Policy Briefing: The Self-Regulatory Framework for Business Invoice Payment Services in Japan

The landscape of business-to-business (B2B) transactions in Japan is undergoing a significant transformation, driven by the rapid growth of Business Invoice Payment Services (BIPS). These services provide a vital bridge between traditional invoicing and modern cashless payments, enhancing operational flexibility for Japanese enterprises.

This rapid adoption has outpaced direct legislative oversight, creating a regulatory penumbra where the service's classification—whether as a form of lending or a currency exchange—remains ambiguous, posing potential risks to market stability and user protection. This situation necessitates a harmonized, secure operational standard to ensure market integrity.

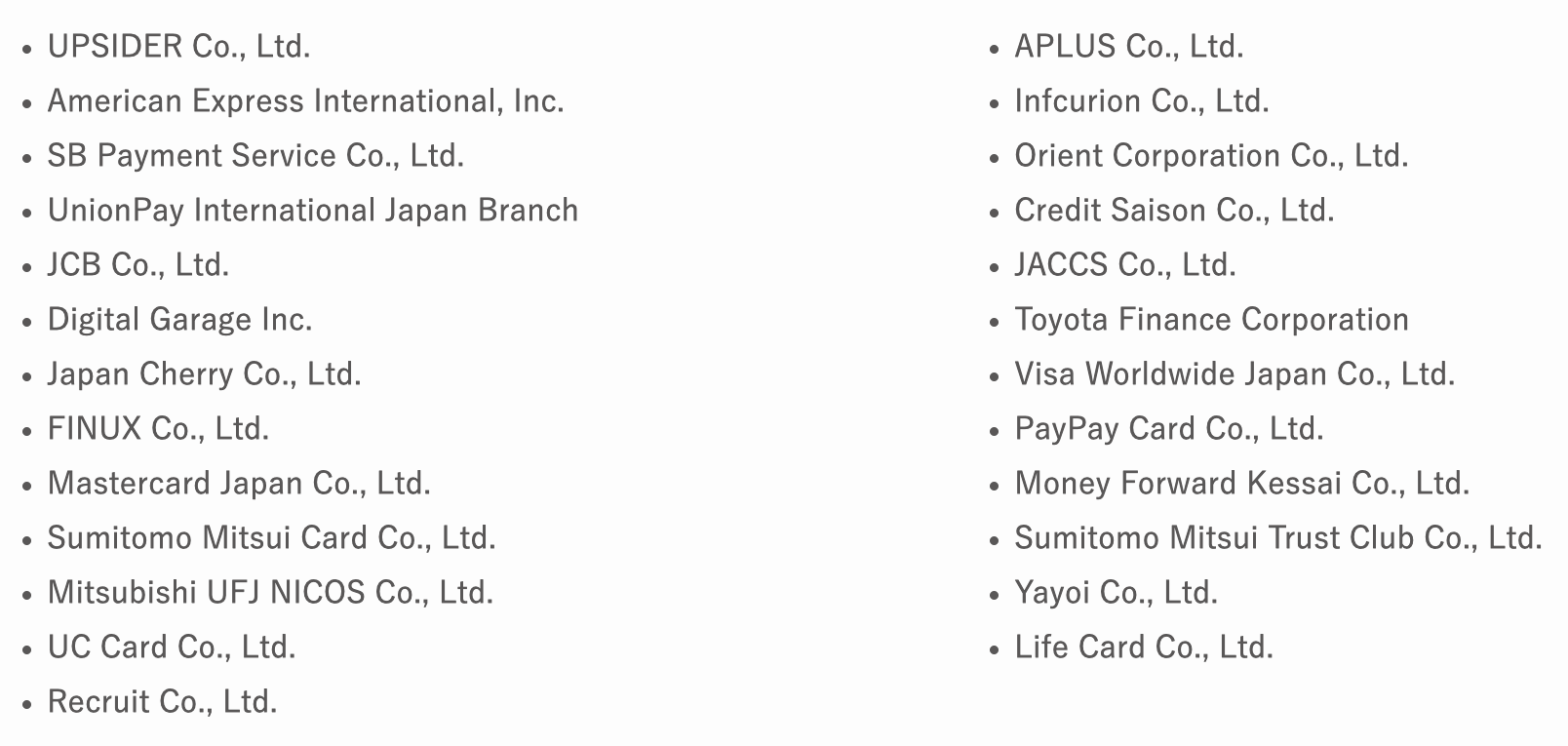

In response, industry leaders have proactively established the Business Invoice Payment Services Association (BIPSA). This self-regulatory body was created to develop and manage a comprehensive framework centered on the "Business Invoice Payment Service Transaction Guidelines." BIPSA is initially supported by 25 member firms.

This policy brief outlines the structure, core principles, and operational mandate of BIPSA and its guidelines. It is designed to inform financial regulators and industry stakeholders about this critical initiative to build a trustworthy and sustainable B2B payment ecosystem.

1. The Business Invoice Payment Service (BIPS) Model

A foundational knowledge of the BIPS operational model is essential for appreciating the scope and necessity of the new self-regulatory guidelines. The framework is designed to govern the specific mechanics and multi-party relationships inherent in this service.

Formally, Business Invoice Payment Service (BIPS) is a B2B transaction service where a BIPS provider, upon the buyer's request, remits payment for a supplier's invoice via bank transfer. The provider then collects the principal amount from the buyer using a cashless payment method, thus settling the buyer's original debt to the supplier.

The core transaction flow involves three primary entities:

- Buyer: The entity receiving goods or services that is obligated to pay the corresponding invoice, utilizing the BIPS provider to settle this debt via a cashless method.

