Report on Currency and Monetary Control: Recent Economic Developments and Policy Decisions by the Bank of Japan

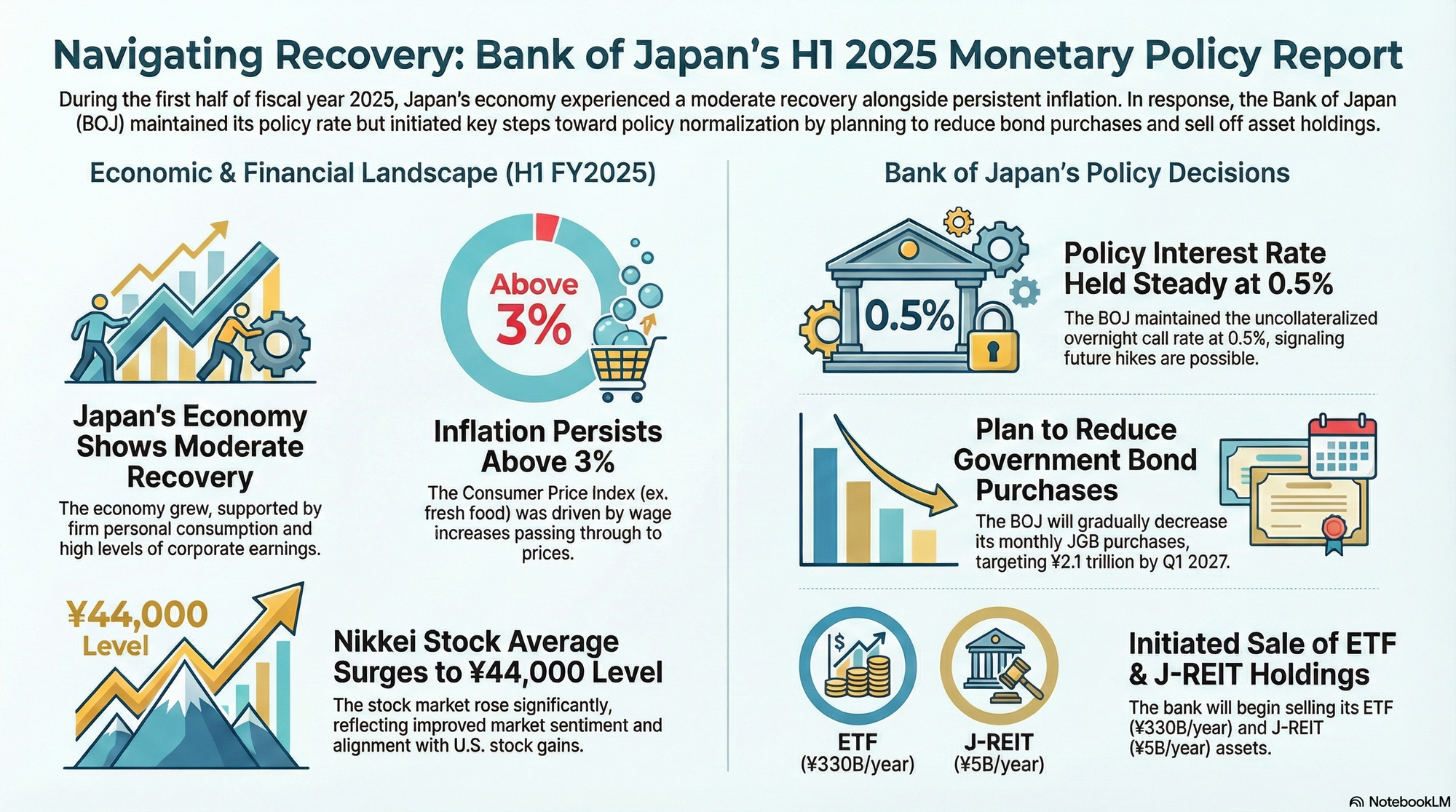

In December 2025, the Bank of Japan (BOJ) submitted its semi-annual "Report on Currency and Monetary Control" to the Diet, covering the developments in the first half of fiscal year 2025 (April through September). The report offers a comprehensive detailed account of the Japanese economy’s performance, financial market behavior, and the central bank’s strategic policy maneuvers during a period characterized by significant transitional pressures. As Japan continues to navigate the complex path of monetary normalization, the six-month period under review was defined by a moderate economic recovery amidst external headwinds—specifically the imposition of trade tariffs by the United States—and a definitive shift in the BOJ’s balance sheet management, including the reduction of Japanese Government Bond (JGB) purchases and the commencement of the disposal of Exchange-Traded Funds (ETFs).

