Rakuten Bank Second Quarter Financial Results

Rakuten Bank delivered a record-setting performance for the first half of fiscal year 2025 (1H FY2025), ending September 30, 2025. Consolidated Ordinary Profit surged 55.3% year-over-year (YoY) to JPY 48.2 billion, while Net Income increased by 53.5% YoY to JPY 34.0 billion. This robust growth was primarily fueled by a significant expansion in interest income, driven by the accumulation of a well-diversified loan portfolio and the positive impact of the Bank of Japan's policy rate hikes. The bank's annualized Return on Equity (ROE) for the period stood at a high 21.2%.

Key strategic initiatives are proving effective. The portfolio of middle-risk assets, a core component of the growth strategy, expanded by over 22% YoY. The bank continues to leverage the expansive Rakuten Ecosystem for highly efficient customer acquisition, maintaining a low Customer Acquisition Cost (CAC) of JPY 1,933. To secure a stable funding base, a new "Bonus Interest Rate" program was launched in July 2025 to attract deposits and encourage main account usage, with early results indicating success.

An external analysis by Goldman Sachs corroborates this positive outlook, noting that the 1H results were in line with consensus and guidance. The analysis highlights the bank's continued high growth and high ROE, with a key focus on the effectiveness of its deposit acquisition strategy in a rising interest rate environment. For the first time, Rakuten Bank disclosed its interest rate sensitivity, estimating a JPY 13.5 billion increase in Net Interest Income for every 25-basis-point policy rate hike. While maintaining its full-year guidance, the bank is re-evaluating its medium- to long-term targets to account for the new positive interest rate environment.

Core Growth Drivers and Strategic Initiatives

Interest Income Expansion

The primary engine of profit growth was the expansion of Net Interest Income, which benefited from both strategic asset accumulation and a favorable macroeconomic environment.

- Diversified Asset Growth: The total balance of loans and monetary claims bought grew in a well-balanced manner, increasing by JPY 1.17 trillion (+16.9%) YoY to JPY 8.1 trillion.

- Middle-Risk Asset Focus: The bank continued its strategy of expanding middle-risk assets. The total for this category—which includes card loans, investment property loans, Asset-Based Lending (ABL), and other monetary claims bought—grew by 22.2% YoY to JPY 3.02 trillion.

- BOJ Rate Hike Impact: The Bank of Japan's policy rate hike contributed significantly to profitability, adding an estimated JPY 7.6 billion to ordinary profit.

- Interest Rate Sensitivity: The bank disclosed its interest rate sensitivity for the first time, simulating that a +25 basis point increase in the policy rate would generate an additional JPY 13.5 billion in Net Interest Income annually. This assumes a 50% pass-through rate (deposit beta) to floating-rate deposits.

Deposit Acquisition and Main Account Strategy

Securing a low-cost, stable funding base is central to the bank's ability to expand its investment portfolio.

- Focus on Ordinary Deposits: Individual ordinary deposits constitute over 70% of the bank's total deposit base.

- Bonus Interest Rate Program: Launched on July 1, 2025, this program offers preferential interest rates to customers who use the bank for payroll, direct debits, debit card transactions, and other services, directly incentivizing main account usage.

