PayPay Powers LY Corp's First Quarter as it Prepares for IPO

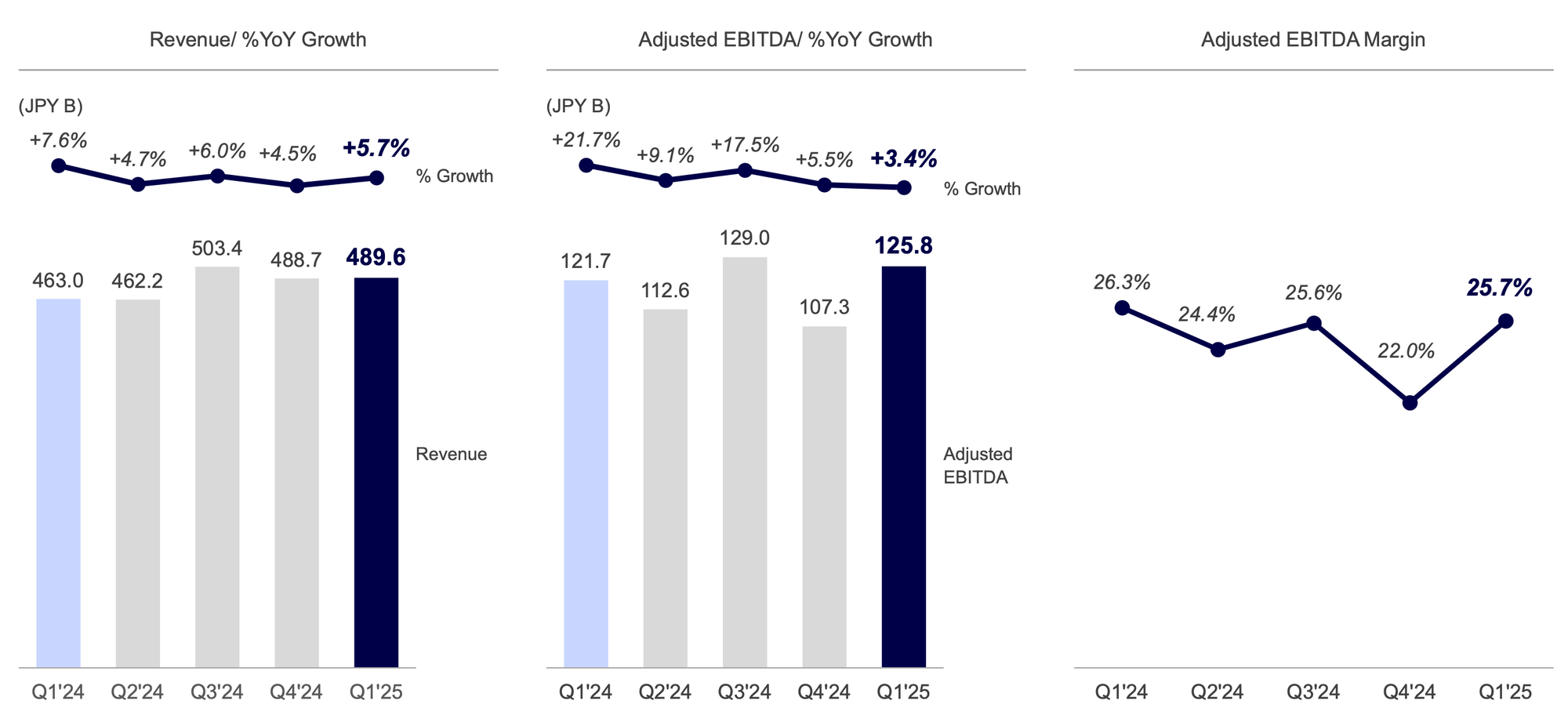

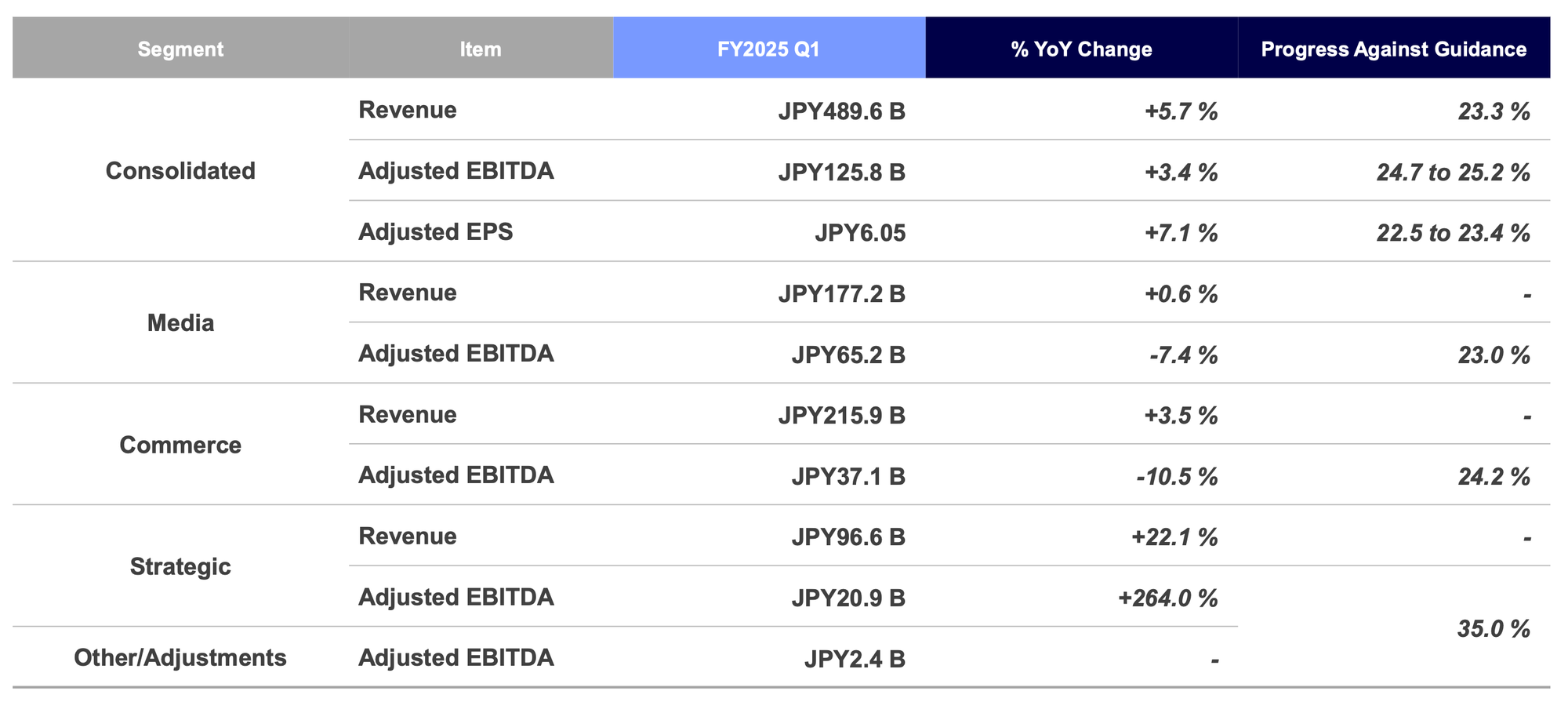

LY Corporation's revenue for the cumulative consolidated first quarter of the fiscal year ending March 31, 2026 amounted to 489.6 billion yen (up 5.7% year on year), representing the highest cumulative consolidated first quarter revenue to date. This was due to an increased revenue in the Strategic Business accompanied by the growth in PayPay consolidated, increased revenue in the Commerce Business accompanied by factors including the favorable performance of the ASKUL Group and ZOZO Group, among others, as well as increased revenue in the Media Business driven by the growth of account advertising.

Adjusted EBITDA for the cumulative consolidated first quarter of the fiscal year ending March 31, 2026 amounted to 125.8 billion yen (up 3.4% year on year), representing the highest cumulative consolidated first quarter earnings to date. This was mainly due to the increased revenues mentioned above, despite the absence of increased income as a result of a gain on loss of control of subsidiary (cash transaction) recorded in the same period of the previous fiscal year, and an increase in sales promotion expenses.

In addition, operating income for the cumulative consolidated first quarter of the fiscal year ending March 31, 2026 amounted to 95.0 billion yen (down 11.0% year on year), mainly due to the recognition of a gain on loss of control of subsidiary (non-cash transaction) during the same period of the previous fiscal year.

