Nomura's Third Quarter Financial Results

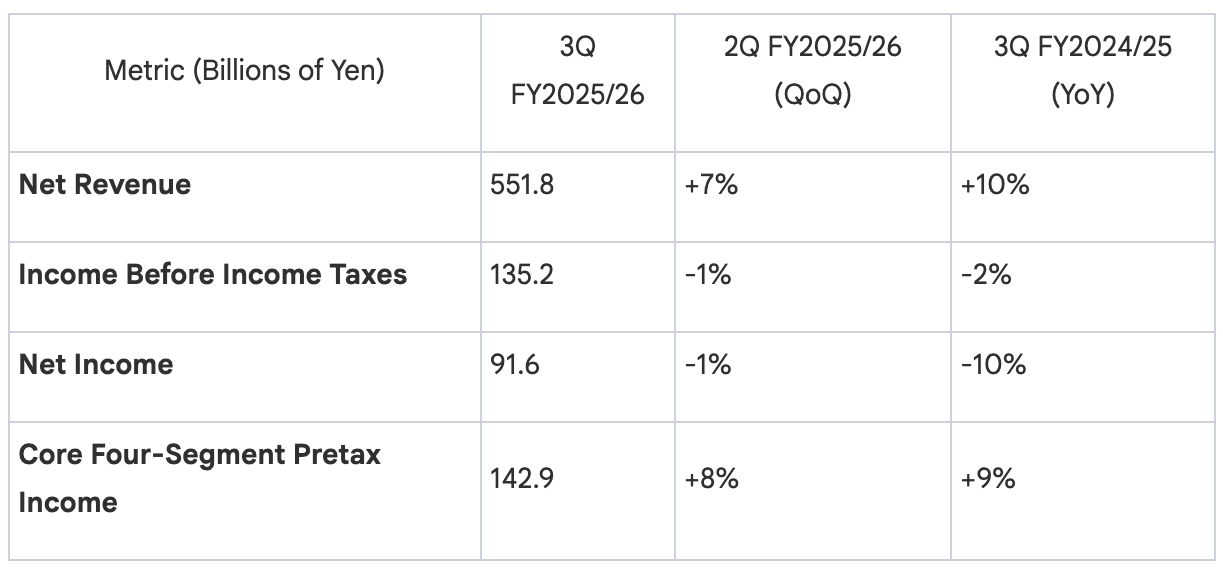

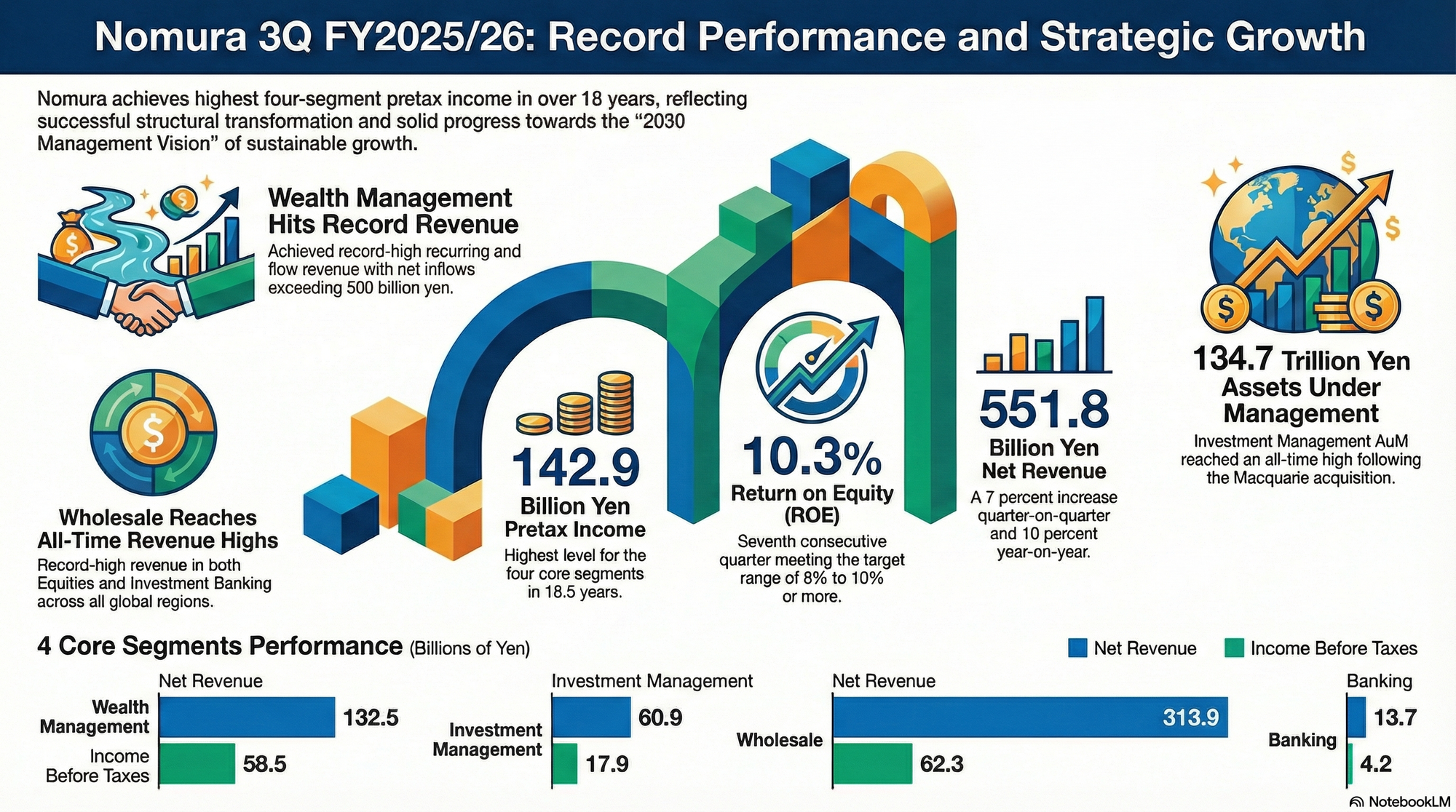

Nomura Holdings’ third-quarter results for the fiscal year ending March 31, 2026, provide a clear validation of the firm’s "2030 Management Vision." Achieving a Return on Equity (ROE) of 10.3%, the group has now successfully met its 8%–10% target range for the seventh consecutive quarter. The defining metric of this period is the record-breaking pretax income from the four core business segments, which reached Y142.9 billion—the highest level in eighteen and a half years. This performance signals a decisive pivot away from historical reliance on volatile market swings toward a diversified, resilient earnings model.

CEO Kentaro Okuda has appropriately framed these results as the fruit of a deliberate "Structural Transformation." While consolidated pretax income saw a marginal 1% sequential decline due to losses in the "Other" segment—specifically stemming from weaker market conditions in digital asset-related businesses—the record performance in core segments confirms that the business model reforms are de-risking the group. The current earnings profile is increasingly defined by sustainable, recurring revenue streams rather than "one-off market factors," marking a transition into a more durable phase of growth.

1. Wealth Management: The Recurring Revenue Engine

The Wealth Management division remains the linchpin of Nomura’s stability. The transition to a full-service asset management business has matured into a powerful margin engine, maintaining a pretax profit margin exceeding 40% (58.5 billion yen pretax income). This stability is critical as it provides the group with a reliable capital base to fund expansion in more capital-intensive divisions.

