Progmat-led Consortium to Commence Joint Study on "Tokenized Stock" and "Tokenization Law"

The "Digital Asset Co-creation Consortium" (abbreviated as DCC, with 315 member organizations), hosted by Progmat, will establish the "Tokenization Law & Stock ST Working Group (WG)" and commence a joint study with the purpose to enable the transfer of rights for all securities, including stocks and investment trusts, on-chain and to maximize the benefits of Security Token (ST) implementation.

In this joint study, referring to overseas precedents that have enacted general laws concerning tokenization, the participants will develop a private-sector-led framework/draft for the "Tokenization Law" legislation to comprehensively resolve analog regulations premised on certificate issuance. Furthermore, for stocks where domestic infrastructure has already been developed to a certain degree, the working group aims to identify areas where the utility of tokenization exceeds replacement costs and to design products/systems, thereby leading to the concrete formation of "tokenized stock" products.

Following the announcement of the WG establishment, the DCC will accept participation from related organizations as needed, with a kickoff in November 2025 and a goal to compile and publish a "Report" and "Tokenization Law (Draft)" by March 2026. Additionally, the working group aims to implement individual tokenized stock product formation projects based on the "Report" starting in spring 2026.

1. Background: Global Trends

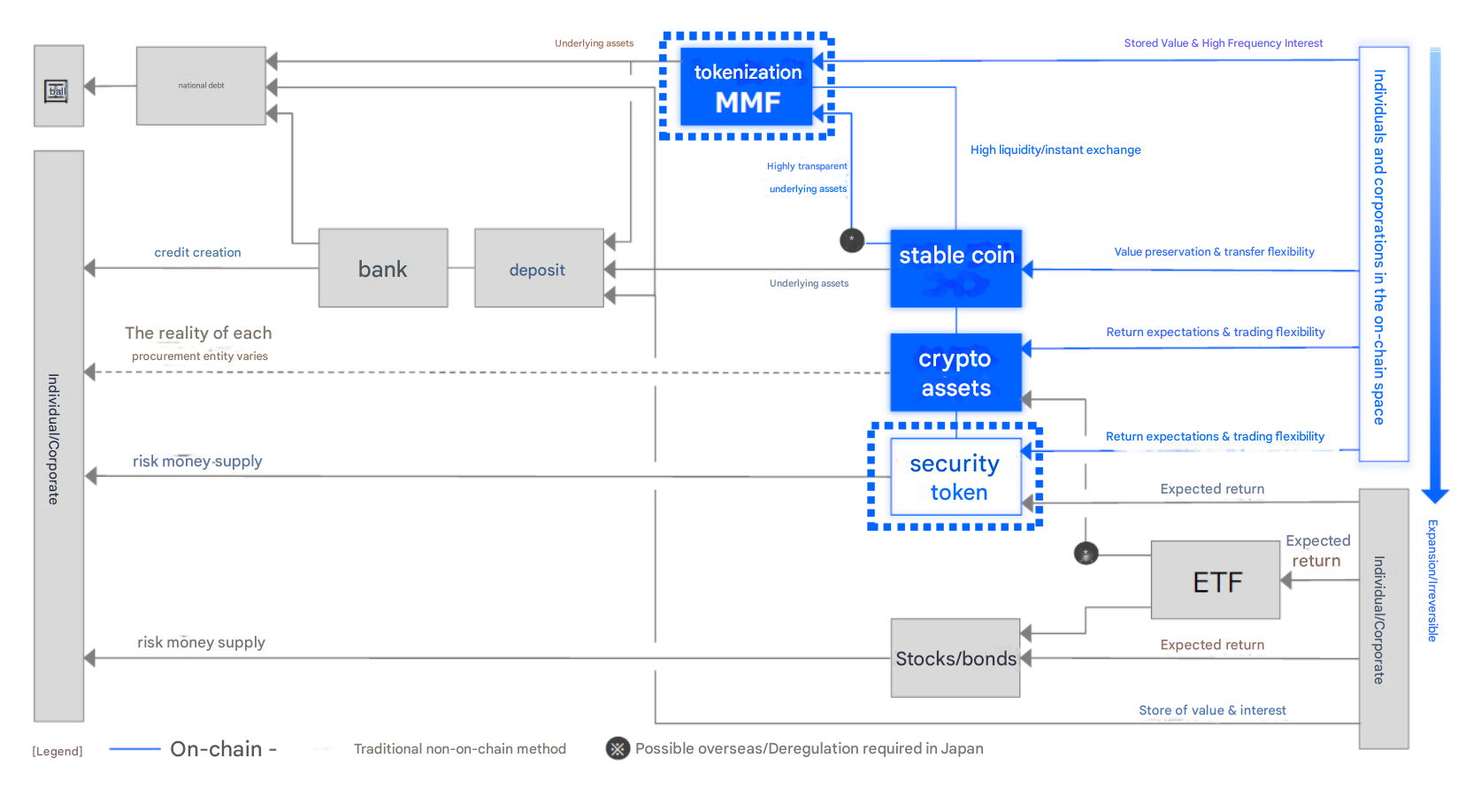

"On-chain finance," which is advancing overseas, is gaining prominence as a means of capital supply from the "on-chain investor base" in the investment chain. Following crypto assets and stablecoins (SC), tokenized MMF (Money Market Fund) balances have surged since 2024, and signs of rapid expansion of "tokenized stocks" (stock ST) have emerged from 2025.

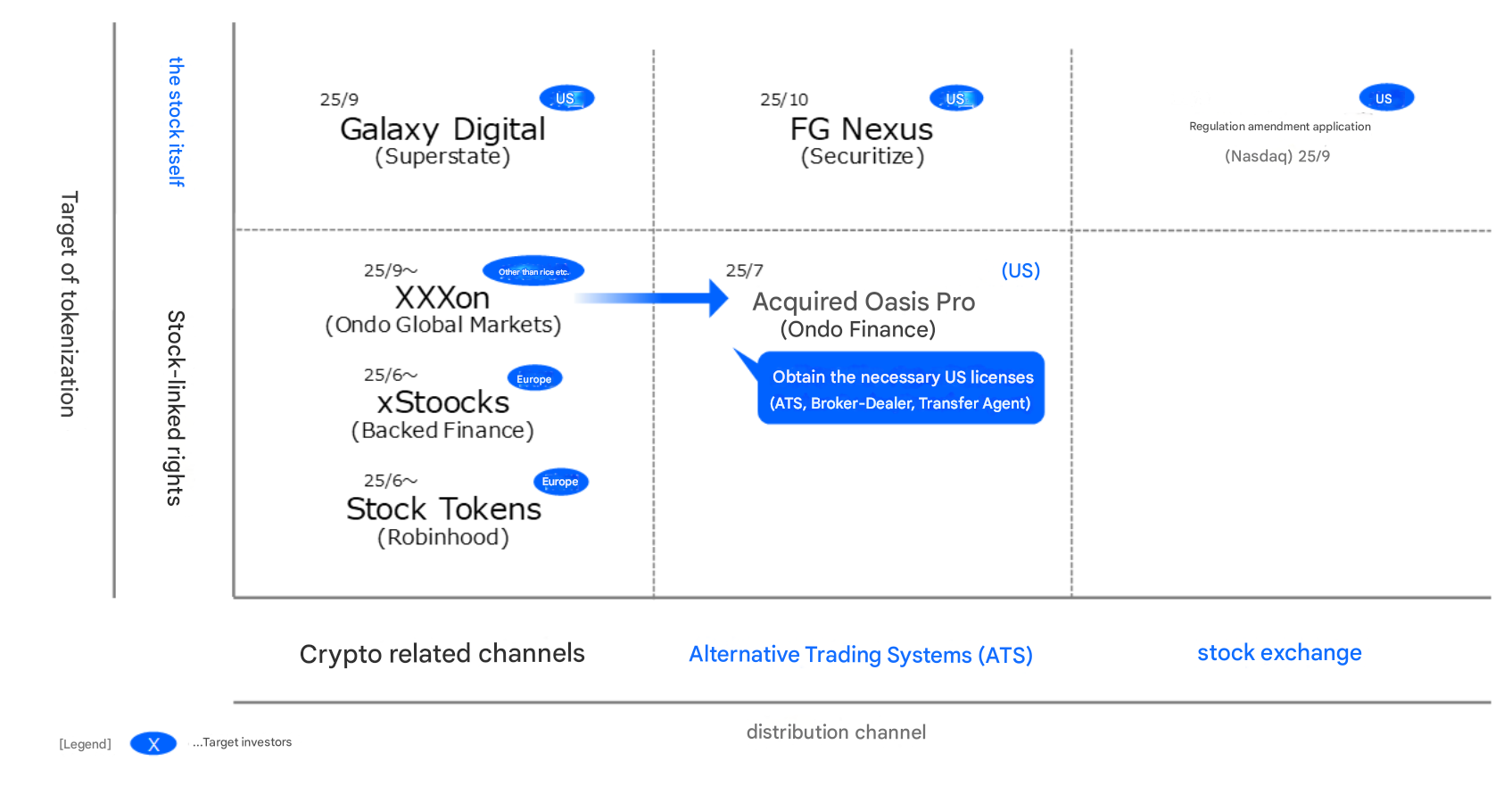

"Tokenized stocks" have begun with a method that makes tokens representing rights linked to US stocks tradable, primarily in European markets. However, movements to enable US investors to trade tokens representing US stocks themselves on Nasdaq and ATS (Alternative Trading Systems) are also accelerating, and this is no longer a distant concern for existing capital markets.

