MUFG to Launch Tokenized Money Market Fund

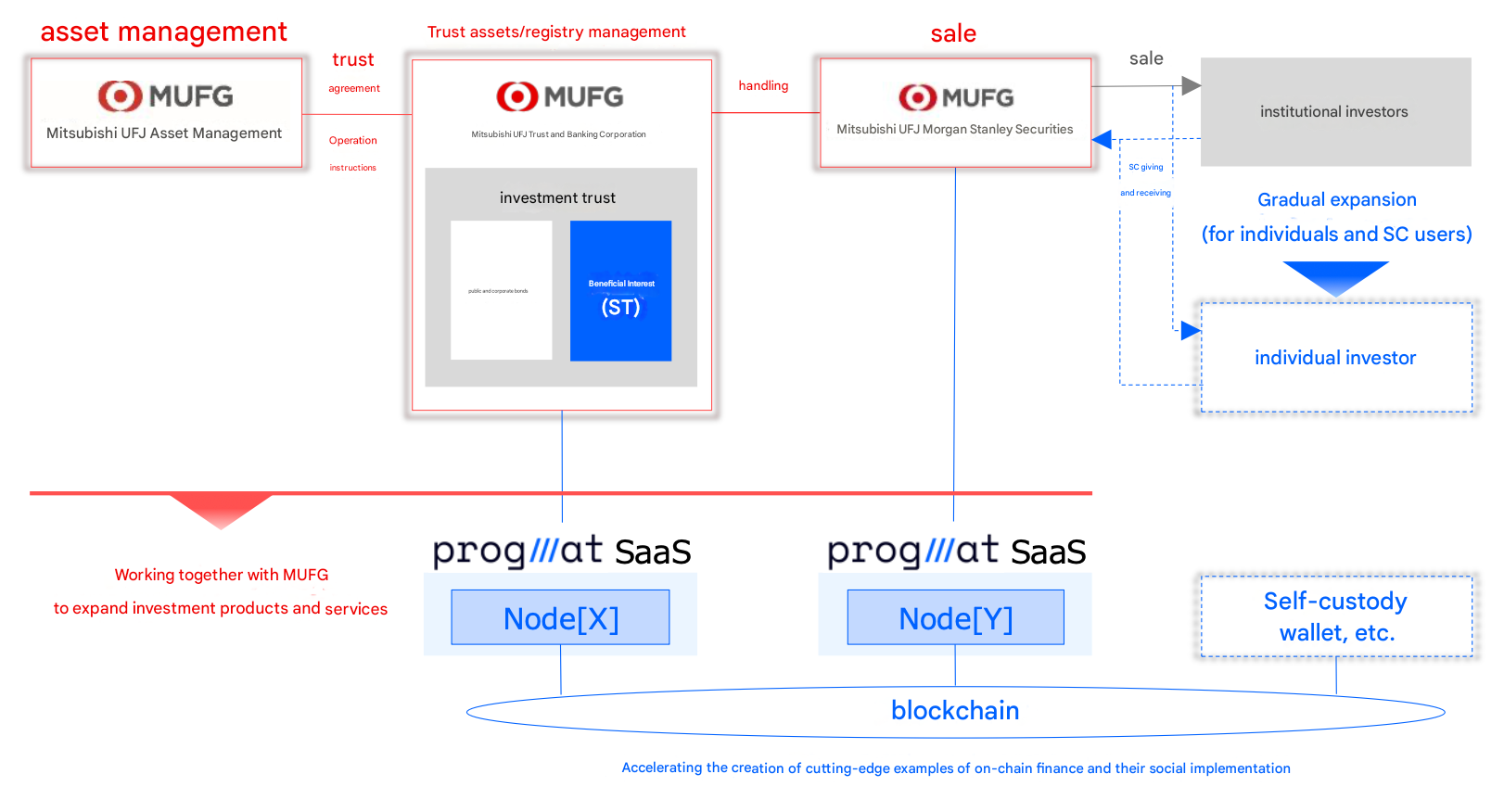

Mitsubishi UFJ Asset Management, Mitsubishi UFJ Morgan Stanley Securities, and Mitsubishi UFJ Trust and Banking, together with Progmat, will commence collaboration on infrastructure development for a "Tokenized Money Management Fund" as the first step toward developing Japan's first tokenized investment trust.

1. Background for Moving to TMMF Infrastructure Development

Overseas, many financial products have been tokenized, and the market for tokenized financial products continues to expand. In particular, money market funds overseas have already reached a scale exceeding $8.5 billion (approximately 1.3 trillion yen), becoming one of the core elements of the digital asset market.

In Japan as well, financial products tokenized as security tokens (ST) have emerged in real estate and corporate bonds, with expectations for future market expansion. Yen-denominated Money Management Funds (MMF) had previously suffered from declining investor demand and poor performance due to the negative interest rate policy and other factors, leading to their disappearance from the domestic market.

However, as Japan returns to a world with interest rates, and considering the results organized in the "On-Chain Complete ST WG Report" by the Digital Asset Co-Creation Consortium, for which Progmat serves as the secretariat, MMFs in Japan could become a viable option for investors who prioritize capital efficiency. Therefore, in anticipation of growing investor demand and with the aim of establishing a system that can respond swiftly, MUFG has decided to commence collaboration on TMMF infrastructure development.

2. Roles of Each Company and Future Plans

Following the TMMF infrastructure development, the planned role allocation among the relevant companies is as follows:

First, MUFG will proceed with preparations aiming to provide Japan's first yen-denominated TMMF to institutional investors in 2026. In the future, MUFG will also consider gradual expansion of target customers and product lineups, including offerings for individual investors.

Additionally, in recent years, momentum has been growing both domestically and internationally for the issuance and circulation of stablecoins (hereinafter, SC). While SCs suppress price volatility risk by pegging their value to fiat currency and enable instant settlement on blockchain, they have a structural constraint of "no direct interest payment." Therefore, from an asset management perspective, collaboration with other tokenized assets is key. By tokenizing investment trusts and enabling seamless movement and exchange with SCs, MUFG can expect an improved value provision.

Through this collaboration, Mitsubishi UFJ Asset Management, Mitsubishi UFJ Morgan Stanley Securities, and Mitsubishi UFJ Trust and Banking will expand investment products and services leveraging tokenization expertise, aiming to become a financial group trusted by a wider range of customers.

Progmat, utilizing its No. 1 track record in the domestic ST market in terms of transaction scale, number of cases, and number of companies using the service, as well as its SC collaboration expertise, will promote the creation of cutting-edge examples in on-chain finance and social implementation through various collaborations beyond capital affiliations.