidiary of a Dutch bank highlights the continued importance of London as a financial toolbox, even for EU-centric groups.

- MUFG Europe Lease (Deutschland) GmbH (i.L.): Based in Dusseldorf, Germany. The "i.L." designation (in Liquidation) signals that this entity is being wound down. Historically, Japanese banks maintained specific leasing subsidiaries to support the export of Japanese machinery and capital goods. The liquidation of this entity suggests a strategic streamlining, with leasing activities either being discontinued or folded into the main corporate banking product suite offered directly by the German branch of MBE.

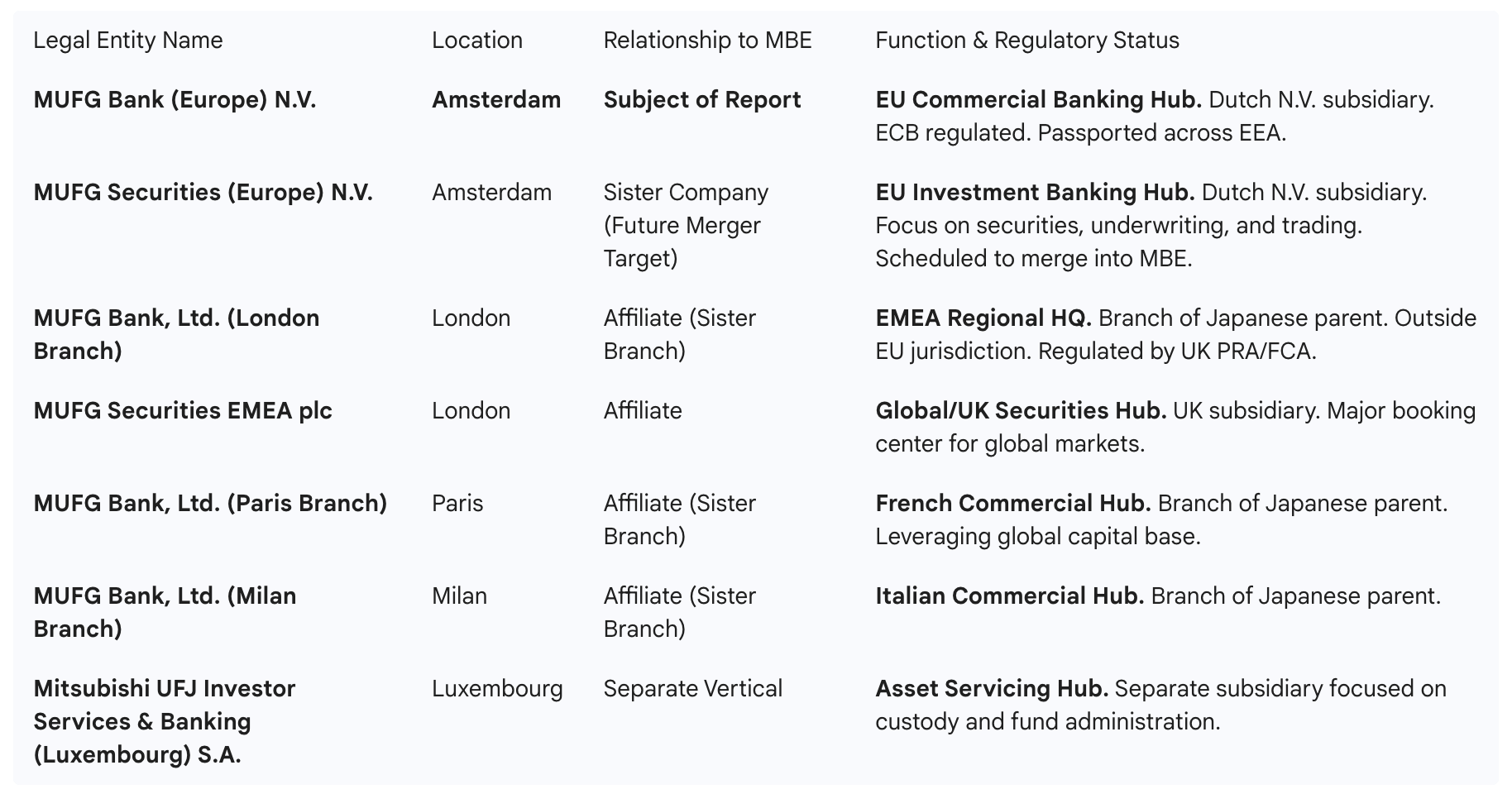

