SBI Global Asset Management Third Quarter Financial Results

SBI Global Asset Management (SBIGAM) has delivered a historic quarter, achieving record-breaking financial results and successfully executing key strategic initiatives. These outstanding achievements are the culmination of a consistent, long-term strategy focused on delivering superior value through innovation, scale, and customer trust. The results from this quarter unequivocally validate SBIGAM's strategic direction and operational excellence.

The premier achievements of the quarter include:

- Record Financials: The company achieved all-time highs for revenue and across all profit categories, demonstrating exceptional financial strength and operational leverage.

- Sustained Profit Growth: SBIGAM has now recorded 17 consecutive periods of recurring profit growth, a powerful testament to the stability, resilience, and reliability of the business model.

- Accelerated AUM Expansion: Group-wide assets under management (AUM) surged by 70.8% year-over-year, reflecting significant market share capture and strong client confidence.

- Subsidiary Excellence: All three of SBIGAM's core domestic asset management companies—SBI Asset Management, SBI Okasan Asset Management, and Rheos Capital Works—recorded double-digit AUM growth and achieved new, record-high assets under management.

This landmark performance provides a robust foundation for future growth.

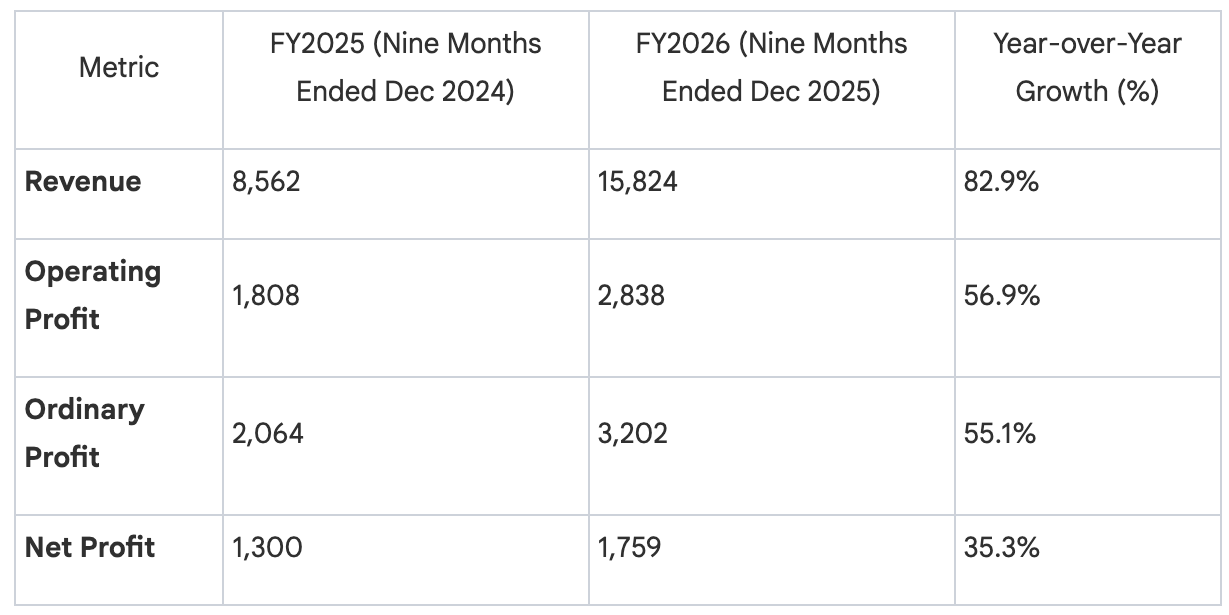

1. Analysis of Consolidated Financial Results

The consolidated financial results serve as the primary evidence of the Group's successful growth strategy. The significant top- and bottom-line expansion reflects not only strong underlying organic performance but also the positive impact of recent mergers and acquisitions, which have been instrumental in scaling the business, diversifying revenue streams, and solidifying SBIGAM's market position.