Segment Performance

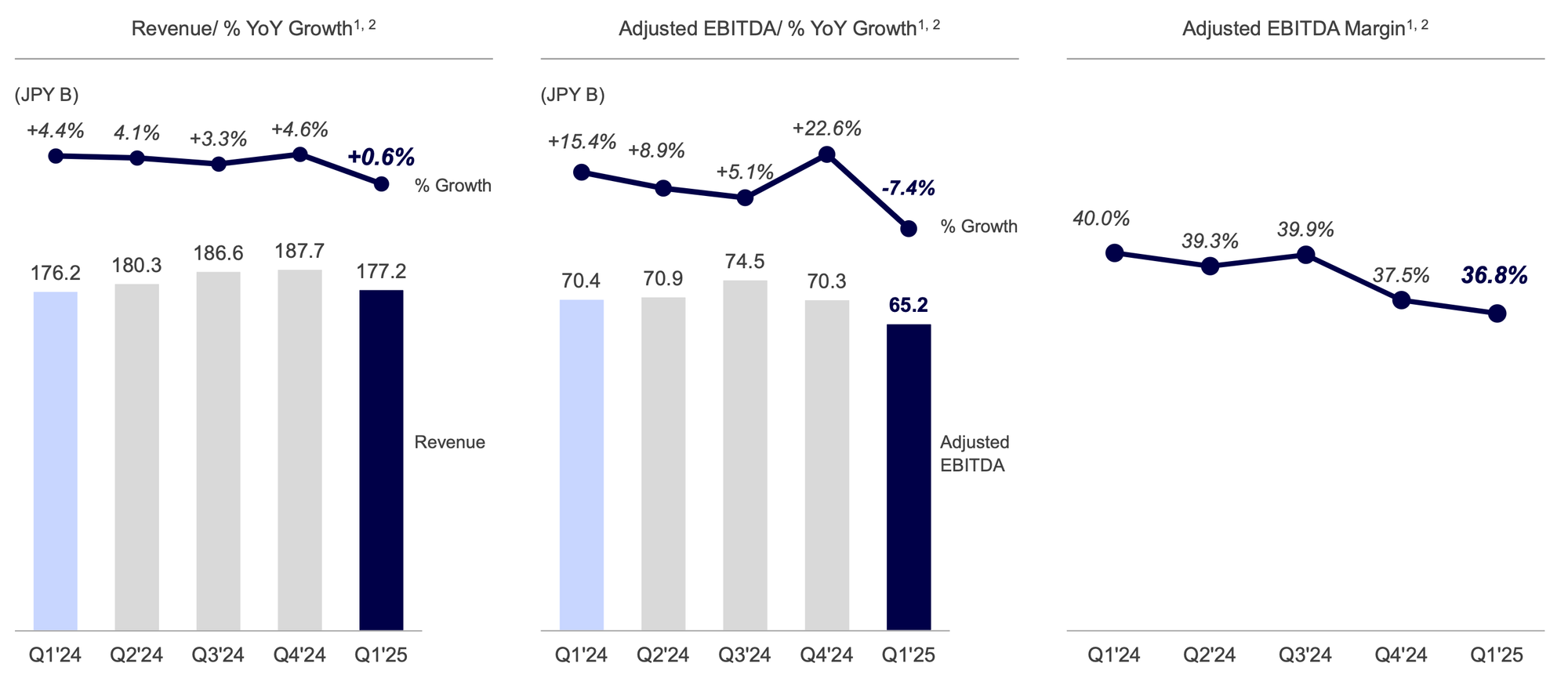

Media Business

The revenue of the Media Business for the cumulative consolidated first quarter amounted to 177.2 billion yen (up 0.6% year on year). This was due to increased revenue from account advertising and other factors. Furthermore, adjusted EBITDA amounted to 65.2 billion yen (down 7.4% year on year) mainly due to increases in personnel expenses and generative AI-related expenses. The revenue of the Media Business accounted for 36.2% of the total revenue.

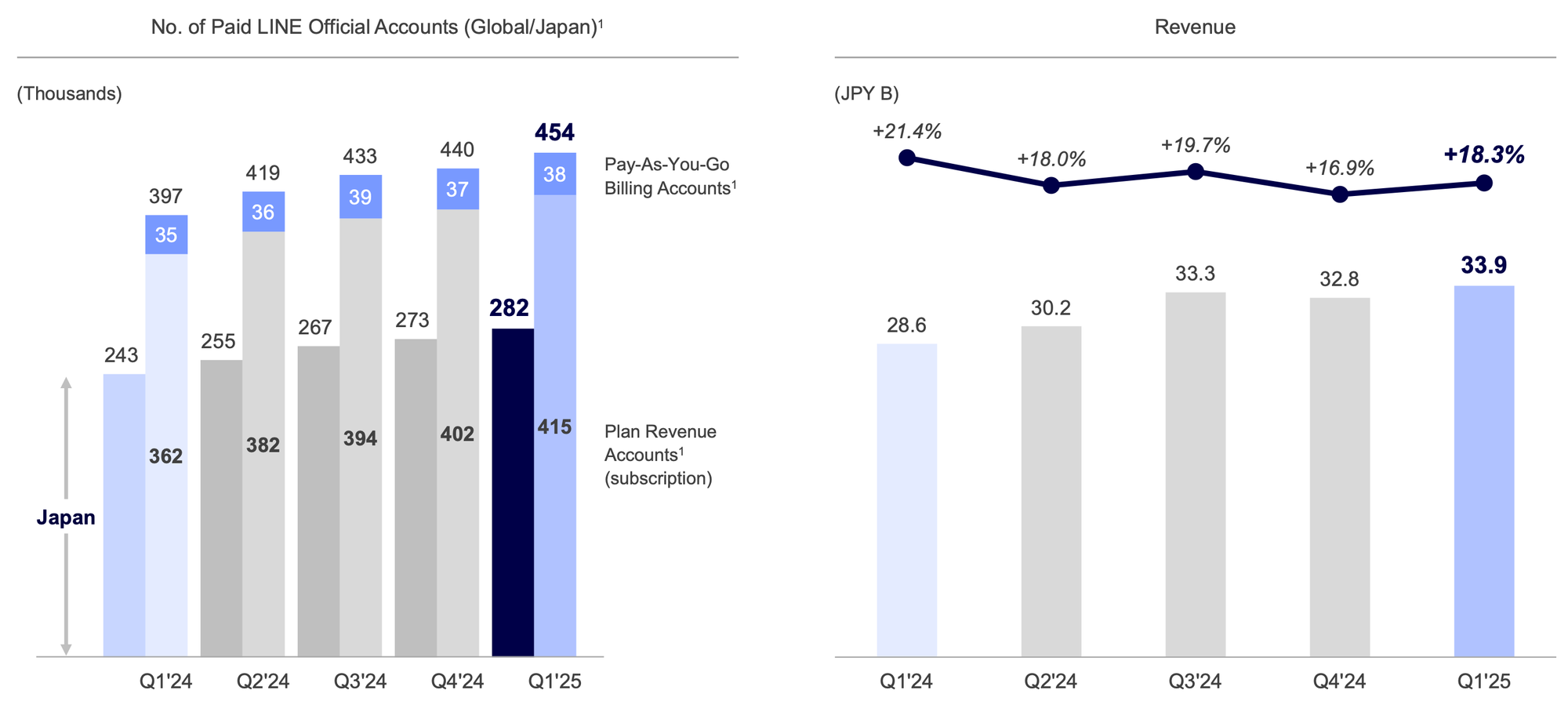

- Account advertising: Revenue increased 18.3% year on year, maintaining a high growth, due to an increase in the number of paid accounts and expansion of pay-as-you-go billing in LINE Official Account.

- Search advertising: Revenue decreased year on year from both LY Corporation's websites and partners' websites.

- Display advertising: Revenue slightly increased year on year as a result of an increase in revenue from LINE Ads.

Account advertising experienced high growth backed by an increase in paid accounts and expansion of usage-based billing.

