SBI Holdings' Third Quarter Financial Results

SBI Holdings has reached a definitive tipping point in its evolution from an online brokerage pioneer to Japan’s dominant financial powerhouse. The 9M FY2025 results signal a successful "Beyond Brokerage" transition where the group’s diversified revenue engines now more than compensate for the elimination of trading commissions. Crucially, SBI has now surpassed Nomura Holdings in 9M profit attributable to owners, officially claiming the #1 spot in the sector—a massive signal to institutional markets that SBI is cannibalizing traditional players through its ecosystem efficiency.

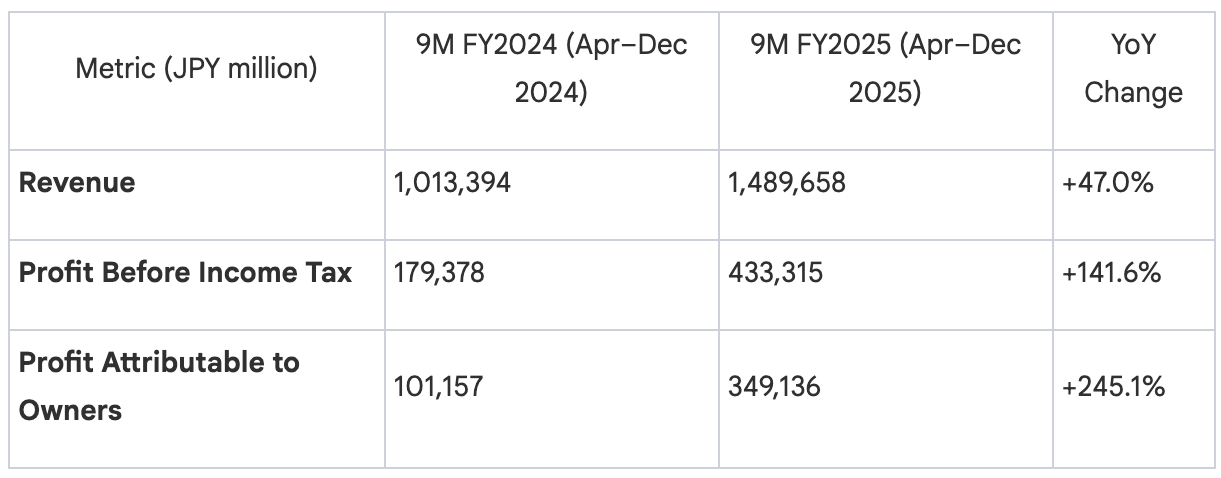

The group’s consolidated performance during this period was characterized by aggressive growth across all metrics.

Consolidated Financial Performance (9M YoY Comparison)

Capital efficiency remains the primary driver of institutional sentiment. SBI reported an overwhelming annualized ROE of 29.9% for 9M FY2025, essentially doubling its FY2028 mid-term target of 15%. When measured against the TSE-listed averages for FY2024 (Banks: 7.25%; Securities: 10.33%), SBI’s pace of execution is unprecedented, providing a robust foundation for the group's mid-term strategic pivots into AI and blockchain.

1. Segment Performance Deep-Dive: Diversification and Resilience

SBI’s multi-segment architecture serves as a structural hedge against market volatility and the "ZERO Revolution." Synergies are no longer theoretical—they are quantified across the group’s record-high performance.

- Financial Services: This segment recorded a high of JPY 321.3bn in profit before tax. SBI Securities reached record highs in operating revenue (JPY 207.1bn) and income (JPY 66.5bn) by aggressively expanding financial revenues (margin trading) and underwriting. This record was achieved despite a JPY 12.5bn extraordinary loss related to phishing-scam compensation and financial instrument reserves, highlighting the underlying earnings power of the brokerage engine.

- PE Investment & Asset Management: These segments were transformed by the strategic reclassification of unlisted operating investment securities (moved from Financial Services to PE Investment) and significant valuation gains. PE Investment profit surged to JPY 95.2bn, while Asset Management benefitted from the consolidation of SBI Okasan and Rheos Capital Works.

- Crypto-asset & Next-Gen Business: Both segments returned to profitability, driven by valuation gains on crypto holdings. The Next-Gen segment, in particular, delivered a record PBT of JPY 22.4bn, validating the group's venture investment strategy.

9M FY2025 "Record High" Segment Revenue and Profit:

- Financial Services: Record Revenue (JPY 1.22tn) and PBT (JPY 321.3bn).

- Asset Management: Record Revenue and PBT.

- PE Investment: Record Revenue.

- Crypto-asset Business: Record Revenue and PBT.

- Next-Gen Business: Record Revenue and PBT.

These diverse revenue streams are now being unified under a new, AI-driven technological architecture.