It is crucial to note that Mitsubishi UFJ Investor Services & Banking (Luxembourg) S.A. (MIBL) is not a subsidiary of MBE. MIBL is a separate Luxembourgish entity focused on asset servicing and custody, sitting parallel to the commercial bank structure. This distinction prevents the commingling of the custody business's fiduciary risks with the commercial bank's credit risks.

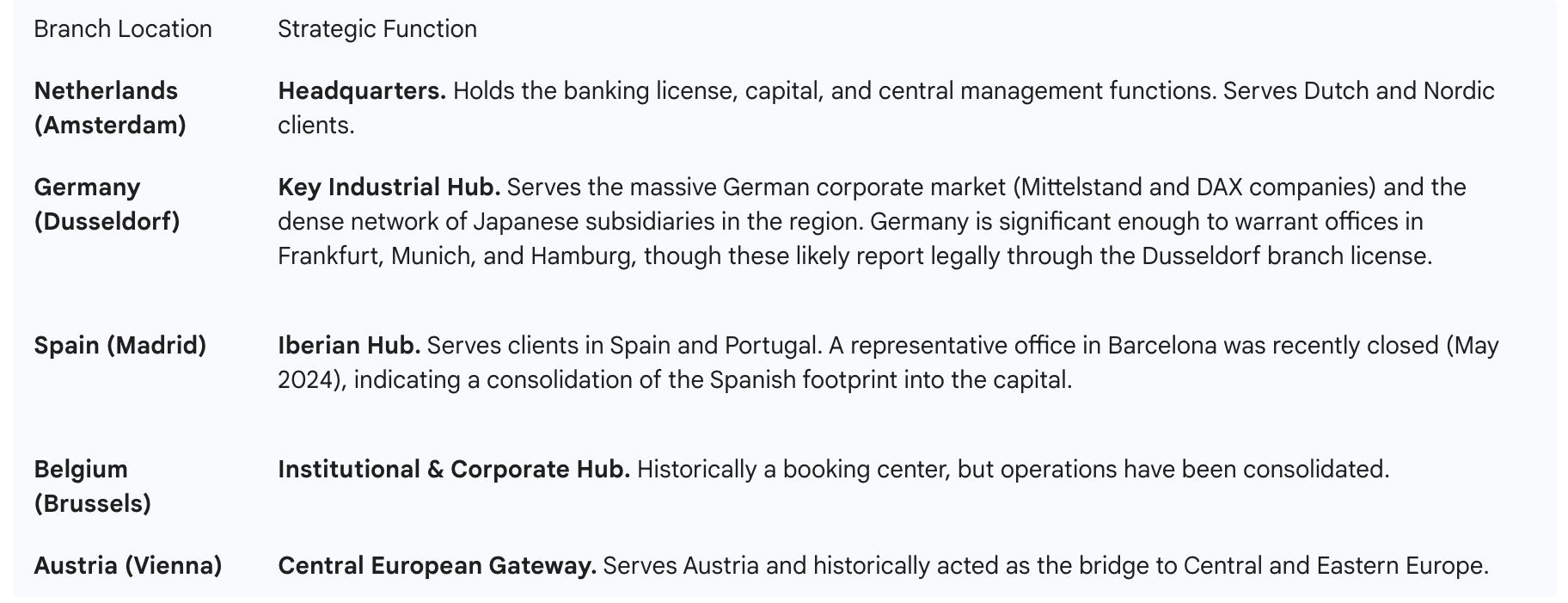

3. The Branch Network: The "Hub and Spoke" Operating Model

MUFG Bank (Europe) N.V. employs a centralized "Hub and Spoke" operating model to serve the European continent. In this configuration, Amsterdam serves as the central hub for capital, risk management, regulatory reporting, and back-office processing, while the branches act as the front-office "spokes" for client relationship management and local origination.