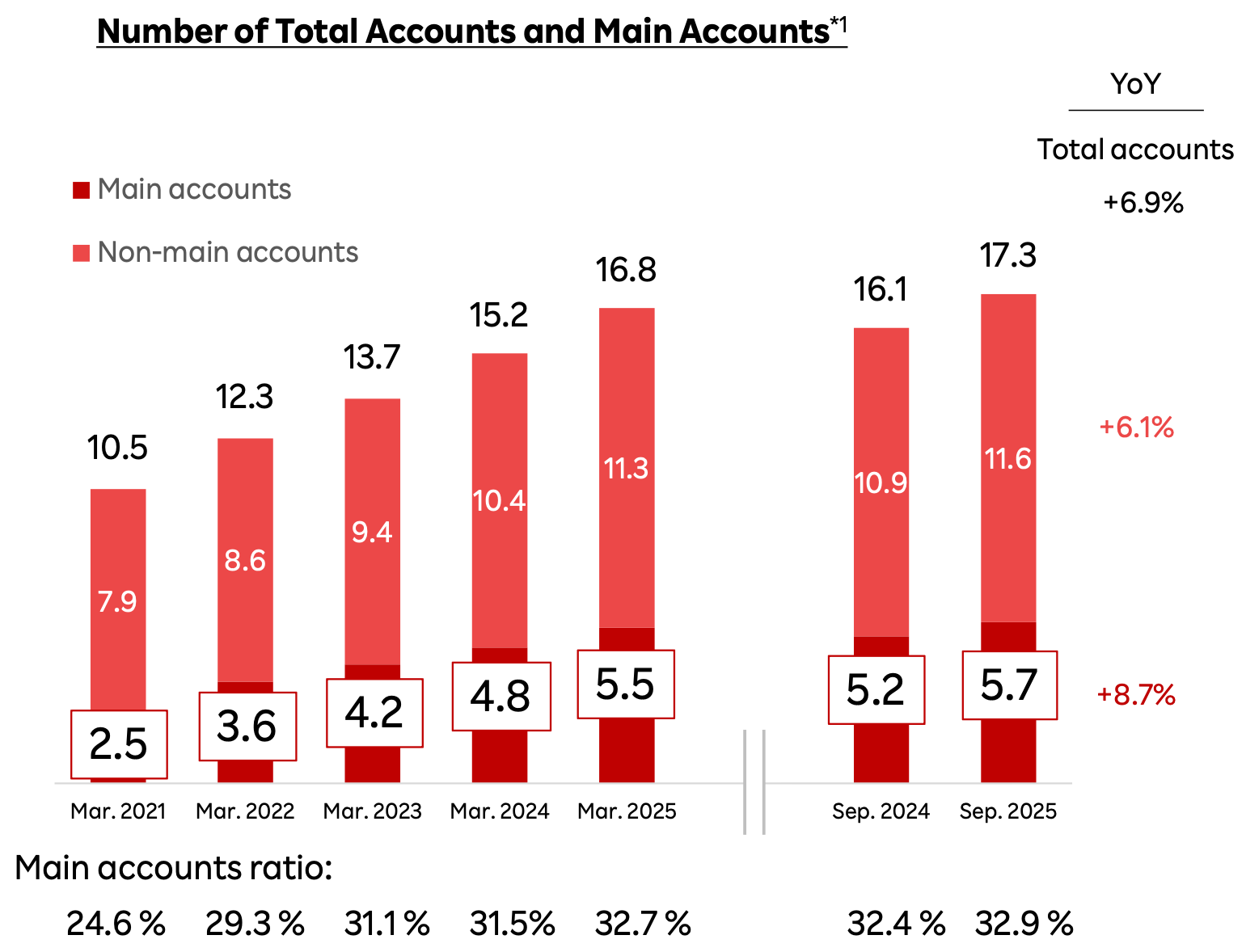

- Main Account Growth: The number of main accounts, which are more profitable and have higher balances, grew by 8.7% YoY, outpacing the 6.9% growth in total accounts.

- Analyst Observation (Goldman Sachs): The deposit acquisition program appears to be generating results as expected, with deposit balances recovering to 10% YoY growth while deposit interest rates rose by only 2 basis points quarter-over-quarter.

Leveraging the Rakuten Ecosystem

The synergy with the broader Rakuten Group remains a core competitive advantage, enabling efficient growth and the creation of unique financial products.

- Customer Acquisition: The ecosystem provides a powerful customer acquisition channel, with 62.3% of new customers sourced from other Rakuten Group services at a low Customer Acquisition Cost (CAC) of JPY 1,933.

