Rakuten Bank FY3/25 Financial Results

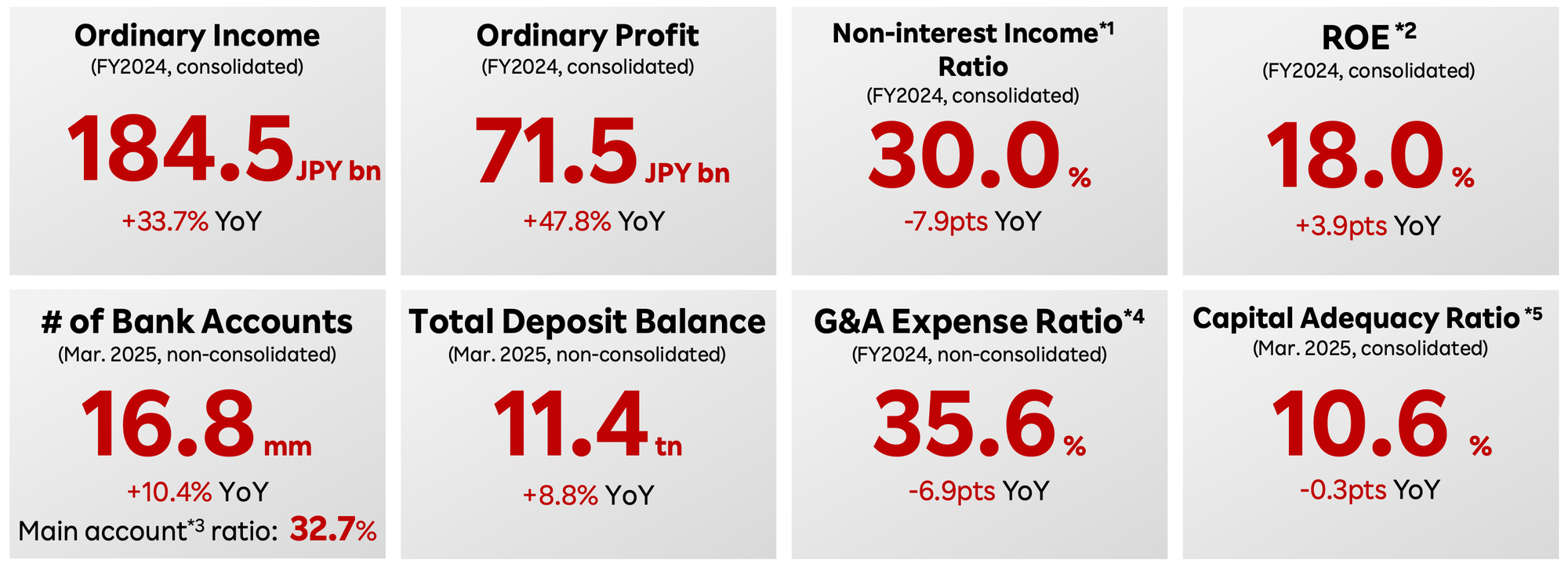

Rakuten Bank announced its FY3/25 financial results, exceeding expectations in both ordinary and net profits. Full-year ordinary profits reached ¥71.5 billion, representing a 47.8% year-over-year increase and surpassing the company's guidance of ¥69.0 billion. Net profits also demonstrated strong growth, totaling ¥50.8 billion, up 47.4% year-over-year and exceeding both the company's guidance of ¥48.9 billion and Bloomberg consensus of ¥48.9 billion.

Looking ahead, Rakuten Bank's FY3/26 guidance projects net profits of ¥64.3 billion, a 26.7% year-over-year increase. This forecast aligns closely with the Bloomberg consensus of ¥63.9 billion. The bank anticipates that earnings growth will be primarily driven by continued momentum in card loan growth and expansion in middle-risk assets, including investment property loans and asset-based lending (ABL), consistent with prior expectations. The company projects revenue and profit growth even assuming a flat BOJ policy rate of 0.5%.

While deposit balances are expected to decline quarter-over-quarter, Rakuten Bank anticipates that the number of accounts will continue to grow at the current pace, driven by the convenience and economic incentives provided by Rakuten points. The bank believes it can attract and retain deposits without significantly increasing prime interest rates on deposits beyond the previously announced 0.22%. The FY3/25 ordinary profit result marks an early achievement of the FY3/27 target of ¥70 billion under Rakuten Bank's long-term vision.