Consolidated Financial Highlights (Nine Months Ended December 2025 vs. December 2024) (in millions of Yen)

These substantial increases, including an 82.9% rise in revenue, are a direct outcome of SBIGAM's strategic execution. It is crucial to note that SBIGAM's established, long-term track record of organic growth predates its recent large-scale M&A activities. The achievement of 14 consecutive periods of revenue growth and 17 consecutive periods of recurring profit growth was driven by the core business. This frames SBIGAM's recent M&A not as the source of the momentum, but as a strategic accelerant to an already powerful growth engine, demonstrating both a robust underlying business and shrewd capital allocation.

This financial outperformance is a direct result of the primary growth engine: the rapid expansion of assets under management.

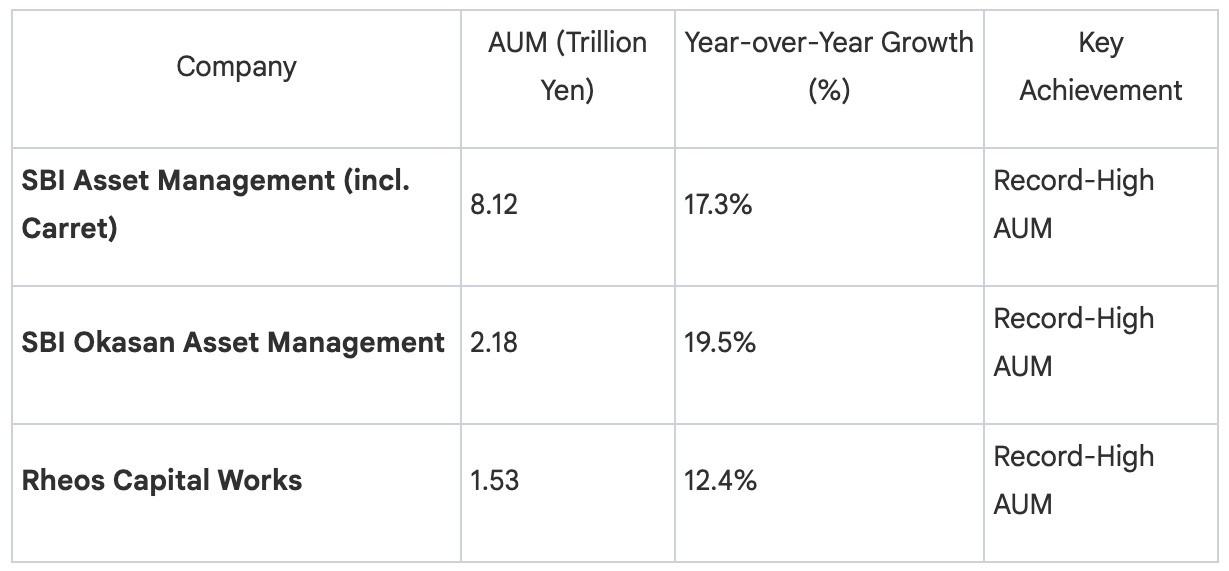

2. Accelerating Growth in Assets Under Management (AUM)

The growth of Assets Under Management (AUM) is the core engine of revenue and profitability for the firm. Its rapid expansion is a direct indicator of market trust, product competitiveness, and future earnings potential. SBIGAM's momentum in attracting client assets has accelerated significantly over the past year.

As of December 2025, total group AUM reached ¥11.827 trillion, a remarkable year-over-year increase of 70.8%.

Performance of Core Domestic Asset Management Companies

SBIGAM's multi-brand strategy has proven highly effective, with each of its core domestic asset management companies contributing significantly to this growth and setting new internal records.

The synchronized, double-digit growth across all three entities demonstrates the power of SBIGAM's multi-brand strategy, where SBI Asset Management captures the mass market with low-cost, high-scale products, SBI Okasan Asset Management targets growth with innovative, tech-driven funds, and Rheos Capital Works serves discerning investors seeking premier active management. This collective strength allows SBIGAM to effectively capture diverse market segments and highlights the powerful synergy within the Group.