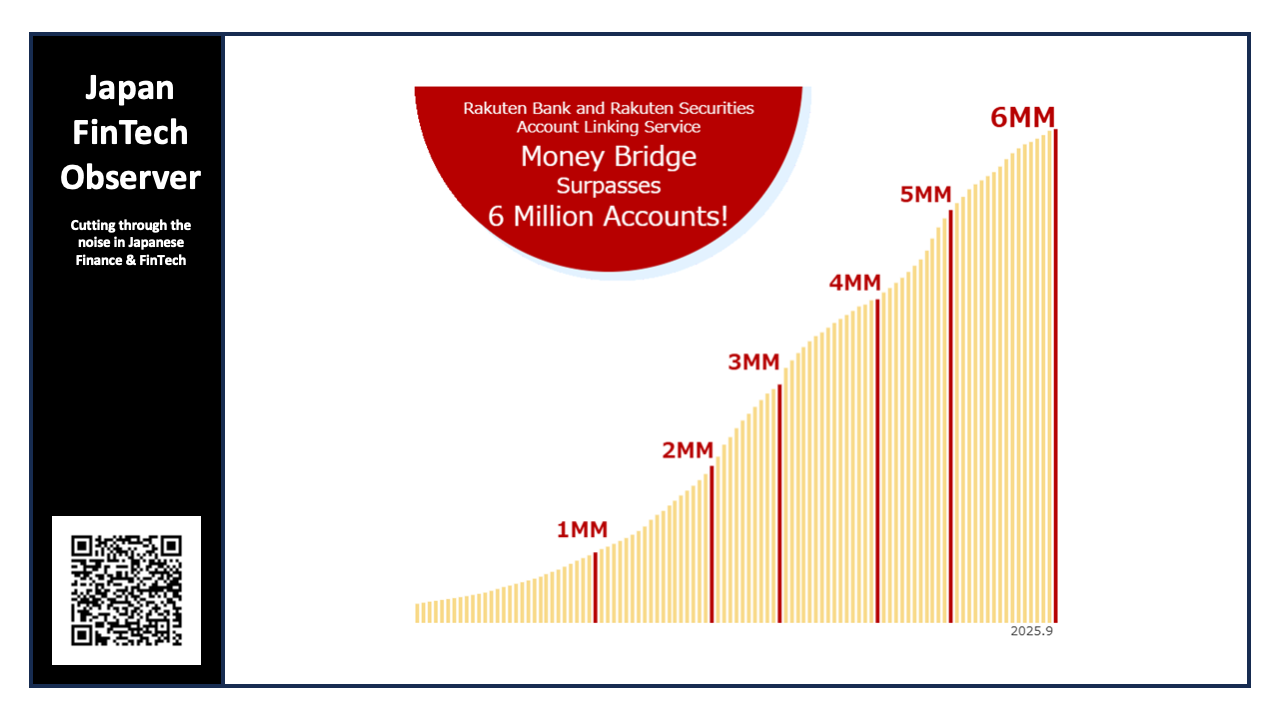

- Customer Loyalty: Services like "Money Bridge" (linking to Rakuten Securities) and the "Super Point Up Program" (SPU) deepen customer engagement and encourage cross-service utilization. As of Q2/CY2025, there are 6.0 million Money Bridge customers, and their deposit balance of JPY 6.1 trillion makes up 52.3% of the bank's total.

- Unique Asset Origination: The bank's securitization business, which purchases trust beneficiary rights of Rakuten Card receivables, provides a significant and proprietary source of investment assets. The balance of these rights stood at JPY 2.39 trillion as of September 30, 2025, up 12.2% YoY.