3.1 The Active Branch Footprint

The bank’s passported branch network is strategically concentrated in Western Europe’s core economies:

3.2 Network Optimization and Rationalization

In recent years, MBE has aggressively optimized this network, shifting away from a widespread physical presence toward a more centralized model. This is evidenced by the closure of its branches in Poland and the Czech Republic (Prague). These closures, executed around 2022/2023, reflect a strategic calculation that the cost of maintaining local regulatory interfaces in these smaller markets outweighed the benefits, especially when clients could be served remotely from Vienna or Germany under the freedom to provide services.

Furthermore, the Brussels Branch has undergone a functional shift. While the physical office remains to maintain client relationships, the "booking" of assets—the legal recording of loans on the balance sheet—has been consolidated into the Amsterdam Head Office. This "remote booking" model is increasingly common in global banking as it simplifies the balance sheet, reduces the fragmentation of capital, and streamlines regulatory reporting to the ECB.

3.3 The Critical Distinction: Paris and Milan

A source of frequent confusion in analyzing MUFG’s European structure is the status of its offices in Paris and Milan. These are NOT branches of MUFG Bank (Europe) N.V. Instead, they operate under a dual-track legal structure that allows MUFG to arbitrage the benefits of different legal forms.

- Paris: The Paris operation is structured as a Branch of MUFG Bank (Tokyo). It is regulated by the French Autorité de Contrôle Prudentiel et de Résolution (ACPR) but relies on the capital of the Japanese parent.

- Why this matters: By operating as a branch of the Japanese parent, the Paris office can underwrite loans based on the massive global capital base of MUFG Bank, rather than the smaller capital base of the Dutch subsidiary (MBE). This is essential for participating in the large syndicated loans required by French multinational giants (CAC 40 companies).

- Dual Presence: Alongside the banking branch, Paris also hosts a branch of MUFG Securities (Europe) N.V.. This securities branch is a Dutch entity (currently separate from MBE), regulated by the Autorité des Marchés Financiers (AMF).

- Milan: Similarly, the Milan office is a Branch of MUFG Bank (Tokyo). It is supervised by the Bank of Italy but is legally an extension of the Tokyo headquarters.

- Context: Established nearly 50 years ago, this branch status is a legacy of the era before the Single Market, but it has been retained to support the specific needs of Italian corporate clients and Japanese investors in Italy.

This hybrid network—using MBE (Dutch N.V.) for the majority of the EU, but direct Japanese branches for France and Italy—allows MUFG to offer the "best of both worlds": the passporting convenience of a European bank and the sheer lending power of a Japanese mega-bank.

4. Strategic Transformation: The Creation of the "Universal Bank"

The most forward-looking aspect of MBE’s structure is its designated role in MUFG’s "Universal Bank" strategy. Currently, MUFG operates a bifurcated model in the EU:

- Commercial Banking: MUFG Bank (Europe) N.V. (Lending, Transaction Banking).

- Investment Banking: MUFG Securities (Europe) N.V. (Bond Underwriting, Sales & Trading).

4.1 The Merger Trajectory

MUFG has formally announced plans to merge these two entities. MUFG Securities (Europe) N.V. will be absorbed into MUFG Bank (Europe) N.V., with the latter being the surviving legal entity.

- Headquarters of Combined Entity: Amsterdam.

- Target Timeline: The merger is expected to be completed during the Japanese Fiscal Year ending March 2027 (FY2026), implying a completion date likely in late 2026 or early 2027.

- Management: The current President of MBE, Harm Bots, is slated to lead the combined entity, underscoring that the banking entity is the acquirer.

4.2 Rationale and Implications

This merger is not merely administrative; it fundamentally alters the legal nature of MBE.

- Capital Efficiency: Currently, MUFG must capitalize both the bank and the securities firm separately. Merging them allows for a shared capital pool. Excess capital from the lending business can support market risk in the trading business, and vice versa.

- Client Experience: Clients will face a single legal counterparty for all products. A corporate treasurer can sign one master agreement that covers both their revolving credit facility and their interest rate swaps or bond mandates.

- Operational Simplicity: The merger eliminates the duplication of governance structures. Instead of two Supervisory Boards, two Audit Committees, and two Risk Committees in Amsterdam, there will be one unified governance stack.

