Nomura Reports Q2/FY2025 Results

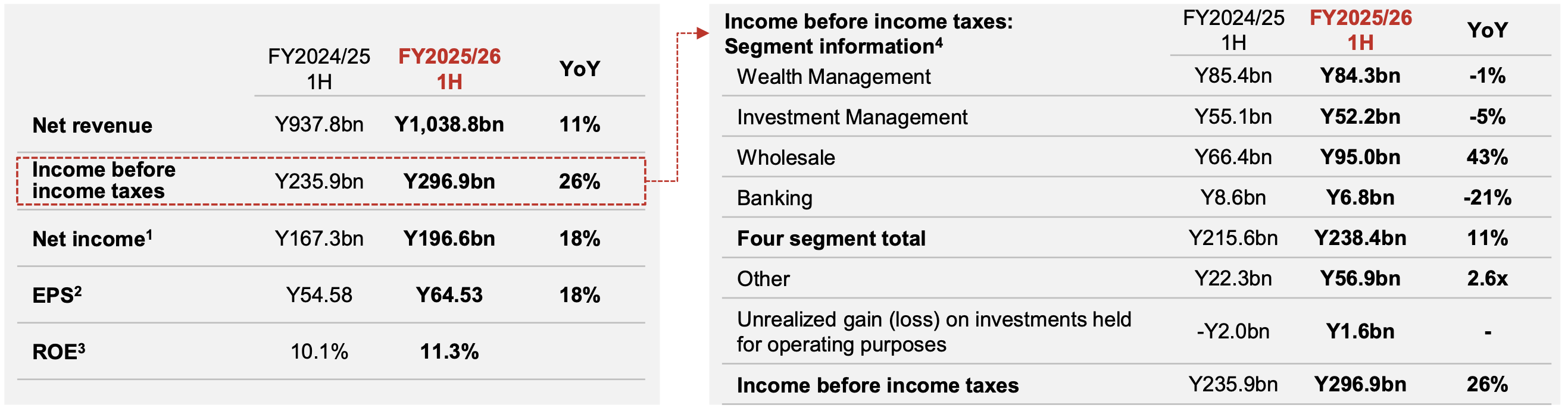

Nomura Holdings reported solid financial results for the second quarter (Q2) of the fiscal year ending March 31, 2026 (FY2025/26), demonstrating strengthened profitability across its key segments, particularly Wholesale and its stable revenue businesses.

While Group Net Income Attributable to Shareholders of Nomura Holdings declined quarter-on-quarter (QoQ) to ¥92.1 billion, the results were robust when normalizing for one-off real estate gains recorded in the preceding quarter (Q1). The firm achieved an annualized Return on Equity (ROE) of 10.6% in Q2 and 11.3% for the first half (1H), marking the sixth consecutive quarter exceeding the medium-to-long-term target of 8% to 10%.

The quarter’s performance was fundamentally driven by record highs in client-focused divisions—Wealth Management (WM) and Investment Management (IM)—and exceptional strength in Wholesale’s Equities business. Income before income taxes (IBT) from the three international regions (Americas, Europe, Asia/Oceania) rose 63% QoQ to ¥44.9 billion, achieving the ninth consecutive quarter of profitability abroad.

Key Financial Highlights (Q2 FY2025/26)