3. Subsidiary Performance Deep Dive: Engines of Growth

SBIGAM's multi-company structure is a key strategic advantage. SBI Asset Management, SBI Okasan Asset Management, and Rheos Capital Works operate as specialized engines of growth, each possessing unique strengths in product development, market positioning, and client engagement. This structure provides comprehensive market coverage and a diverse product suite that meets the evolving needs of every type of investor.

3.1 SBI Asset Management: Scale, Innovation, and Cost Leadership

SBI Asset Management continues to solidify its position as a market leader through a combination of scale, product innovation, and an unwavering commitment to low costs.

- Record Performance: The company achieved record-high revenue and operating profit for the period, driven by strong asset growth and operational efficiency.

- Strong Fund Inflows: From April to December 2025, the top funds by net inflows were the iShares Gold Fund (no currency hedge) at ¥116.8 billion and the SBI V S&P 500 at ¥100.2 billion, highlighting demand for both alternative assets and core US equity exposure.

- Rapid Customer Growth: The number of public fund beneficiaries grew by 29.3% in the year to December 2025, reaching a total of 3.44 million individuals.

- Product Success: The SBI iShares Gold Fund has been a remarkable success, surpassing ¥350 billion in net assets. Concurrently, the popular High Dividend Stock Fund series has seen its net assets grow by over 11 times in just two years.

- Market-Leading Offerings: The company continues to lead the industry on cost, with offerings like the SBI Japan High Dividend Stock Fund boasting the lowest trust fees in its category, ensuring maximum value for SBIGAM's clients.

3.2 SBI Okasan Asset Management: Pioneering AI and High-Yield Products

SBI Okasan Asset Management has distinguished itself as a pioneer in technology-driven and specialized income products, achieving strong double-digit revenue growth.

- Dominance in Tech-Driven Investing: SBI Okasan's AI-managed ROBOPRO Fund delivered extraordinary results, attracting ¥169.4 billion in net inflows and surpassing ¥270 billion in total net assets. Its success was validated by its selection as the #3 fund in the prestigious "Fund of the Year 2025" active category.

- Leadership in Foreign Currency Products: The US Dollar MMF has become an industry leader, achieving the highest yield at 3.43% and growing its asset base to over ¥80 billion within a year of its launch.

3.3 Rheos Capital Works: Renowned Active Management and Product Innovation

Rheos Capital Works, renowned for its expertise in active Japanese equity management, has achieved new milestones while pushing the boundaries of product innovation.

- Record Performance: The company posted record-high revenue and operating profit, underscoring the enduring appeal of its investment philosophy.

- Landmark AUM: The flagship Hifumi Investment Trust mother fund surpassed the significant milestone of ¥1 trillion in net assets. It also earned the #4 ranking in the "Fund of the Year 2025" awards, a testament to its consistent popularity among individual investors.

- Innovative Crossover Fund: The Hifumi Crossover pro fund, the first of its kind in Japan to allow NISA investment in both listed and unlisted stocks, has exceeded ¥45 billion in net assets. Its distribution network has expanded rapidly, with sales partners now totaling 24 companies.

The stellar performance of SBIGAM's individual subsidiaries translates directly into a commanding competitive position for the Group within the broader Japanese asset management industry.

4. Establishing Market Dominance and Industry Leadership

Market position and third-party validation are crucial, objective benchmarks of a firm's competitive strength, product quality, and trustworthiness. Recent industry data and awards confirm that SBI Global Asset Management has ascended to the top tier of the Japanese asset management industry.

- Top-Tier Industry Player: Based on total net assets (public and private funds), SBI Global Asset Management now ranks 9th in the Japanese asset management industry, with total net assets of ¥10.9755 trillion.

