Rakuten Advances FinTech Strategy with Launch of AI-Powered Spending Assistant on Card Lite App

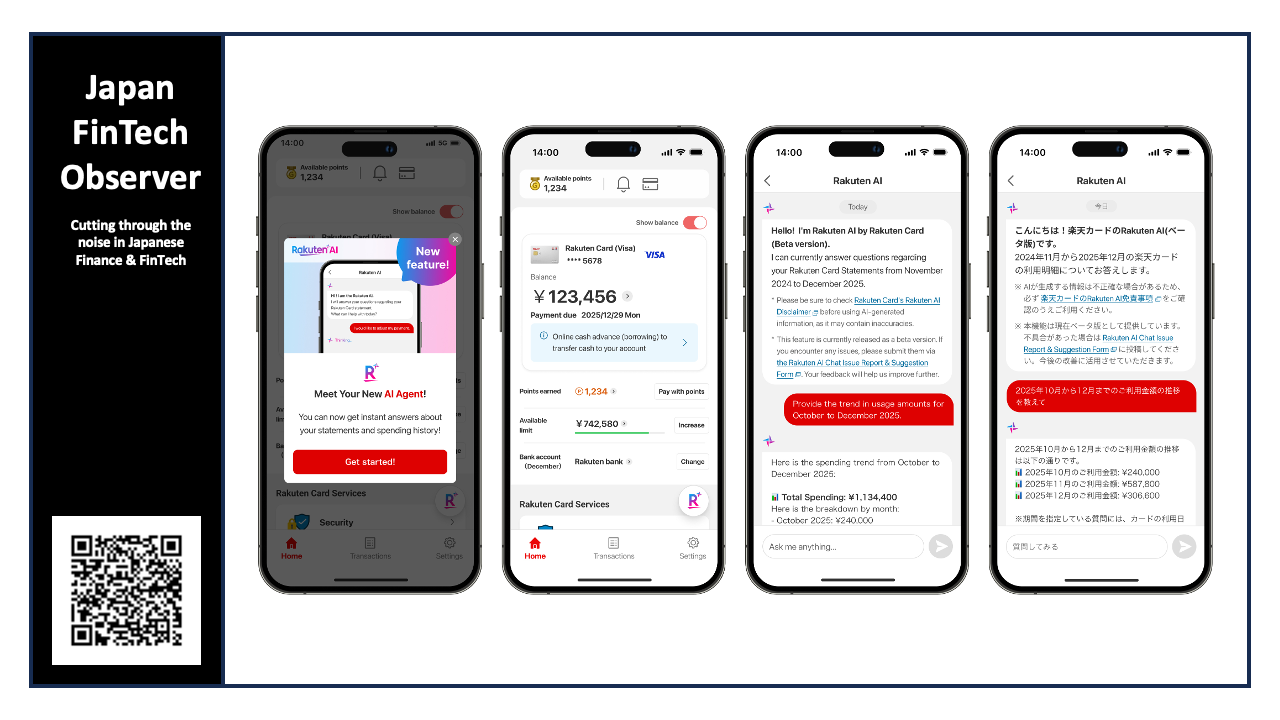

Rakuten Group and its FinTech subsidiary, Rakuten Card, have announced the integration of a proprietary AI agent into the Rakuten Card Lite app, effective today. The launch marks the latest step in the company’s "AI-nization" initiative, a strategic push to embed artificial intelligence across its business portfolio to drive growth and user engagement.

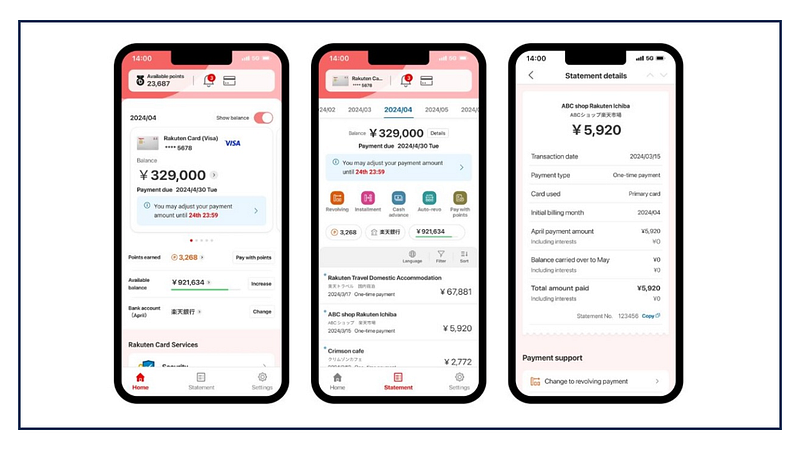

The new tool, available on both iOS and Android platforms, is designed to leverage robust transaction data to provide a personalized financial overview for cardholders. Functioning within the English-language version of the app, the AI agent allows users to query their spending habits through a conversational interface in either English or Japanese.

Key functionalities of the agent include the ability to summarize monthly spending in chronological order and provide estimated expenditures across specific categories, such as supermarkets or restaurants. The system analyzes credit card statement data covering a rolling 14-month period, offering users immediate insights into their financial trends without cost.

For Rakuten, the deployment of this technology serves is positioned as a gateway to the broader Rakuten Ecosystem. By enhancing the user experience through data-driven personalization, the company aims to increase retention and cross-service usage.

Looking ahead, Rakuten Card plans to scale the technology significantly. The company has confirmed intentions to roll out the AI service to its primary Japanese-language Rakuten Card app later this year, potentially reaching a much larger segment of its domestic user base. Future development roadmaps include expanding the AI’s capabilities to handle general service inquiries—moving beyond simple statement analysis—and adding support for additional languages.