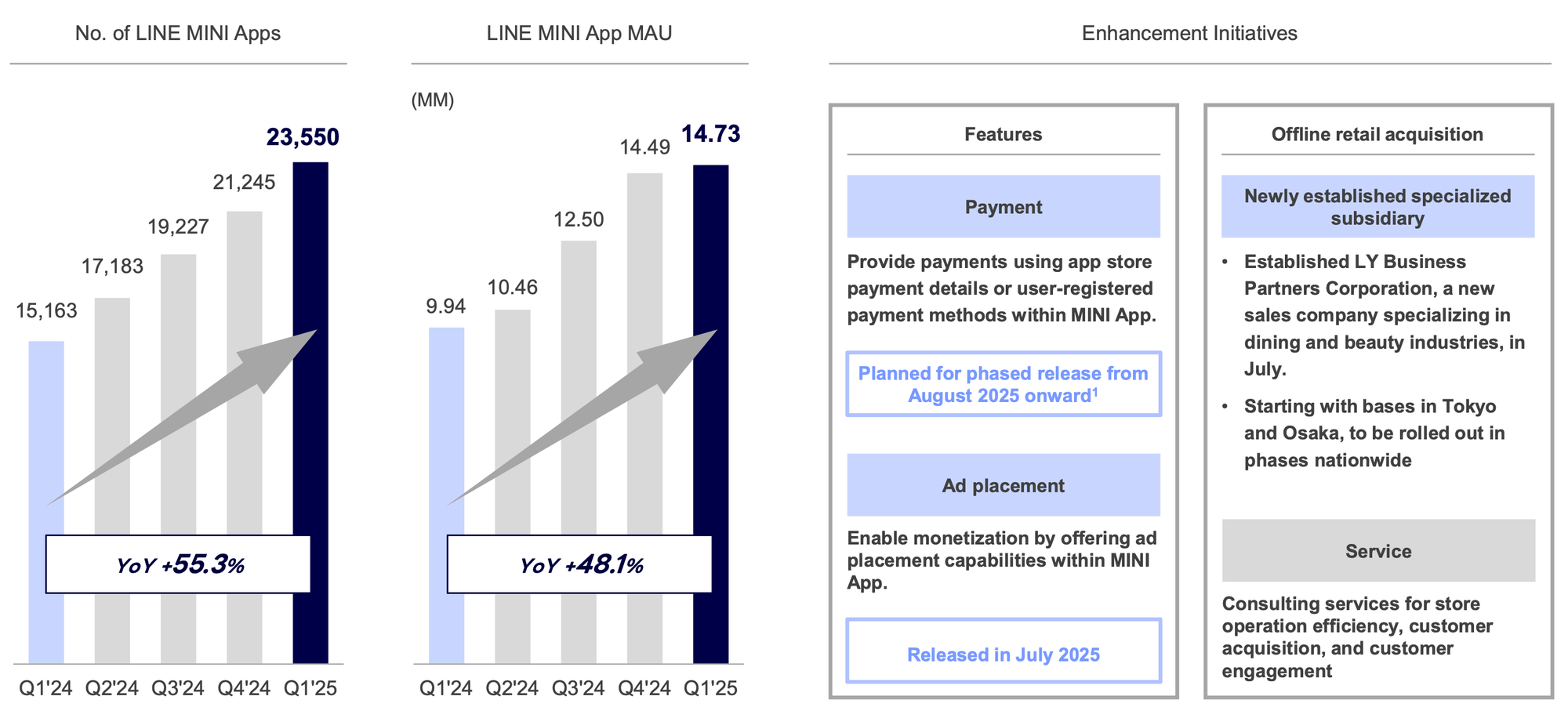

Mini app adoption is accelerating; LY Corporation plans to strengthen features and sales to drive further growth.