Group Financial Performance

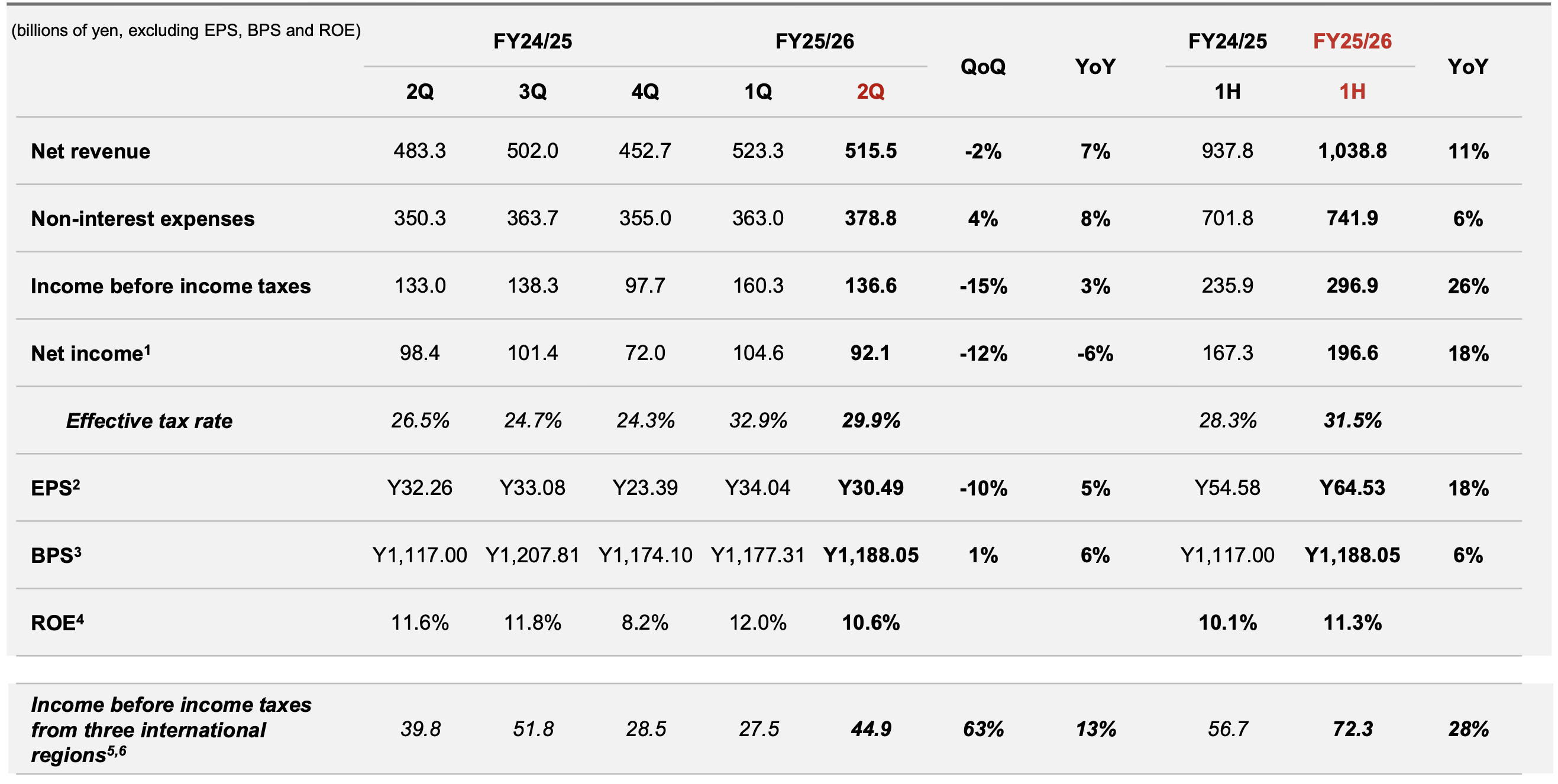

Nomura’s net revenue for Q2 was ¥515.5 billion, a 7% increase year-on-year (YoY), but a marginal 2% decline QoQ. The QoQ decrease in IBT to ¥136.6 billion (-15%) was primarily attributed to the absence of significant gains on real estate sales that boosted Q1 results. Excluding this factor, management noted a steady improvement in underlying performance, with net revenue up 10% and net income up 40% QoQ on an adjusted basis.

The first half (1H) results demonstrated clear trajectory growth, with net revenue of ¥1,038.8 billion (+11% YoY) and net income of ¥196.6 billion (+18% YoY). This sustained improvement was credited to strategic cost controls and operating leverage across the group.