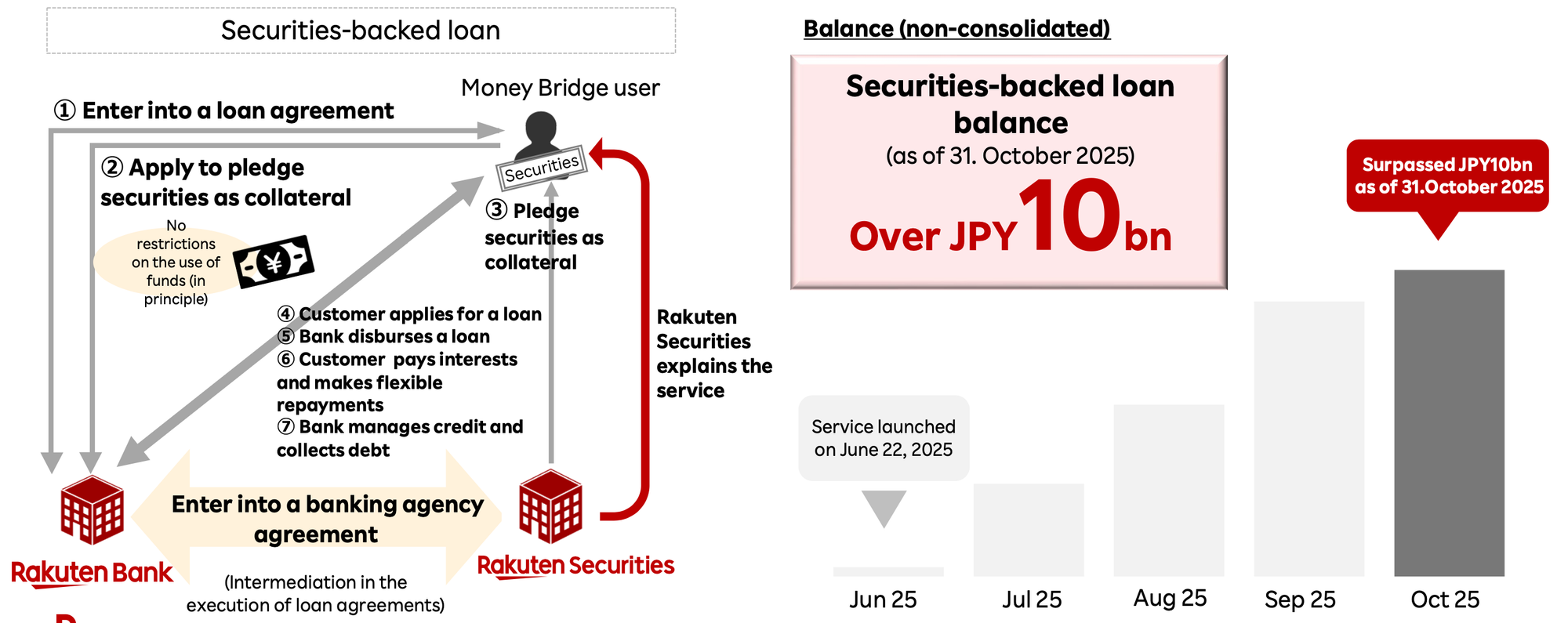

New Service Development

- Securities-Backed Loan: Launched on June 22, 2025, this personal loan product allows customers to borrow against their securities. The service has seen rapid uptake, with the loan balance surpassing JPY 10 billion approximately four months after launch (as of October 31, 2025).

- Banking-as-a-Service (BaaS): The bank is expanding its BaaS offerings, notably launching the "JRE BANK" service with the JR East Group on May 9, 2024, to provide financial services integrated with JR East's transportation and retail assets.

Analyst Assessment

Goldman Sachs maintains a Buy rating on Rakuten Bank, noting the 1H FY2025 results were in line with expectations. The analysis highlights the bank's ability to sustain high growth and a high ROE.

- Investment Thesis: The positive outlook is based on:

- Continued growth in net interest income driven by middle-risk assets.

- Higher fee income from sustained growth in accounts and a rising main account ratio.

- The prospect of ROE remaining at a high level (normalized FY3/28E ROE estimate of 20.5%).

- Key Focus Areas:

- Deposit Costs: The market will closely watch the impact of the preferential interest rate program and marketing spend on the bank's funding costs, especially in anticipation of further BOJ rate hikes.

- Loan-to-Deposit Ratio (LDR): The LDR is considered low at 66% (53% excluding loans to the Ministry of Finance), indicating significant scope to deploy surplus funds into higher-yielding assets. The bank is aiming for an LDR of 70%.

- Price Target and Estimates: The 12-month price target was slightly lowered to ¥8,800 from ¥8,900. Net profit estimates for FY3/26-FY3/28 were revised by +2%/-1%/-1% to reflect a higher deposit beta assumption, stronger-than-expected lending growth, and a lower cost ratio.

- Identified Downside Risks:

- A larger-than-expected increase in deposit yields or beta.

- A decline in monthly account or deposit balances.

- An unexpected public offering to address the parent-subsidiary listing structure.