This transition mirrors the structure of European "Universal Banks" (like Deutsche Bank or BNP Paribas) and signifies MUFG's intent to compete on equal footing with these local incumbents, rather than operating as a niche foreign lender.

5. Governance Architecture: The Dutch Two-Tier Model

As a Dutch public limited company, MBE operates under a governance regime that is structurally distinct from the Anglo-American "Unitary Board" model used by its UK sister entity or its Japanese parent. The Dutch Civil Code mandates a strict "Two-Tier Board" structure, designed to ensure independent oversight.

5.1 The Management Board (Raad van Bestuur)

The Management Board (MB) constitutes the executive leadership of the bank.

- Function: It is responsible for the day-to-day management of the bank, the formulation of strategy, and the realization of the bank's objectives. It bears collective responsibility for the bank’s risk profile and compliance.

- Composition: The MB typically consists of the Chief Executive Officer (CEO), Chief Financial Officer (CFO), Chief Risk Officer (CRO), and other key functional heads. The current CEO, Harm Bots, represents the bridge between the local Dutch operations and the global Japanese parent strategy.

5.2 The Supervisory Board (Raad van Commissarissen)

The Supervisory Board (SB) sits above the Management Board.

- Function: Its role is strictly non-executive. It supervises the policy of the Management Board and the general course of affairs of the bank. It advises the MB but does not manage the bank. Crucially, the SB has the power to appoint, suspend, and dismiss members of the Management Board (subject to shareholder approval).

- Composition: The SB is composed of a mix of representatives from the MUFG parent (ensuring strategic alignment) and independent members (ensuring local regulatory compliance and independent judgment). The Chair of the SB is a pivotal role in mediating between Dutch regulatory demands and Tokyo's corporate directives.

5.3 The Committee Ecosystem

To effectively discharge its duties, the Supervisory Board delegates detailed oversight to a comprehensive ecosystem of committees that govern the bank’s operations:

- Audit, Compliance & Risk Management Committee (ACRMC): This is the most critical supervisory committee. It meets separately with the Internal Audit division, the External Auditor, the CRO, and the Chief Compliance Officer. This direct line of communication ensures that the supervisors hear "unfiltered" news about the bank's health, bypassing the CEO if necessary.

- Risk Management Committee: Focuses specifically on the bank’s risk appetite, credit portfolio, and market risk exposures.

- Credit Committee: adjudicates on large loan exposures, acting as the final gatekeeper for credit risk before it hits the balance sheet.

- Asset Liability Management (ALM) Committee: Manages the bank’s balance sheet structure, liquidity risk, and interest rate risk. This committee is vital for managing the "maturity transformation" inherent in banking.

- Client Acceptance & Review Committee: Given the intense regulatory focus on financial crime, this committee oversees the Know Your Customer (KYC) and Anti-Money Laundering (AML) processes, approving high-risk client relationships.

- Outsourcing Committee: As MBE relies heavily on "outsourced" services from MUFG Bank (Tokyo) and MUFG Bank (London) for IT and operations, this committee monitors the service level agreements (SLAs) to ensure the bank retains control over its critical functions, a key requirement of the ECB.

This elaborate governance structure provides a regulatory firewall. It ensures that while MBE is owned by Tokyo, it is governed in Amsterdam, with the autonomy to say "no" to the parent if a directive conflicts with Dutch law or threatens the local entity's solvency.

6. Operational Framework and Financial Reporting

6.1 Financial Reporting Standards

MBE prepares its financial statements in accordance with International Financial Reporting Standards (IFRS) as adopted by the European Union. This aligns its reporting with its European peers and its Japanese parent (which also utilizes IFRS/US GAAP for various global reporting lines). The bank’s fiscal year runs from April 1 to March 31, synchronizing with the Japanese financial year. This alignment facilitates the seamless consolidation of MBE’s results into the global MUFG group accounts.

6.2 The "Medium-Term Business Plan" (MTBP)

The strategic direction of MBE is governed by a rolling three-year Medium-Term Business Plan (MTBP), which is cascaded down from the global group strategy. The bank has recently transitioned from the FY21-FY23 plan—which focused on "reshaping and reorganizing" (e.g., closing Polish/Czech branches)—to the FY24-FY26 plan.

