NLI Research Institute: Future Interest Rate Outlook

Takeshi Ueno, Chief Economist at the NLI Research Institute, published an update to his interest rate outlook this past week. The report analyzes the recent surge in Japan's long-term interest rates (10-year JGB yield) and provides a forecast for the coming 18 months. The key argument is that the recent rise to a 17-year high of 1.6% is not driven by external factors like US rates, but by unique domestic developments.

Two primary drivers are identified:

- Rising expectations of Bank of Japan (BOJ) rate hikes, fueled by strong wage growth and persistent inflation.

- An expanding risk premium on JGBs, initially due to market volatility and subsequently driven by growing concerns over Japan's fiscal policy and increased government bond issuance.

Investor behavior has shifted dramatically. While domestic institutions like banks and insurers have become cautious and are reducing their JGB holdings, foreign investors have stepped in as aggressive buyers, attracted by the higher yields.

NLI's main forecast is for a continued, gradual rise in long-term rates, reaching 1.7% by the end of fiscal year 2025 (March 2026) and 1.8% by the end of fiscal year 2026 (March 2027). This is based on the expectation of further BOJ policy rate hikes and a persistently high risk premium. Risks to this forecast are balanced, with potential for both higher rates (from fiscal expansion) and lower rates (from an economic downturn).

1. Key Drivers of the Rise in Japanese Yields

Unlike in the past, Japan's long-term interest rates have risen significantly in 2025 even as US Treasury yields have fallen. This divergence points to Japan-specific causes.

BOJ Rate Hike Expectations

- The 10-year OIS (Overnight Index Swap) rate, a market proxy for future policy rate expectations, has risen from 1.0% at the start of the year to around 1.3%.

- This reflects the market pricing in further BOJ rate hikes, encouraged by the strong results of the "Shunto" spring wage negotiations and persistently high inflation, which is now expected to be supported by wage growth.

Expansion of the Risk Premium

- The spread between the 10-year JGB yield and the 10-year OIS rate has widened, indicating an increase in the risk premium investors demand to hold JGBs.

- Through April 2025: This was mainly attributed to higher volatility in the bond market following the BOJ's policy normalization.

- Post-April 2025: The driver shifted to fiscal risk. Ahead of the July Upper House election, political parties competed on promises of tax cuts and stimulus, raising alarms about future increases in government debt. This concern has intensified pressure on longer-term bonds (20- and 30-year JGBs), with the effect spilling over to the 10-year benchmark.

2. Shifting Investor Landscape & Supply/Demand Dynamics

The structural demand for JGBs is weakening, contributing to the higher risk premium.

- Bank of Japan (BOJ): As part of its policy normalization, the BOJ is gradually reducing its JGB purchase amounts, diminishing its role as the dominant buyer that has suppressed yields for years. The BOJ estimates its massive holdings (the "stock effect") were suppressing yields by 1.0%; this effect is now unwinding.

- Domestic Institutions: Life insurers, previously major buyers of ultra-long-term bonds to meet regulatory needs, have largely completed this positioning. Banks and insurers have sharply curtailed their JGB purchases in H1 2025.

- Foreign Investors: Foreigners have become the primary buyers, viewing the rising yields as an opportunity. In H1 2025, they were significant net buyers of both long-term and ultra-long-term JGBs, effectively absorbing the bonds offloaded or avoided by domestic players. This shift, however, makes the market more vulnerable to changes in global sentiment, as foreign investors tend to be more tactical and less buy-and-hold.

3. NLI's Interest Rate Forecast (Main Scenario)

NLI expects a gradual upward trend in long-term rates to continue.

- BOJ Policy Rate: A hike to 0.75% is forecast for late 2025, with a further hike to 1.0% in the second half of 2026. This is contingent on confirmation that wage growth is feeding into service prices and the economy can withstand potential headwinds like US tariffs.

- Long-Term Interest Rate (10-year JGB):

- End of FY2025 (March 2026): 1.7%

- End of FY2026 (March 2027): 1.8%

- Reasoning: The forecast is a function of both rising policy rate expectations and a sustained, high risk premium. The risk premium is expected to remain elevated due to the BOJ's tapering and heightened fiscal uncertainty following the ruling coalition losing its majority in the Upper House election, which may force the government to adopt more expansionary fiscal policies to maintain power.