The division achieved record-high net inflows of recurring revenue assets totaling Y503.9 billion. This is a critical milestone, as it marks the 15th consecutive quarter of net inflows. The strategic implications of this growth include:

- Asset Management Scalability: The "So What?" behind this figure is the successful conversion of brokerage clients into advisory relationships, ensuring revenue is captured regardless of transaction frequency.

- Market Tailwinds: Buoyant market conditions in 2Q and 3Q supported valuations, but the underlying driver was the steady demand for long-term diversified investment products.

- Workplace Services Expansion: Growth was bolstered by a steady increase in Employee Stock Ownership Plans (ESOPs) and other workplace services, creating a sticky, long-term client base.

The de-risking of the division is further evidenced by the balance between Recurring Revenue (Y52.7 billion) and Flow Revenue (Y79.8 billion). Despite a 22% surge in flow revenue driven by equity market activity, the recurring revenue base hit an all-time high. Consequently, the recurring revenue cost coverage ratio reached 71%, an 8-percentage-point increase year-on-year. This high coverage ratio essentially protects the division’s profitability from market corrections, as nearly three-quarters of operating expenses are covered by stable, ongoing fees. This asset-gathering success serves as a primary feeder for the Assets under Management (AuM) growth seen in the Investment Management division.

2. Investment Management: Strategic Expansion and M&A Integration

Investment Management’s quarter was headlined by the completion of the Macquarie Group’s U.S. and European public asset management business acquisition on December 1, 2025. This strategic move was the primary catalyst for propelling the division’s AuM to an all-time high of Y134.7 trillion.