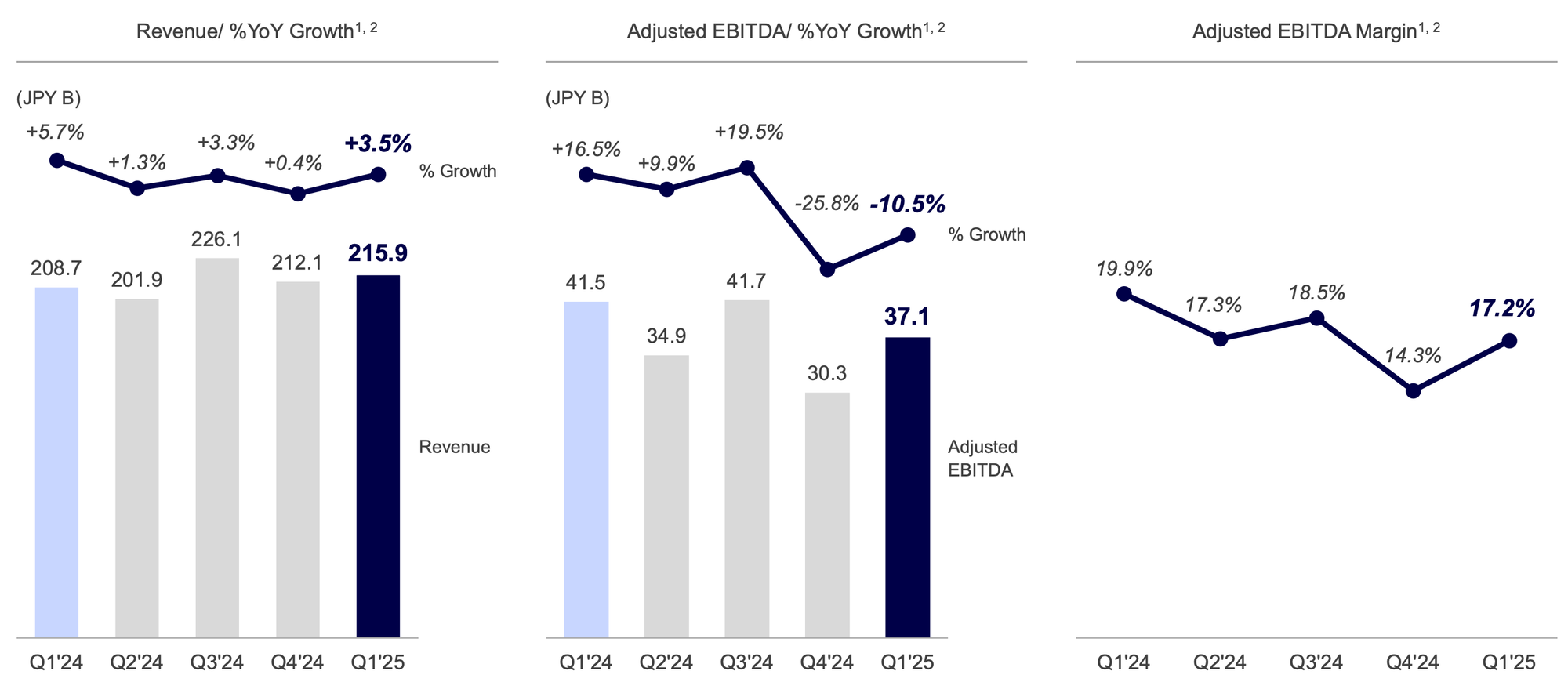

Commerce Business

The revenue of the Commerce Business increased mainly by subsidiaries including the ASKUL Group and ZOZO Group. In addition, revenue increased year on year as a result of the consolidation of BEENOS Inc. in May 2025 and continued steady growth in services e-commerce business, despite the impact from the deconsolidation of ValueCommerce and the IPX Group implemented in May 2024. As a result, the revenue of the Commerce Business for the cumulative consolidated first quarter amounted to 215.9 billion yen (up 3.5% year on year).

Adjusted EBITDA decreased 10.5% year on year, to 37.1 billion yen mainly due to an increase in expenses such as sales promotion costs and advertising and promotional expenses as well as the absence of increased income as a result of a gain on loss of control of ValueCommerce recorded in the same period of the previous fiscal year. The revenue of the Commerce Business accounted for 44.1% of the total revenue.

E-commerce transaction value amounted to 1,095.1 billion yen (up 6.8% year on year) due to growth in domestic merchandise transaction value mainly from the shopping business and steady growth in the transaction value of domestic services. Domestic merchandise transaction value accounted for 782.1 billion yen (up 4.9% year on year) of the total e-commerce transaction value.