2. Background: Current Situation and Challenges in Japan

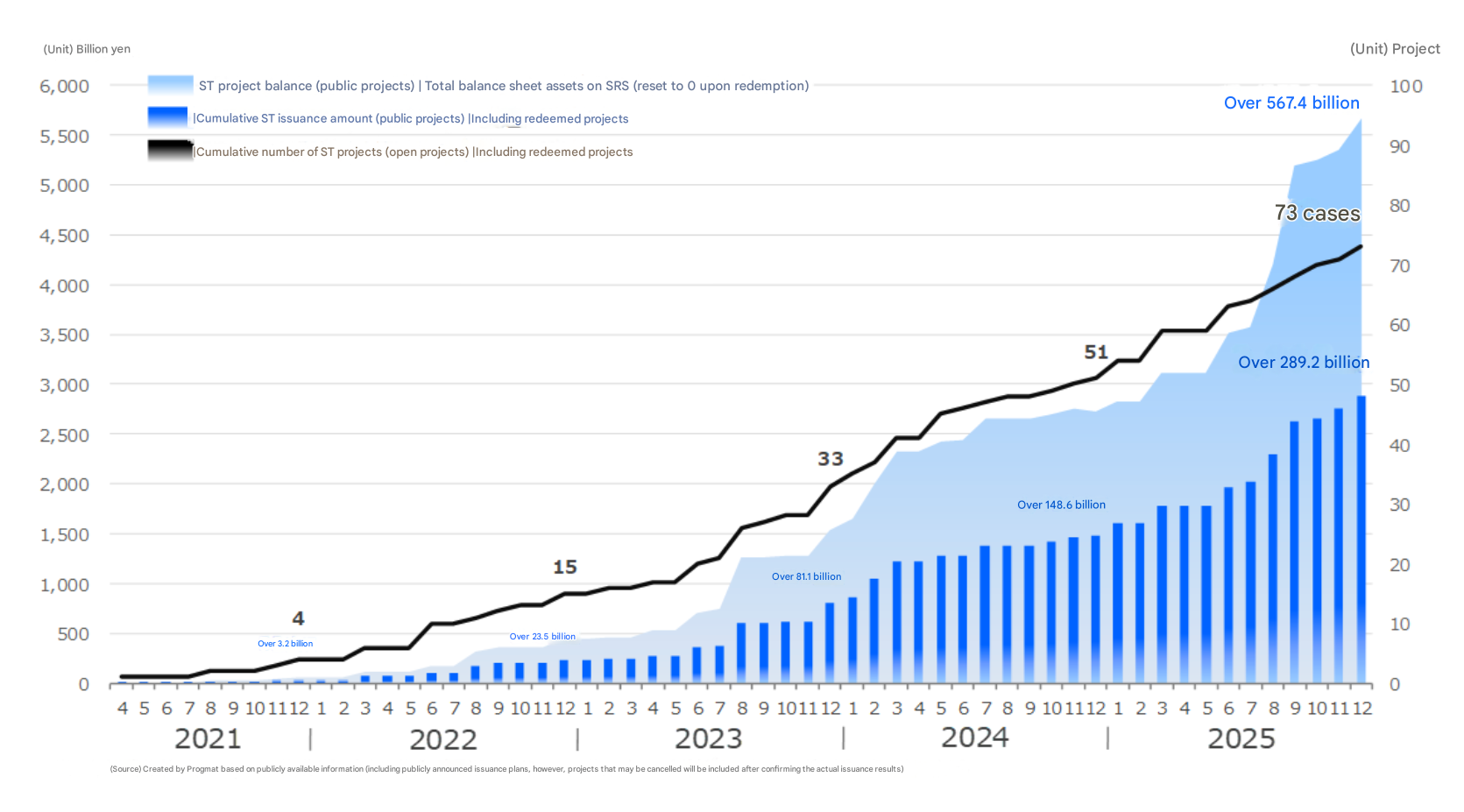

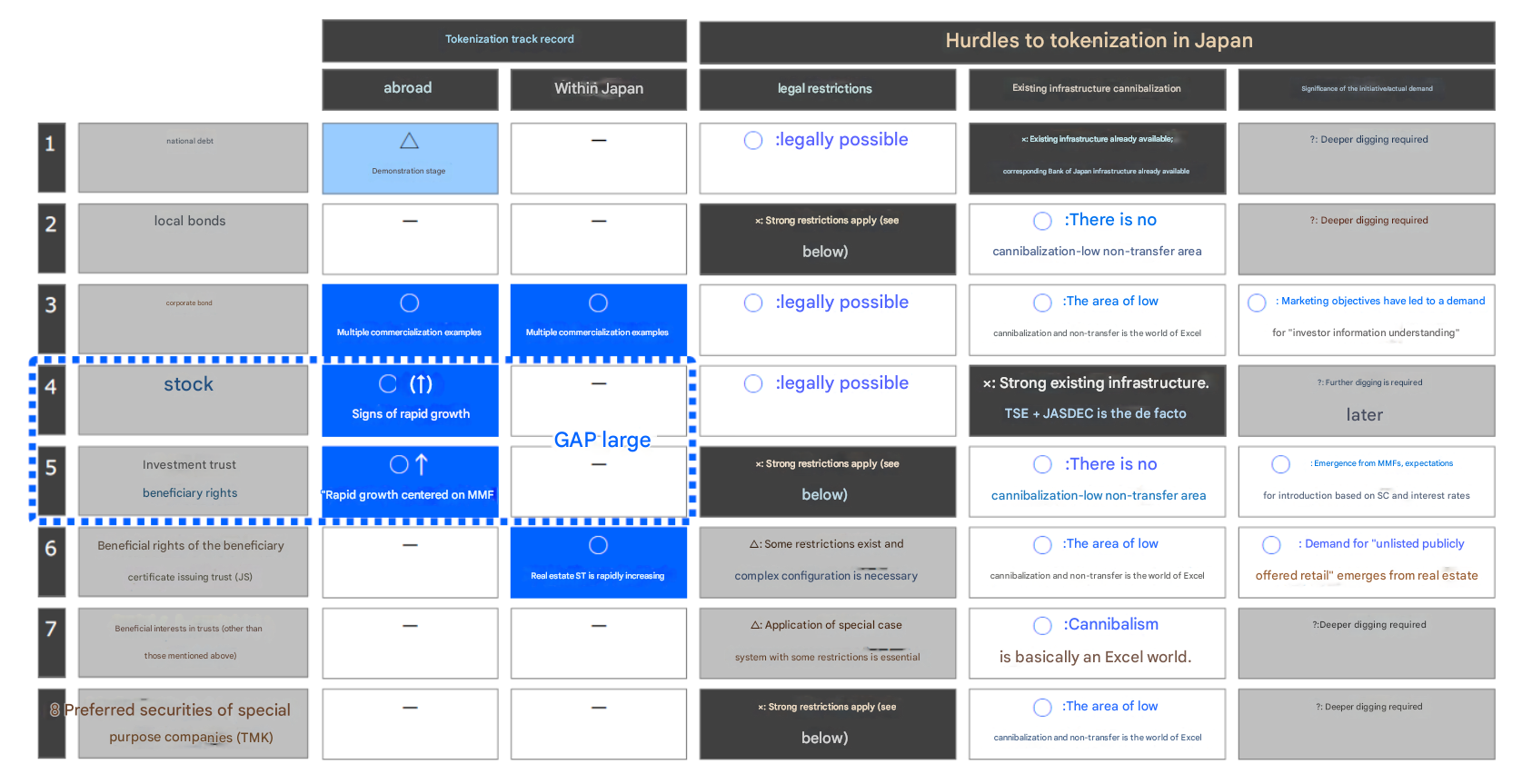

The outstanding balance of domestic ST projects has reached over 567.4 billion yen, and the cumulative ST issuance amount has reached over 289.2 billion yen, with the ST market continuing to expand. Until now, the majority has consisted of STs for securitized products using "beneficial interest certificate issuance trusts" backed by real estate (real estate ST) or tokenized corporate bonds (ST bonds), with the formation of tokenized products targeting investment trusts including MMF and stocks still to come.

Different hurdles exist for investment trusts and stocks, where the gap with overseas tokenization cases is particularly large. Namely, for investment trusts, "resolution of legal constraints" is necessary, while for stocks, "identification of actual demand that exceeds replacement/coexistence costs in the presence of already robust existing infrastructure" is required.