Capital Management and Shareholder Policy

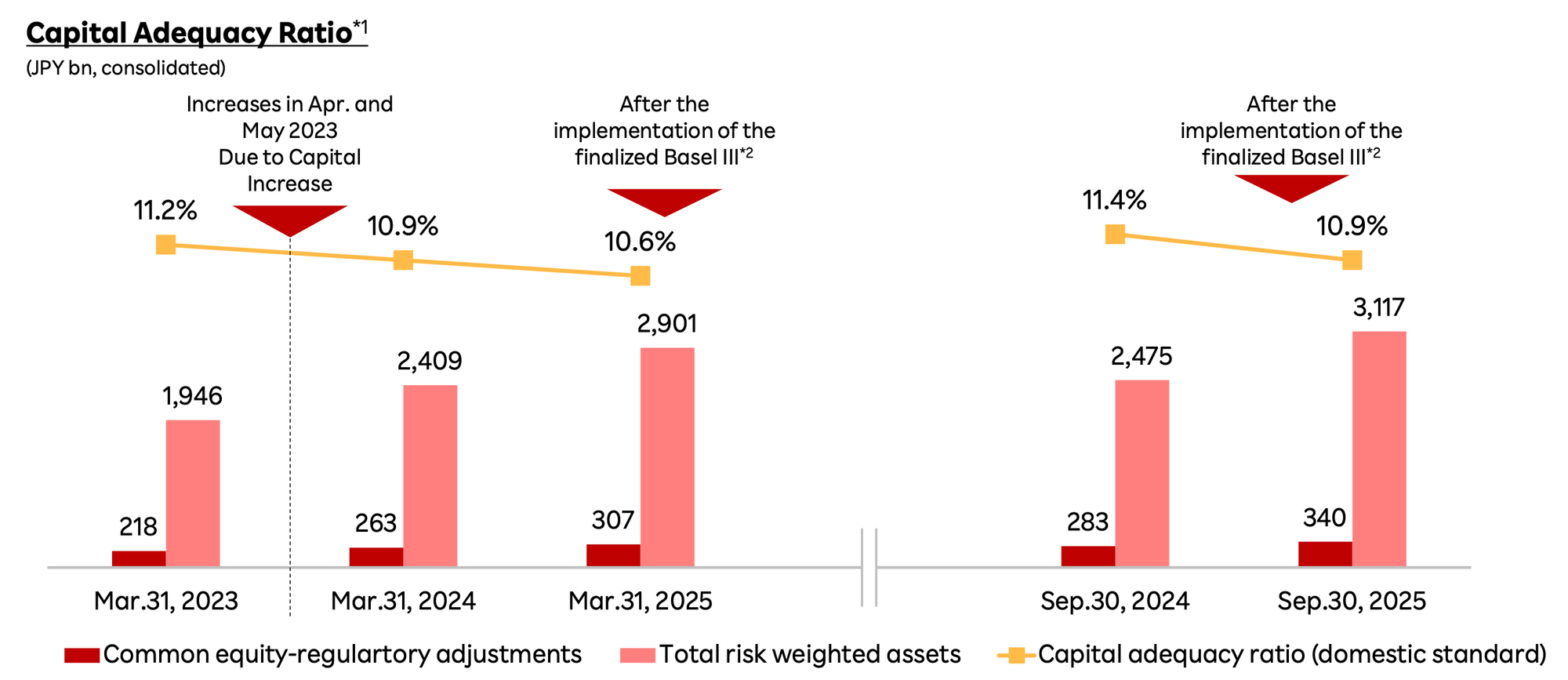

- Capital Adequacy: The consolidated capital adequacy ratio (domestic standard) was 10.9% as of September 30, 2025, which the bank describes as a "sound level."

- Dividend Policy: The bank is maintaining its policy of prioritizing investment in further growth over paying dividends for the near term. The stated approach is to deliver shareholder returns through the enhancement of corporate value driven by business expansion.

Outlook and Medium-Term Vision

Rakuten Bank has maintained its full-year forecasts for FY2025.

FY2025 Full-Year Consolidated Forecasts

Metric | FY2025 Forecast | YoY Change |

Ordinary Income | JPY 246.8 bn | +33.7% |

Ordinary Profit | JPY 91.2 bn | +27.5% |

Net Income | JPY 64.3 bn | +26.7% |

The bank is currently operating under a medium- to long-term vision formulated in April 2022, which set targets for FY2026 including approximately 25 million accounts and JPY 20 trillion in deposits. However, this vision was based on an assumption of negative interest rates. The bank is now "discussing and evaluating new medium- to long-term targets for an environment with positive interest rates." Goldman Sachs expects a new medium-term business plan to be announced toward the end of the second half of the fiscal year.