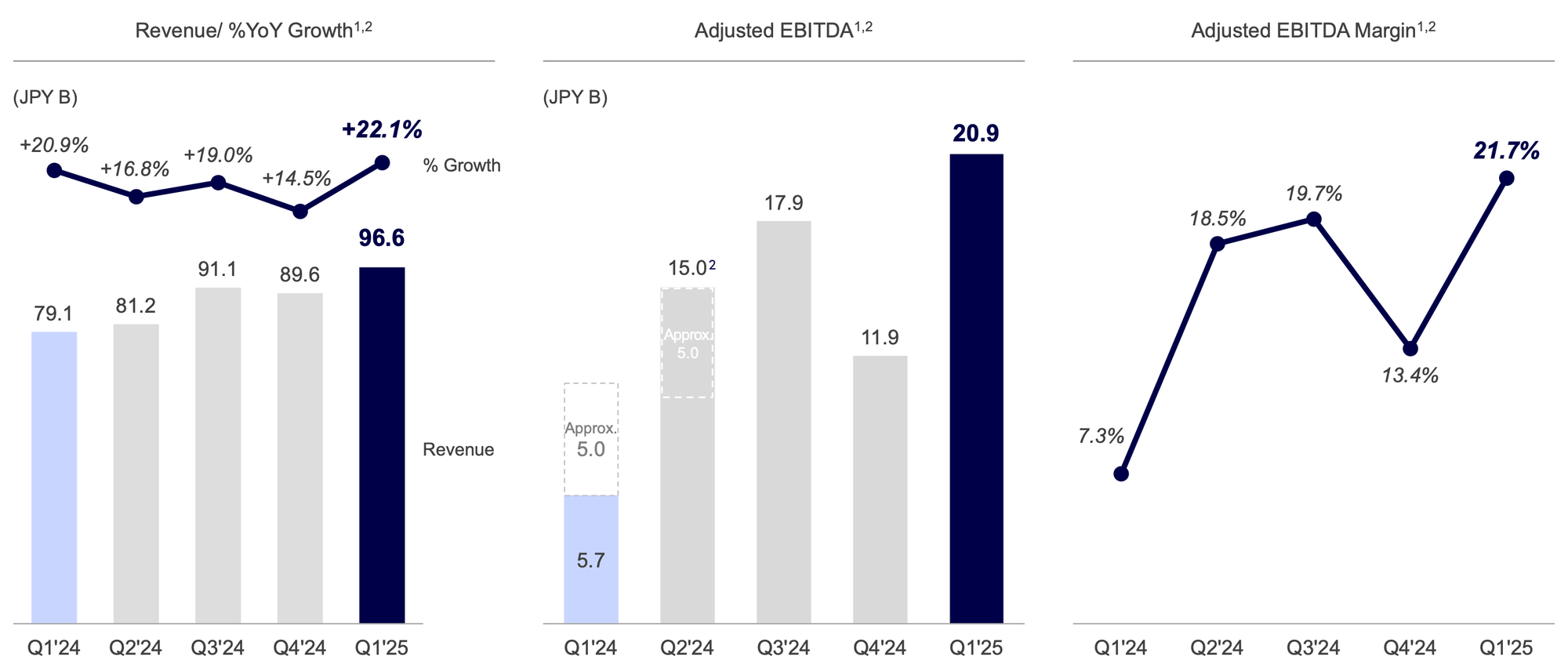

Strategic Business

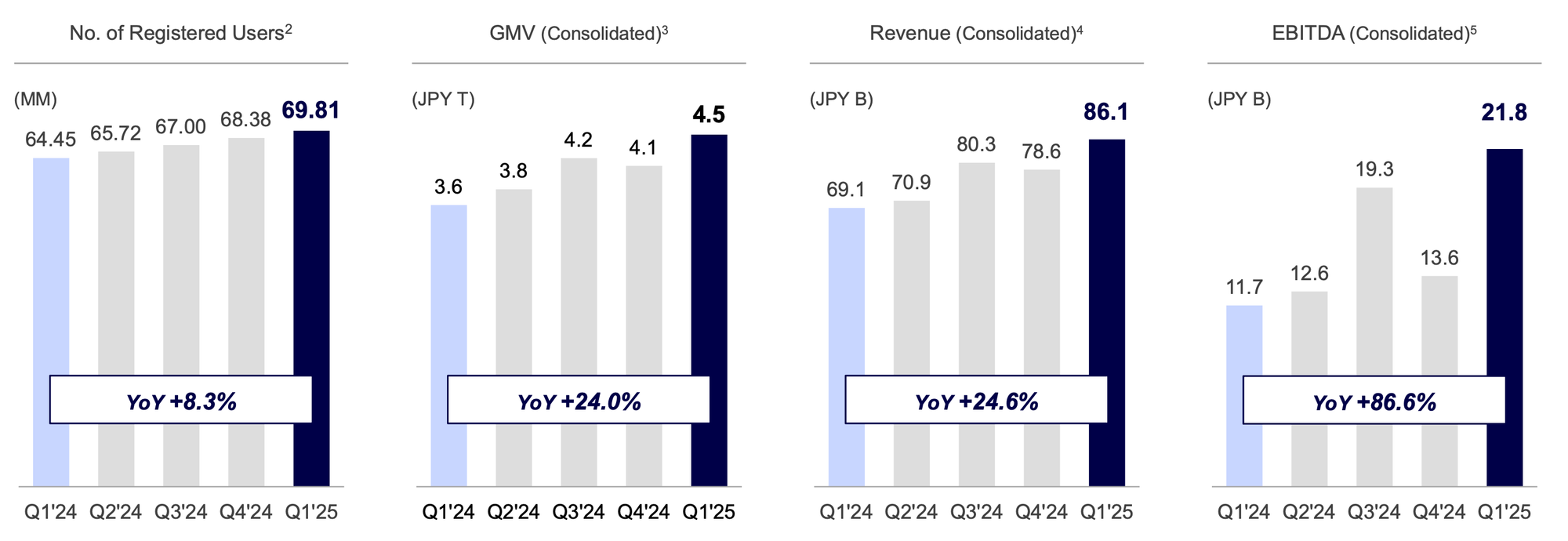

PayPay consolidated GMV for the cumulative consolidated first quarter amounted to 4.5 trillion yen (up 24.0% year on year) while maintaining steady growth. Furthermore, the loan balance of PayPay Bank Corporation came to 980.5 billion yen (up 26.8% year on year).

As a result, the revenue of the Strategic Business for the cumulative consolidated first quarter amounted to 96.6 billion yen, representing a 22.1% increase year on year. In addition, adjusted EBITDA amounted to 20.9 billion yen (up 264.0% year on year). The revenue of the Strategic Business accounted for 19.7% of the total revenue.

