Raksul Partners with GMO Aozora Net Bank to Launch "Raksul Bank" for SMEs in 2025

Raksul Bank, which aims to solve financial challenges faced by small and medium enterprises (SMEs), has signed a BaaS (Banking as a Service) usage agreement with GMO Aozora Net Bank, toward the launch of services within 2025.

Background and Purpose

The Raksul Group has served customers including over 3 million registered SMEs through comprehensive business support in printing, advertising, and other areas. Through this experience, Raksul has strongly felt that financial challenges are hindering corporate growth.

SME Customer Challenges

- Complex corporate account opening procedures with lengthy approval processes

- High transfer fees and cumbersome procedures

- Cash flow shortages due to client-specified payment methods

- Limited payment options to business partners, preventing smooth payment processing

- Insufficient funds during growth periods, missing investment opportunities

To address these SME management challenges, the Raksul Group is working toward providing a financial platform. Through "Raksul Bank," both companies have partnered to support business growth by addressing SME concerns and providing cost reduction and cash flow support. The Raksul Group aims for "Raksul Bank" to serve as strategic infrastructure necessary for SME growth.

GMO Aozora Net Bank, which has set "No.1 bank for small & startup companies" as one of its medium to long-term strategic pillars, will strengthen its value proposition through this partnership by providing banking services to "Raksul Bank," contributing to the growth support of SMEs and startup companies.

About "Raksul Bank"

Features:

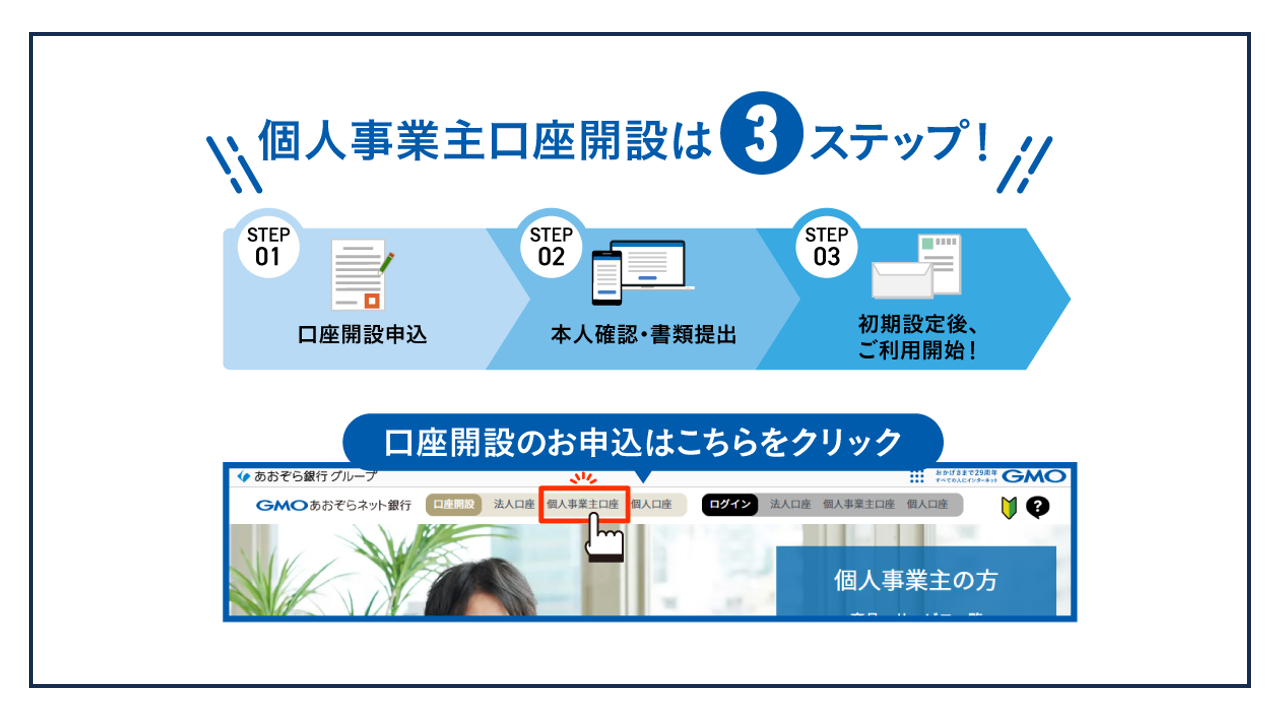

- Account opening completion as early as the day of application

- Mobile-complete application and usage possible

- Industry-lowest level transfer fees to other banks under consideration

- 2% point cashback (with some exceptions) on Raksul Bank debit card

- 2% point cashback (with some exceptions) on Raksul Bank payments

The banking service "Raksul Bank" that Raksul Bank plans to provide aims to achieve industry-lowest level transfer fees to other banks, supporting SME cost reduction.

Furthermore, through 2% point cashback (with some exceptions) on payments for Raksul orders from "Raksul Bank" and debit card usage for advertising fees, online tools, and other business scenarios, Raksul Bank will provide more beneficial and convenient services to Raksul customers. Supporting mobile applications and usage, "Raksul Bank Branch" accounts can be used for transfers and deposits as early as the day of application (under certain conditions).

Future Outlook

The financial platform envisioned by the Raksul Group includes:

- Entry into corporate credit card business

- Provision of deferred payment functions for received invoices and invoice factoring services

- Development of financial support services for diverse funding needs of SMEs including working capital and equipment investment

- Minimization of friction in all financial transactions including foreign currency transfers

Raksul Group will provide comprehensive financial value that leads to business growth beyond "UI/UX" and "convenience."