3. Overview of "Tokenization Law"

(1) Background Recognition

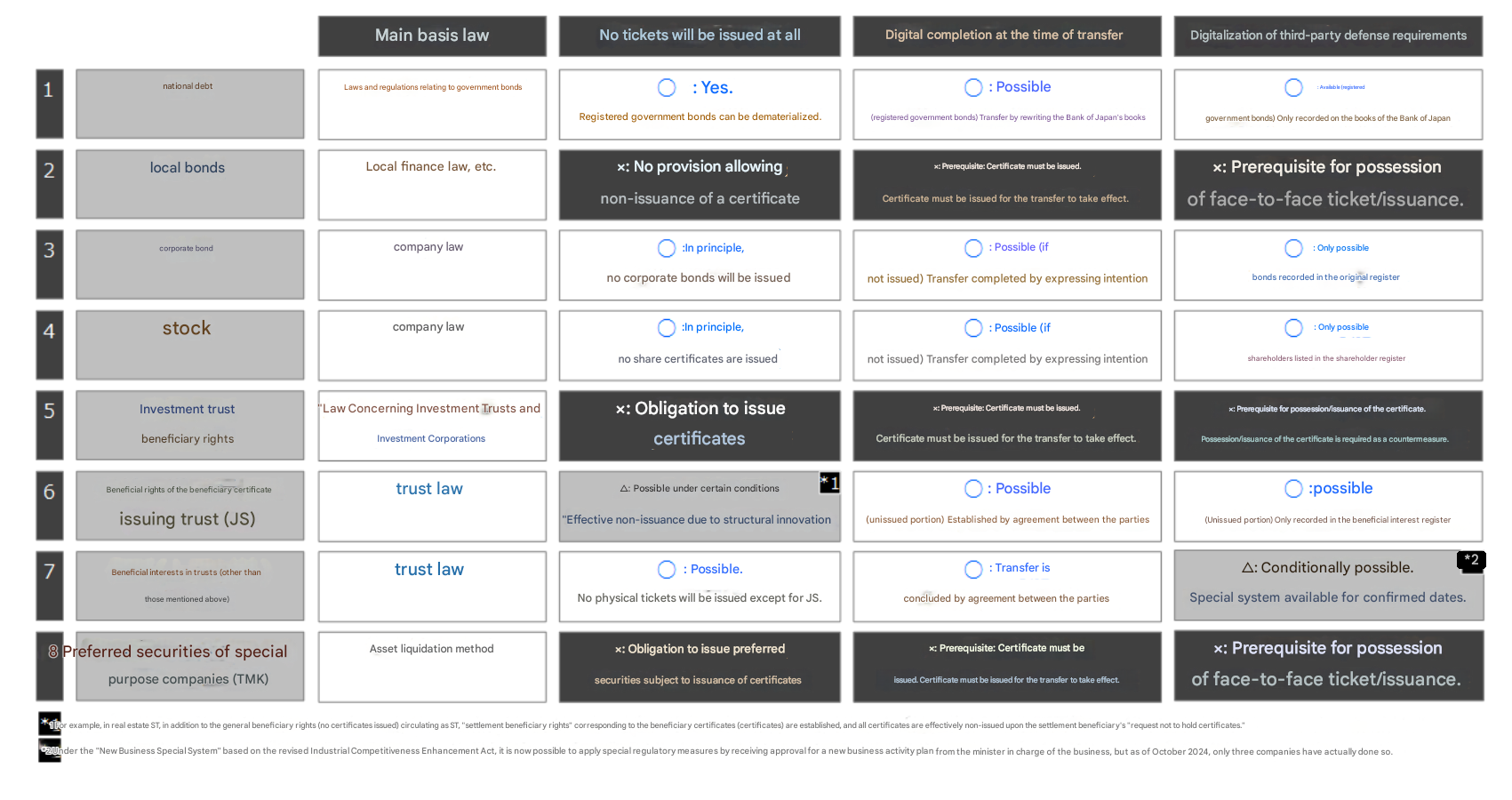

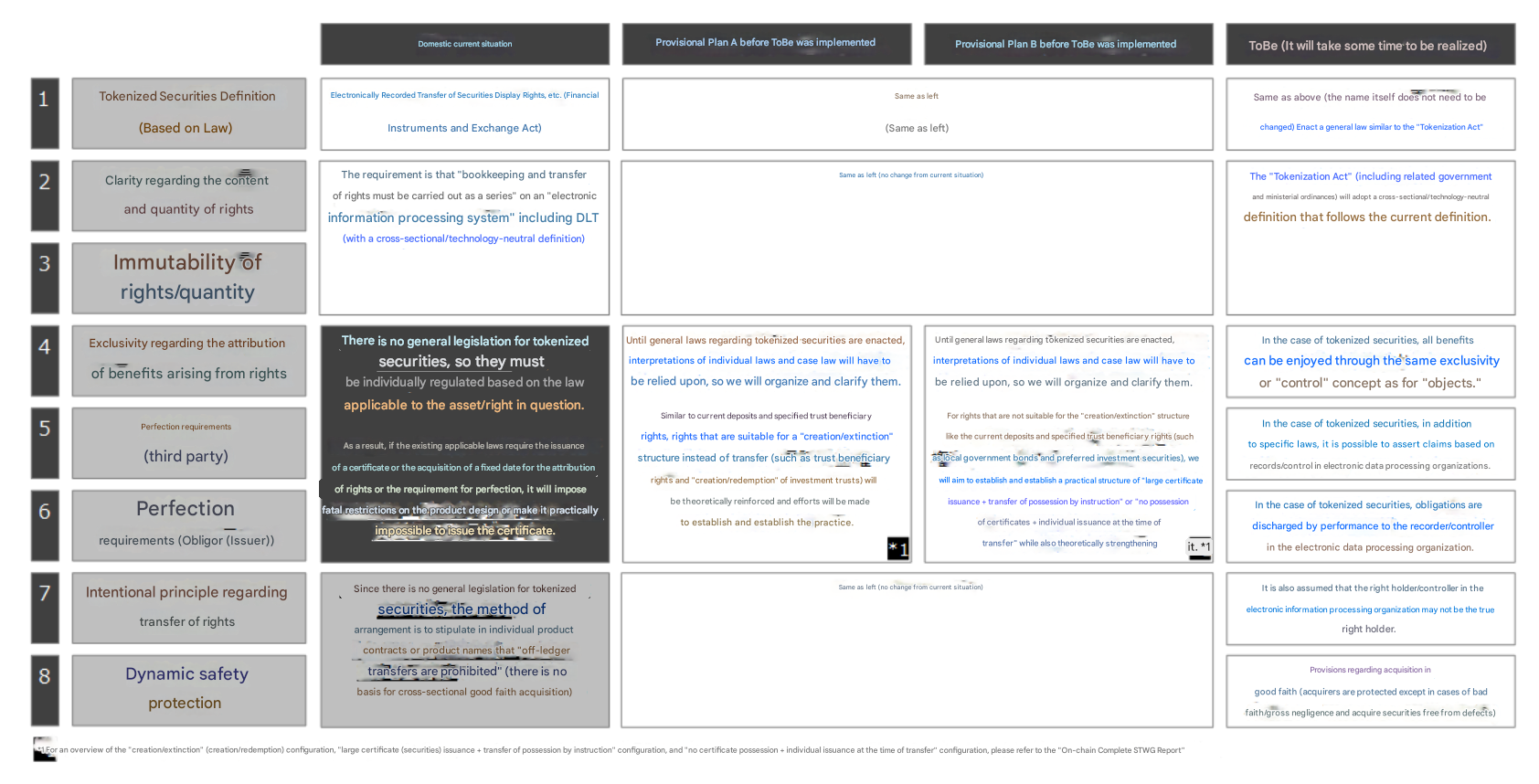

"Investment trusts," as well as "local bonds" and "special purpose companies," have legal systems premised on certificate issuance, making tokenization (digitalization) extremely difficult. "Beneficial interest certificate issuance trusts," which are mainly real estate STs, must adopt complex legal structures because interpretations differ on whether complete non-issuance of certificates is possible. "Trusts" are also difficult to complete digitally without special systems, but actual examples of special system application are minimal.

(2) Design Proposal

Similar to the "Act on Transfer of Bonds, Shares, etc." which realized "book-entry transfer securities," the DCC envisions enacting general legislation to horizontally clarify the legal characteristics of "tokenized securities" in general and to resolve "analog regulations" in an additive manner. (During the transitional period until enforcement, individual legal arrangements/clarifications will be implemented in parallel.)