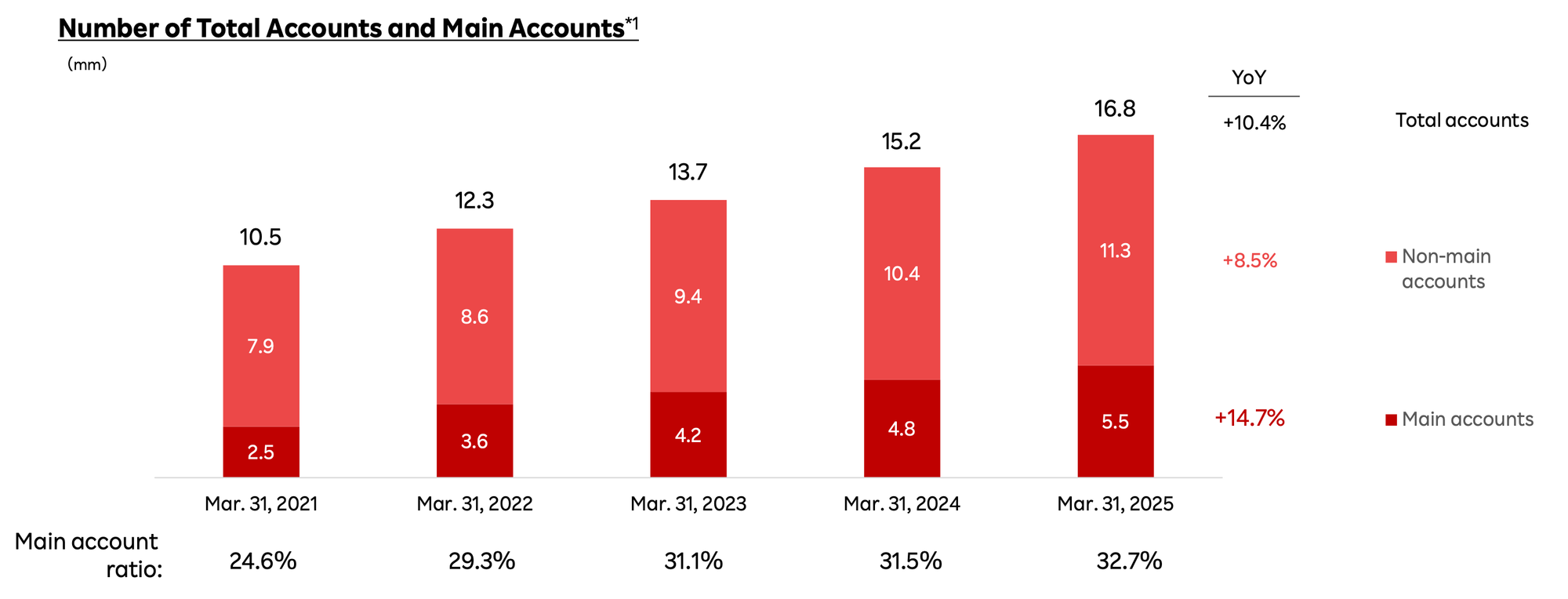

Strong Growth in Account Base and Deposits

Rakuten Bank continues to expand its customer base and deposit balances, leveraging its connection to the Rakuten Group.

- Number of Bank Accounts (Mar. 2025, non-consolidated): 16.83 million, a +10.4% YoY increase.

- Total Deposit Balance (Mar. 2025, non-consolidated): JPY 11.4 trillion, a +8.8% YoY increase.

- Main Accounts: Accounts used for direct debit or direct deposit of payroll are increasing at a faster pace (+14.7% YoY) than total accounts, reaching a ratio of 32.7% of total accounts. These accounts are highlighted as being "highly profitable and have large deposit balances per account."