- Current Strategic Pillars: The current plan focuses on "growth," "optimization," and "solidifying the platform". This implies a shift from defensive restructuring to offensive market share acquisition, particularly in the lead-up to the Universal Bank merger.

- Financial Resilience: The bank has reported a return to profitability and is focused on diversifying its income streams beyond pure net interest income, looking towards fee-based businesses.

6.3 Sustainability and ESG Integration

A notable evolution in the bank’s governance is the formal integration of sustainability. MBE has published a dedicated "Sustainability Statement" and is preparing for the Corporate Sustainability Reporting Directive (CSRD).

- Structural Integration: Sustainability is no longer a peripheral "CSR" activity but a core component of the Management Board’s fiduciary duties. The bank is integrating climate risk into its credit adjudication process and actively engaging with clients on their transition strategies.

- Strategy: The MTBP explicitly targets "Sustainable Finance" as a growth engine, aligning with the EU’s Green Deal and the high demand for green bonds and sustainability-linked loans among European corporates.

7. Regulatory Compliance and International Obligations

As a cross-border entity, MBE sits at the intersection of multiple regulatory regimes.

7.1 Single Supervisory Mechanism (SSM)

MBE falls under the direct supervision of the European Central Bank (ECB) within the Single Supervisory Mechanism. This classification is due to the "significant" nature of MUFG’s aggregate presence in the EU. The ECB supervises the bank’s capital adequacy (ICAAP), liquidity (ILAAP), and governance. The De Nederlandsche Bank (DNB) acts as the national competent authority, assisting the ECB and supervising conduct and AML compliance.

7.2 MiFID II and Market Conduct

For its investment services (and the future securities business), MBE is subject to MiFID II (Markets in Financial Instruments Directive). The research highlights a specific regulatory nuance regarding the "Systematic Internaliser" (SI) regime: MUFG Bank and MUFG Securities EMEA plc discontinued their SI status, limiting their ability to provide certain investment services to retail clients. This reflects a broader strategic decision to focus MBE almost exclusively on Professional Clients and Eligible Counterparties (corporates and institutions), exiting the high-regulatory-cost retail segment.

7.3 Extraterritorial US Regulations (Dodd-Frank / Patriot Act)

Despite being a European entity, MBE is enmeshed in US regulations due to the global nature of MUFG.

- Patriot Act: As a foreign bank with correspondent accounts in the US (via its parent), MBE must certify its compliance with the US Patriot Act, confirming it is not a shell bank and has a physical presence.

- Dodd-Frank: The securities entities associated with the group are registered as Swap Dealers. While MBE is a non-US entity, its derivatives dealings with US persons bring it into the orbit of the CFTC and SEC.

8. Comparative Entity Table: Navigating the "Name Alikes"

To provide absolute clarity, the following table distinguishes MBE from the other MUFG entities that often cause confusion in legal and operational contexts.

9. Conclusion: A Pillar of Stability in a Fragmented Landscape

The analysis of MUFG Bank (Europe) N.V. reveals an entity that is far more than a mere satellite office of a Tokyo giant. It is a sophisticated, independently governed, and strategically vital fortress within MUFG’s global empire.

In the post-Brexit era, MBE has ascended to become the primary guarantor of MUFG’s access to the European Single Market. Its legal structure—a Dutch N.V. with a passported branch network—provides the necessary regulatory certainty for clients. The bank’s governance architecture, defined by the rigorous Dutch two-tier board system, ensures that it maintains a distinct corporate personality and risk culture, insulated yet aligned with its parent.

Looking ahead, the transformation of MBE into a Universal Bank by 2027 represents the final act in its maturation. By absorbing the securities business, consolidating its branch booking models, and shedding peripheral operations in Central Europe, MBE is streamlining itself into a potent competitor. It is evolving from a lender-of-choice for Japanese subsidiaries into a comprehensive, pan-European financial services platform capable of servicing the continent's largest corporations with a full spectrum of debt, equity, and transaction banking products. For the MUFG group, MBE is the anchor of its European ambition.