The effective tax rate in Q2 was 29.9%, contributing to the difference between IBT growth (+3% YoY) and net income decline (-6% YoY) for the quarter.

Nomura announced a half-year dividend of ¥27 per share, translating to a dividend payout ratio of 40.3%, consistent with its policy of maintaining a payout ratio of 40% or more.

Divisional Performance Breakdown

All four core segments saw combined IBT rise 25% QoQ to ¥132.6 billion, highlighting balanced growth.

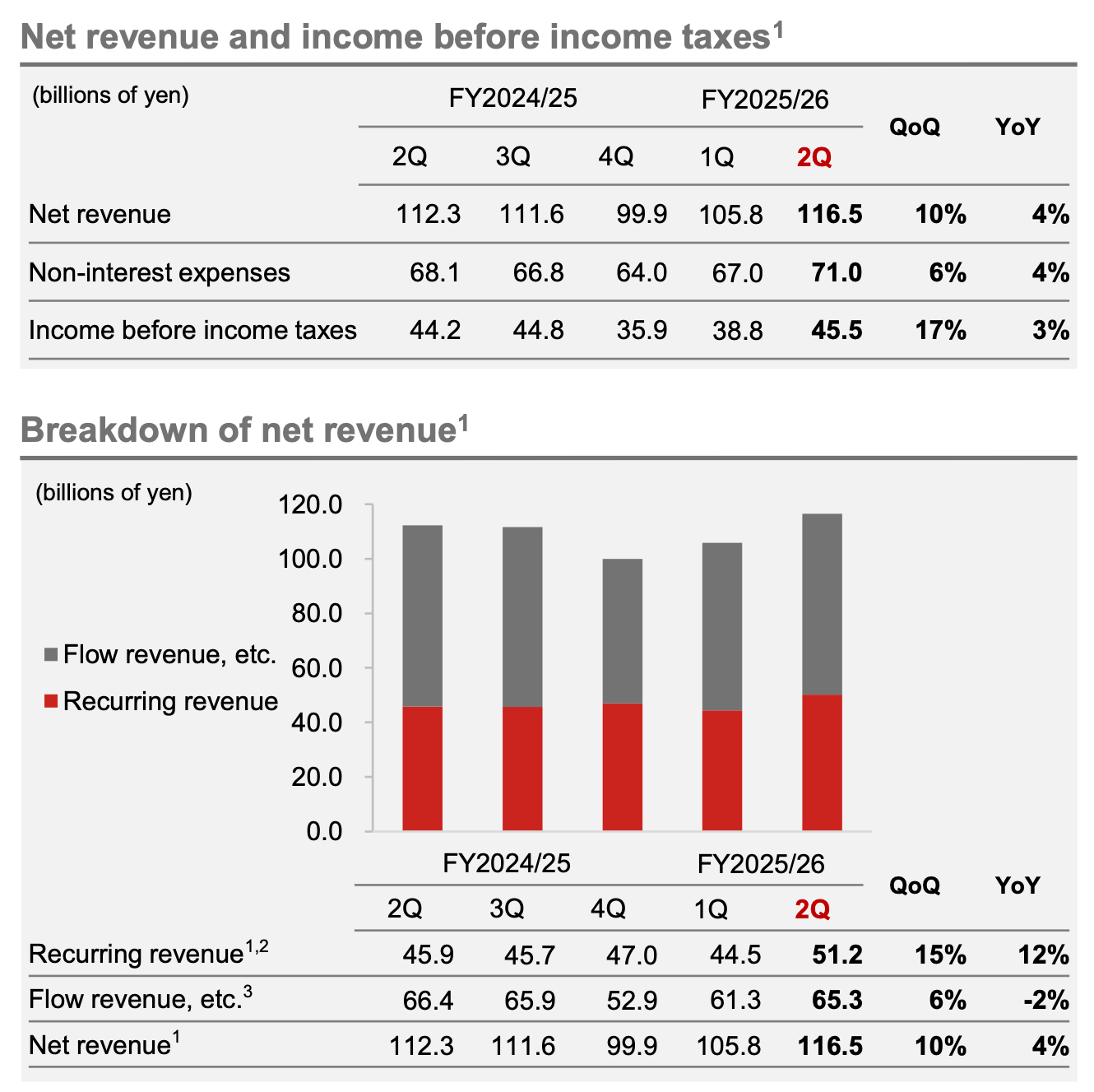

1. Wealth Management (WM)

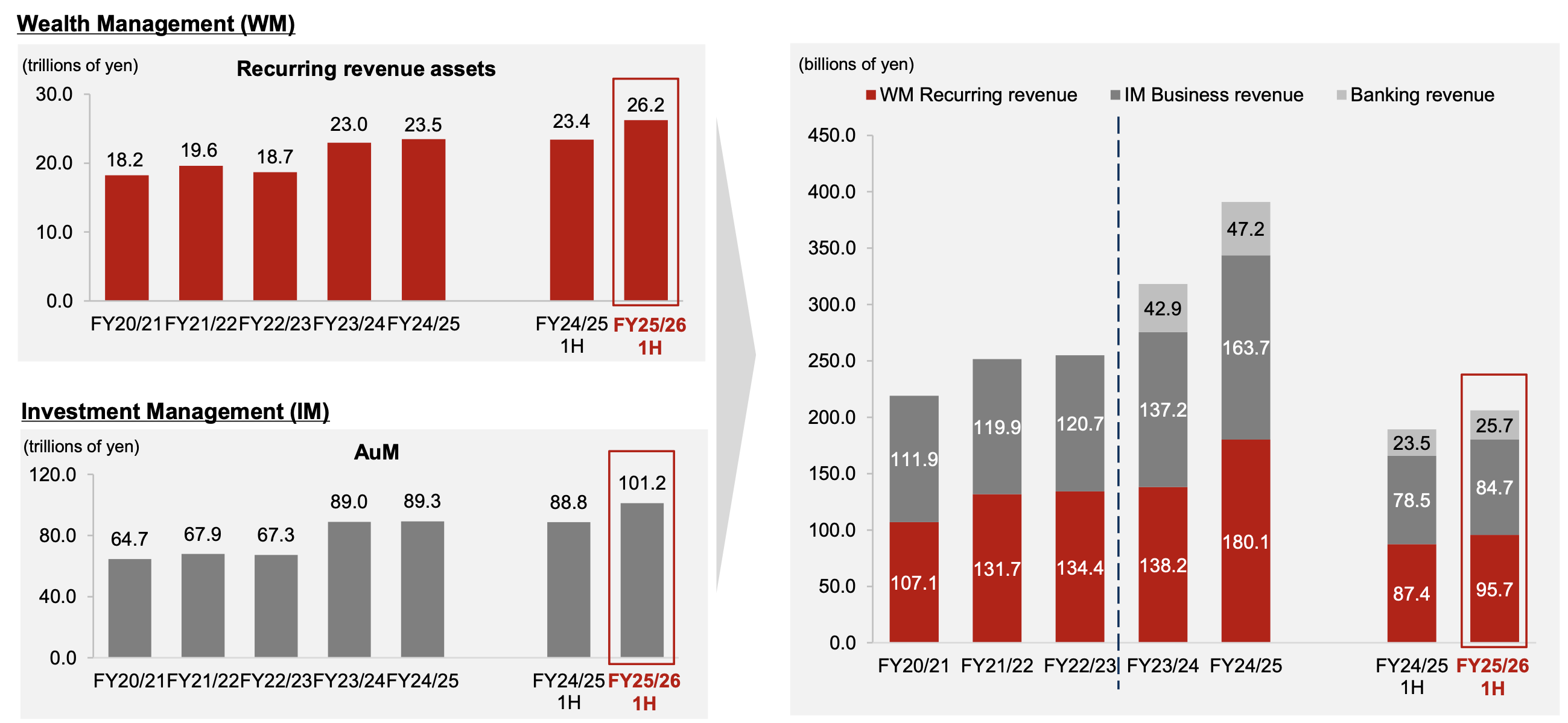

The WM division delivered its strongest IBT in approximately ten years (since June 2015), driven by robust client activity and continued inflows.

