SBI Investment Completes JPY 100bn "SBI Digital Space Fund"

SBI Investment, a subsidiary of SBI Holdings which manages and operates venture capital funds, has completed fundraising for the “SBI Digital Space Fund”, with total capital commitments reaching JPY 100 billion.

In March 2023, the SBI Group established SBI PE Holding as an intermediate holding company to oversee its private equity business. The PE investment business, one of the SBI Group’s five core business segments, is eager to rapidly expand its assets under management to JPY 1 trillion. To support this goal, SBI Investment has been actively establishing new funds. With the launch of this latest fund, SBI Investment's total cumulative fund commitments have now reached JPY 841.4 billion.

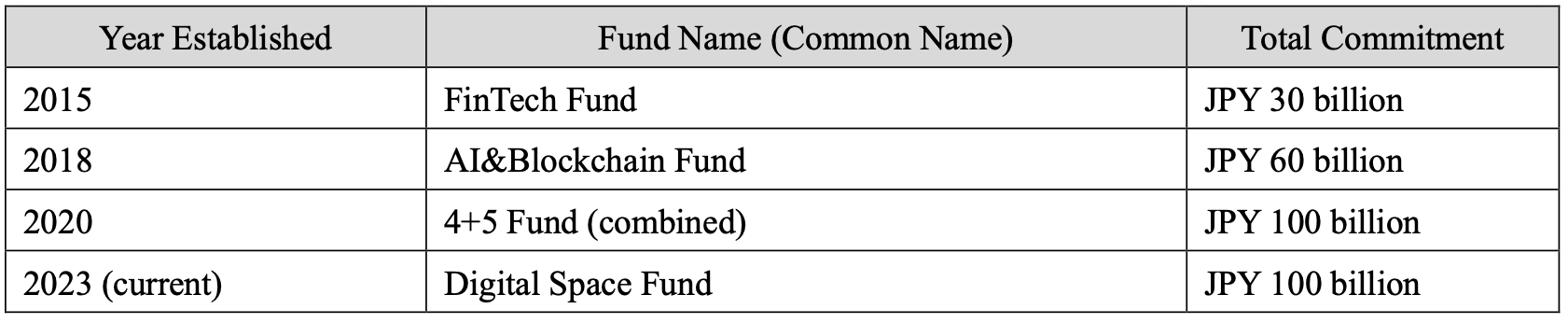

The flagship funds currently under management have entered the exit phase. Notably, the FinTech Fund, which was launched in 2015, is expected to deliver a DPI (Distributions to Paid-In Capital ratio) of over 3.0x, placing it among the top-performing domestic VC funds. SBI Investment is committed to maximizing fund performance by leveraging the strengths of the SBI Group to enhance the value of its portfolio companies across its other flagship funds as well.

The Fund primarily invests in a wide range of future growth sectors, including the digital Space such as Web3 and the metaverse, as well as areas where SBI has already made significant investments, including AI and big data, semiconductors, FinTech, robotics, and healthcare. It also targets media sectors with strong intellectual property.

In addition to recurring investors, such as Sumitomo Mitsui Banking Corporation, The Dai-ichi Life Insurance Company, Mizuho Bank, The Norinchukin Bank, The Bank of Fukuoka, and other major Japanese institutional investors, as well as major business companies such as SoftBank Group, SoftBank, and TOPPAN Holdings, new investors have also contributed, including Nippon Life Insurance, Mandom Corporation, and TAKARA HOLDINGS.

Through this Fund, SBI Investment will leverage its extensive network with startup companies to actively promote digital transformation and open innovation, which are key societal challenges. Furthermore, SBI Investment fosters open innovation between its portfolio companies and investors, thereby enhancing the value of these companies and maximize the Fund’s performance.

The SBI Group has positioned the United States as a priority region in its overseas business strategy, and will continue to expand its operations in the region and invest in global startups in North America by utilizing the networks of leading local partners. In addition, the SBI Group is utilizing its proprietary ecosystem, developed through collaborations with SBI SECURITIES and SBI Shinsei Bank, an investor in the Fund, to support the long-term creation and growth of unicorn companies. Through these efforts, the SBI Group seeks to contribute to the revitalization of the startup ecosystem and the development of new industries.

SBI Investment remains committed to fostering the growth of next-generation and cutting-edge industries and enhancing the corporate value of its portfolio companies.