2. The "4th Megabank" Concept and Regional Revitalization

The "4th Megabank" concept addresses Japan’s regional economic stagnation by utilizing SBI Shinsei Bank as a high-tech platform for regional revitalization. Since joining the group, SBI Shinsei has seen explosive growth:

- Retail Accounts: 4.17 million (up from 3.04 million in March 2022).

- Total Deposits: Reached JPY 16.9tn.

- Group Referrals: Approx. 70% of new accounts originate from SBI Securities, proving the efficacy of the ecosystem.

The "SBI Hyper Yokin" sweep account is the primary acquisition engine. By offering a 5.0% interest rate (capped at JPY 1 million), the product surpassed JPY 1tn in deposits in just 108 days. Crucially, this product creates "stickiness," preventing the "cherry-picking" behavior typical of high-yield seekers by integrating the banking and securities experience.

The scalability of the "F-PaaS" model is best evidenced by Shimane Bank, where deposits increased 48% (from JPY 360bn to JPY 533.8bn) via SBI’s "Smartphone Branch" strategy. Furthermore, SBI is deploying an "Asset-Light/Asset-Recycling" (O&D) model to support regional liquidity, originating JPY 13.8tn in assets while selling down JPY 594.7bn to regional investors. Alliances with KKR (providing asset management capabilities) and Norinchukin Bank (strengthening agriculture/forestry networks) further solidify SBI Shinsei’s status as a Tier-1 platformer.

3. Strategic Transformation: AI-Oriented and On-Chain Ecosystems

Under the mandate of "Organization Follows Strategy," SBI is executing a structural shift to an AI-oriented organization. This is a survival necessity, not a trend.

- AI-Oriented Evolution: In collaboration with Ridge-I, SBI is adopting group-wide "AI Agents." This is a fundamental shift: AI will handle the labor while humans provide direction. This targets radical cost reform and new revenue generation by deploying AI-as-a-Service to external partners.

- On-Chain Financial Ecosystem: SBI envisions "Everything on-chain." SBI Shinsei Trust Bank is central to this, specifically focusing on the trust-type stablecoin model because it bypasses the JPY 1 million issuance limit imposed on other models. Through the Startale partnership, SBI is targeting the tokenization of Real World Assets (RWA), including stocks and real estate, to enable 24/7 global trading.

- SBI Neo Financial Platform: This "Financial Super App" integrates banking, securities, insurance, and crypto into a single interface. This F-PaaS (Financial Platform as a Service) is already being extended to external partners like Chubu Electric Power, allowing them to offer SBI’s full suite of financial products to their captive customer bases.

4. Neo-Media Strategy and Youth Market Penetration

To mitigate "Asset Inheritance" risks as wealth transfers to younger generations, SBI is utilizing its "Neo-Media" segment to lower the average customer age.

- In-house Agency Internalization: SBI is consolidating its annual advertising spend of JPY 25–30bn, previously fragmented across 30 agencies, into Neo-Media Holdings. The goal is the eventual total "internalization" of marketing to eliminate agency fees and increase bargaining power with media outlets.

- IP and Brand Affinity: Investments in entertainment (e.g., Music Circus) are designed to build brand affinity with youth demographics before they enter their peak investing years, securing the path toward 100 million group customers.

5. Shareholder Value, Valuation, and Investment Thesis

SBI continues to aggressively address its valuation through capital returns and shareholder incentives.

- Capital Efficiency: The board authorized a JPY 50bn share buyback and a 2-for-1 stock split (effective Dec 1, 2025) to increase retail liquidity.

- XRP Shareholder Benefit: This program generates significant "hidden value." The six-distribution weighted average acquisition price of JPY 58.8 stands against a market value of JPY 252.46 (as of Feb 2, 2026), representing approximately 4 times growth for long-term holders.

Valuation Synthesis: The Conglomerate Discount

SBI Holdings’ market cap of JPY 2.28tn remains significantly undervalued compared to the simple aggregate market cap of its subsidiaries (JPY 4.92tn). Key holdings include:

- SBI Shinsei Bank: JPY 1.68tn

- SBI Global Asset Management: JPY 87.1bn

This profound discount suggests that investors are essentially receiving the core brokerage and PE businesses at a negative valuation.

Investment Thesis Summary

- Growth Catalysts:

- AI Cost Reform: Radical margin expansion through group-wide AI Agent adoption.

- F-PaaS Scaling: Rapid AUM/deposit growth via external partnerships (e.g., Chubu Electric).

- On-Chain Leadership: First-mover advantage in trust-type stablecoins and RWA tokenization.

- Critical Investment Risks:

- Crypto Volatility: Sentiment and valuation gains remain sensitive to underlying crypto-asset prices.

- Regional Alliance Stability: The Dec 24, 2025, termination of the "Chihou Bank" alliance due to communication failures highlights the difficulty of deep-level regional integration.

- M&A Execution: Achieving the 30% overseas profit target will require aggressive international M&A, which carries significant integration and regulatory risks.