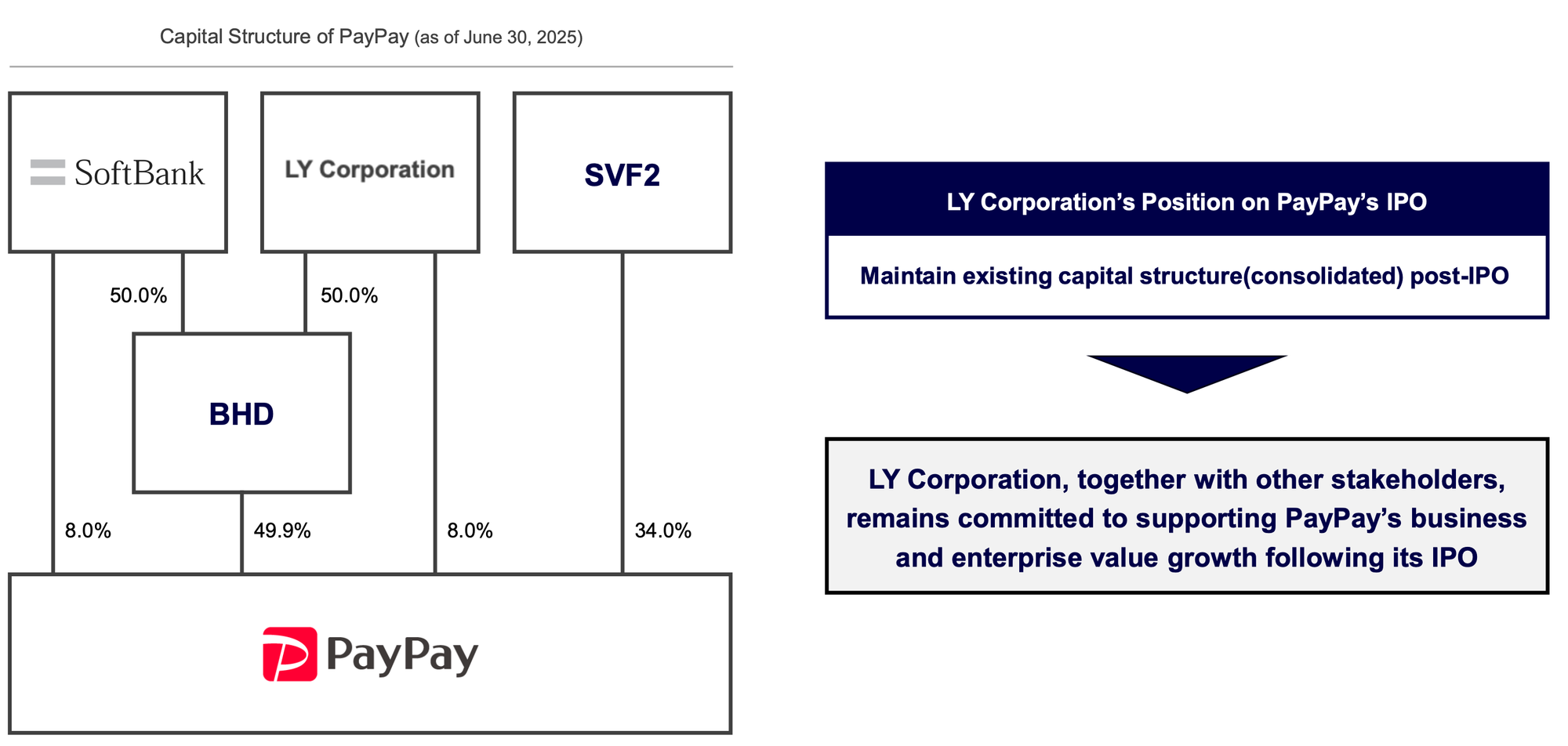

As presented in May 2025, PayPay has begun preparations for an IPO on the back of its consolidated operating profit turning black for the full prior fiscal year. PayPay is eyeing the U.S. market, which could make it the largest U.S. IPO ever by a Japanese company, with the IPO taking place this year or next year, subject to a decision depending on market conditions. The current A Holdings held a U.S. IPO in 2016 for $895 million (about 132 billion yen), according to Bloomberg data.

PayPay's market capitalization could reach 1.5 trillion yen, or even higher if growth scenarios such as expansion of the financial services businesses like credit cards and banking are taken into account. Based on the 1.5 trillion yen estimate, even a 10% stock offering would exceed the size of the current A Holdings IPO.

LINE Bank Taiwan

LY Corporation has decided on April 10, 2025, to increase the capital of LINE Bank Taiwan, an equity method affiliate of LY Corporation, through its consolidated subsidiary, LINE Financial Taiwan, by 2.745 billion Taiwan dollars. The capital increase was completed on June 17, 2025.

Upon completion of the capital increase, LINE Financial Taiwan holds 51.15%, or the majority of voting rights in LINE Bank Taiwan and, accordingly, LY Corporation gained control over LINE Bank Taiwan. As a result, LINE Bank Taiwan newly became LY Corporation's consolidated subsidiary.

