Neo First Life to Introduce New AI-Based Advanced Detection of Fraudulent Claims

Neo First Life Insurance, a member of the Dai-ichi Life Group, announced a new AI-based system that detects potential fraudulent insurance claims early, which will be gradually introduced from June to October 2025.

In recent years, insurance claims suspected to be fraudulent have become increasingly complex and sophisticated. Dealing with moral risk is a critical challenge for the life insurance industry, ensuring that policyholders can utilize insurance in a fair and sustainable manner.

The Dai-ichi Life Group, aiming to establish itself as a "global top-tier insurance group" by 2030, has committed to digital transformation including the internal development of digital organizational capabilities and the adoption of data-driven business operations in its new medium-term management plan.

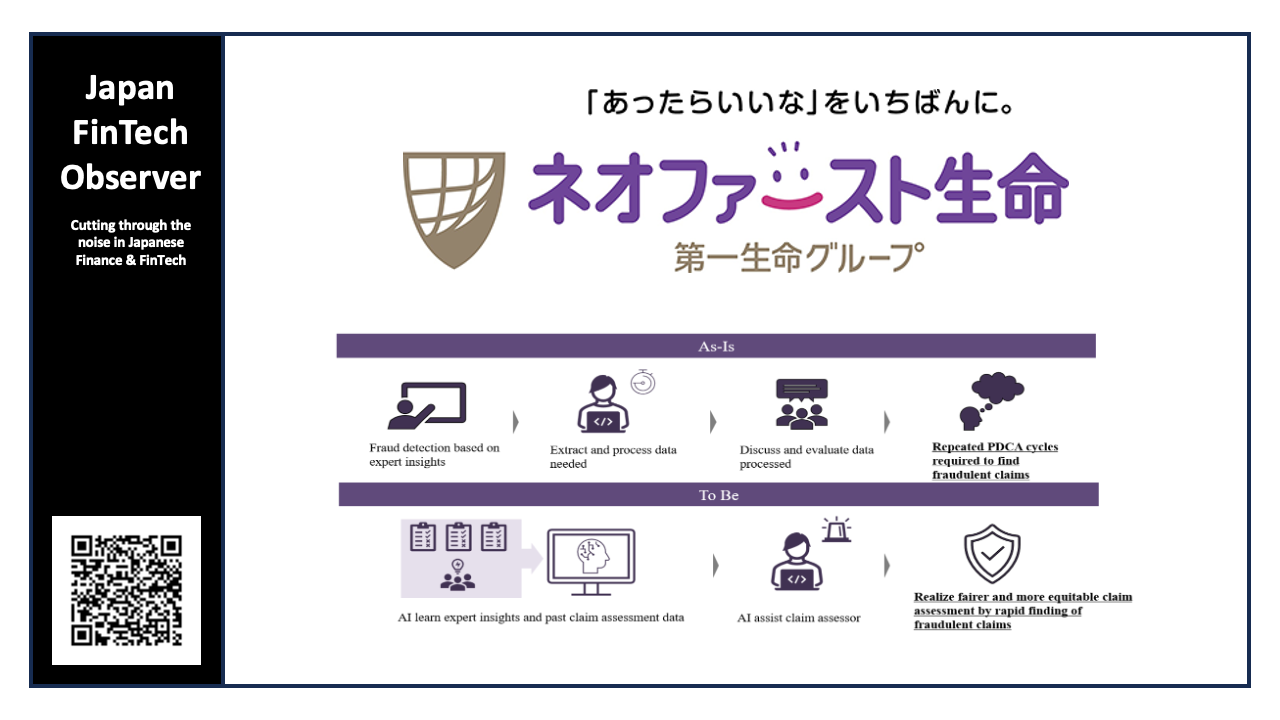

Conventionally, analysis by expert assessors in Neo First Life Insurance has been a major method to detect fraud signs. However, since the 2024 fiscal year, as a part of its efforts to become a data-driven organization, Neo First Life Insurance has been developing an internal system utilizing Business Intelligence (BI) tools to improve detection capabilities of fraudulent insurance claims. By integrating AI support into its internally developed BI tools, Neo First Life Insurance will achieve faster and more accurate fraud detection.

Overview

With this implementation, AI will automatically group similar claims based on past payment data and extract risk factors that may indicate fraudulent claims. Following by this implementation, in October, Neo First Life Insurance will launch an updated system that utilizes multiple perspectives to detect suspicious claims more quickly and accurately.

In the conventional operations, fraud detection has required significant time and human resources, nevertheless, the accuracy of the detection and the method of evaluating priorities have not been defined.

By enabling AI to learn from expert insights and past claims assessment data, however, the new system will consolidate industry expertise and allow for more advanced and efficient fraud detection.

By fully internalizing the mechanism for detecting fraudulent insurance claims, Neo First Life Insurance will be able to flexibly improve and enhance its performance even after implementation, based on feedback from expert assessors in the claims department. Furthermore, by sharing information related to fraudulent insurance across the organization, Neo First Life Insurance will be able to deal with moral risks appropriately at every stage of the insurance business—including product development, new business application and claims processing.

Future Vision

As a group company within the Dai-ichi Life Group that excels in digital capabilities, Neo First Life Insurance aims to provide fair, equitable, and reliable insurance services by further leveraging AI technologies through a more sophisticated and multifaceted fraud detection framework.

Neo First Life Insurance will continue to recognize and address even the smallest concerns of its customers, striving to be a trusted partner in helping them lead long and healthy lives.