Nippon Life Insurance Company's Tender Offer for Medical Data Vision

Nippon Life Insurance Company is currently executing a tender offer to acquire Medical Data Vision, with the ultimate objective of making it a wholly-owned subsidiary. This acquisition represents a decisive strategic step by Nippon Life, marking a significant investment into the high-growth healthcare data sector. This analysis will deconstruct the strategic rationale, the bespoke transaction structure engineered to ensure success, and the sophisticated financial terms of the offer.

Acquirer | Nippon Life Insurance Company |

Target Company | Medical Data Vision Co., Ltd. (TSE Prime: 3902) |

Transaction Goal | To make Medical Data Vision a wholly-owned subsidiary. |

Offer Type | Tender Offer, followed by a multi-step process for full acquisition. |

Announcement Date | December 15, 2025 |

This acquisition is designed to integrate deep healthcare data capabilities into Nippon Life's core operations, reflecting a fundamental evolution in its long-term corporate strategy.

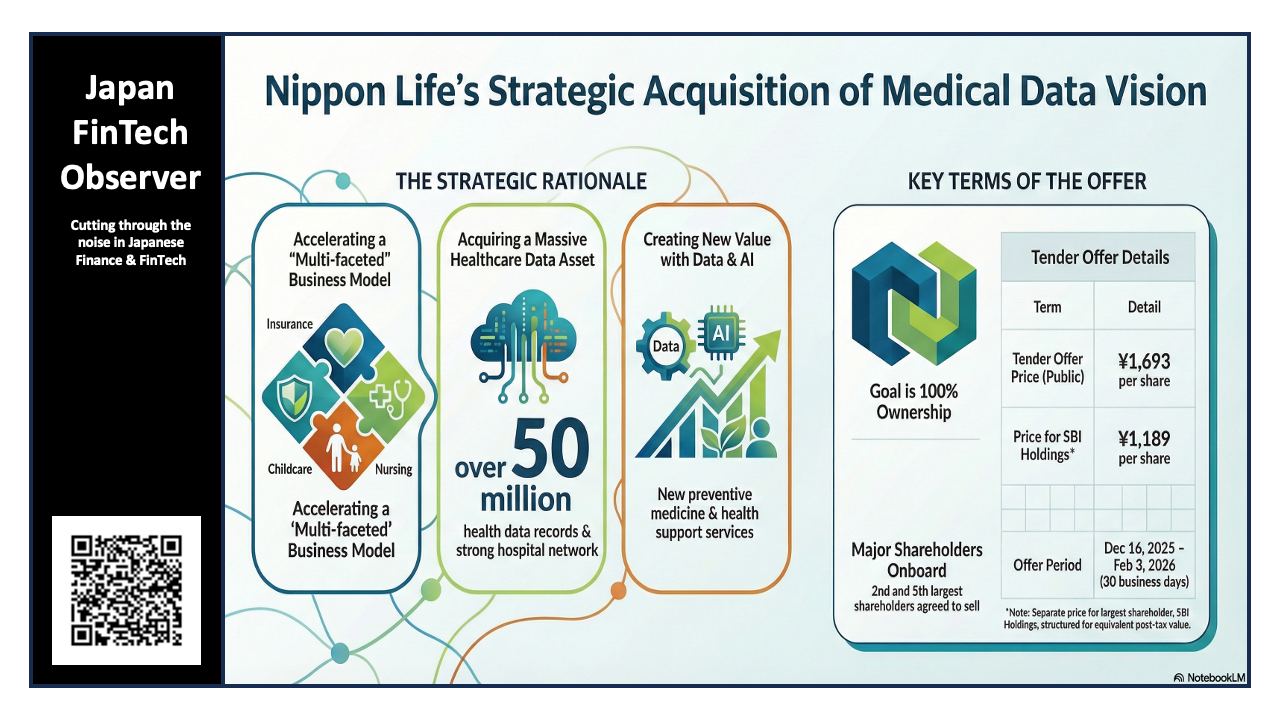

1. Strategic Rationale: Fusing Insurance with Healthcare Data

This transaction is a strategic bolt-on acquisition designed to build a new, data-centric business vertical for Nippon Life. The move is a direct manifestation of the company's long-term corporate vision to evolve beyond its traditional insurance role into a comprehensive "peace of mind" provider.

Nippon Life's long-term corporate vision aims to establish a multifaceted enterprise offering integrated services across insurance, asset management, healthcare, and nursing care. Enhancing the customer experience (CX) by providing value beyond conventional insurance products is central to this ambition.

The healthcare domain is a critical focus area, directly addressing the societal challenge of Japan's super-aging society and the rising public interest in health promotion and disease prevention. Since its formal entry into the healthcare sector in 2017, Nippon Life has developed foundational initiatives, including its "Nissay Health Promotion Consulting Service (Wellness-Star☆)," which assists organizations in analyzing health data and implementing wellness programs. These efforts have enabled the company to amass a dataset of over 3.3 million health data records.