- Net Revenue: ¥116.5 billion (+10% QoQ, +4% YoY)

- IBT: ¥45.5 billion (+17% QoQ, +3% YoY)

Key Drivers:

- WM recorded its 14th consecutive quarter of net inflows into recurring revenue assets, which reached a record high of ¥26.2 trillion.

- The Recurring Revenue Cost Coverage Ratio—a key indicator of performance stability—was 70% over the last four quarters.

- Flow Revenue (transaction-based) grew strongly, supported by increased client activity in equities as major global equity markets reached new highs.

- Total sales were impacted by a large tender offer in Q1, but sales of long-term diversified investments (Investment Trusts and Discretionary Investments) grew steadily.

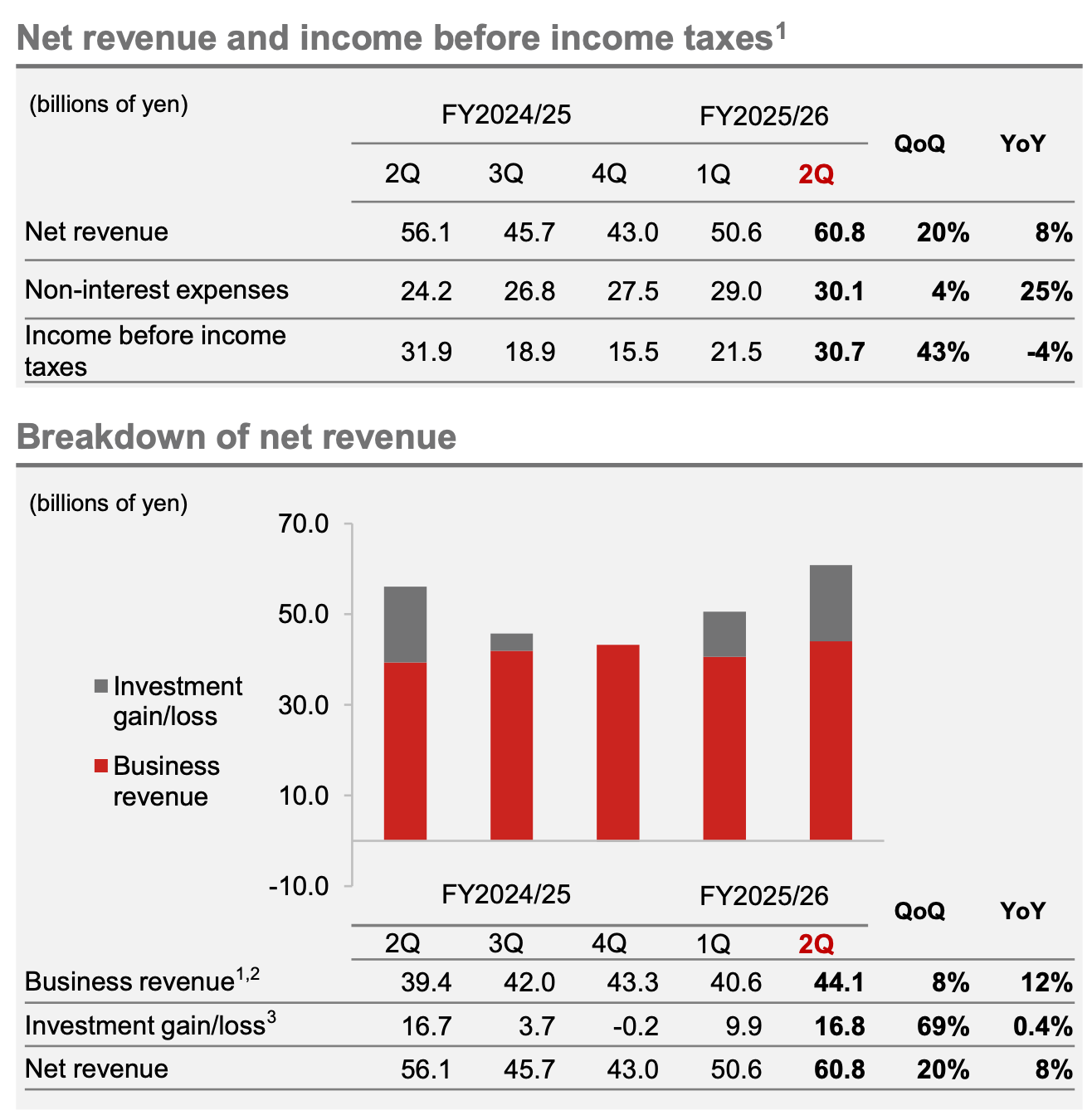

2. Investment Management (IM)

IM maintained its strong upward trajectory, fueled by market factors and strategic private asset gains.

- Net Revenue: ¥60.8 billion (+20% QoQ, +8% YoY)

- IBT: ¥30.7 billion (+43% QoQ, -4% YoY)

Key Drivers:

- The division recorded its 10th consecutive quarter of net inflows, pushing Assets under Management (AuM) to a new all-time high of ¥101.2 trillion. Alternative assets under management also hit a record high (¥2.9 trillion).

- The 43% QoQ jump in IBT was mainly due to a sharp increase in Investment Gain/Loss (¥16.8 billion), which benefited significantly from valuation gains related to American Century Investments (ACI) and profits from the IPO of Orion Breweries (a portfolio company of Nomura Capital Partners).