While the division reported record-high business revenue (Y57.8 billion), pretax income fell 42% QoQ to Y17.9 billion. This contraction was not a reflection of core business health but rather a combination of:

- One-time Integration Costs: Acquisition-related expenses and the amortization of intangible assets following the Macquarie closing.

- Investment Gain/Loss Delta: Revenue in this category dropped sharply from Y16.8 billion in 2Q to Y3.1 billion in 3Q. This was primarily due to the lapse of sales gains from Nomura Capital Partners and a lower (though still positive) valuation contribution from American Century Investments (ACI).

The division’s organic performance showed a nuanced trend across domestic and international markets:

- Domestic Investment Trusts: While there were strong inflows into newly established actively managed Japanese equity funds and private assets, ETFs experienced net outflows as investors engaged in profit-taking amid rising markets.

- International Business: The platform saw healthy demand for Japanese equities, though this was partially offset by outflows from U.S. high-yield bonds.

- Domestic Advisory: Steady inflows were maintained, specifically targeted toward yen bonds as domestic interest rates evolved.

3. Wholesale: Record Revenues in Equities and Investment Banking

The Wholesale division delivered a powerhouse performance, capitalizing on corporate activity in Japan and global market volatility to reach record revenue levels across both its Global Markets and Investment Banking arms.

Equities net revenue reached a record high for the second consecutive quarter at Y119.9 billion. This was driven by record-high revenue in "Equity Products" in the Americas, where Derivatives saw significant client activity, and robust growth in "Execution Services" in Japan. Notably, Wholesale revenue in Japan reached an all-time high of Y124.1 billion, reinforcing Nomura's home-market dominance.

Investment Banking achieved its highest quarterly revenue (Y57.1 billion) since reporting began in FY2016/17, driven by a surge in advisory and equity capital markets (ECM).

- Dominant M&A Advisory: Nomura maintained its #1 ranking in Japan-related M&A. Major transactions this quarter included the Sony Financial Group spin-off (Y1,038.8 billion), Sumitomo Corp’s deal to take SCSK private (Y881.8 billion), and Sapporo Holdings’ sale of real estate to KKR and PAG (Y504.7 billion).

- ECM Competitive Advantage: Nomura’s ability to capture the recovery in Japan’s ECM—typified by the SBI Shinsei Bank IPO (Y370.2 billion)—serves as a critical differentiator. While international rivals face headwinds in global deal flow, Nomura’s domestic moat ensures it captures high-margin local activity.

4. Banking: Supporting the Ecosystem Through Lending and Innovation

The Banking division is increasingly vital to Nomura's ecosystem, providing the credit facilities and trust services necessary to deepen Wealth Management relationships. Net revenue rose 7% sequentially to Y13.7 billion.

The division reported a surge in loan execution rates, particularly for "Nomura Web Lending." This execution rate surge demonstrates a high ROI on targeted advertising spend, validating the group's digital lending scalability and its ability to attract a younger, tech-savvy demographic.

The "So What?" for the Banking division’s current margin compression—where pretax income is weighed down by depreciation—is the upcoming FY2026/27 launch of the "deposit sweep service." Current system upgrade costs are a necessary strategic investment that will automate cash management for Wealth Management clients, further embedding Nomura into the client's primary financial journey and securing a lower cost of funding for the group in the long term.

5. Capital Position, Expenses, and Shareholder Returns

Nomura remains in a robust financial position with a CET1 capital ratio of 12.8%. This balance sheet strength allows the firm to execute its dual strategy of aggressive inorganic growth, such as the Macquarie acquisition, and significant capital return to shareholders.

Non-interest expenses rose 10% QoQ to Y416.5 billion. This increase is dissected as follows:

- Compensation: A 13.2% increase (Y220.7 billion) due to performance-linked bonus provisions and the addition of Macquarie personnel.

- Business Development: A sharp 37.4% jump in advertising expenses (Y10.0 billion), specifically allocated to the successful Web Lending campaign.

- IT Services: A 7.3% rise in information processing costs due to new and renewed IT service contracts required for the group's digital transformation.

To enhance shareholder value and optimize ROE, Nomura announced a share buyback program of up to 100 million shares (maximum Y60 billion) to run from February to September 2026. This move, combined with the record core segment earnings, signals a fundamental shift: Nomura is no longer a firm at the mercy of market cycles, but a structurally transformed, diversified financial powerhouse.