The report highlights that while the domestic economy showed resilience, supported by wage growth and robust corporate profits, the global economic landscape presented heightened uncertainties. The BOJ maintained the uncollateralized overnight call rate at approximately 0.5 percent throughout the period, despite growing internal debate regarding the necessity of further rate hikes to address inflationary pressures. The period also marked a historic turning point in the Bank’s asset management, with the finalization of a detailed plan for Quantitative Tightening (QT) regarding sovereign debt and the establishment of guidelines for offloading risk assets accumulated during the era of aggressive monetary easing.

Part I: Economic and Financial Developments

The Real Economy: Resilience Amidst Trade Tensions

According to the report, the Japanese economy continued to recover moderately during the first half of fiscal year 2025, although some sectors exhibited weakness. A dominant theme influencing real economic activity was the trade policy stance of the United States. The report notes that exports and industrial production remained largely flat on a trend basis. This stagnation was colored by volatile movements: a surge in demand prior to the raising of U.S. tariffs followed by a reactionary decline. Specifically, exports to the U.S. fell due to the pullback after the pre-tariff rush for automotive parts and production line stoppages by some automakers. Conversely, exports to the EU showed signs of picking up late in the period, driven by a recovery in capital goods demand, while exports to Asia (NIEs and ASEAN) maintained an upward trend supported by robust global demand for AI-related goods and pre-emptive shipping of semiconductors.

Despite these external pressures, corporate health remained robust. The report indicates that while manufacturing profits faced downward pressure from the tariff hikes, overall corporate profits remained at high levels. Business sentiment held firm, buoyed by the progress in passing on cost increases to sales prices, particularly in the non-manufacturing sector. Under these conditions, business fixed investment maintained a moderate increasing trend, driven by digitalization, labor-saving investments to counter labor shortages, and green transformation initiatives.

Private consumption, a critical engine of the domestic economy, showed resilience. The report observes that while consumer sentiment was dampened by persistent inflation—highlighting the rising prices of rice and other food items—consumption was underpinned by improvements in the employment and income environment. The spring wage negotiations resulted in significant pay hikes, and the report notes that nominal wages rose steadily. Special payments, such as summer bonuses, also increased, reflecting strong corporate earnings from the previous fiscal year. However, housing investment declined, weighed down by rising construction costs and the pullback following a surge in demand related to regulatory changes. Public investment remained relatively flat.

Price Dynamics and Inflation

Inflation remained a central focus of the report. The year-on-year rate of change in the Consumer Price Index (CPI) for all items less fresh food hovered in the mid-3 percent range during the early part of the fiscal half, before moderating to around 3 percent by late September. The report attributes this persistence to the continued pass-through of wage increases to selling prices and the elevated costs of food staples, particularly rice.

A breakdown of price movements reveals that goods inflation narrowed as the spike in rice prices began to moderate, though food products remained a driver. Service prices, however, continued to rise, specifically in dining and telecommunications, reflecting the intense pressure to reflect higher labor costs. Public utility prices saw a narrowing of year-on-year increases due to government subsidies for electricity and gas. Crucially, the report emphasizes that inflation expectations continued to rise moderately, suggesting that the mindset of households and firms regarding price stability is shifting away from the deflationary norms of the past.

Global Economic Context

The international backdrop described in the report was one of moderate growth peppered with risks. The U.S. economy maintained solid growth despite some weak indicators, with inflation remaining sticky above 2 percent. The Federal Reserve, responding to evolving data, cut its target range for the federal funds rate by 0.25 percentage points in September to 4.00-4.25 percent, signaling a cautious approach to further adjustments. The Euro area remained weak, heavily influenced by the fluctuations in exports, though the European Central Bank (ECB) proceeded with rate cuts in April and June. China’s economy decelerated toward the end of the period, burdened by real estate sector adjustments and trade frictions, prompting the People's Bank of China to enact easing measures.

Financial Market Movements

Global financial markets were highly sensitive to trade policy news. In early April, sentiment deteriorated sharply due to uncertainties surrounding international trade negotiations, leading to a "risk-off" environment. However, as negotiations progressed and fears of a global economic collapse receded, sentiment improved.

In Japan, short-term interest rates remained stable, anchored by the BOJ’s policy. The uncollateralized overnight call rate tracked closely to 0.5 percent. However, the bond market witnessed volatility. Long-term yields (10-year JGBs) plummeted in early April amidst the global risk-off sentiment but subsequently trended upward. This rise reflected rising yields in the U.S. and Europe, as well as domestic market perceptions regarding the future normalization of BOJ policy following the conclusion of trade negotiations.

The equity market mirrored this volatility. The Nikkei 225 Stock Average suffered a sharp decline in early April but staged a significant recovery thereafter. Supported by strong corporate earnings and the relief provided by the Japan-U.S. trade agreement in late July, the index surged, reclaiming the 44,000-yen level by the end of September. In the foreign exchange market, the yen experienced volatility; it appreciated in April during the period of heightened risk aversion but gradually weakened thereafter as stability returned, ending the period largely unchanged around the 148 yen-to-the-dollar level.

