Sony Bank Launches New Fujitsu Core Banking System on AWS

Sony Bank, in collaboration with Fujitsu, has launched a next-generation digital banking system built on Amazon Web Services (AWS), revamping its core banking system.

The financial industry environment is evolving with technological advances. As customer needs diversify, there is increasing demand to improve customer satisfaction through enhanced convenience and value delivery. To provide Sony Bank's unique and advanced products and services with greater speed, it was necessary to transform the conventional tightly coupled, complex, and expanded system environment into a loosely coupled platform with higher efficiency and flexibility.

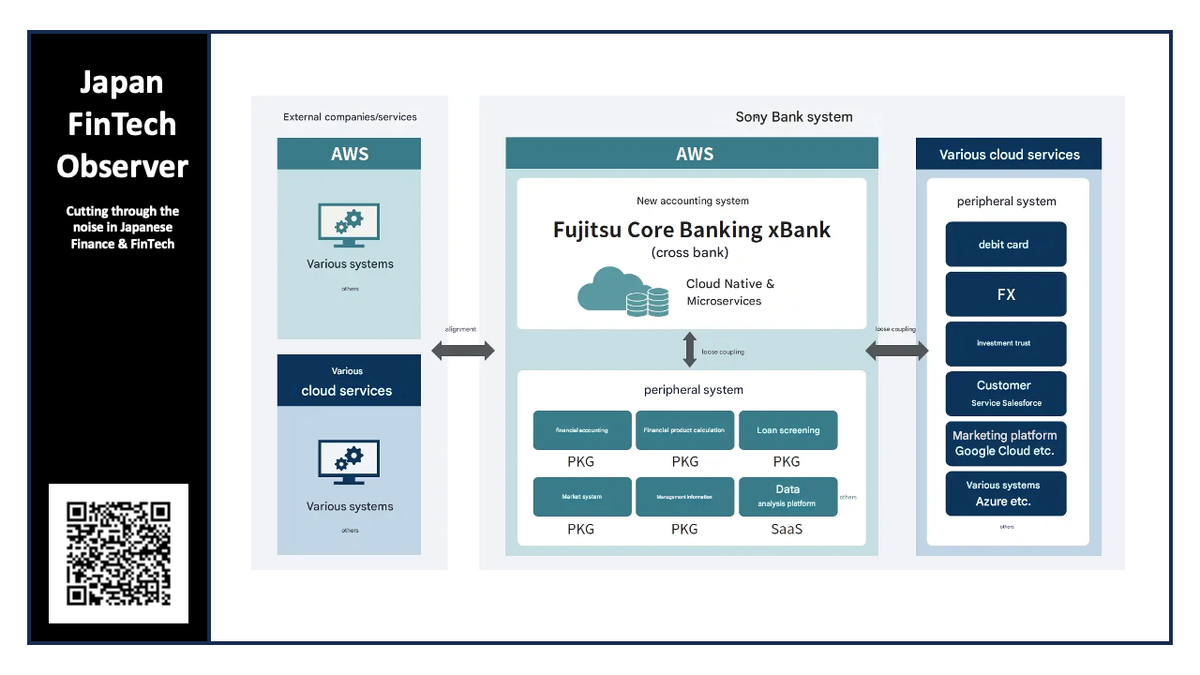

Sony Bank has been working as the first user of Fujitsu's next-generation core banking system "Fujitsu Core Banking xBank", which provides core digital banking systems by business unit. The next-generation digital banking system is designed with a cloud-native architecture that maximizes AWS services, implementing Sony Bank's various products, services, and transaction functions as microservices. This enables the rapid introduction of new products/services and flexible improvement of existing ones, achieving high "business agility."

With this migration, the core banking system, which is the most critical system for providing banking services, will now operate on AWS cloud services, in addition to the peripheral systems that had already been migrated to the cloud. This ensures high resilience using the AWS Asia Pacific (Tokyo) Region and (Osaka) Region multi-region approach, creating an environment that enables quick recovery even in the event of a disaster in the main Tokyo Region.

Moreover, compared to 2012 when all systems were built on-premises (company-owned), Sony Bank has achieved a 90% reduction in CO2 emissions. This is supported by AWS's energy-efficient infrastructure and investments in renewable energy.

New products and services are being released along with the migration to the next-generation digital banking system. For details, please see Sony Bank's service renewal announcement: https://sonybank.jp/info/renewal/

Features of the Next-Generation Digital Banking System

Shifting from Defensive IT to Offensive IT

In on-premises environments, regular infrastructure updates are necessary, creating a significant burden of fixed IT investments for system maintenance. The new core banking system, with its cloud-native configuration, substantially reduces these fixed IT investments, allowing more management resources to be allocated to offensive IT initiatives such as new product and service development.

Speedy Introduction of New Products

Conventional core banking systems led to extended development periods for new products due to system complexity. The new core banking system implements a loosely coupled system with microservices for each product, service, and business function on a cloud-native architecture utilizing AWS container application management services (Amazon ECS/AWS Fargate). This has reduced the core banking business application assets to 40% of their previous size. The system's high flexibility and productivity characteristics enable speedy delivery of new products.

Flexible External Integration and New Technology Implementation

Traditional core banking systems often constrained business needs by requiring new IT systems and networks for external integrations or new technology implementations. The new core banking system has cloud-native implementation of core banking functions, making it easy to utilize various cloud services for external integration and new technology implementation.

Sony Bank's New Core Banking System Overview

The new core banking system Fujitsu xBank is central to a loosely coupled, flexible system configuration where peripheral systems are built on AWS or used as cloud services. A cloud-native next-generation digital banking system covering Sony Bank's rich product lineup from deposits and payments to foreign currency and loans.