4. Risk Analysis

The risks to the main forecast are significant and balanced.

Upside Risk (Rates rise higher/faster than forecast)

- Fiscal Expansion: If the government enacts a large-scale fiscal stimulus, leading to a surge in JGB issuance, the risk premium could expand significantly. "Flighty" foreign investors might sell off aggressively on fiscal concerns, pushing yields sharply higher.

- Accelerated BOJ Hikes: If inflation (especially food prices) remains stubbornly high and starts feeding into underlying inflation expectations, the BOJ might be forced to hike rates more quickly to maintain credibility, pushing up the entire yield curve. The report suggests rates could exceed 2% in this scenario.

Downside Risk (Rates fall or rise slower than forecast)

- Economic Downturn: A sharper-than-expected global or domestic economic slowdown, potentially triggered by US "Trump tariffs," would delay the BOJ's rate hike plans, putting downward pressure on yields.

- Offsetting Factor: However, the report notes a crucial nuance: a severe economic downturn would likely be met with fiscal stimulus. This stimulus, while meant to support the economy, would increase bond supply and support the risk premium, thereby putting a floor under long-term rates and preventing them from falling substantially.

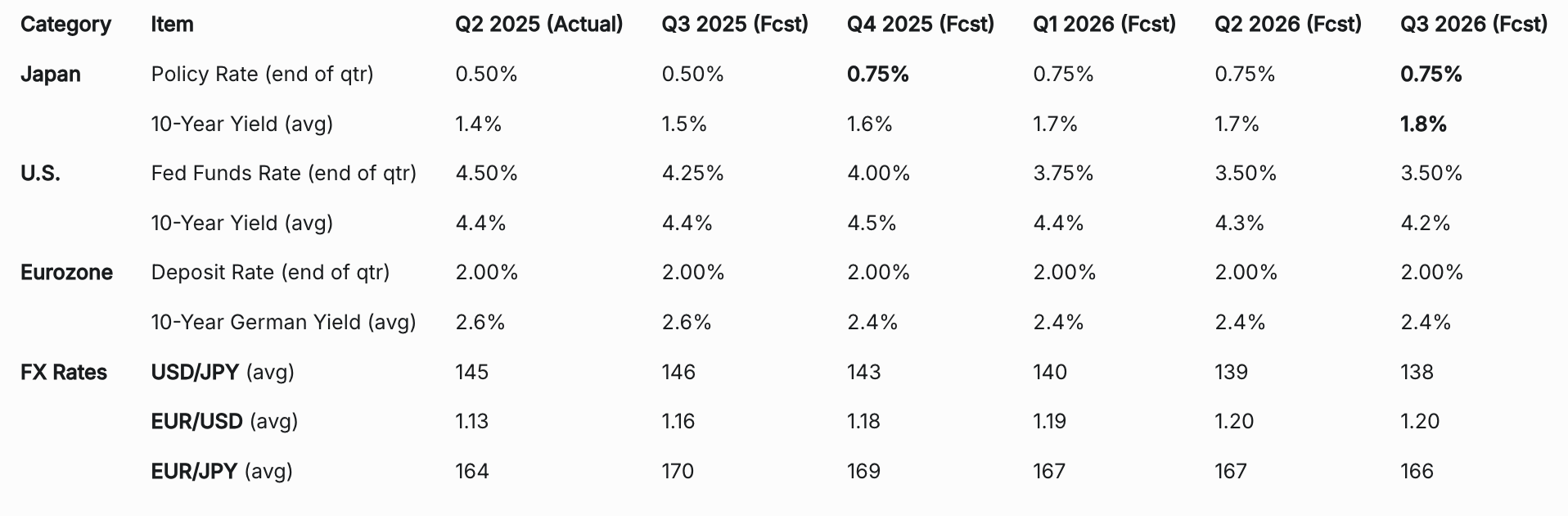

5. Financial Markets Forecast Table