To accelerate this strategy, Medical Data Vision (MDV) was identified as an ideal acquisition target due to its unique capabilities:

- A robust network centered around hospitals and other medical institutions.

- A substantial data asset of over 50 million health data points, primarily composed of high-value Diagnosis Procedure Combination (DPC) data.

- Established services and proven expertise in health data analysis and utilization.

By making MDV a wholly-owned subsidiary, Nippon Life intends to establish health data as a new business foundation to achieve two primary objectives:

- Enhance and upgrade both its healthcare segment and its core insurance business by leveraging MDV’s superior data and analytical capabilities.

- Create new customer value by combining its existing data with MDV's assets, AI, and digital technology to develop innovative services in preventive medicine and health support.

Executing these strategic goals required a bespoke transaction structure, engineered to secure the cooperation of key stakeholders and ensure a clear path to full ownership.

2. Transaction Structure: A Multi-Step Path to Full Ownership

To achieve 100% ownership, the transaction is structured as a sophisticated, multi-phase process principally designed to accommodate the tax-advantaged exit required to secure the cooperation of its largest shareholder, SBI Holdings, while ensuring a fair outcome for all parties.

The transaction is engineered to unfold in five distinct steps:

- Step 1: The Tender Offer

Nippon Life has launched a tender offer for all common stock and stock acquisition rights of Medical Data Vision, excluding shares held by the largest shareholder, SBI Holdings, and treasury stock. - Step 2: The Squeeze-Out

Conditional on the tender offer's success, any minority shareholders who do not tender their shares will be acquired through a statutory share consolidation process (株式併合), which will consolidate ownership under Nippon Life and SBI Holdings. - Step 3: Capital Restructuring

To secure the necessary funds and distributable amount for the final acquisition step, MDV will execute a third-party allotment of new class shares to Nippon Life and a reduction of its capital and capital reserves. The issuance of class shares is a critical mechanism specifically designed to increase the distributable amount for the subsequent share buyback without affecting the "capital, etc." amount used for calculating deemed dividends, a tax-efficient method that maximizes the value available to all shareholders. - Step 4: The Self-Tender (Buyback)

Using the funds secured in the prior step, MDV will launch a self-tender (自己株式取得) to acquire all shares held by SBI Holdings. - Step 5: Final Outcome

Upon completion of this sequence, Medical Data Vision will become a wholly-owned subsidiary of Nippon Life.

The viability of this intricate process is underpinned by pre-negotiated shareholder agreements securing the cooperation of MDV's key shareholders:

- SBI Holdings: A non-tender agreement ensures the largest shareholder (37.81% stake) will not participate in the initial tender offer but will instead sell its entire stake to MDV during the self-tender phase.

- Medipal Holdings Corporation: A tender agreement secures the participation of the second-largest shareholder (8.37% stake), who will tender all of its shares.

- Mr. Hiroyuki Iwasaki: A tender agreement has been secured with MDV's President and fifth-largest shareholder (2.09% stake), who will also tender all of his shares.

These binding agreements provide a high degree of certainty for the transaction's successful execution and lead into the specific financial terms offered.