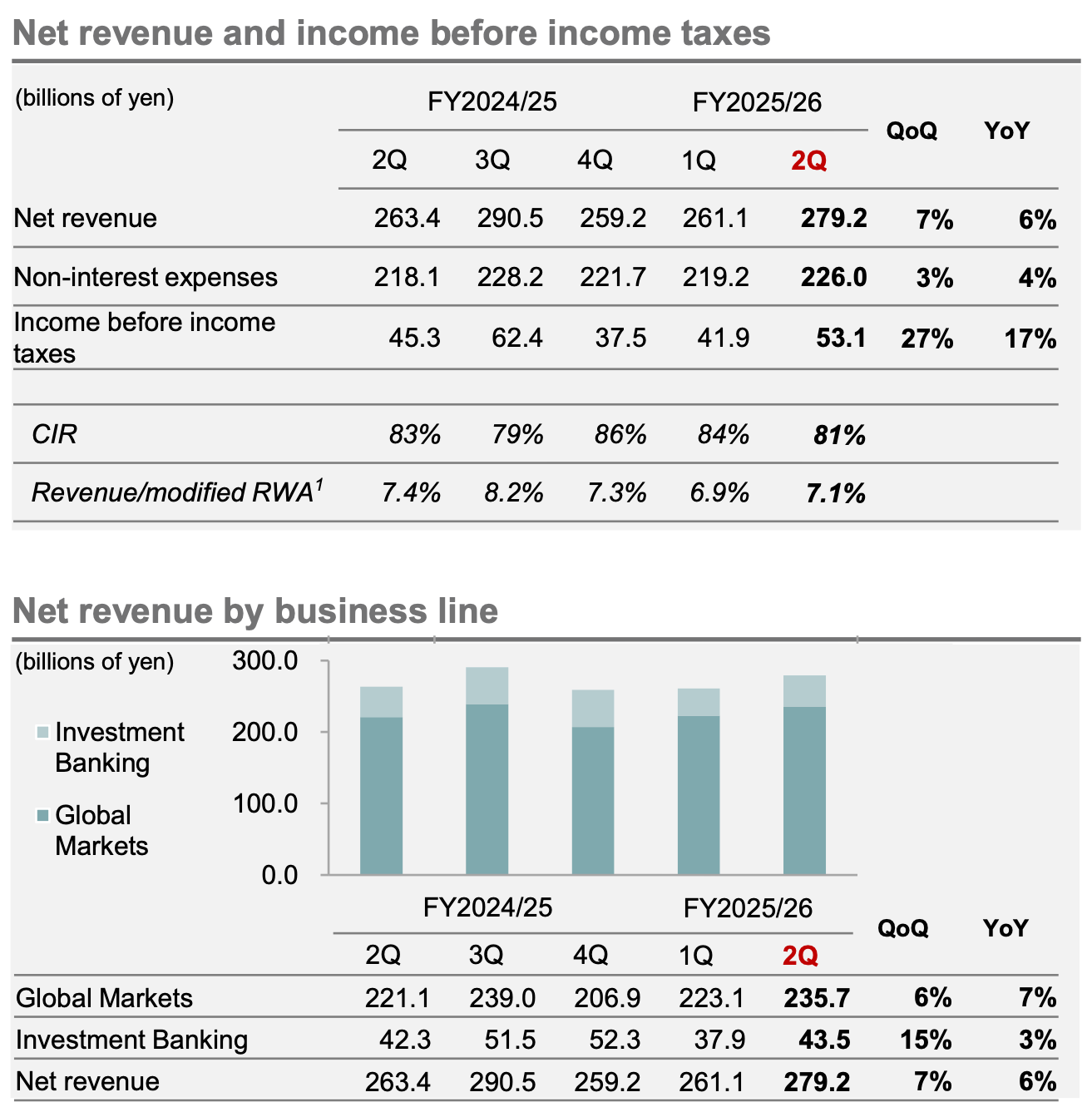

3. Wholesale

Wholesale performance strengthened further, emphasizing the success of the self-sustained growth and capital discipline framework.

- Net Revenue: ¥279.2 billion (+7% QoQ, +6% YoY)

- IBT: ¥53.1 billion (+27% QoQ, +17% YoY)

Global Markets (GM) – Net Revenue: ¥235.7 billion (+6% QoQ)

- Equities: Revenue reached a record high (¥113.8 billion, +16% QoQ). This growth was driven by strong client activity in Japan and AEJ, particularly in the derivatives business, and sustained strength in the Americas.

- Fixed Income (FI): Revenue was essentially flat QoQ (¥121.9 billion, -2%). Strong performance in Spread Products (Credit in Japan/AEJ, and Securitized Products in the Americas) offset lower revenues from Macro Products (Rates in EMEA, and FX/EM in AEJ).

Investment Banking (IB) – Net Revenue: ¥43.5 billion (+15% QoQ)

- IB momentum remained strong. Advisory was solid, fueled by cross-border M&A and large private equity transactions in Japan, and a rebound in overseas business, especially EMEA deals related to renewable energy and digital infrastructure.

- The firm maintained its top rank in the Japan-related M&A league table.

- Financing and Solutions revenue rose, supported by strong DCM (Debt Capital Markets) performance in Japan and international ALF (Acquisition Leveraged Finance) deals in the Americas.