4. Overview of "Tokenized Stock (Stock ST)"

(1) Background Recognition

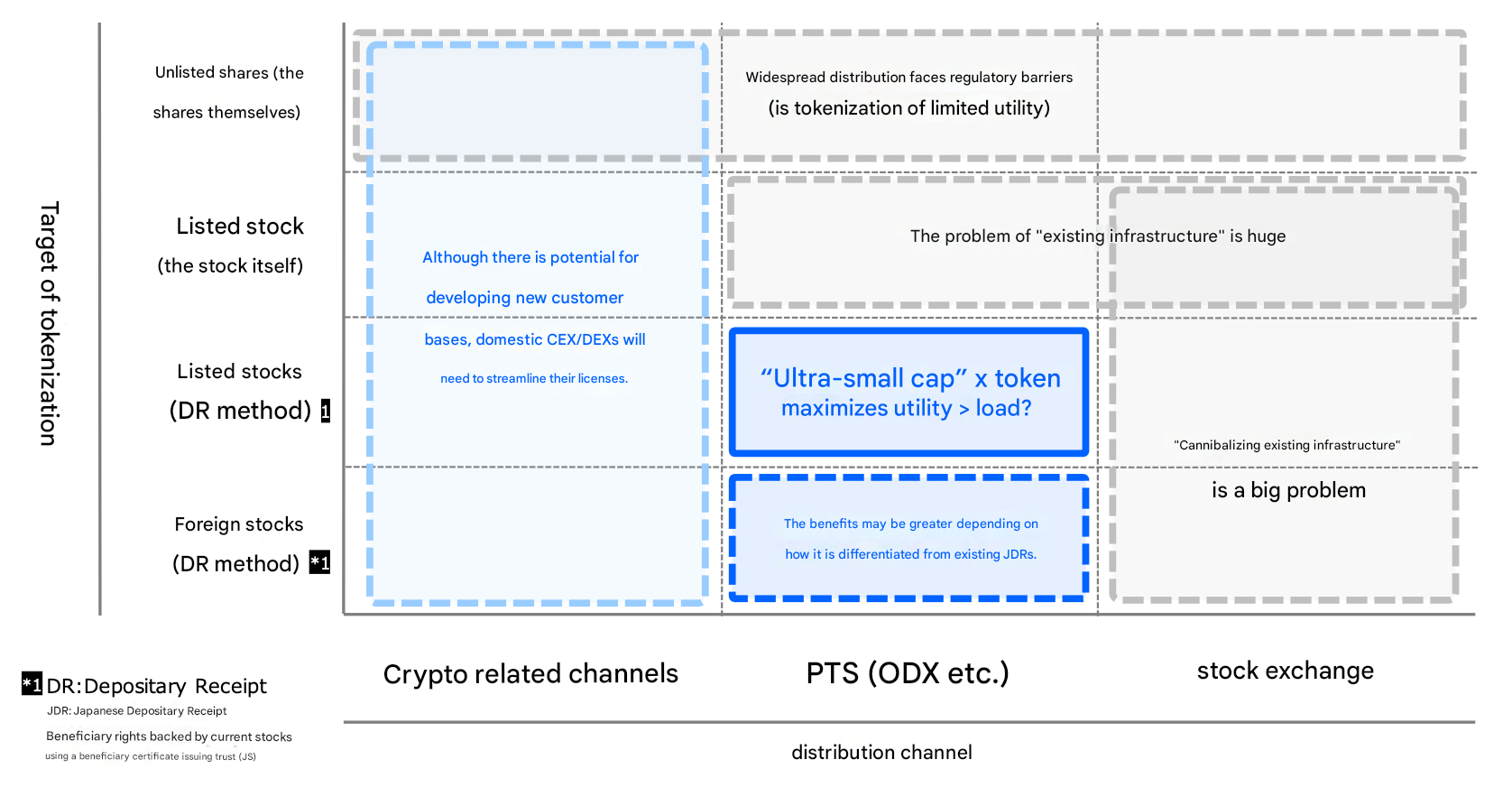

The "DR (Depositary Receipt) method" and "PTS (Private Trading Systems) trading" distribution have relatively less "cannibalization with existing infrastructure," and depending on product design ingenuity, utility may prevail.