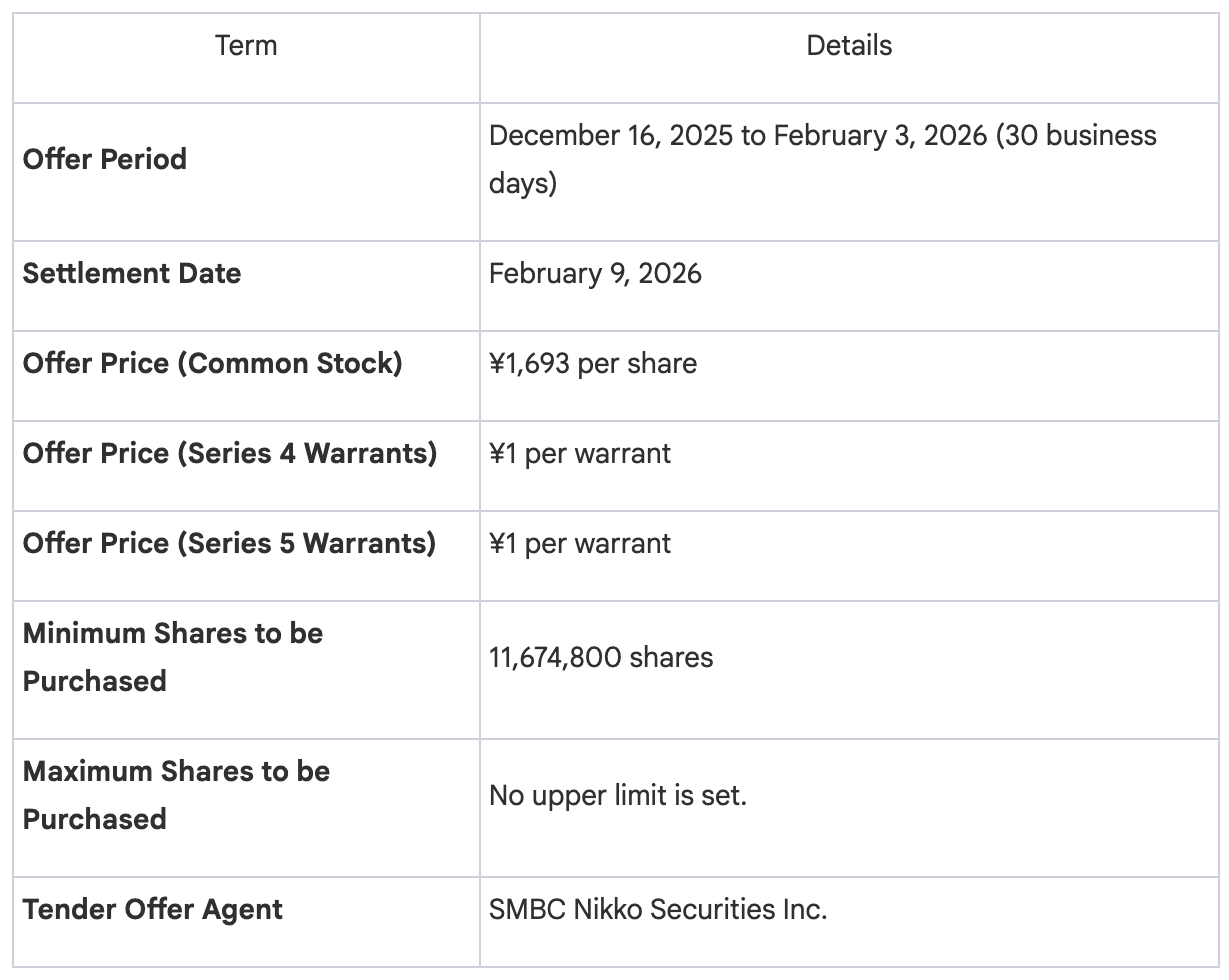

30 Financial Terms and Shareholder Considerations

The transaction's financial terms are meticulously structured to provide fair value to different shareholder classes, reflecting the sophisticated, multi-step nature of the acquisition.

Tender Offer Terms

Analysis of the Dual-Pricing Structure

A key feature of this transaction is the dual-pricing structure, which was engineered to achieve shareholder fairness on an after-tax basis.

The transaction utilizes two distinct prices: a ¥1,693 per share tender offer price for minority shareholders and a ¥1,189 per share self-tender price for SBI Holdings. The difference is rooted in Japanese tax law; the self-tender structure allows SBI Holdings, as a corporate entity, to benefit from the "dividends-received deduction" (益金不算入規定), which treats a portion of the buyback proceeds as a dividend and thus reduces the associated tax liability.

The self-tender price of ¥1,189 was specifically calculated to ensure that SBI Holdings' after-tax proceeds are equivalent to what it would have received had it tendered its shares at the higher ¥1,693 price. This structure has a significant strategic impact: it achieves equity for the largest shareholder on a post-tax basis while simultaneously maximizing the price that could be offered to minority shareholders, thereby balancing the interests of all parties.

This carefully engineered financial structure was designed to acquire the specific capabilities and data assets of Medical Data Vision.

4. Profile of the Target: Medical Data Vision

Medical Data Vision, the target of this strategic acquisition, is a pivotal player in Japan's medical data and healthcare analytics field. Established in 2003, the company is a leader in developing medical information systems and providing sophisticated data analysis and consulting services to medical institutions.

Corporate Snapshot: Medical Data Vision

MDV's established infrastructure, network, and vast data repository are the core assets that make it a transformative acquisition for Nippon Life.

5. Conclusion: A Strategic Leap into a Data-Driven Future

Nippon Life's acquisition of Medical Data Vision is a forward-looking strategic move designed to integrate a vast pool of healthcare data and advanced analytical capabilities directly into its core business. This transaction represents a fundamental step toward redefining the role of an insurer in an aging society, shifting from a focus on reactive claims processing to proactive health and wellness support.

The acquisition directly supports the objectives outlined in Nippon Life's Mid-Term Management Plan (2024-2026) by advancing the "further diversification of peace of mind in Japan." By building a new business foundation on health data, Nippon Life is positioning itself to create next-generation services that enhance customer value. Ultimately, this strategic leap is aligned with the company's highest corporate aim: to contribute to the realization of a "society where everyone can live with peace of mind for a long time."