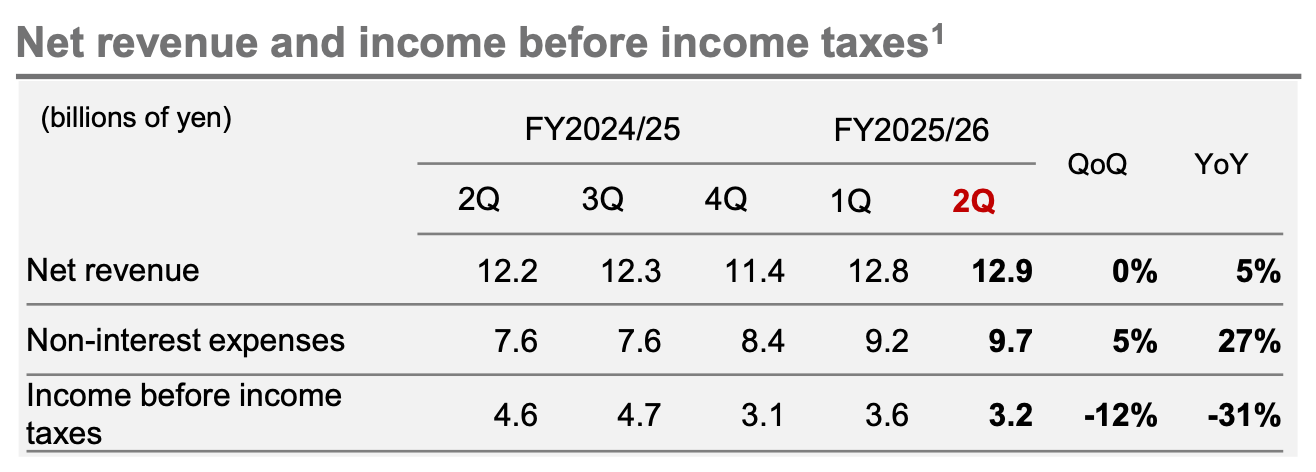

4. Banking

The Banking division maintained steady revenues despite a notable rise in expenses.

- Net Revenue: ¥12.9 billion (Flat QoQ, +5% YoY)

- IBT: ¥3.2 billion (-12% QoQ, -31% YoY)

Key Drivers:

- Revenues from lending and trust/agent operations were firm, supported by growth in balances (e.g., loans outstanding reached ¥1.093 trillion).

- The decline in IBT was mainly due to a 27% QoQ increase in Non-Interest Expenses (to ¥9.7 billion) resulting from fully booked depreciation charges related to the completion of the core banking system upgrade at Nomura Trust and Banking in May 2025.

Expense and Risk Management

Non-interest expenses totaled ¥378.8 billion, a 4% increase QoQ, primarily driven by performance-linked factors and integration costs.

Expense Drivers:

- Compensation and Benefits: Rose 5% QoQ to ¥195.1 billion, reflecting higher bonus provisions tied to strong performance.

- Phishing Scam Compensation: The firm incurred a negative impact of approximately ¥4.8 billion on Q2 profits related to compensation paid out to clients affected by fraudulent trading due to phishing scams. Management stated that security levels have been raised (including the introduction of a passkey authentication system) and anticipate the impact to be "much smaller" going forward.

Capital and Risk:

The Common Equity Tier 1 (CET1) ratio stood at 12.9% (vs. 13.2% in Q1), remaining well within the 11% to 14% target range. The quarter’s decrease was attributed to the accumulation of positions commensurate with revenue opportunities and an increase in risk-weighted assets (RWA) due to market factors.

Management confirmed that the pending acquisition of Macquarie’s U.S. asset management business is expected to depress the CET1 ratio by approximately 0.7 percentage points upon closing, bringing it to around 12.2%.

Analyst Outlook

Nomura’s second quarter results reinforce the success of its strategy to build a more stable, recurring revenue base, while Wholesale continues to capitalize on favorable market conditions, particularly in Equities. The 11.3% ROE achieved in the first half suggests the firm’s core earning capacity is stabilizing at a higher baseline, despite management’s cautious stance on raising the 2030 ROE target of 8%-10% due to monitoring the economic cycle.

Forward Guidance Notes:

- Fixed Income Outlook: Management sees upside potential in Fixed Income, particularly Macro Products, depending on future interest rate volatility.

- Investment Banking Pipeline: The advisory pipeline remains very strong globally, and DCM is expected to maintain first-half levels. ECM (Equity Capital Markets) is expected to show modest recovery, driven potentially by the unwinding of cross-shareholdings in Japan.

- Capital Strategy: Nomura will balance investment opportunities (organic and inorganic, such as the Macquarie acquisition) with shareholder returns (total payout target of 50% or more), maintaining financial soundness above all.

The sustained momentum in WM and IM, combined with record performance in Global Markets Equities and robust IB deal flow, positions Nomura to continue meeting or exceeding its long-term profitability targets in the near term. The limited exposure to private credit and minimal impact from the "First Brands" default further underline prudent risk management policies in Wholesale.