NTT Docomo Tender Offer for SBI Sumishin Net Bank

NTT Docomo has launched a tender offer for SBI Sumishin Net Bank (SSNB), and the latter has resolved at its board of directors meeting held on Thursday, May 29, 2025 to express its opinion in support of the tender offer, and to recommend that the SSNB's shareholders tender their shares in the Tender Offer.

Concurrently, SSNB resolved to enter into a business alliance agreement with DOCOMO and Sumitomo Mitsui Trust Bank (SMTB), and a business alliance agreement with DOCOMO, SBI Holdings and SBI Securities.

In our last Japan FinTech Observer webinar on May 20, 2025, I explained the fall in SSNB shares after their earnings release, and that the conservative forecast provided was out of line with management's previous statements on SSNB's interest rate sensitivity, even if the Bank of Japan would not raise the policy rate further during 2025.

Background and Purpose of the Transaction

SSNB has continued to achieve high customer satisfaction and growth by creating innovative business models utilizing cutting-edge technology, such as providing highly convenient financial services and NEOBANK, which is a Banking-as-a-Service (BaaS) business, in order to realize its goal whereby “with technology, in the spirit of integrity we will create a society where affluence circulates”.

While Internet-based financial transactions have continued to expand since SSNB commenced its operations, driven by the increasing popularity of smartphones, tablets and other digital devices, SSNB believes that the competitive environment has intensified in recent years with the participation of domestic IT companies and other major corporations in online-only banking and the strengthening of personal finance business by major banks using digital services.

In addition, the financial and capital markets surrounding SSNB are also undergoing a major phase of transformation, as evidenced by the revision of monetary policy and interest rate conditions by the Bank of Japan.

Under such environment, SSNB has concluded that pursuing synergies with the DOCOMO Group through the Transaction is the best means to enhance its competitiveness and to achieve sustainable growth and increase of its corporate value.

Based on its customer-centric philosophy, SSNB aims to maximize its corporate value by pursuing further convenience through utilizing cutting-edge technology, enhancing products and services in collaboration with the DOCOMO Group, strengthening sales capabilities by leveraging DOCOMO's membership base, corporate network, and various channels such as DOCOMO retail stores, and developing new business areas by making full use of cutting-edge technology and data.

SSNB has also entered into a business alliance agreement with DOCOMO, SBI Holdings, and SBI Securities, under which it has been agreed that the existing business alliance between SSNB and SBI Securities will be maintained. SSNB will continue to strive to enhance its services so that it remains the preferred choice for both its existing customers and SBI Securities’ customers.

Major synergies expected from the business alliance with DOCOMO

Growth through increase in the number of bank accounts and expansion of deposit balances accompanying becoming a main bank in Digital Banking Business

- Strengthening of bank account acquisition by providing services utilizing DOCOMO’s customer base and both physical and digital contact points

- Promoting the use of SSNB's bank accounts as customers’ primary accounts through collaboration with the DOCOMO Group’s services and point reward programs

Strengthening of competitiveness in the mortgage loan market by leveraging DOCOMO’s services and sales network under the Mortgage Platform Business

- Differentiation of products through the development of preferential interest rate offerings etc. in collaboration with the services of the DOCOMO Group

- Expansion sales channels by enhancing recognition through DOCOMO’s media and utilizing the agency network such as DOCOMO retail stores

Expansion of platform and capabilities in the BaaS Business

- Expansion of BaaS Business alliances by utilizing the corporate network of the DOCOMO Group

Pursuit of synergies for expansion into adjacent business domains

- Consideration of collaboration on next-generation financial services utilizing technology

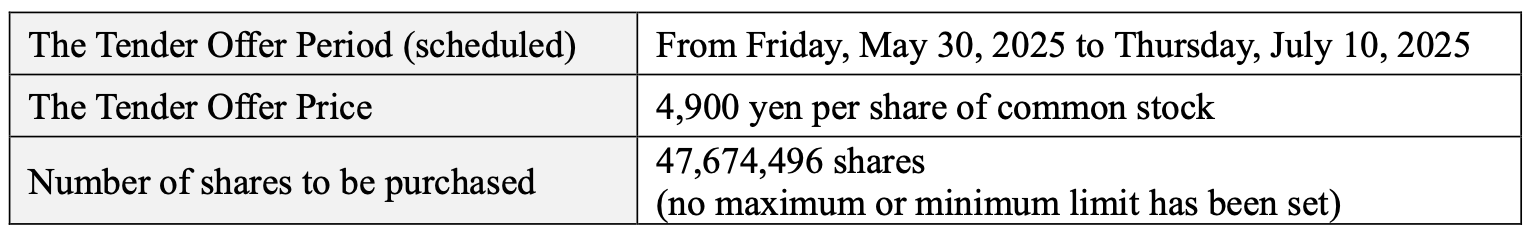

Outline of the Transaction

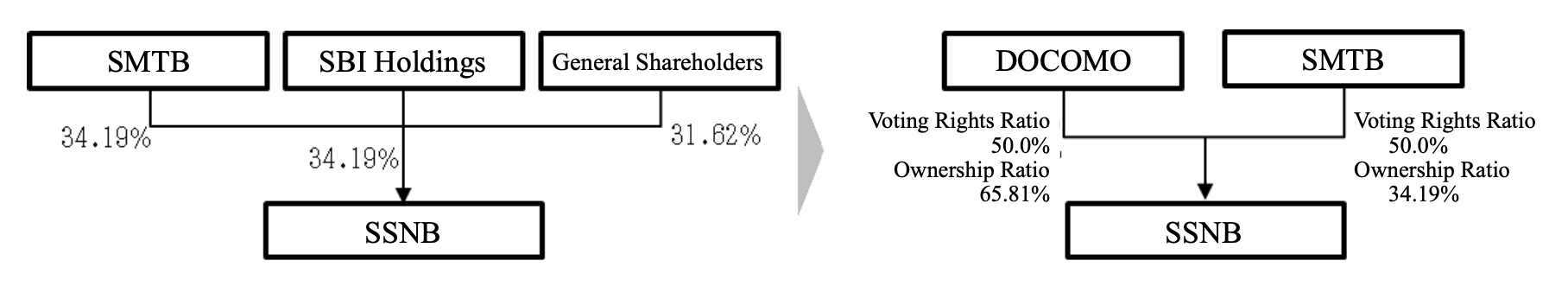

After the completion of the Tender Offer, DOCOMO will hold 65.81% of SSNB's stock (including 31.62% of non-voting shares) and SMTB will hold 34.19% of SSNB's stock. The resulting voting rights will be equally split, with DOCOMO and SMTB each holding 50%. These changes will be executed through a series of transaction processes as agreed among SSNB, DOCOMO, SMTB and SBI Holdings in the Basic Agreement. As a result, SSNB will become a consolidated subsidiary of DOCOMO.