- Leading Active Fund Manager: In the highly competitive public domestic equity active fund segment, the Group holds the #2 ranking in Japan by net assets, second only to Nomura Asset Management.

- #1 in Fund Performance Evaluation: Critically, the quality of SBIGAM's offerings is recognized as superior. SBI Global Asset Management is ranked No. 1 for the performance of its domestic equity active funds, with a weighted average Wealth Advisor (formerly Morningstar) rating of 3.94, the highest among major firms.

- Award-Winning Funds: SBIGAM's products continue to win accolades from investors themselves. In the "Individual Investors' Choice! Fund of the Year 2025" awards, two of SBIGAM's funds were recognized in the active category: SBI Okasan's ROBOPRO Fund placed 3rd, and Rheos's Hifumi Investment Trust placed 4th.

These achievements are a direct result of SBIGAM's focused strategy, which provides a clear roadmap for its continued ascent.

5. Strategic Vision: Forging the Next-Generation Asset Management Group

SBIGAM's record performance is the foundation upon which an even more ambitious future is being built. To accelerate SBIGAM's growth trajectory, the Group has established a clear, three-pronged strategic framework designed to transform SBI into a "Next-Generation Asset Management Group" that will lead the industry in scale, innovation, and global reach.

5.1 Strategy 1: Accelerating Domestic Organic Growth

The first pillar of SBIGAM's strategy is to maximize the potential of its three core asset management companies by fostering greater synergy and efficiency. Key initiatives include the integration of middle- and back-office functions to streamline operations and reduce costs. Furthermore, the firm is developing a common AI agent to enhance risk management, automate compliance checks, and improve operational processes across all three firms, driving scalable and intelligent growth.

5.2 Strategy 2: Expanding into High-Growth Asset Classes

Recognizing the immense and sustained global growth trends in Exchange-Traded Funds (ETFs) and alternative assets, as evidenced by industry data, SBIGAM is strategically positioning the Group to capture a significant share of these high-growth markets. SBIGAM is achieving this by partnering with world-class global firms to deliver innovative products to our clients.

- ETFs: SBIGAM is partnering with AllianceBernstein, a global leader in active management, to establish a new asset management company focused exclusively on bringing sophisticated active ETFs to the Japanese market.

- Alternative Assets: SBIGAM is collaborating with premier global firms like KKR and Man Group to provide access to advanced alternative products. Recent launches include the SBI Alternative High Income Select Fund, which invests in private credit, and the SBI-Man Liquid Trend Fund, a sophisticated managed futures strategy.

- Digital and Crypto Assets: In partnership with Franklin Templeton, SBIGAM is pioneering product development in the digital asset space. The Group is actively preparing to list crypto-asset ETFs on the Tokyo Stock Exchange as soon as the regulatory framework permits.

5.3 Strategy 3: Global Expansion and M&A

SBIGAM's ambitions extend beyond the domestic market. The Group is actively pursuing a strategy to acquire and invest in overseas asset management companies to expand its global footprint and capabilities. Simultaneously, SBIGAM is intensifying its efforts to attract capital from foreign institutional investors, sovereign wealth funds (SWFs), and family offices by offering bespoke investment solutions.

The disciplined execution of this three-pronged strategy provides a clear and credible pathway for achieving the Group's ambitious long-term goals.

6. Conclusion: A Clear Trajectory for Sustained Growth

In summary, the third quarter of fiscal year 2026 was a period of unprecedented success for SBI Global Asset Management. The Group delivered record-breaking financial results, driven by the powerful, synergistic growth of its core subsidiaries and the accelerating expansion of its assets under management. SBIGAM's market leadership is validated by top-tier industry rankings and awards, reflecting the trust clients place in the firm.

With a strong foundation of performance and a clear, forward-looking strategy focused on domestic synergy, expansion into high-growth asset classes, and global M&A, SBI Global Asset Management is on a clear trajectory to exceed its growth targets. SBIGAM is confident in its path towards the goal of ¥20 trillion in assets under management.