Corporate Finance and Money Stock

The report notes a tightening in the funding environment in terms of cost, with corporate funding costs rising in line with the policy rate. However, financial conditions remained accommodative in terms of availability. Lending attitudes by financial institutions remained loose, and demand for funds continued to grow moderately, driven by mergers and acquisitions and working capital needs. The year-on-year growth rate of bank lending ranged between 2.5 percent and 4 percent. The money stock (M2) growth remained subdued, fluctuating between 0.5 percent and 1.5 percent, while the monetary base saw a widening negative growth rate, reflecting the reduction in the BOJ’s asset purchases.

Part II: Monetary Policy Decisions and Deliberations

The core of the report details the deliberations of the Policy Board across four Monetary Policy Meetings (MPMs) held in April, June, July, and September 2025. Through these meetings, the BOJ navigated the delicate balance of nurturing the virtuous cycle between wages and prices while managing the risks posed by external economic fragmentation.

Economic Assessment and Outlook

In all four meetings, the Board maintained the assessment that the Japanese economy was "recovering moderately, although some weak movements were seen." The Board consistently viewed the overseas economic slowdown caused by trade policies as a headwind that would decelerate Japan’s growth pace temporarily before a return to a path of higher growth.

Regarding prices, the Board acknowledged throughout the period that the pass-through of wage increases to prices was intensifying. In the Outlook Reports published in April and July, the Board projected core CPI inflation to be in the low-2 percent range for fiscal 2025, before moderating to the upper-1 percent range in 2026 and returning to around 2 percent in 2027. The narrative remained consistent: while cost-push factors from import prices were waning, domestic inflationary pressure driven by the wage-price spiral was strengthening. The Board expressed confidence that underlying inflation would gradually rise toward the 2 percent price stability target in a sustainable manner.

Policy Implementation: The Interest Rate Stance

Throughout the first half of fiscal 2025, the Policy Board voted to maintain the guideline for market operations, keeping the uncollateralized overnight call rate at "around 0.5 percent." This decision was unanimous in April, June, and July. The rationale was that real interest rates remained extremely low, providing significant accommodation to the economy. The Board emphasized the need to scrutinize the impact of global trade uncertainties before making further adjustments to the policy rate.

However, the September meeting revealed a widening rift within the Board regarding the timing of future rate hikes. While the decision to hold the rate at 0.5 percent passed, it was a split vote of 7 to 2. The summary of the September meeting highlights that the dissenting members argued for an immediate hike to 0.75 percent. They contended that the "norm" of zero inflation had been fundamentally broken and that the price stability target was essentially achieved. They warned of the risks of falling behind the curve if upside risks to inflation materialized. The majority, however, preferred to wait to confirm the full economic impact of the U.S. tariffs and the outcome of domestic corporate earnings before moving further.

Balance Sheet Normalization: JGBs and ETFs

A significant portion of the report is dedicated to the operational details of the BOJ’s balance sheet normalization, marking a decisive step away from the aggressive easing of the past decade.

- Reduction of JGB Purchases (June Decision):

At the June meeting, the Board decided on a concrete plan to reduce its monthly purchases of Japanese Government Bonds (JGBs). The plan was designed to be predictable while allowing flexibility for market stability. The scheduled reduction outlined that monthly purchase amounts would decrease by approximately 400 billion yen each quarter until March 2026, and then by 200 billion yen each quarter thereafter. The ultimate goal set was to reach a monthly purchase pace of about 2 trillion yen by the first quarter of 2027. The Board emphasized that long-term interest rates should essentially be determined by financial markets. This decision was passed by a majority vote (8-1), with one dissenter arguing for a faster reduction or a different mechanism for determining market rates. - Disposal of ETFs and J-REITs (September Decision):

In September, the Board took the historic step of deciding to dispose of the ETFs and J-REITs accumulated under the Quantitative and Qualitative Easing (QQE) program. This decision followed the successful completion of the sale of stocks purchased from financial institutions in July 2025.

The approved plan entails selling ETFs at an annual pace of approximately 300 billion yen (book value) and J-REITs at about 5 billion yen per year. The guiding principles for this disposal were to avoid disrupting the markets and to minimize losses for the Bank. To achieve this, the BOJ set the scale of sales to be roughly equivalent to the disposal pace of stocks purchased from financial institutions, representing only about 0.05 percent of the total trading value of the Tokyo Prime Market. This gradual approach aims to smooth out the impact over a long horizon. The Board also decided to terminate the ETF lending facility, given the change in policy stance.