- Supplier: The entity providing goods or services that issues the invoice and receives payment directly from the BIPS provider via bank transfer.

- BIPS Provider: The intermediary that pays the Supplier on the Buyer's behalf and subsequently collects the payment from the Buyer.

The unique tripartite interaction at the heart of the BIPS model necessitated the development of a dedicated governance framework to ensure operational clarity and security.

2. Rationale and Development of the Self-Regulatory Framework

The establishment of BIPSA was a strategic, preemptive maneuver by industry leaders to address regulatory gaps and ensure the market's sustainable and trustworthy development.

The primary impetus for the framework stemmed from discussions within Financial Services Agency working groups, which highlighted the need to clarify the legal standing of emerging payment services. Furthermore, the complexity of the multi-party BIPS ecosystem—involving buyers, suppliers, BIPS providers, acquirers, and issuers—demanded the creation of industry-wide standards to ensure harmonized and secure operations.

To ensure credibility and comprehensive scope, the guidelines were developed by the Cashless Promotion Council through extensive discussions with a wide range of stakeholders, including BIPS providers, payment service providers (both issuers and acquirers), and international payment brands. Critically, this development process included a direct exchange of views with the Financial Services Agency (FSA) and the Ministry of Economy, Trade, and Industry (METI).

Guided by a spirit of "autonomy," the overarching mission of BIPSA is to foster a safe and secure transaction environment and contribute to the stability of Japan's business transaction payment infrastructure.

To achieve these objectives, the association was established with a robust governance structure and a clear operational mandate, which are detailed in the following sections.

3. BIPSA Governance and Organizational Mandate

To function effectively as a self-regulatory body, BIPSA has established a formal organizational structure, equivalent to that of a general incorporated association. This ensures rigorous oversight, transparent decision-making, and specialized focus on key regulatory areas.

The primary governing bodies responsible for high-level policy are:

- General Meeting: The highest decision-making body, comprising all members with voting rights, responsible for appointing officers and approving major policies and guideline revisions.

- Board of Directors: The executive body responsible for overseeing the association's operations, finances, and execution of policy.

Supporting the executive leadership are specialized committees tasked with managing specific aspects of the self-regulatory framework.

This robust governance structure is designed to effectively administer and enforce the core principles laid out in the BIPS Transaction Guidelines.

4. Core Principles of the BIPS Transaction Guidelines

The BIPS Transaction Guidelines form the operational core of the self-regulatory framework. They are architected around four core pillars, each designed to address a specific dimension of risk and governance within the BIPS ecosystem and to establish clear, enforceable rules of conduct.

A. Mandatory Registration and Centralized Oversight

The cornerstone of the framework is the requirement that all BIPS providers must be registered with BIPSA to operate. BIPSA functions as the central Registration Body, with the authority to maintain and publicize a registry of approved providers, reject applications that fail to meet standards, and deregister providers for non-compliance or guideline violations.

B. Comprehensive Risk Management and Due Diligence

The guidelines mandate that providers conduct thorough due diligence, verifying the identity and authenticity of both Buyers (who must be domestic corporations or sole proprietors) and Suppliers (who must be domestic corporations or individuals). This includes requiring providers to exclude any transactions involving anti-social forces and to forbid specific high-risk practices such as fictitious transactions, circular transactions, and any transactions not grounded in legitimate business activities.

C. Shared Responsibility Across the Payment Ecosystem

A key strength of the framework is its "whole-of-industry" approach, which places distinct obligations on other payment service providers to uphold the integrity of the system.

- Acquirers: Acquirers serve a vital gatekeeping function. They are prohibited from concluding merchant agreements with unregistered BIPS providers and are required to terminate contracts with any provider that fails to register within a specified grace period.

- Issuers: Issuers play a crucial role in user protection. The guidelines mandate that if a BIPS provider fails to execute payment to a supplier for reasons attributable to the provider, the issuer must, upon the buyer's request, refund the transaction amount to the buyer.

D. Transparency, Fairness, and User Protection

To protect end-users, the guidelines establish clear rules of engagement, including a prohibition on misleading advertising and a requirement to provide clear information on all fees and terms. Providers are also obligated to establish a formal complaint handling process. Notably, the guidelines specifically prohibit providers from requiring collateral from buyers as a condition of service.

The framework's success depends on its consistent application, which is governed by a clear implementation timeline and BIPSA's ongoing activities.

5. Implementation and Future Outlook

The BIPSA framework is designed as a dynamic system, with a clear implementation path and ongoing activities aimed at adapting to market evolution and continuously strengthening the B2B payment environment.

The BIPS Transaction Guidelines were published on December 26, 2025. Following a six-month transition period, they will be fully enforced starting June 26, 2026.

Beyond direct enforcement, BIPSA's mandate includes several ongoing and future activities:

- Statistical Data Collection: BIPS providers must submit quarterly data on transaction volume, number of transactions, and buyer contracts, which BIPSA will aggregate and publish to provide transparent market analysis.

- Public Awareness and Education: The association is tasked with providing accurate information to users to promote the proper use and benefits of BIPS.

- Fraud Information Sharing: A mechanism is planned for members to share information on fraudulent activities to enhance collective security. This feature will be implemented once the necessary systems are in place.

The BIPSA framework thus serves as a critical model of industry-led governance, balancing the promotion of financial innovation in B2B payments with the imperative for systemic stability and integrity. It provides a clear, preemptive solution to regulatory ambiguity, ensuring the BIPS market develops soundly within Japan's broader financial ecosystem.