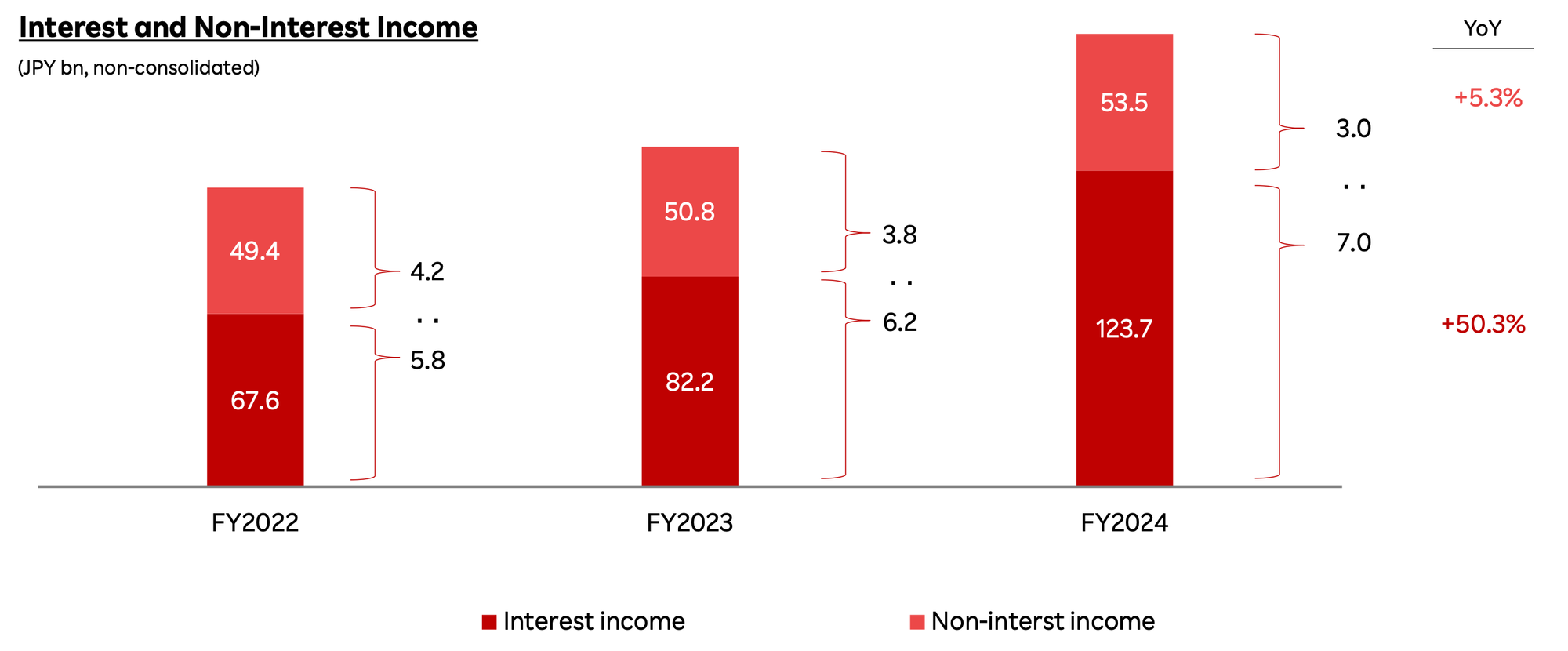

Interest and Non-Interest Income

The shift in the Bank of Japan's policy significantly boosted interest income.

- Interest income increased by +50.3% YoY to JPY 123.7 billion in FY2024.

- Rakuten Bank notes the "impact of the BOJ raising the interest rate as plus JPY 13.3 billion" on the change in Ordinary Profit from FY2023 to FY2024.

- Following the lifting of the negative interest rate policy, the ratio of interest income to non-interest income shifted from approximately 6:4 to a 7:3 ratio in FY2024.

Leveraging the Rakuten Ecosystem

Synergies with the broader Rakuten Group are a key driver of growth and efficiency.

- The "Unique Ecosystem" with over 70 services, 100mm+ membership, and a popular point program facilitates "Customer Acquisition" and "Cross-selling."

- 64.6% of new customers come via the Rakuten Group channel, contributing to a "Low CAC: JPY1,621".

- The "Money Bridge" service, linking Rakuten Bank and Rakuten Securities accounts, offers favorable interest rates (0.28% per annum for balances up to JPY 3 million) and constitutes 52.2% of Rakuten Bank's total deposit balance. This is highlighted as contributing to "high customer loyalty."

- The securitization business utilizing Rakuten Trust and Rakuten Card's credit card receivables is a strategy to "Origination of Unique Investment Assets."

Focus on Digitalization and Efficiency

Rakuten Bank emphasizes its digital-native model for efficiency and innovation.

- The Bank has "No possession of legacy assets (branches/own ATMs)" and utilizes "state-of-the-art technology (Systems development, maintenance, and operation using internal resources)."

- The G&A Expense Ratio (non-consolidated) for FY2024 was 35.6%, down -6.9pts YoY, indicating improved operational efficiency.

- Data and AI technology are used for "Advanced Credit Scoring" to expand credit access and improve accuracy, and for "Optimized Marketing" to accelerate customer acquisition and enhance service usage.

- The BaaS (Banking-as-a-Service) initiative, such as the partnership with JR East Group for "JRE BANK," is seen as a way to provide a "New Customer Experience."