Detailed Discussions from Meeting Minutes

The report includes detailed summaries of the discussions held during the meetings, offering insight into the Board’s thinking.

- April Meeting:

Members agreed that the economy was recovering but faced high uncertainties regarding trade policy. They discussed the "Outlook Report," concluding that while the baseline scenario projected achieving the 2 percent target, risks were skewed to the downside for growth due to external factors. Financial conditions were deemed "accommodative," and members agreed that if the outlook were realized, further rate hikes would be appropriate. - June Meeting:

The discussion centered heavily on the JGB reduction plan. The Executive staff reported on meetings with bond market participants, who generally favored a predictable reduction. The Board agreed that reducing the BOJ's presence in the bond market was necessary to restore market functionality. While one member pushed for a more aggressive reduction to normalize the balance sheet faster, the majority favored a measured pace to avoid volatility, especially given the "flash rise" in yields seen in April. They also discussed the ongoing impact of the weak yen on import costs, noting that while pass-through was continuing, it was not accelerating dangerously at that moment. - July Meeting:

The Board reviewed the July Outlook Report. The inflation forecast for fiscal 2025 was revised upward due to cost-push factors (import prices), but the medium-term outlook remained unchanged. Members noted that the conclusion of the Japan-U.S. trade talks had reduced some uncertainty, but implementation risks remained. There was a consensus that the "virtuous cycle" of wages and prices was strengthening, with service prices rising more broadly. Some members began to voice stronger concerns that keeping real rates deeply negative for too long could overstimulate the economy or lead to financial imbalances. - September Meeting:

This meeting marked a shift in tone. While the global economy was seen as stabilizing, the divergence in views on domestic policy widened. The majority view was that with the U.S. Federal Reserve cutting rates, the risk of a hard landing for the U.S. economy had diminished, but the impact of tariffs still needed monitoring. They argued that waiting a bit longer to hike rates would not risk de-anchoring inflation expectations.

However, the hawkish dissenters argued strongly that the conditions for a rate hike were already met. They pointed out that real wages were turning positive, consumption was holding up, and inflation was broadening beyond cost-push factors. One dissenter argued that a rate of 0.5 percent was too low for an economy with 2 percent inflation and proposed a hike to 0.75 percent immediately. Another argued that the "neutral rate" was likely higher and that the BOJ was "behind the curve."

The discussion on ETF disposal was less contentious. Members agreed that holding these assets indefinitely was undesirable and that the market environment (with the Nikkei at historic highs) was conducive to starting sales without causing shock.

Part III: Decisions and Implementation

The final section of the report formalizes the decisions made. It records the specific text of the policy statements released after each meeting.

- May 1st (April Meeting Conclusion): The policy rate was maintained at 0.5 percent by unanimous vote. The Board adopted the "Basic View" of the April Outlook Report.

- June 17th: The JGB reduction plan was adopted. The vote was 8-1, with Mr. Tamura dissenting because he favored a faster reduction schedule that would leave interest rate formation entirely to the market without the specific "3 trillion yen floor" implied in the early stages.

- July 31st: The policy rate was maintained at 0.5 percent unanimously. The July Outlook Report was adopted.

- September 19th: The policy rate was maintained at 0.5 percent, but the vote fractured to 7-2. Mr. Takata and Mr. Tamura dissented, proposing a hike. Concurrently, the Board unanimously approved the "Guidelines for the Disposal of Index-Linked Exchange-Traded Fund Beneficiary Interests," setting the framework for the long-term unwinding of the Bank's equity portfolio.

Financial Market Operations Data

The report concludes with data on market operations. As of the end of September 2025, the BOJ’s total assets stood at 695.8 trillion yen, a decrease of 7.6 percent from the previous year. This contraction reflects the beginning of the normalization process.

- JGB Holdings: Decreased by 4.8 percent year-on-year to 555.1 trillion yen.

- Loans: Decreased significantly by 23.8 percent to 83.8 trillion yen, as pandemic and disaster-relief lending programs wound down.

- Current Account Balances: Decreased by 8.6 percent to 502.1 trillion yen.

Conclusion

The "Currency and Monetary Control Report" for the first half of fiscal 2025 paints a picture of a central bank carefully executing a historic pivot. Having exited negative interest rates previously, the BOJ spent this period laying the groundwork for a smaller balance sheet through JGB and ETF reduction plans. While the economy showed moderate recovery and inflation appeared to be anchoring around the target, the Bank prioritized caution regarding interest rate hikes in the face of global trade uncertainties. However, the emergence of significant dissent at the September meeting suggests that the consensus for a "wait-and-see" approach is fraying, setting the stage for potentially active policy debates in the latter half of the fiscal year. The report underscores that while the era of massive stimulus is ending, the path to a fully normalized policy stance remains gradual and data-dependent.