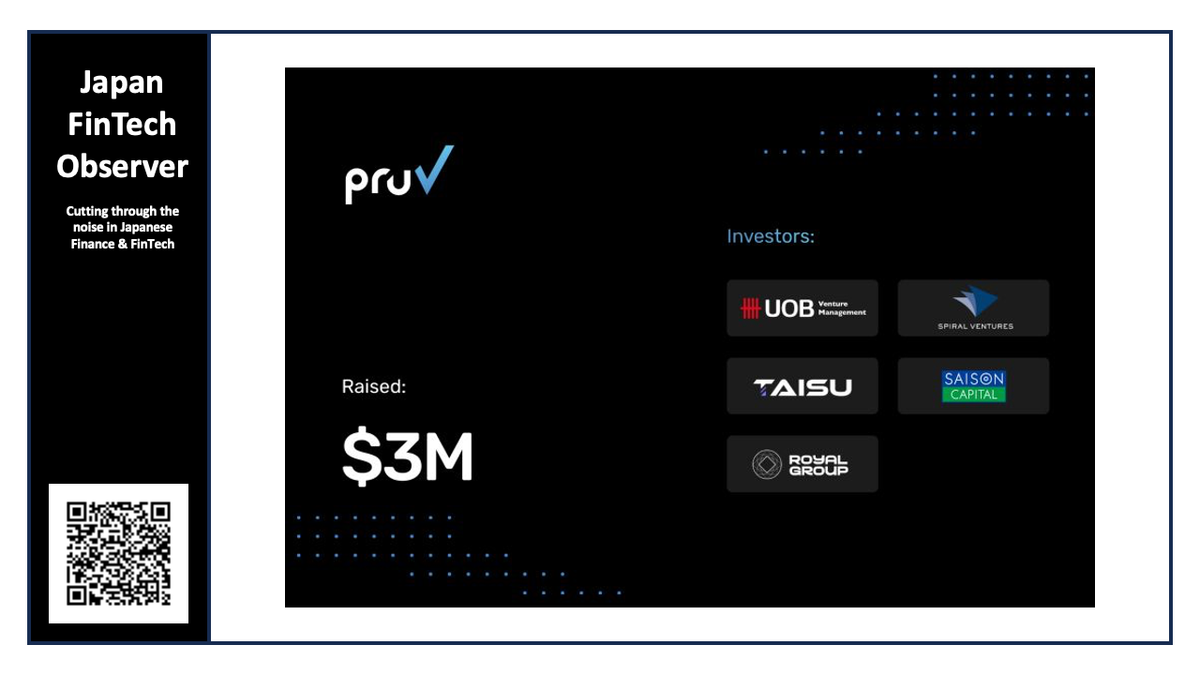

Saison Capital and Taisu Ventures Participate in Pruv Finance's Pre-Series A

Pruv Finance has completed its USD 3m Pre-Series A round, led by UOB Venture Management, with participation from Saison Capital, Taisu Ventures, Spiral Ventures, and Royal Group. This funding accelerates Pruv Finance's mission to build the first compliant RWA infrastructure that enables seamless, on-chain distribution of tokenized assets.

Solving RWA’s Core Dilemma

The RWA sector has grown past $35 billion, yet 93% of tokenized assets remain locked behind whitelists or non-transferable structures that prevent DeFi integration and block mass adoption.

Pruv addresses this market inefficiency.

As the first and only Digital Financial platform approved by OJK’s Sandbox (Indonesia’s Financial Services Authority), Pruv Finance provides institutions with a compliant framework that still preserves the free transferability expected in decentralized markets, without having to choose between regulation and liquidity, and without isolated pools or asset wrappers.

“The industry has been stuck with a false choice: compliance or liquidity. Our infrastructure makes that trade-off obsolete," said Chung Ying (CY), Co-founder of Pruv Finance

What Pruv Finance Is Building

Pruv Finance is building compliant RWA infrastructure where tokenized assets are born liquid and DeFi-ready, instead of locked away.

The platform is shaped around 4 core pillars.

Regulatory Compliance

Pruv operates under Indonesia’s OJK regulatory sandbox (POJK 3/2024) and works with leading partners to tokenize and distribute assets within a clear, approved framework. Institutions can get true compliance without giving up the benefits of being on-chain.

RWAs That Are Born DeFi Composable

Most RWAs today are stuck behind whitelists and transfer limits. Tokens issued through Pruv are freely transferable from day one, enabling real liquidity and seamless movement across DeFi.

This gives builders the ability to create lending markets, indexes, structured products, and other DeFi primitives using regulated RWAs as actual building blocks, not static assets.

Multi-Chain Access

RWAs issued through Pruv can move freely across major chains, reaching users wherever they are. Pruv already works with many leading ecosystems including Avalanche, Polygon, Stellar, Sei, and Manta.

Global Partnerships

RWA is a global effort that requires collaboration across regulators, institutions, and ecosystems. Pruv has built a worldwide network of institutional partners, exchanges, and asset managers, including Floq, Pintree, and SBI Digital Markets.

This ecosystem gives Pruv Finance the foundation to bring RWAs to life at scale, not just in theory but in real-world deployment.