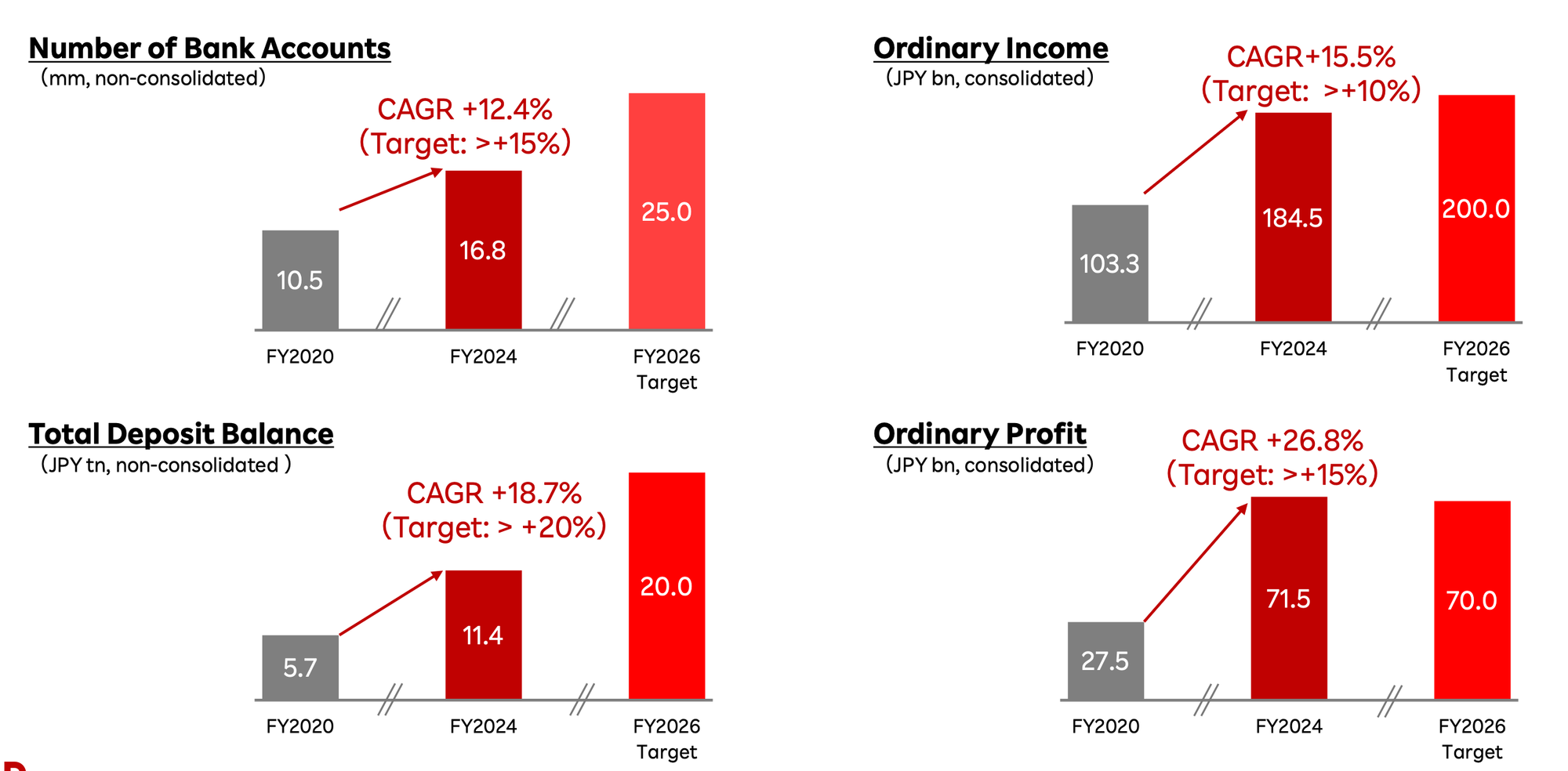

Medium- to Long-Term Vision Progress (Indexed to FY2020, Target FY2026)

- Number of accounts: 16.83 million (FY2024) vs. Target Approx. 25 million (CAGR +10.4%, Target >+15%)

- Balance of deposits: JPY 11.4 trillion (FY2024) vs. Target Approx. JPY 20 trillion (CAGR +12.4%, Target >+15%)

- Consolidated ordinary income: JPY 184.5 billion (FY2024) vs. Target Approx. JPY 200.0 billion (CAGR +15.5%, Target >+10%)

- Consolidated ordinary profit: JPY 71.5 billion (FY2024) vs. Target Approx. JPY 70.0 billion (CAGR +26.8%, Target >+15%)