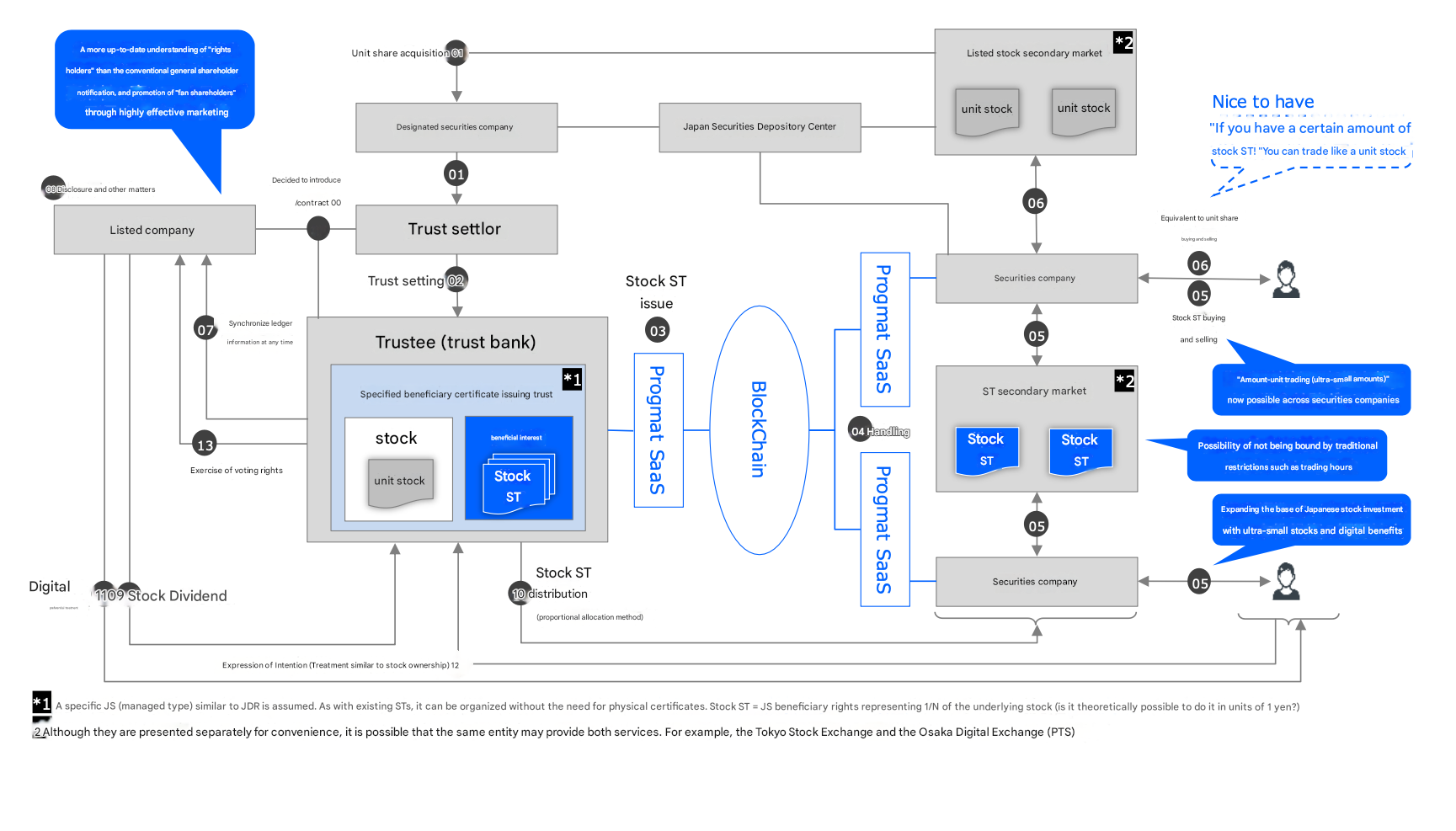

(2) Design Proposal

In existing stock markets, only "fractional shares (less than 100 shares)" are seeing shareholder increases, but they have no voting rights and cannot be traded on exchanges. By making "ultra-miniaturized" stocks (from 1 yen units) tradable on tokenization platforms using the DR method, the working group envisions bringing issuers and individual investors closer together (as a receptacle after reducing policy investment stocks), increasing trading flexibility, and leading to further activation of the stock market.

By resolving issues with "fractional shares" through "ultra-miniaturization," and resolving existing infrastructure constraints when forming "ultra-miniature stocks" as book-entry transfer securities through tokenization, there is potential to elevate this into a product category that benefits both investors and issuers.

Organizations Expected to Participate in "Tokenization Law & Stock ST Working Group (WG)"

Asset Management Companies

- SBI Asset Management Co., Ltd.

- SBI Okasan Asset Management Co., Ltd.

- SPARX Asset Management Co., Ltd.

- Nissay Asset Management Corporation

- Nomura Asset Management Co., Ltd.

- Mitsubishi UFJ Asset Management Co., Ltd.

Banks & Trust Banks

- SMBC Trust Bank Ltd.

- Shinsei Trust & Banking Co., Ltd.

- Norinchukin Trust & Banking Co., Ltd.

- Mizuho Trust & Banking Co., Ltd.

- Sumitomo Mitsui Trust Bank, Limited

- Mitsubishi UFJ Trust and Banking Corporation

Securities Companies & Market Operators

- AlpacaJapan Co., Ltd.

- SMBC Nikko Securities Inc.

- SBI SECURITIES Co., Ltd.

- Osaka Digital Exchange Inc.

- Daiwa Securities Co. Ltd.

- Daiwa Securities Group Inc.

- Nomura Securities Co., Ltd.

- Nomura Holdings, Inc.

- Mizuho Securities Co., Ltd.

- Mitsubishi UFJ Morgan Stanley Securities Co., Ltd.

Law Firms

- Anderson Mori & Tomotsune

- TMI Associates

- Nagashima Ohno & Tsunematsu

- Nishimura & Asahi

- Mori Hamada & Matsumoto

Accounting Firms / Tax Accounting Firms

- Tokyo Kyodo Accounting Office

- PwC Tax Japan