SBI Holdings Targets Coinhako Acquisition to Expand Global Digital Asset Corridor

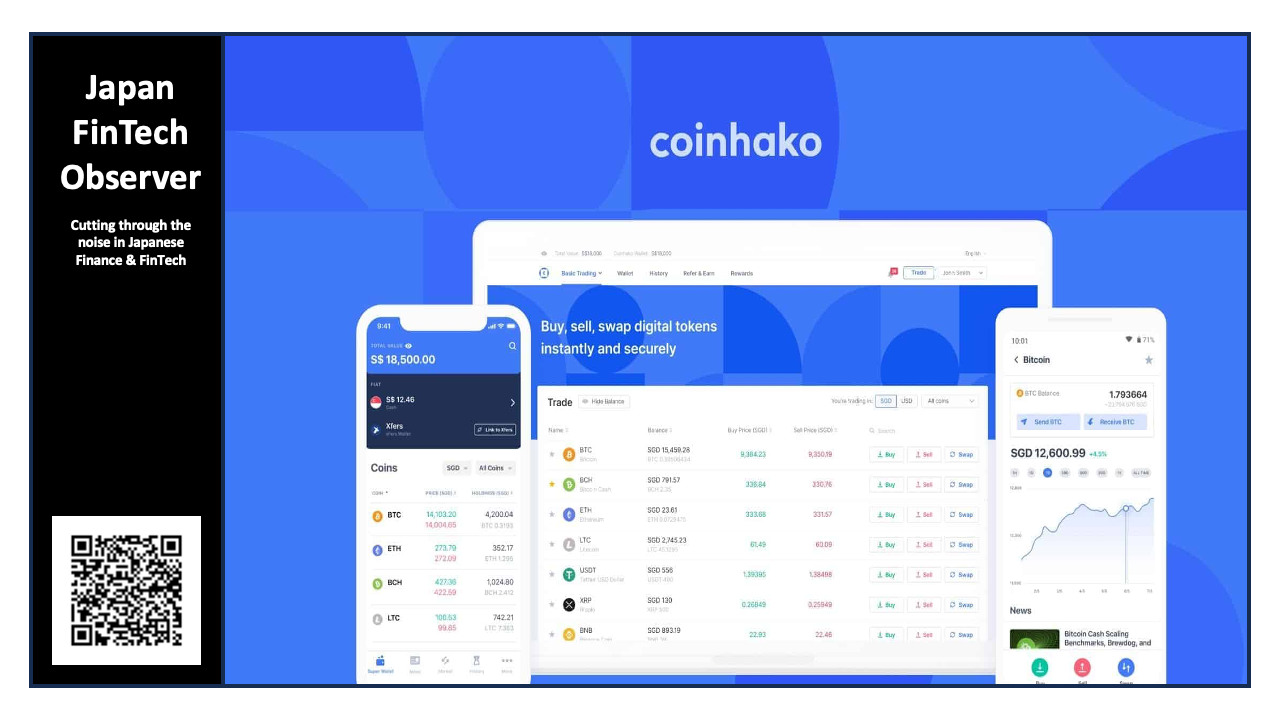

Japanese financial services giant SBI Holdings is set to significantly expand its footprint in the Southeast Asian crypto market, announcing its intention to acquire a majority stake in Coinhako, a leading Singapore-based digital asset platform.

SBI confirmed that its subsidiary, SBI Ventures Asset, has signed a letter of intent with Holdbuild, the operator of the Coinhako Group. The proposed transaction involves both a fresh capital injection into Coinhako and the acquisition of shares from existing shareholders. Upon completion, Coinhako is expected to operate as a consolidated subsidiary of the SBI Group.

Strategic Expansion into Singapore

The deal represents a major strategic consolidation for SBI as it seeks to build what it describes as a "next-generation financial ecosystem." By acquiring Coinhako, SBI gains a regulated foothold in Singapore—a critical financial hub. Coinhako operates under a Major Payment Institution license from the Monetary Authority of Singapore (MAS) and holds a registration with the BVI Financial Services Commission.

Yoshitaka Kitao, Representative Director, Chairman and President of SBI Holdings, framed the acquisition as a play on the future of financial infrastructure rather than a simple portfolio addition.

"In this era of tokenization, the importance of global infrastructure for digital assets is growing ever greater," Kitao said. "Bringing Coinhako into the SBI Group... is a solid step toward realizing the SBI Group's strategy: expanding the global corridor for digital assets and creating next-generation finance including tokenized stock and stable coin."

Synergies and Institutional Focus

The merger aims to combine Coinhako’s decade of operational experience in the retail and institutional crypto space with SBI’s massive capital resources and global network.

Yusho Liu, Co-founder and CEO of Coinhako, noted that the alignment with SBI serves their ambition to become Asia’s premier digital asset hub. "With SBI Group’s extensive network and resources, Coinhako will scale its institutional-grade infrastructure to meet the surging demand for tokenized assets and stablecoins," Liu stated.

Next Steps

The specific financial terms of the deal were not disclosed. Both parties are currently in ongoing discussions regarding the methods of capital injection and share acquisition. The finalization of the deal is subject to customary regulatory approvals.