Shareholder Focus

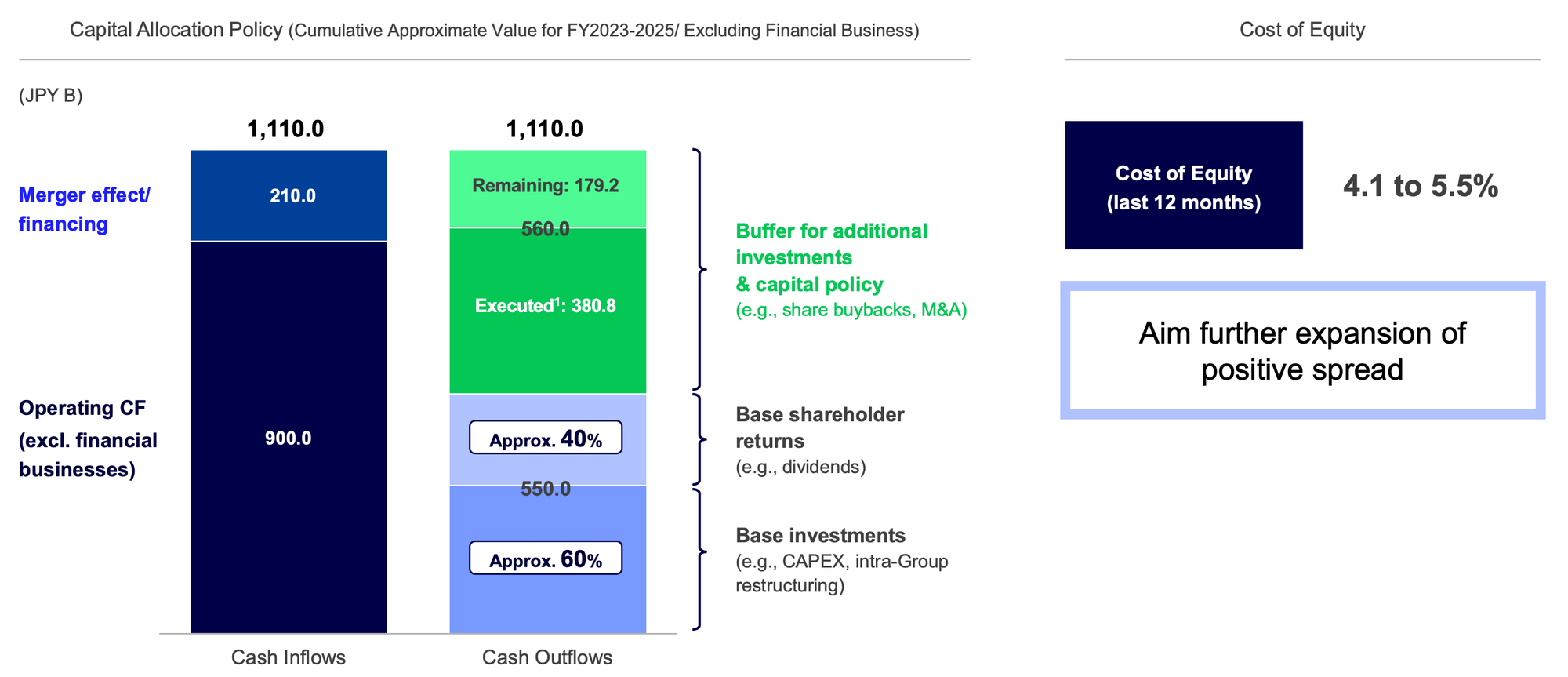

LY Corporation is balancing growth investments and shareholder returns to drive positive spread. It has approximately 179.2 billion yen remaining for additional investments and capital policy.

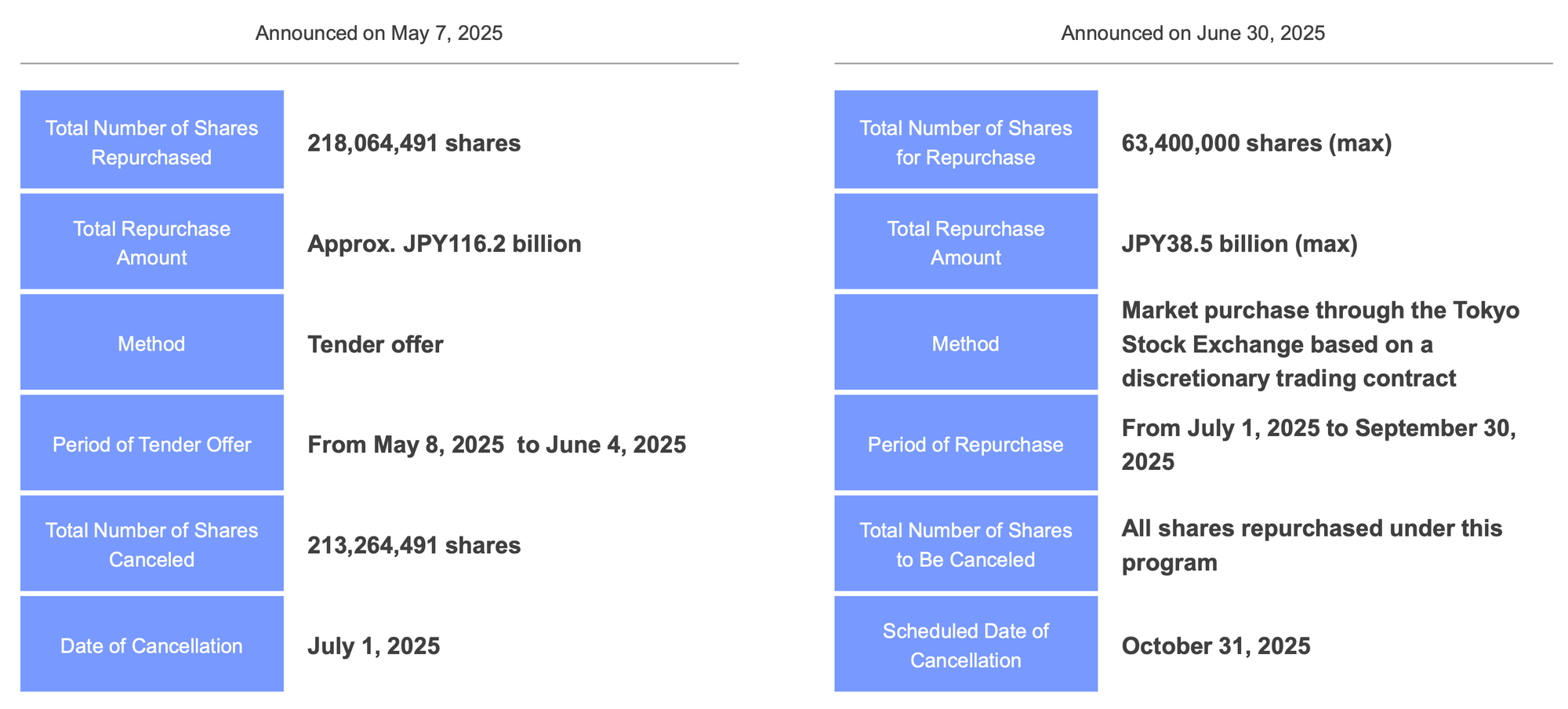

Within the first quarter, LY Corporation has completed the first stage of its ongoing share repurchase and cancellation program totaling approximately 150 billion yen under its capital allocation policy, with the second stage running until October 31, 2025.